Answered step by step

Verified Expert Solution

Question

1 Approved Answer

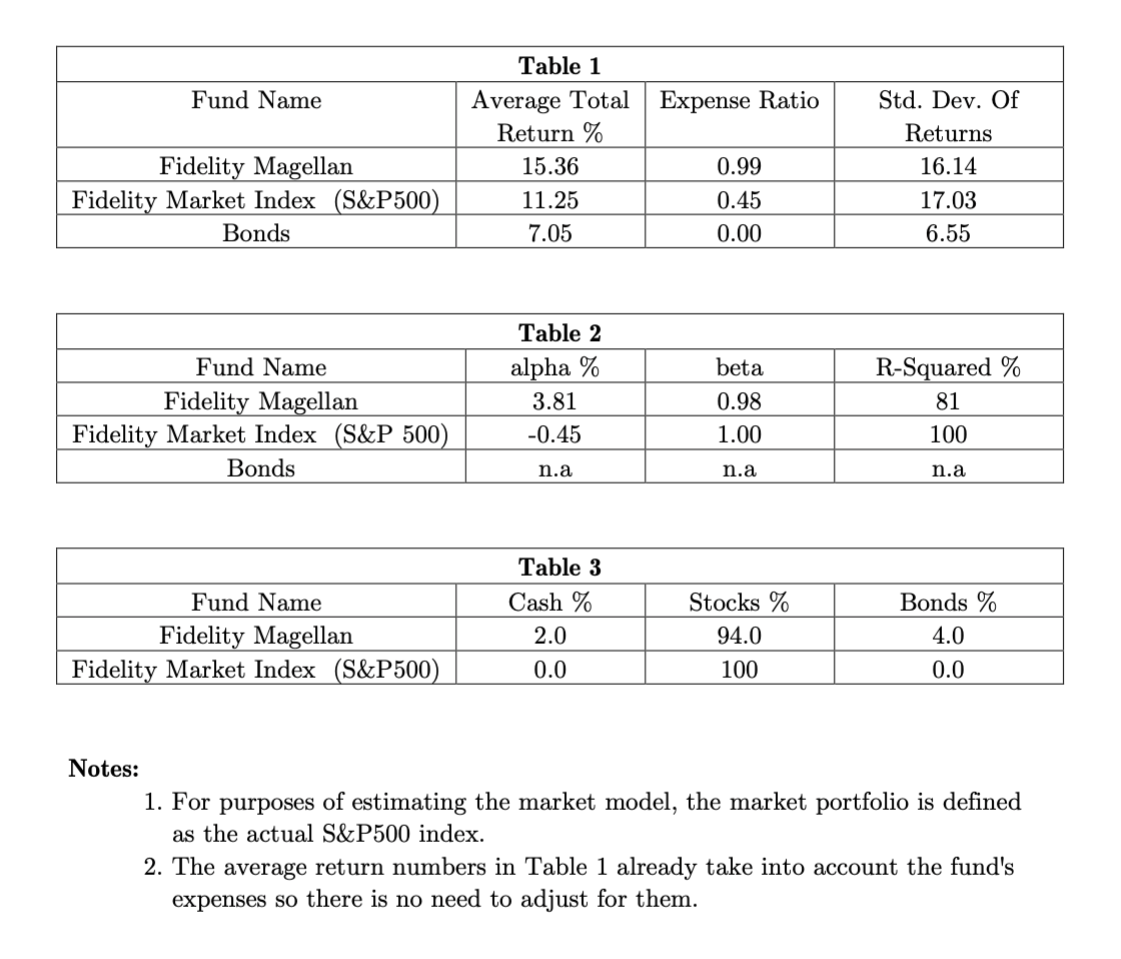

Using the below Table below please answer the question What percentage of Magellan's total risk is idiosyncratic?c)Fidelity Market Index has a beta of 1.00. What

Using the below Table below please answer the question

What percentage of Magellan's total risk is idiosyncratic?c)Fidelity Market Index has a beta of 1.00.

What percentage of Magellan's total risk is idiosyncratic?c)Fidelity Market Index has a beta of 1.00.

What does the fact that its alpha is -0.45 mean? What is the reason for that?

Fund Name Table 1 Average Total Expense Ratio Return % 15.36 0.99 11.25 0.45 7.05 0.00 Fidelity Magellan Fidelity Market Index (S&P500) Bonds Std. Dev. Of Returns 16.14 17.03 6.55 Table 2 alpha % 3.81 -0.45 R-Squared % Fund Name Fidelity Magellan Fidelity Market Index (S&P 500) Bonds beta 0.98 1.00 81 100 n.a n.a n.a Fund Name Fidelity Magellan Fidelity Market Index (S&P500) Table 3 Cash % 2.0 0.0 Stocks % 94.0 100 Bonds % 4.0 0.0 Notes: 1. For purposes of estimating the market model, the market portfolio is defined as the actual S&P500 index. 2. The average return numbers in Table 1 already take into account the fund's expenses so there is no need to adjust for them. Fund Name Table 1 Average Total Expense Ratio Return % 15.36 0.99 11.25 0.45 7.05 0.00 Fidelity Magellan Fidelity Market Index (S&P500) Bonds Std. Dev. Of Returns 16.14 17.03 6.55 Table 2 alpha % 3.81 -0.45 R-Squared % Fund Name Fidelity Magellan Fidelity Market Index (S&P 500) Bonds beta 0.98 1.00 81 100 n.a n.a n.a Fund Name Fidelity Magellan Fidelity Market Index (S&P500) Table 3 Cash % 2.0 0.0 Stocks % 94.0 100 Bonds % 4.0 0.0 Notes: 1. For purposes of estimating the market model, the market portfolio is defined as the actual S&P500 index. 2. The average return numbers in Table 1 already take into account the fund's expenses so there is no need to adjust for themStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started