Answered step by step

Verified Expert Solution

Question

1 Approved Answer

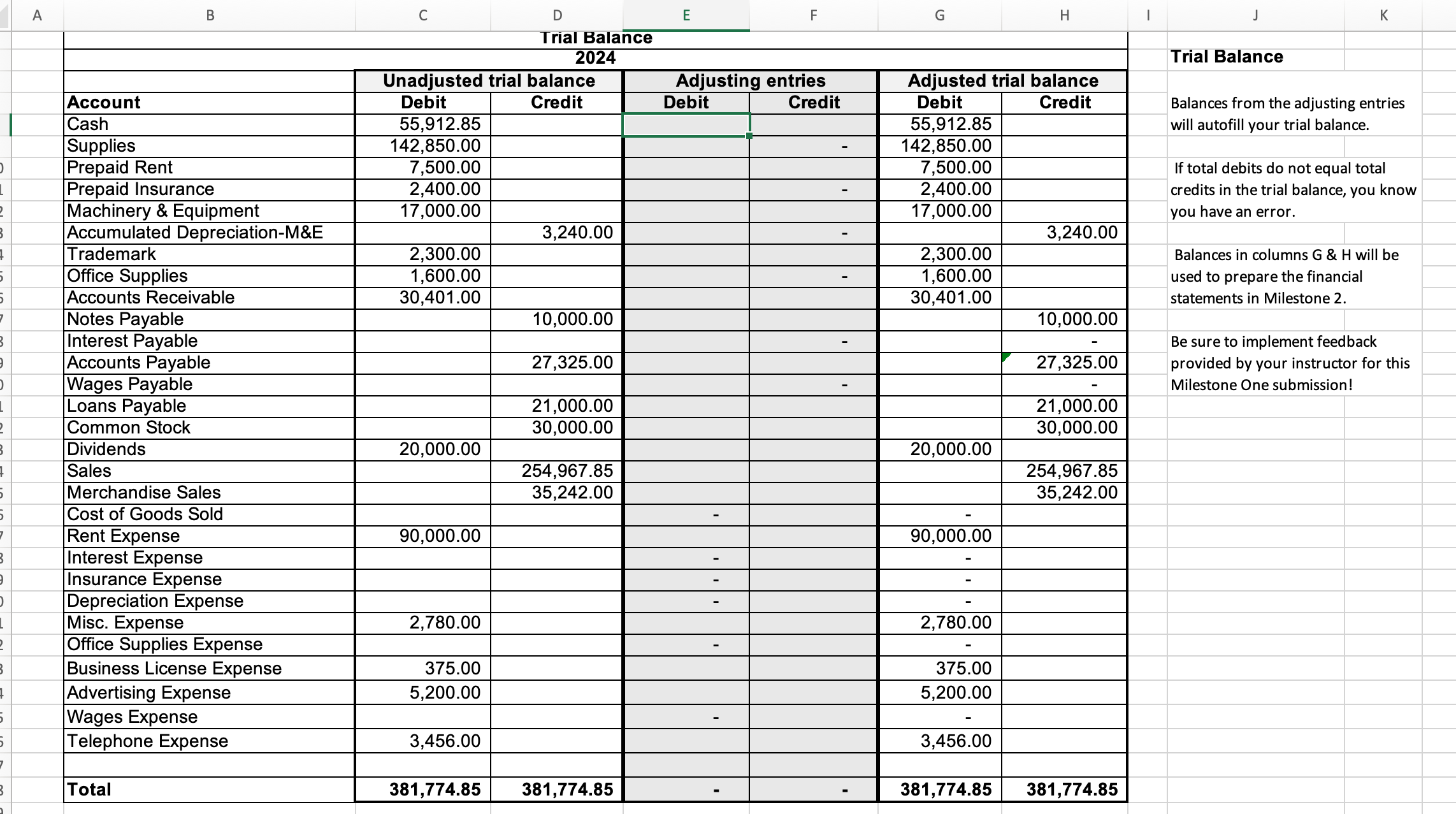

Using the ADjusting entry information, fill it into the balance sheet. A B C D E G H K Trial Balace 2024 Trial Balance Balances

Using the ADjusting entry information, fill it into the balance sheet.

