Answered step by step

Verified Expert Solution

Question

1 Approved Answer

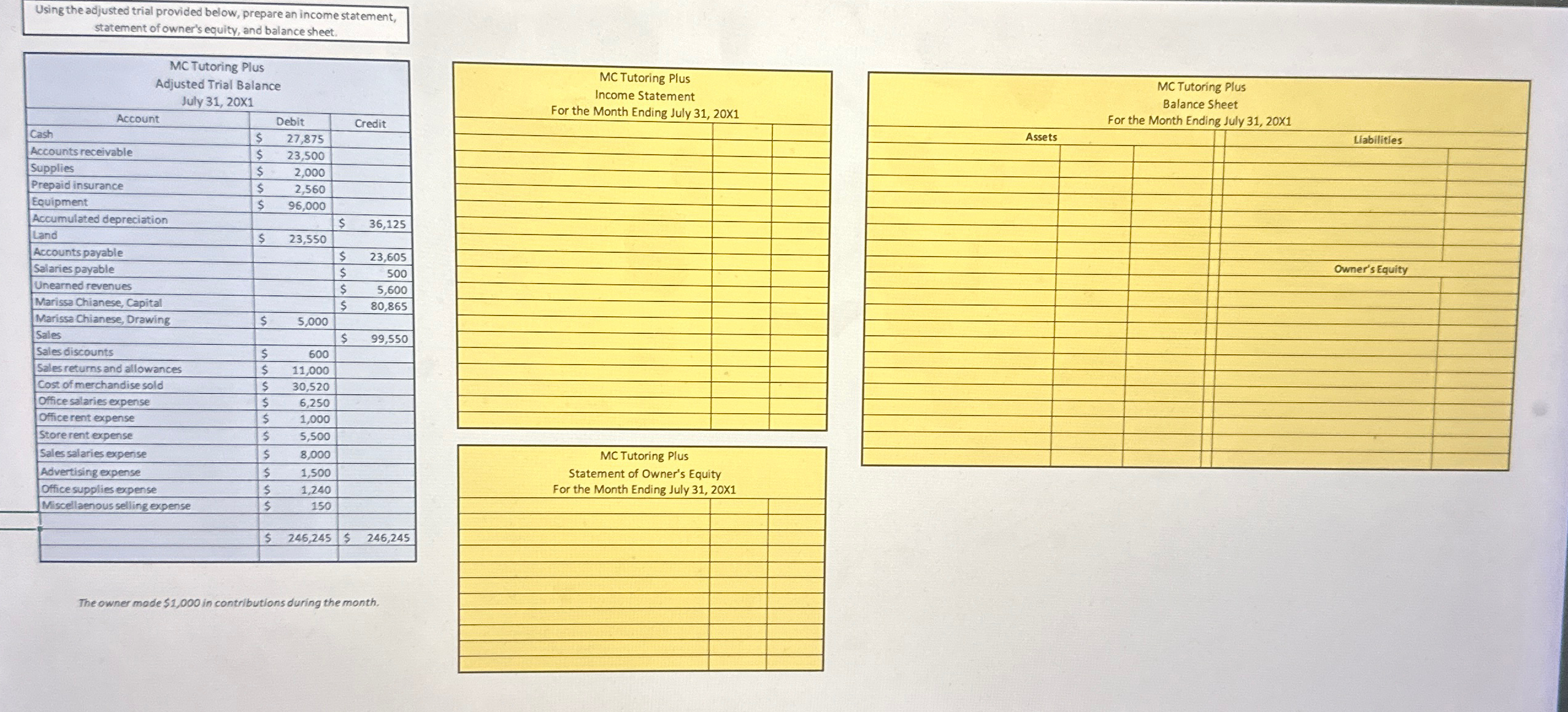

Using the adjusted trial provided below, prepare an income statement, statement of owner's equity, and balance sheet. MC Tutoring Plus Adjusted Trial Balance July

Using the adjusted trial provided below, prepare an income statement, statement of owner's equity, and balance sheet. MC Tutoring Plus Adjusted Trial Balance July 31, 20X1 Account Debit Credit Cash $ 27,875 Accounts receivable $ 23,500 Supplies $ 2,000 Prepaid insurance $ 2,560 Equipment $ 96,000 Accumulated depreciation $ 36,125 Land $ 23,550 Accounts payable $ 23,605 Salaries payable $ 500 Unearned revenues $ 5,600 Marissa Chianese, Capital $ 80,865 Marissa Chianese, Drawing $ 5,000 Sales $ 99,550 Sales discounts $ 600 Sales returns and allowances $ 11,000 Cost of merchandise sold $ 30,520 Office salaries expense $ 6,250 Office rent expense $ 1,000 Store rent expense $ 5,500 Sales salaries expense $ 8,000 Advertising expense $ 1,500 Office supplies expense $ 1,240 Miscellaenous selling expense $ 150 $ 246,245 $ 246,245 The owner made $1,000 in contributions during the month. MC Tutoring Plus Income Statement For the Month Ending July 31, 20X1 MC Tutoring Plus Statement of Owner's Equity For the Month Ending July 31, 20X1 Assets MC Tutoring Plus Balance Sheet For the Month Ending July 31, 20X1 Liabilities Owner's Equity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started