Question

Using the Butterfield case, calculate and interpret the following financial ratios. All needed information is provided, except for the total credit available, which is $10,000

Using the Butterfield case, calculate and interpret the following financial ratios. All needed information is provided, except for the total credit available, which is $10,000 on the Visa credit card and $11,500 on the MasterCard. Answer the following questions based on your findings.

a. How would you rate the Butterfields overall level of liquidity?

b. How would you rate the Butterfields overall level of solvency?

c. Does their periodic savings rate meet the minimum suggested threshold?

d. Are they spending too much on housing?

Be sure to frame your answers as if you are speaking to or presenting them to the client

John and Haley want to protect their income and assets in the event of a catastrophic accident or illness, so that they can pass on their assets to their children.

John and Haley want to protect their income and assets in the event of a catastrophic accident or illness, so that they can pass on their assets to their children.

John and Haley want to continue funding IRAs to the current maximum limit.

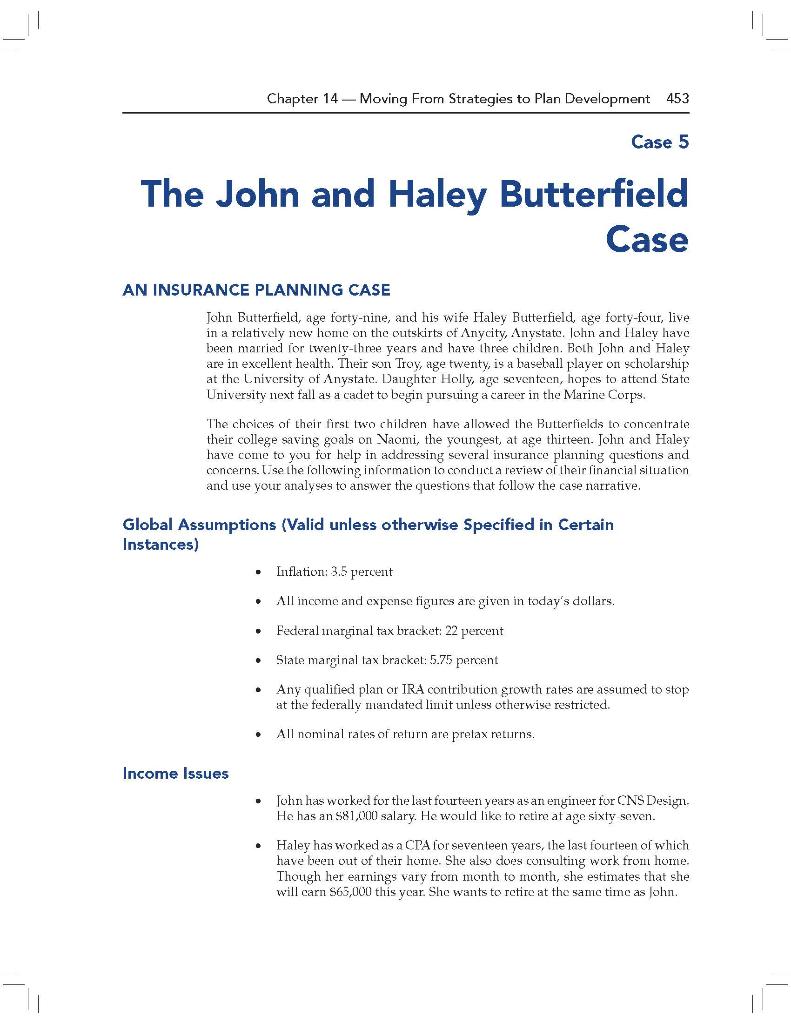

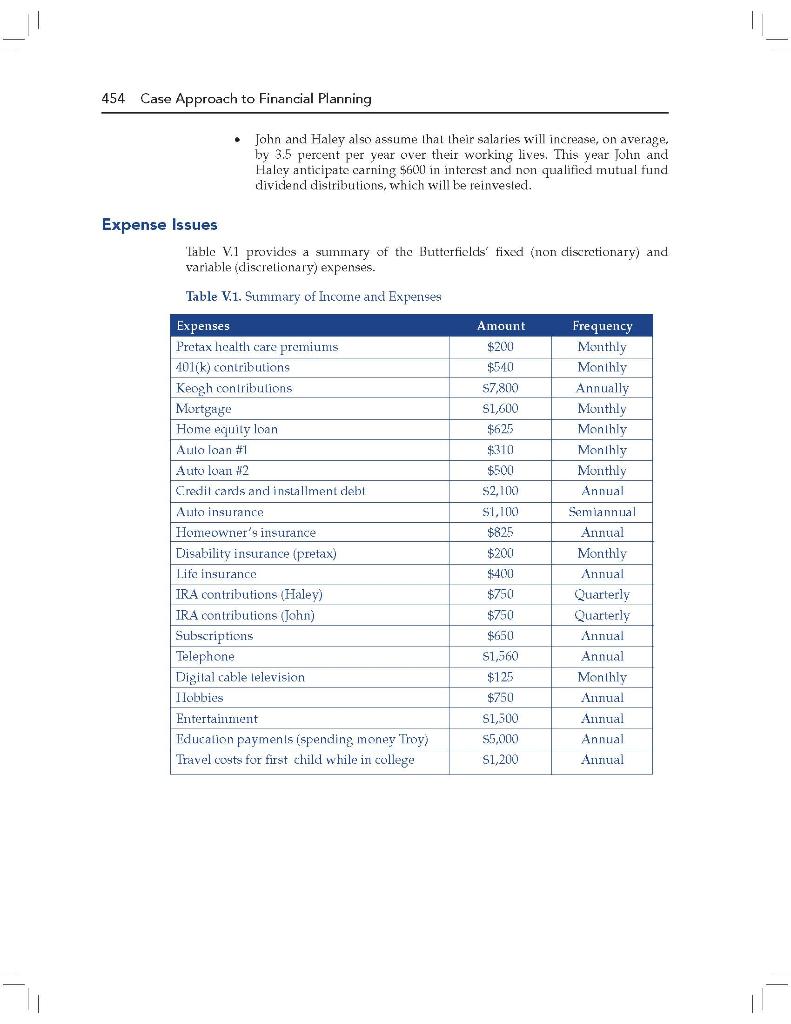

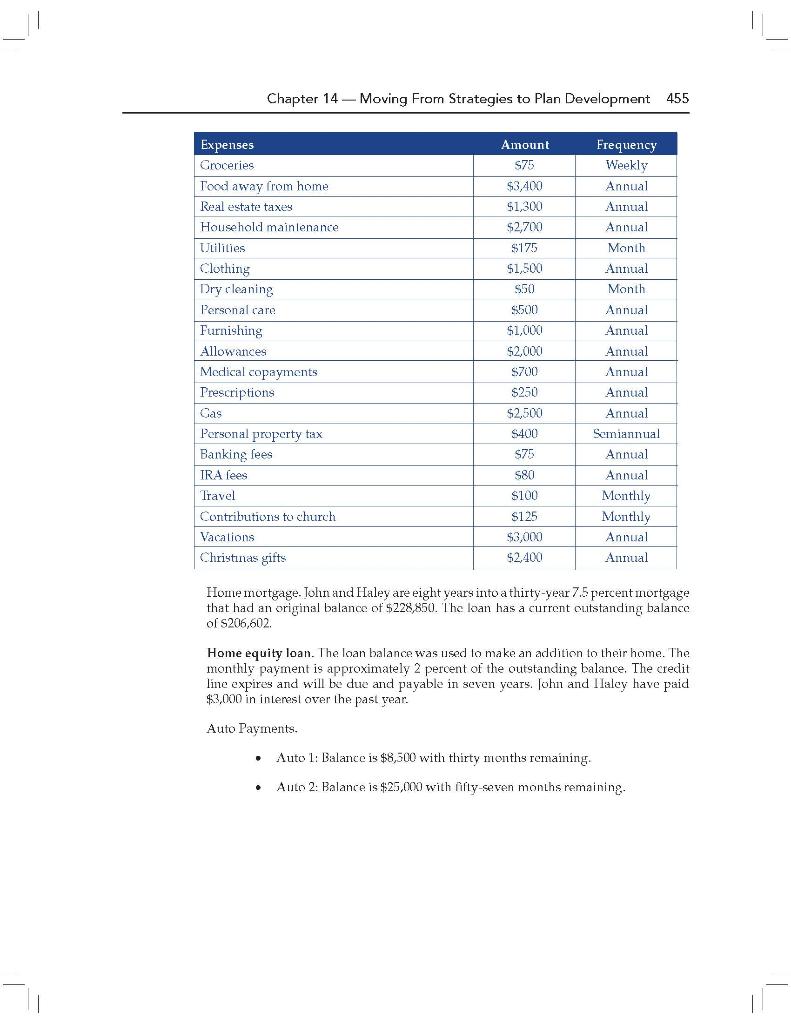

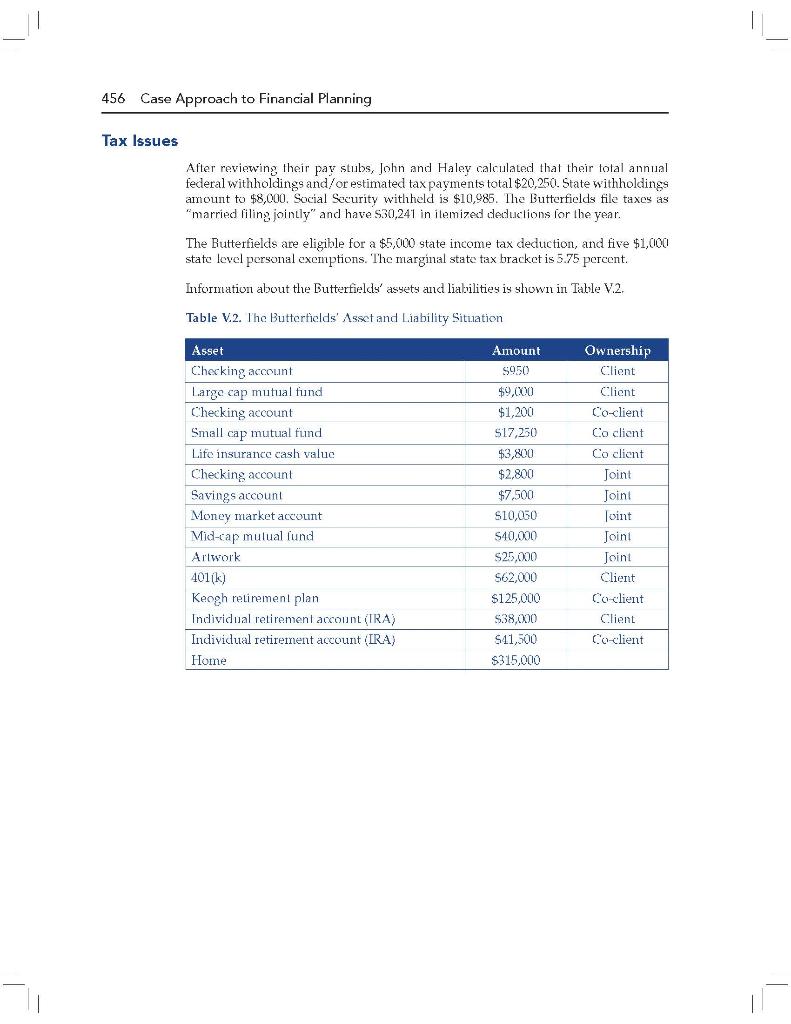

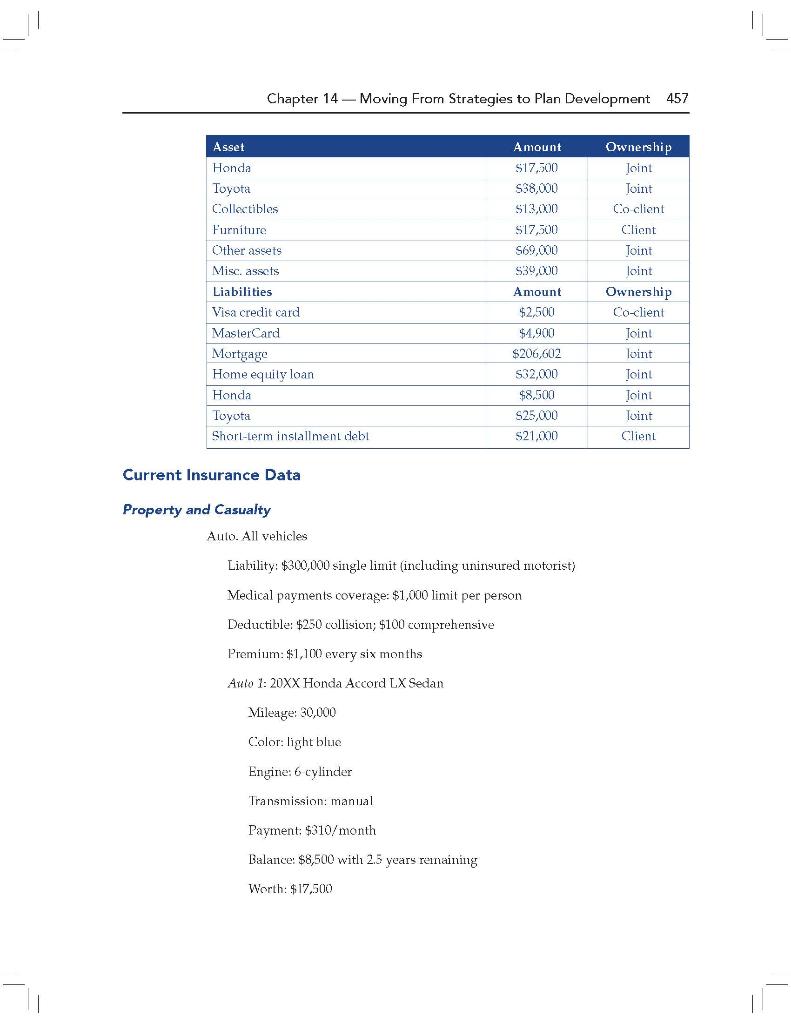

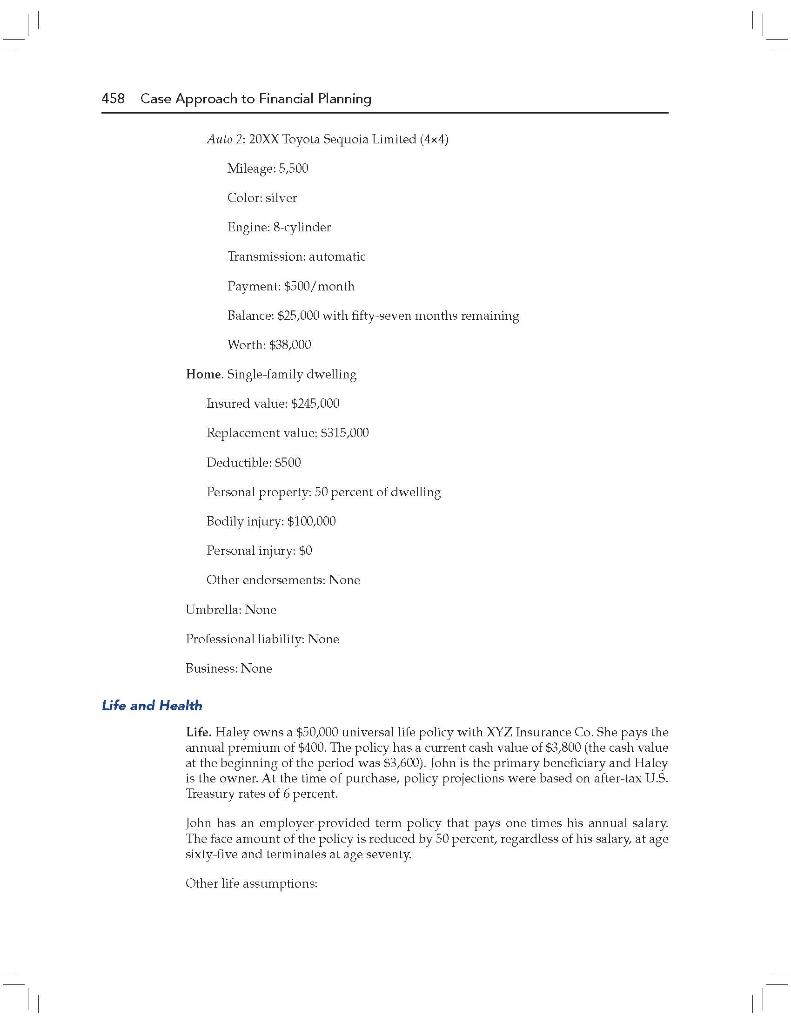

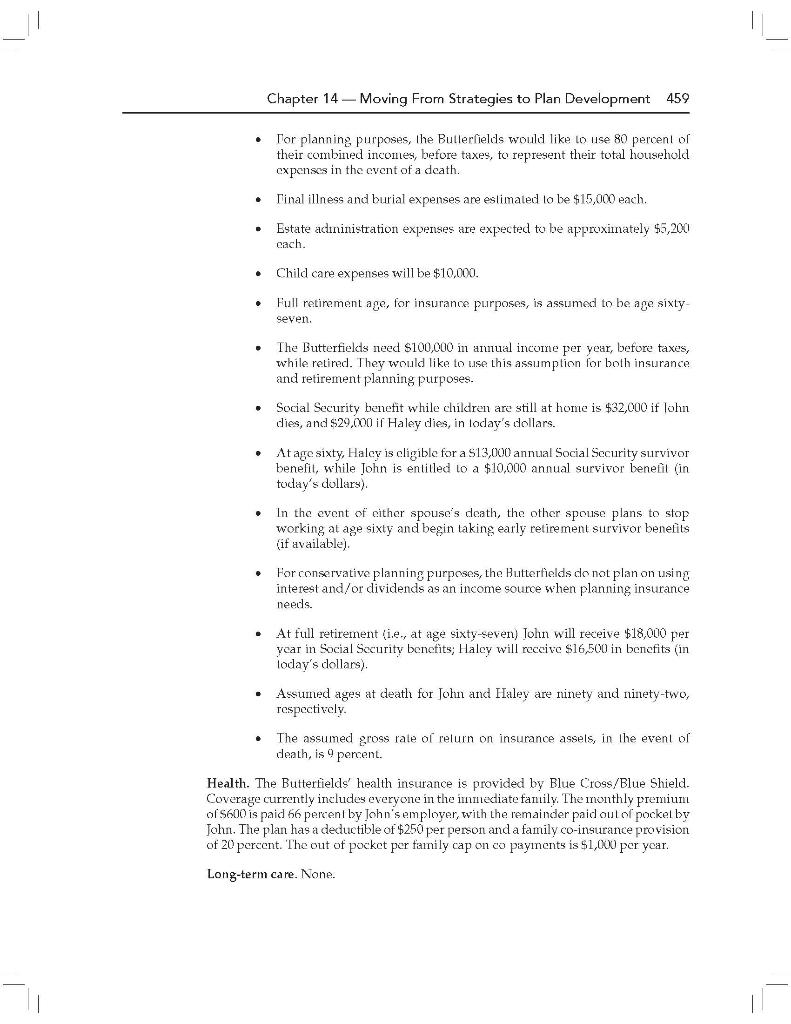

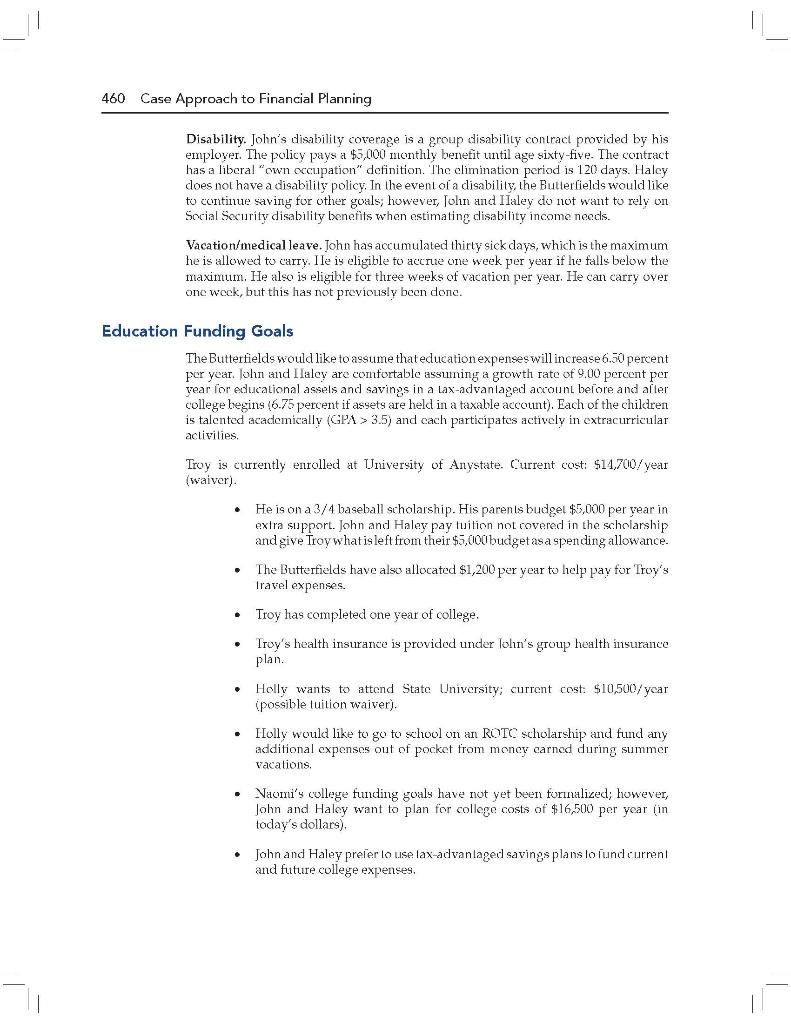

Chapter 14 - Moving From Strategies to Plan Development 453 Case 5 The John and Haley Butterfield Case AN INSURANCE PLANNING CASE John Butterfield, age forty-nine, and his wife Haley Butterfield, age forty-four, live in a relatively new home on the outskirts of Anycity, Anystate. John and Llaley have been married for twenty-three years and have three children. Both John and Haley are in excellent health. Their son Troy, age twenty, is a baseball player on scholarship at the University of Anystate. Daughter Holly, age seventeen, hopes to attend Stato University next fall as a cadet to begin pursuing a career in the Marine Corps The choices of their first two children have allowed the Butterfields to concentrate their college saving goals on Naomi, the youngest, at age thirteen. John and Haley