Answered step by step

Verified Expert Solution

Question

1 Approved Answer

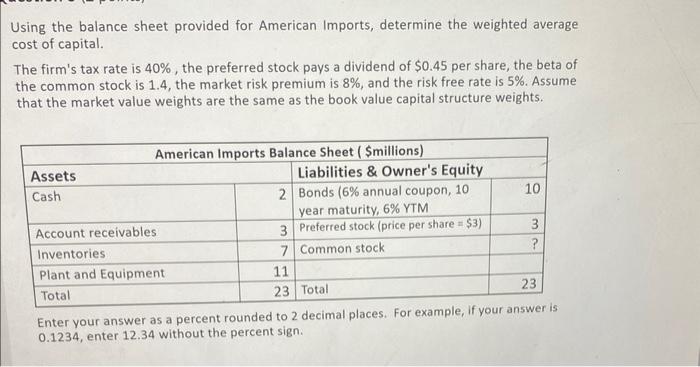

Using the balance sheet provided for American Imports, determine the weighted average cost of capital. The firm's tax rate is 40%, the preferred stock

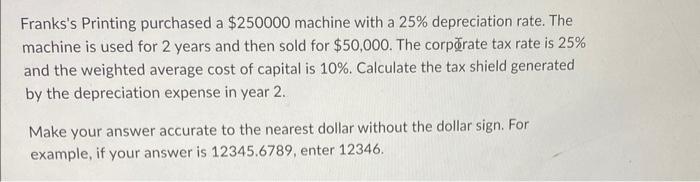

Using the balance sheet provided for American Imports, determine the weighted average cost of capital. The firm's tax rate is 40%, the preferred stock pays a dividend of $0.45 per share, the beta of the common stock is 1.4, the market risk premium is 8%, and the risk free rate is 5%. Assume that the market value weights are the same as the book value capital structure weights. Assets Cash American Imports Balance Sheet($millions) Account receivables Inventories Plant and Equipment Total 2 Liabilities & Owner's Equity Bonds (6% annual coupon, 10 year maturity, 6% YTM 3 Preferred stock (price per share= $3) 7 Common stock 11 23 10 3 ? Total 23 Enter your answer as a percent rounded to 2 decimal places. For example, if your answer is 0.1234, enter 12.34 without the percent sign. Franks's Printing purchased a $250000 machine with a 25% depreciation rate. The machine is used for 2 years and then sold for $50,000. The corporate tax rate is 25% and the weighted average cost of capital is 10%. Calculate the tax shield generated by the depreciation expense in year 2. Make your answer accurate to the nearest dollar without the dollar sign. For example, if your answer is 12345.6789, enter 12346.

Step by Step Solution

★★★★★

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

To determine the weighted average cost of capital WACC for American Imports we need to calculate the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started