Answered step by step

Verified Expert Solution

Question

1 Approved Answer

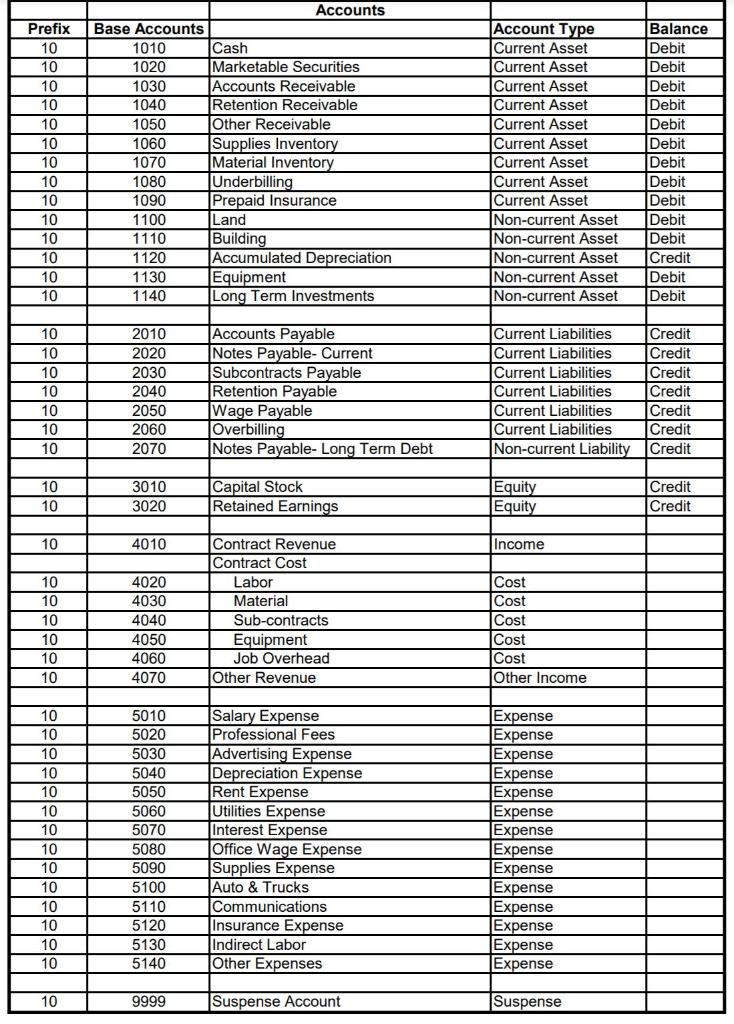

Using the accounts above enter each transaction into a general journal. Prefix 10 10 10 10 10 10 10 10 10 10 10 10 10

Using the accounts above enter each transaction into a general journal.

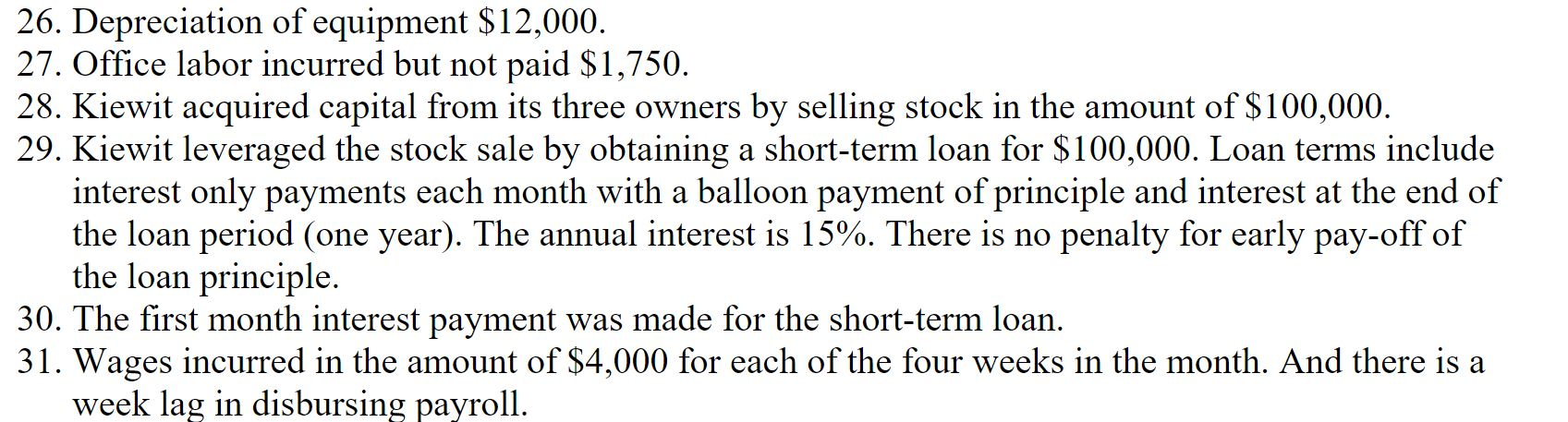

Prefix 10 10 10 10 10 10 10 10 10 10 10 10 10 10 Accounts Base Accounts 1010 Cash 1020 Marketable Securities 1030 Accounts Receivable 1040 Retention Receivable 1050 Other Receivable 1060 Supplies Inventory 1070 Material Inventory 1080 Underbilling 1090 Prepaid Insurance 1100 Land 1110 Building 1120 Accumulated Depreciation 1130 Equipment Long Term Investments Account Type Current Asset Current Asset Current Asset Current Asset Current Asset Current Asset Current Asset Current Asset Current Asset Non-current Asset Non-current Asset Non-current Asset Non-current Asset Non-current Asset Balance Debit Debit Debit Debit Debit Debit Debit Debit Debit Debit Debit Credit Debit Debit 1140 10 10 10 10 10 10 10 2010 2020 2030 2040 2050 2060 2070 Accounts Payable Notes Payable- Current Subcontracts Payable Retention Payable Wage Payable Overbilling Notes Payable- Long Term Debt Current Liabilities Current Liabilities Current Liabilities Current Liabilities Current Liabilities Current Liabilities Non-current Liability Credit Credit Credit Credit Credit Credit Credit 10 10 3010 3020 Capital Stock Retained Earnings Equity Equity Credit Credit 10 4010 Income Cost Cost 10 10 10 10 10 10 Cost Contract Revenue Contract Cost Labor Material Sub-contracts Equipment Job Overhead Other Revenue 4020 4030 4040 4050 4060 4070 Cost Cost Other Income 10 10 10 10 10 10 10 10 10 10 10 10 10 10 5010 5020 5030 5040 5050 5060 5070 5080 5090 5100 5110 5120 5130 5140 Salary Expense Professional Fees Advertising Expense Depreciation Expense Rent Expense Utilities Expense Interest Expense Office Wage Expense Supplies Expense Auto & Trucks Communications Insurance Expense Indirect Labor Other Expenses Expense Expense Expense Expense Expense Expense Expense Expense Expense Expense Expense Expense Expense Expense 10 9999 Suspense Account Suspense 26. Depreciation of equipment $12,000. 27. Office labor incurred but not paid $1,750. 28. Kiewit acquired capital from its three owners by selling stock in the amount of $100,000. 29. Kiewit leveraged the stock sale by obtaining a short-term loan for $100,000. Loan terms include interest only payments each month with a balloon payment of principle and interest at the end of the loan period (one year). The annual interest is 15%. There is no penalty for early pay-off of the loan principle. 30. The first month interest payment was made for the short-term loan. 31. Wages incurred in the amount of $4,000 for each of the four weeks in the month. And there is a week lag in disbursing payrollStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started