Question

Using the below information fill in the answers to parts (a), (b) and (c) for a change in accounting principle Partial Income Statement using Completed-

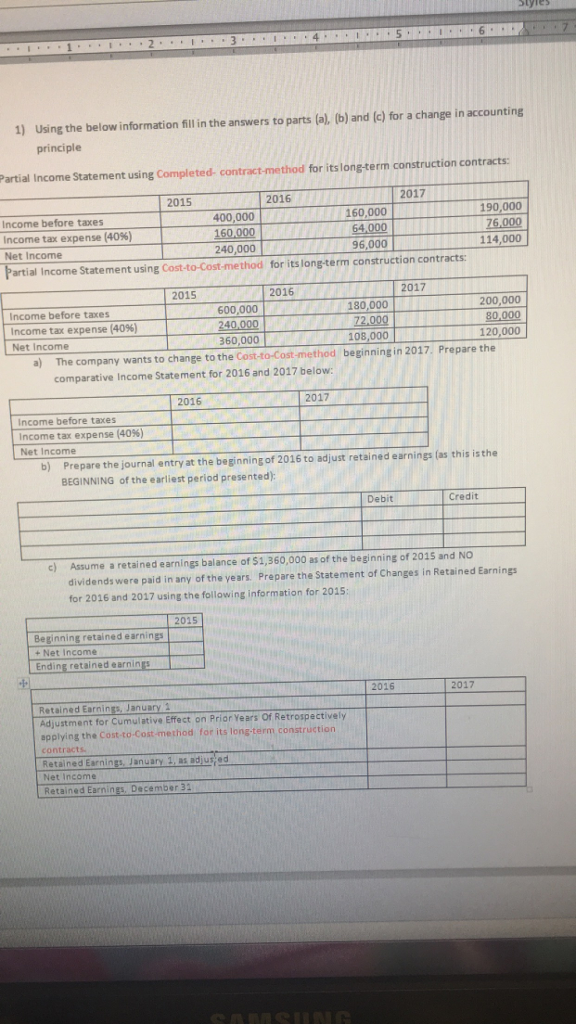

Using the below information fill in the answers to parts (a), (b) and (c) for a change in accounting principle Partial Income Statement using Completed- contract-method for its long-term construction contracts: 2015 2016 2017 Income before taxes 400,000 160,000 190,000 Income tax expense (40%) 160,000 64,000 76,000 Net Income 240,000 96,000 114,000 Partial Income Statement using Cost-to-Cost-method for its long-term construction contracts: 2015 2016 2017 Income before taxes 600,000 180,000 200,000 Income tax expense (40%) 240,000 72,000 80,000 Net Income 360,000 108,000 120,000 a)The company wants to change to the Cost-to-Cost-method beginning in 2017. Prepare the comparative Income Statement for 2016 and 2017 below: 2016 2017 Income before taxes Income tax expense (40%) Net Income b)Prepare the journal entry at the beginning of 2016 to adjust retained earnings (as this is the BEGINNING of the earliest period presented): Debit Credit c)Assume a retained earnings balance of $1,360,000 as of the beginning of 2015 and NO dividends were paid in any of the years. Prepare the Statement of Changes in Retained Earnings for 2016 and 2017 using the following information for 2015: 2015 Beginning retained earnings 1,360,000 + Net Income 240,000 Ending retained earnings 1,600,000 2016 2017 Retained Earnings, January 1 Adjustment for Cumulative Effect on Prior Years Of Retrospectively applying the Cost-to-Cost-method for its long-term construction contracts. Retained Earnings, January 1, as adjusted Net Income Retained Earnings, December 31

Using the below information fill in the answers to parts (a), (b) and (c) for a change in accounting principle Partial Income Statement using Completed- contract-method for its long-term construction contracts: 2015 2016 2017 Income before taxes 400,000 160,000 190,000 Income tax expense (40%) 160,000 64,000 76,000 Net Income 240,000 96,000 114,000 Partial Income Statement using Cost-to-Cost-method for its long-term construction contracts: 2015 2016 2017 Income before taxes 600,000 180,000 200,000 Income tax expense (40%) 240,000 72,000 80,000 Net Income 360,000 108,000 120,000 a)The company wants to change to the Cost-to-Cost-method beginning in 2017. Prepare the comparative Income Statement for 2016 and 2017 below: 2016 2017 Income before taxes Income tax expense (40%) Net Income b)Prepare the journal entry at the beginning of 2016 to adjust retained earnings (as this is the BEGINNING of the earliest period presented): Debit Credit c)Assume a retained earnings balance of $1,360,000 as of the beginning of 2015 and NO dividends were paid in any of the years. Prepare the Statement of Changes in Retained Earnings for 2016 and 2017 using the following information for 2015: 2015 Beginning retained earnings 1,360,000 + Net Income 240,000 Ending retained earnings 1,600,000 2016 2017 Retained Earnings, January 1 Adjustment for Cumulative Effect on Prior Years Of Retrospectively applying the Cost-to-Cost-method for its long-term construction contracts. Retained Earnings, January 1, as adjusted Net Income Retained Earnings, December 31

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started