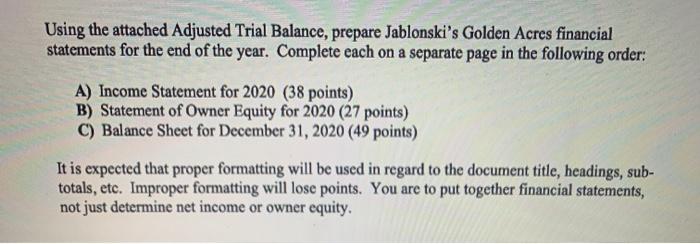

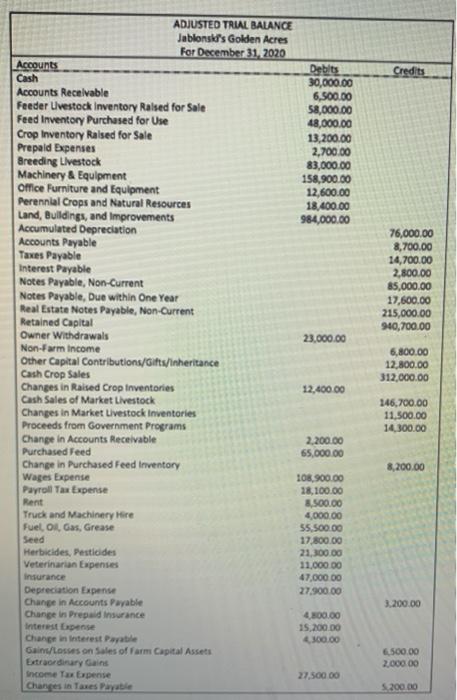

Using the attached Adjusted Trial Balance, prepare Jablonski's Golden Acres financial statements for the end of the year. Complete each on a separate page in the following order: A) Income Statement for 2020 (38 points) B) Statement of Owner Equity for 2020 (27 points) C) Balance Sheet for December 31, 2020 (49 points) It is expected that proper formatting will be used in regard to the document title, headings, sub- totals, etc. Improper formatting will lose points. You are to put together financial statements, not just determine net income or owner equity. Credits Debits 30,000.00 6,500.00 58,000.00 48,000.00 13,200.00 2,700,00 83,000.00 158,900.00 12,600.00 18.400.00 984,000.00 76,000.00 8,700.00 14,700.00 2,800.00 85,000.00 17,600.00 215,000.00 940,700,00 23,000.00 ADJUSTED TRIAL BALANCE Jablonski's Golden Acres For December 31, 2020 Accounts Cash Accounts Receivable Feeder Livestock Inventory Raised for Sale Feed Inventory Purchased for Use Crop Inventory Raised for Sale Prepaid Expenses Breeding Livestock Machinery & Equipment Office Furniture and Equipment Perennial Crops and Natural Resources Land, Buildings, and improvements Accumulated Depreciation Accounts Payable Taxes Payable Interest Payable Notes Payable, Non-Current Notes Payable, Due within One Year Real Estate Notes Payable, Non-Current Retained Capital Owner Withdrawals Non-Farm Income Other Capital Contributions/Gifts/inheritance Cash Crop Sales Changes in Raised Crop Inventories Cash Sales of Market Livestock Changes in Market Livestock Inventories Proceeds from Government Programs Change in Accounts Receivable Purchased Feed Change in Purchased Feed Inventory Wages Expense Payroll Tax Expense Rent Truck and Machinery Hire Fuel, ol, Gas, Grease Seed Herbicides, Pesticides Veterinarian Expenses Insurance Depreciation Expense Change in Accounts Payable Change in Prepaid insurance Interest Expense Change in interest Payabile Gains/losses on Sales of Farm Capital Assets Extraordinary Gains Income Tax Expense Changes in Taxes Payable 6,800.00 12,800.00 312,000.00 12,400.00 146,700.00 11,500.00 14,300.00 2,200.00 65,000.00 8,200.00 108,900.00 18,100.00 3.500.00 4,000.00 55,500.00 17.800.00 21,300.00 11.000 DO 47.000 00 27.900.00 3.200.00 400.00 15,200.00 4300.00 _500.00 2.000.00 27,500.00 200.00 Using the attached Adjusted Trial Balance, prepare Jablonski's Golden Acres financial statements for the end of the year. Complete each on a separate page in the following order: A) Income Statement for 2020 (38 points) B) Statement of Owner Equity for 2020 (27 points) C) Balance Sheet for December 31, 2020 (49 points) It is expected that proper formatting will be used in regard to the document title, headings, sub- totals, etc. Improper formatting will lose points. You are to put together financial statements, not just determine net income or owner equity. Credits Debits 30,000.00 6,500.00 58,000.00 48,000.00 13,200.00 2,700,00 83,000.00 158,900.00 12,600.00 18.400.00 984,000.00 76,000.00 8,700.00 14,700.00 2,800.00 85,000.00 17,600.00 215,000.00 940,700,00 23,000.00 ADJUSTED TRIAL BALANCE Jablonski's Golden Acres For December 31, 2020 Accounts Cash Accounts Receivable Feeder Livestock Inventory Raised for Sale Feed Inventory Purchased for Use Crop Inventory Raised for Sale Prepaid Expenses Breeding Livestock Machinery & Equipment Office Furniture and Equipment Perennial Crops and Natural Resources Land, Buildings, and improvements Accumulated Depreciation Accounts Payable Taxes Payable Interest Payable Notes Payable, Non-Current Notes Payable, Due within One Year Real Estate Notes Payable, Non-Current Retained Capital Owner Withdrawals Non-Farm Income Other Capital Contributions/Gifts/inheritance Cash Crop Sales Changes in Raised Crop Inventories Cash Sales of Market Livestock Changes in Market Livestock Inventories Proceeds from Government Programs Change in Accounts Receivable Purchased Feed Change in Purchased Feed Inventory Wages Expense Payroll Tax Expense Rent Truck and Machinery Hire Fuel, ol, Gas, Grease Seed Herbicides, Pesticides Veterinarian Expenses Insurance Depreciation Expense Change in Accounts Payable Change in Prepaid insurance Interest Expense Change in interest Payabile Gains/losses on Sales of Farm Capital Assets Extraordinary Gains Income Tax Expense Changes in Taxes Payable 6,800.00 12,800.00 312,000.00 12,400.00 146,700.00 11,500.00 14,300.00 2,200.00 65,000.00 8,200.00 108,900.00 18,100.00 3.500.00 4,000.00 55,500.00 17.800.00 21,300.00 11.000 DO 47.000 00 27.900.00 3.200.00 400.00 15,200.00 4300.00 _500.00 2.000.00 27,500.00 200.00