Answered step by step

Verified Expert Solution

Question

1 Approved Answer

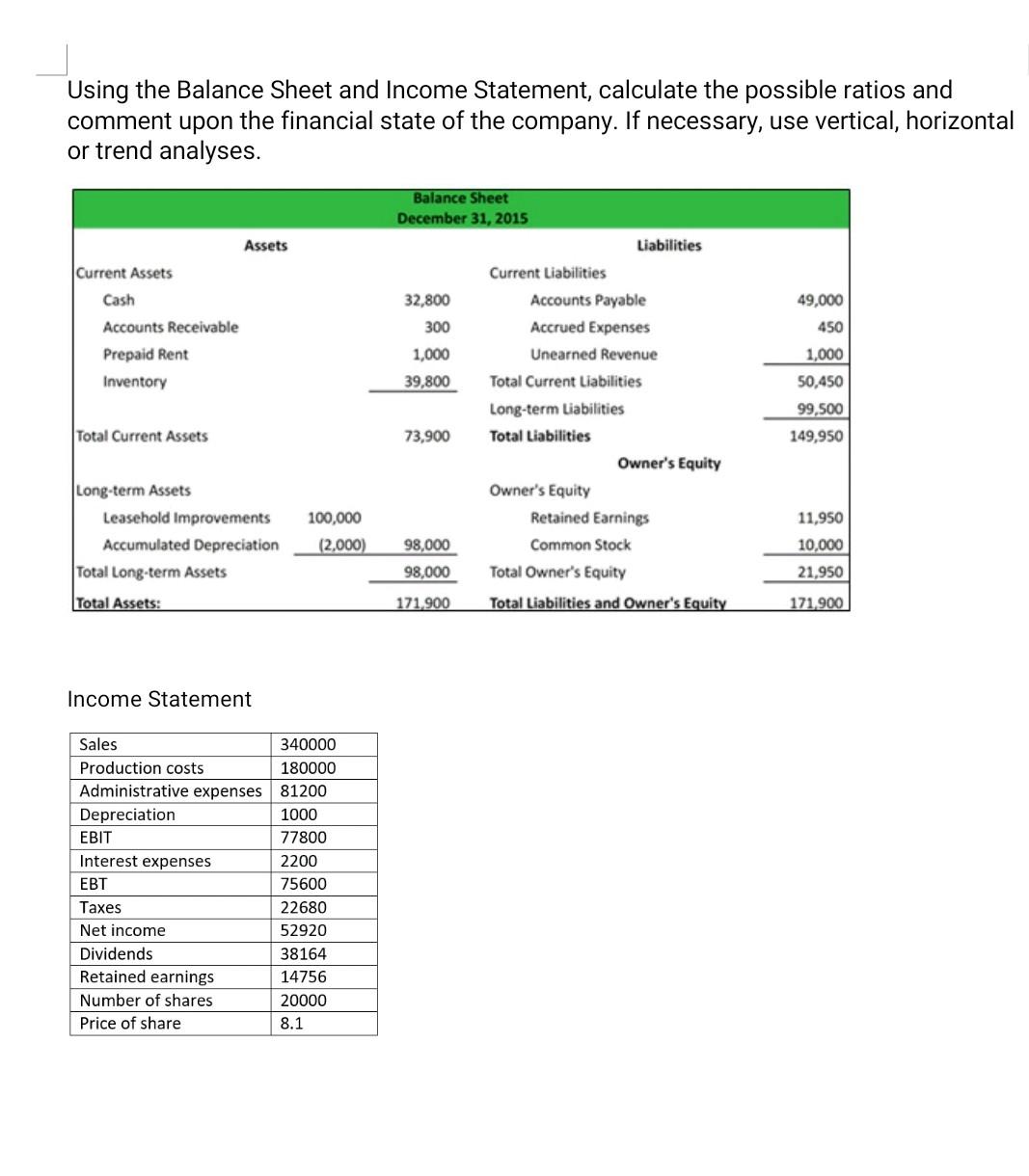

Using the Balance Sheet and Income Statement, calculate the possible ratios and comment upon the financial state of the company. If necessary, use vertical, horizontal

Using the Balance Sheet and Income Statement, calculate the possible ratios and comment upon the financial state of the company. If necessary, use vertical, horizontal or trend analyses. Assets Current Assets Cash Accounts Receivable Prepaid Rent Inventory Balance Sheet December 31, 2015 Liabilities Current Liabilities 32,800 Accounts Payable 300 Accrued Expenses 1,000 Unearned Revenue 39,800 Total Current Liabilities Long-term Liabilities 73,900 Total Liabilities Owner's Equity Owner's Equity Retained Earnings 98,000 Common Stock 98,000 Total Owner's Equity 171.900 Total Liabilities and Owner's Equity 49,000 450 1,000 50,450 99,500 149,950 Total Current Assets Long-term Assets Leasehold Improvements Accumulated Depreciation Total Long-term Assets 100,000 (2.000) 11,950 10,000 21,950 Total Assets: 171.900 Income Statement Sales 340000 Production costs 180000 Administrative expenses 81200 Depreciation 1000 EBIT 77800 Interest expenses 2200 EBT 75600 Taxes 22680 Net income 52920 Dividends 38164 Retained earnings 14756 Number of shares 20000 Price of share 8.1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started