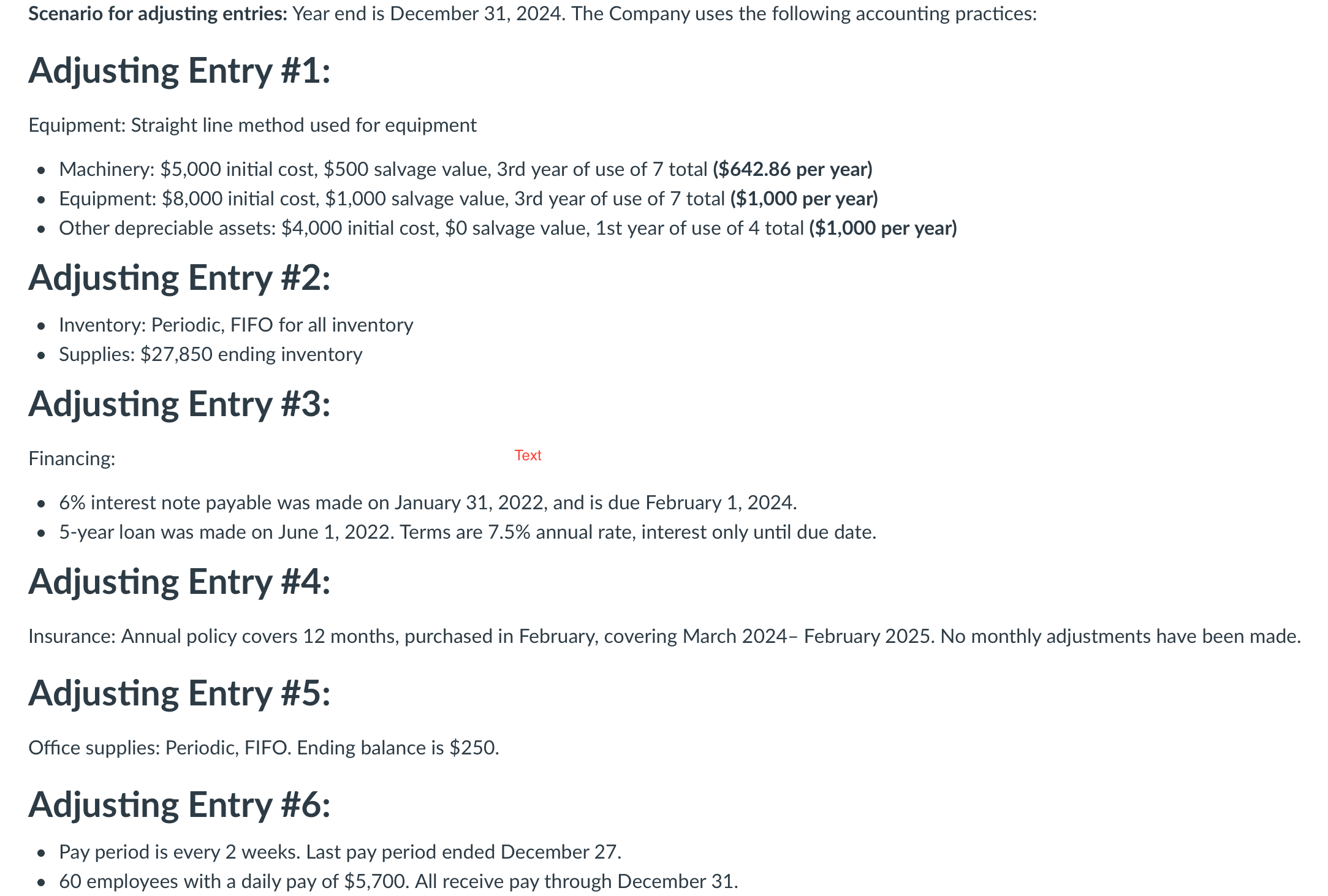

A B C D E G H K Trial Balace 2024 Trial Balance Balances from the adjusting entries will autofill your trial balance. If total debits do not equal total credits in the trial balance, you know you have an error. Balances in columns G&H will be used to prepare the financial statements in Milestone 2. Be sure to implement feedback provided by your instructor for this Milestone One submission! Scenario for adjusting entries: Year end is December 31, 2024. The Company uses the following accounting practices: Adjusting Entry \#1: Equipment: Straight line method used for equipment - Machinery: $5,000 initial cost, $500 salvage value, 3rd year of use of 7 total (\$642.86 per year) - Equipment: $8,000 initial cost, $1,000 salvage value, 3rd year of use of 7 total ( $1,000 per year) - Other depreciable assets: $4,000 initial cost, $0 salvage value, 1st year of use of 4 total (\$1,000 per year) Adjusting Entry \#2: - Inventory: Periodic, FIFO for all inventory - Supplies: $27,850 ending inventory Adjusting Entry \#3: Financing: Text - 6\% interest note payable was made on January 31, 2022, and is due February 1, 2024. - 5-year loan was made on June 1, 2022. Terms are 7.5\% annual rate, interest only until due date. Adjusting Entry \#4: Insurance: Annual policy covers 12 months, purchased in February, covering March 2024- February 2025. No monthly adjustments have been made. Adjusting Entry \#5: Office supplies: Periodic, FIFO. Ending balance is $250. Adjusting Entry \#6: - Pay period is every 2 weeks. Last pay period ended December 27. - 60 employees with a daily pay of $5,700. All receive pay through December 31 . A B C D E G H K Trial Balace 2024 Trial Balance Balances from the adjusting entries will autofill your trial balance. If total debits do not equal total credits in the trial balance, you know you have an error. Balances in columns G&H will be used to prepare the financial statements in Milestone 2. Be sure to implement feedback provided by your instructor for this Milestone One submission! Scenario for adjusting entries: Year end is December 31, 2024. The Company uses the following accounting practices: Adjusting Entry \#1: Equipment: Straight line method used for equipment - Machinery: $5,000 initial cost, $500 salvage value, 3rd year of use of 7 total (\$642.86 per year) - Equipment: $8,000 initial cost, $1,000 salvage value, 3rd year of use of 7 total ( $1,000 per year) - Other depreciable assets: $4,000 initial cost, $0 salvage value, 1st year of use of 4 total (\$1,000 per year) Adjusting Entry \#2: - Inventory: Periodic, FIFO for all inventory - Supplies: $27,850 ending inventory Adjusting Entry \#3: Financing: Text - 6\% interest note payable was made on January 31, 2022, and is due February 1, 2024. - 5-year loan was made on June 1, 2022. Terms are 7.5\% annual rate, interest only until due date. Adjusting Entry \#4: Insurance: Annual policy covers 12 months, purchased in February, covering March 2024- February 2025. No monthly adjustments have been made. Adjusting Entry \#5: Office supplies: Periodic, FIFO. Ending balance is $250. Adjusting Entry \#6: - Pay period is every 2 weeks. Last pay period ended December 27. - 60 employees with a daily pay of $5,700. All receive pay through December 31Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started