Answered step by step

Verified Expert Solution

Question

1 Approved Answer

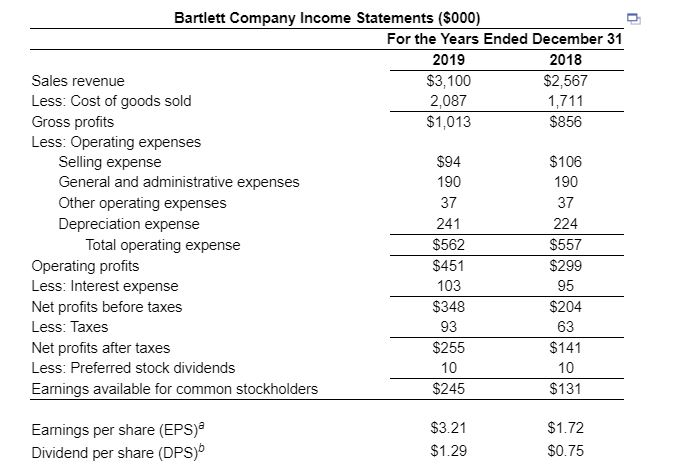

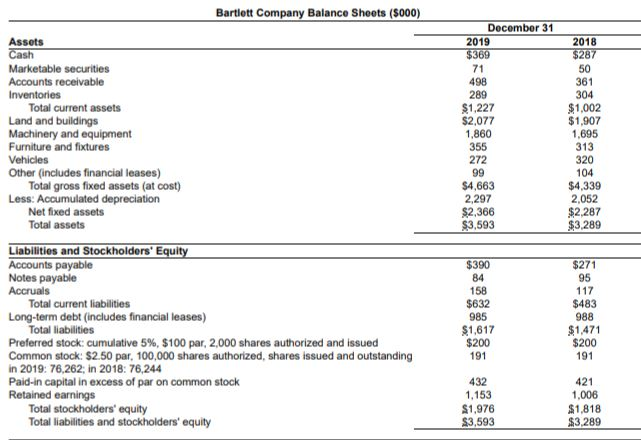

Using the above tables find the following for 2018 and 2019: Current Ratio Quick Ratio Inventory Turnover Average Collection Period Total Asset Turnover Debt Ratio

Using the above tables find the following for 2018 and 2019:

Current Ratio

Quick Ratio

Inventory Turnover

Average Collection Period

Total Asset Turnover

Debt Ratio

Debt/Equity Ratio

Times Interest Earned

Gross Profit Margin

Operating Profit Margin

Net Profit Margin

Return on total Assets

Return on Equity

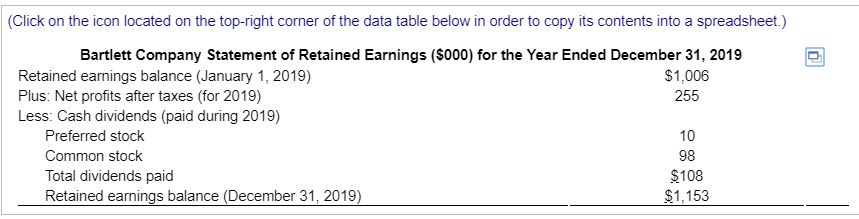

Bartlett Company Income Statements ($000) For the Years Ended December 31 2019 2018 Sales revenue $3,100 $2,567 Less: Cost of goods sold 2.087 1,711 Gross profits $1,013 $856 Less: Operating expenses Selling expense $94 $106 General and administrative expenses 190 190 Other operating expenses Depreciation expense 241 224 Total operating expense $562 $557 Operating profits $451 $299 Less: Interest expense 103 Net profits before taxes $348 $204 Less: Taxes 93 63 Net profits after taxes $255 $141 Less: Preferred stock dividends 10 Earnings available for common stockholders $245 $131 37 95 10 Earnings per share (EPS) Dividend per share (DPS) $3.21 $1.29 $1.72 $0.75 Bartlett Company Balance Sheets (5000) 2018 $287 50 361 304 Assets Cash Marketable securities Accounts receivable Inventories Total current assets Land and buildings Machinery and equipment Furniture and fixtures Vehicles Other (includes financial leases) Total gross fixed assets (at cost) Less: Accumulated depreciation Net fixed assets Total assets December 31 2019 $369 71 498 289 $1,227 $2,077 1,860 355 272 99 $4,663 2,297 $2,366 $3,593 $1,002 $1,907 1,695 313 320 104 $4,339 2,052 $2,287 $3,289 Liabilities and Stockholders' Equity Accounts payable Notes payable Accruals Total current liabilities Long-term debt (includes financial leases) Total liabilities Preferred stock: cumulative 5%, $100 par, 2,000 shares authorized and issued Common stock: $2.50 par, 100,000 shares authorized, shares issued and outstanding in 2019: 76.262, in 2018: 76,244 Paid-in capital in excess of par on common stock Retained earnings Total stockholders' equity Total liabilities and stockholders' equity $390 84 158 $632 985 $1,617 $200 191 $271 95 117 $483 988 $1,471 $200 191 432 1,153 $1,976 $3,593 421 1,006 $1,818 $3,289 (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Bartlett Company Statement of Retained Earnings ($000) for the Year Ended December 31, 2019 Retained earnings balance (January 1, 2019) $1,006 Plus: Net profits after taxes (for 2019) 255 Less: Cash dividends (paid during 2019) Preferred stock Common stock Total dividends paid $108 Retained earnings balance (December 31, 2019) $1,153Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started