Answered step by step

Verified Expert Solution

Question

1 Approved Answer

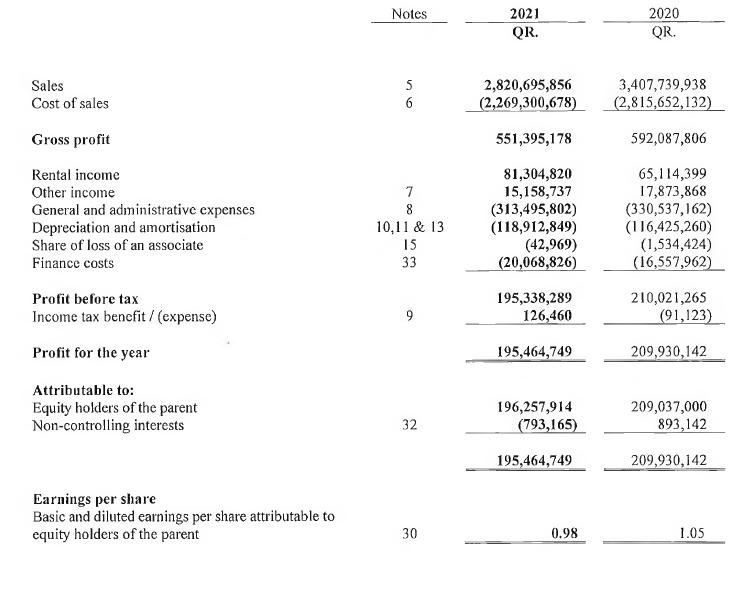

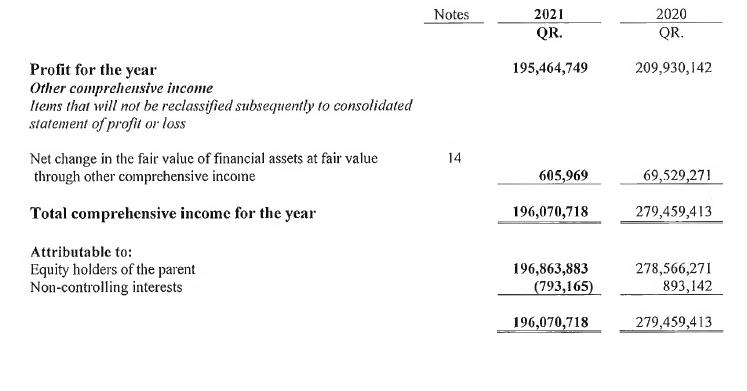

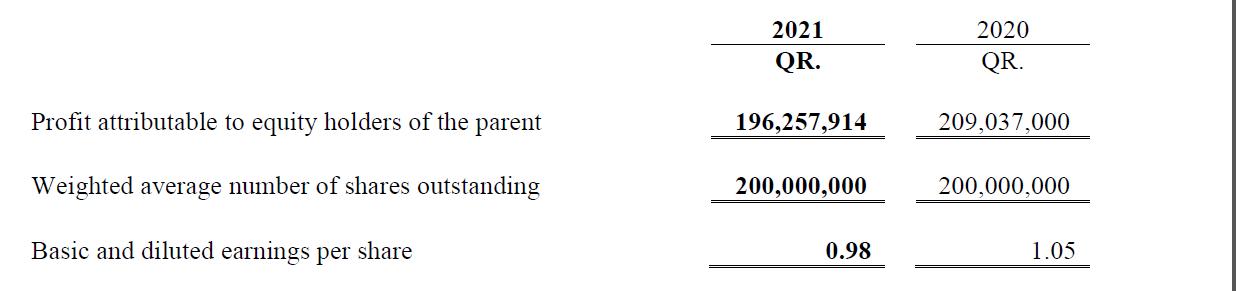

Using the attached financial statements, please calculate the below ratios: Operating margin ratio Book value per share ratio Return on common stockholders equity ratio Payout

Using the attached financial statements, please calculate the below ratios:

Operating margin ratio

Book value per share ratio

Return on common stockholders equity ratio

Payout ratio

Times interest earned ratio

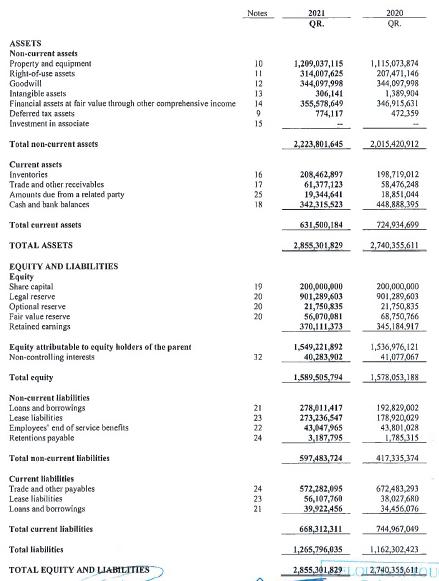

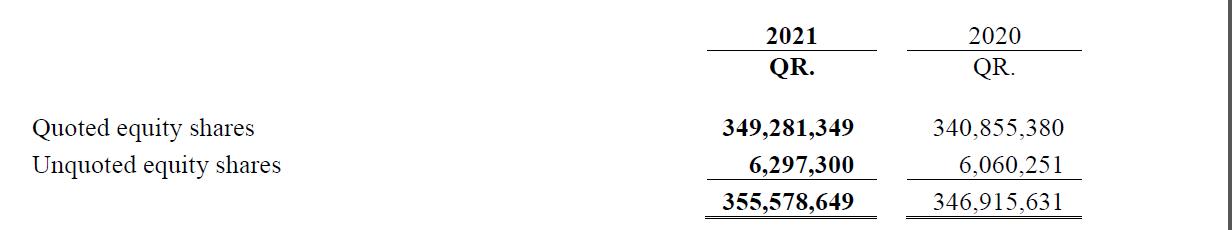

ASSETS Non-current assets Property and equipment Right-of-use assets Goodwill Intangible assets Financial assets at fair value through other comprehensive income Deferred tax assets Investment in associate Total non-current assets assets Current Inventories Trade and other receivables Amounts due from a related party Cash and bank balances Total current assets TOTAL ASSETS EQUITY AND LIABILITIES Equity Share capital Legal reserve Optional reserve Fair value reserve Retained earnings Equity attributable to equity holders of the parent Non-controlling interests Total equity Non-current liabilities Loans and borrowings Lease liabilities Employees' end of service benefits Retentions payable Total non-current liabilities Current liabilities Trade and other payables Lease liabilities Loans and borrowings Total current liabilities Total liabilities TOTAL EQUITY AND LIABILITIES Notes 10 11 12 13 14 9 15 BISK 16 17 25 18 19 8883 20 20 20 32 21 23 22 24 24 23 21 2021 QR. 1,209,037,115 314,007,625 344,097,998 306,141 355,578,649 774,117 2,223,801,645 208,462,897 61,377,123 19,344,641 342,315,523 631,500,184 2,855,301,829 200,000,000 901,289,603 21,750,835 56,070,081 370,111,373 1,549,221,892 40,283,902 1,589,505,794 278,011,417 273,236,547 43,047,965 3,187,795 597,483,724 2020 QR. 1,115,073,874 207,471,146 344,097,998 1,389,904 346,915,631 472,359 2,015,420,912 198,719,012 58,476,248 18,851,044 448,888,395 724,934,699 2,740,355,611 200,000,000 901,289,603 21,750,835 68,750,766 345,184,917 1,536,976,121 41,077,067 1,578,053,188 192,829,002 178,920,029 43,801,028 1,785,315 417,335,374 572,282,095 56,107,760 39,922,456 668,312,311 1,265,796,035 1,162,302,423 2,855,301,829 12.740.355,611 672,483,293 38,027,680 34,456,076 744,967,049

Step by Step Solution

★★★★★

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER A Operating margin ratio The operating margin measures how much profit a company makes on a d...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started