Answered step by step

Verified Expert Solution

Question

1 Approved Answer

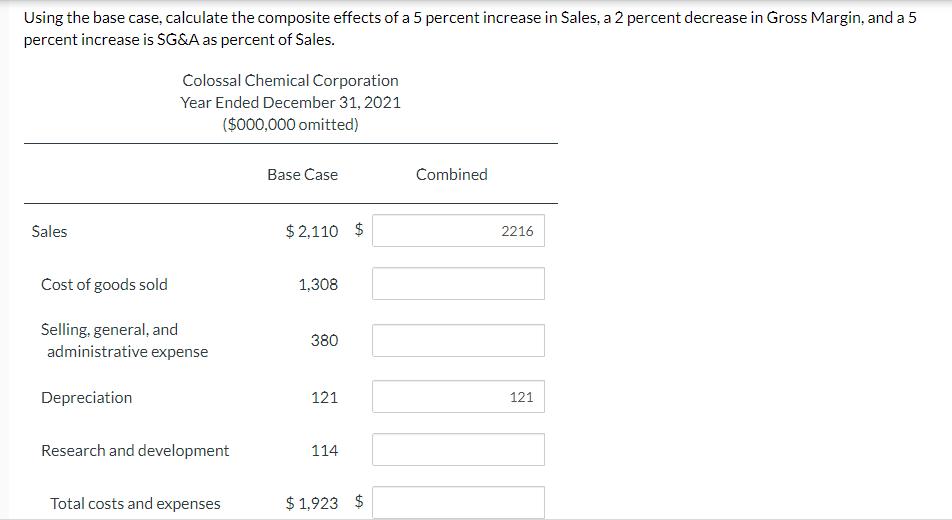

Using the base case, calculate the composite effects of a 5 percent increase in Sales, a 2 percent decrease in Gross Margin, and a

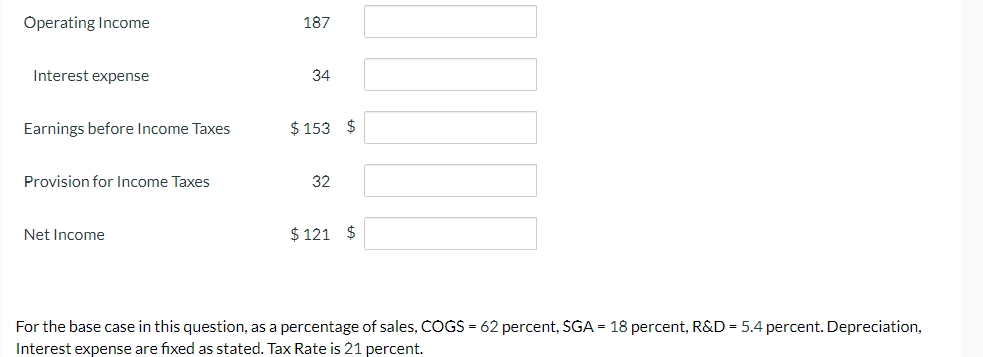

Using the base case, calculate the composite effects of a 5 percent increase in Sales, a 2 percent decrease in Gross Margin, and a 5 percent increase is SG&A as percent of Sales. Colossal Chemical Corporation Year Ended December 31, 2021 ($000,000 omitted) Sales Base Case $2,110 $ Combined 2216 Cost of goods sold 1,308 Selling, general, and 380 administrative expense Depreciation 121 121 Research and development 114 Total costs and expenses $1,923 $ Operating Income Interest expense 187 34 Earnings before Income Taxes $ 153 $ Provision for Income Taxes 32 Net Income $121 $ For the base case in this question, as a percentage of sales, COGS = 62 percent, SGA = 18 percent, R&D = 5.4 percent. Depreciation, Interest expense are fixed as stated. Tax Rate is 21 percent.

Step by Step Solution

★★★★★

3.44 Rating (138 Votes )

There are 3 Steps involved in it

Step: 1

To compute the composite impacts of the progressions in Deals Gross Edge and SGA as a level of Deals ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started