have come to you for help in addressing several insurance planning questions and concerns. Use the following information to conducta review of their financial situation and use your analyses to answer the questions that follow the case narrative. Global Assumptions (Valid unless otherwise specified in Certain Instances) Inflation: 3.5 percent All income and expense figures are given in today's dollars. Federal marginal tax bracket: 22 percent State marginal tax bracket: 5.75 percent Any qualified plan or IRA contribution growth rates are assumed to stop at the federally mandated limit unless otherwise restricted. . All nominal rates of relurn are prelax returns. Income Issues John has worked for the last fourteen years as an engineer for CNS Design. He has an $81,000 salary. He would like to retire at age sixty seven. Haley has worked as a CPA for seventeen years, the last fourteen of which have been out of their home. She also does consulting work from home. Though her earnings vary from month to month, she estimates that she will carn S65,000 this year. She wants to retire at the same time as lohn. 454 Case Approach to Financial Planning . John and Haley also assume that their salaries will increase, on average, by 3.5 percent per year over their working lives. This year John and Haley anticipate carning $600 in interest and non qualified mutual fund dividend distributions, which will be reinvested. Expense Issues Table V.1 provides a summary of the Butterfields fixed (non discretionary) and variable discretionary) expenses. Table V.1. Summary of Income and Expenses Expenses Pretax health care premiums 401(k) contributions Keogh contributions Mortgage Home equity loan Auto loan #1 Auto loan 2 Credit cards and installment debt Auto insurance Homeowner's insurance Disability insurance (pretax) Life insurance IRA contributions (Haley) IRA contributions (John) Subscriptions Telephone Digital cable television Ilobbies Entertainment Education payments (spending money Troy) Travel costs for first child while in college Amount $200 $50 S7,800 S1,600 $625 $310 $500 S2,100 S1,100 $825 $200 $400 $750 $750 $650 S1,560 $125 $750 $1,500 S5.000 $1,200 Frequency Monthly Monthly Annually Monthly Monthly Monthly Monthly Annual Semiannual Annual Monthly Annual Quarterly Quarterly Annual Annual Monthly Annual Annual Annual Annual Chapter 14 - Moving From Strategies to Plan Development 455 Expenses Groceries Tood away from home Real estate taxes Household maintenance Utilities Clothing Dry cleaning Personal care Furnishing Allowances Medical copayments Prescriptions Gas Personal property tax Banking fees IRA lees Travel Contributions to church Vacations Christinas gifts Amount 575 $3,400 $1,300 $2,700 $175 $1,500 S50 $500 $1,000 $2.000 $700 $250 $2.500 S400 $75 Frequency Weekly Annual Annual Annual Month Annual Month Annual Annual Annual Annual Annual Annual Semiannual Annual Annual Monthly Monthly Annual Annual 580 $100 $125 $3,000 52.400 Home mortgage. Tohn and Haley are eight years into a thirty-year 7.5 percent mortgage that had an original balance of $228,850. The loan has a current outstanding balance of S206,602 Home equity loan. The loan balance was used to make an addition to their home. The monthly payment is approximately 2 percent of the outstanding balance. The credit line expires and will be due and payable in seven years. John and Ilaley have paid $3,000 in interest over the past year. Auto Payments. Auto 1: Balance is $8,500 with thirty months remaining Auto 2: Balance is $25,000 with fly-seven months remaining. . 456 Case Approach to Financial Planning Tax Issues After reviewing their pay stubs, John and Haley calculated that their total annual federal withholdings and/or estimated taxpayments total $20,250. State withholdings amount to $8,000. Social Security withheld is $10,985. The Butterfields file taxes as "married filing jointly" and have 530,241 in itemized deductions for the year. The Butterfields are eligible for a $5,000 state income tax deduction, and five $1,000 state level personal exemptions. The marginal state tax bracket is 5.75 percent. Information about the Butterfields' assets and liabilities is shown in Table V.2. Table V.2. The Butterfields' Asset and Liability Situation Asset Checking account Large cap mutual fund Checking account Small cap mutual fund Life insurance cash value Checking account Savings account Money market account Mid-cap mulual lund Artwork 401(k) Keogh retirement plan Individual retirement account (RA) Individual retirement account (IRA) Home Amount $950 $9,000 $1,200 517,250 $3,800 $2,800 $7,500 $10,050 $40,000 $25,000 S62,000 $125,000 $38.000 S41,500 $315,000 Ownership Client Client Co-client Co client Co client Joint Joint Joint Joint Joint Client Co-client Client Co-client Chapter 14 - Moving From Strategies to Plan Development 457 Asset Honda Toyota Collectibles Furniture Other assets Misc, assets Liabilities Visa credit card MasterCard Mortgage Home equily loan Honda Toyota Short-term installment debt Amount $17.500 S38,000 $13,000 S17,500 S69,000 S39,000 Amount $2,500 $1,900 $206,602 S32,000 $8,500 S25,000 S21.000 Ownership Joint Toint Co client Client Toint loint Ownership Co-client Joint 3 loint Toint Joint Toint Client Current Insurance Data Property and Casualty Aulo. All vehicles Liability: $300,000 single limit (including uninsured motorist) Medical payments coverage: $1,000 limit per person Deductible: $250 collision: $100 comprehensive Premium: $1,100 every six months Aulo 1: 20XX Honda Accord LX Sedan Mileage: 30,000 Color: light blue Engine: 6 cylinder Transmission: manual Payment: $310/month Balance: $8,500 with 2.5 years renaining Worth: $ 17,500 458 Case Approach to Financial Planning Auto 2:20XX Toyola Sequoia Limited (4x4) Mileage: 5,500 Color: silver Engine: 8-cylinder Transmission: automatic Payment: $500/month Balance: $25,000 with fifty-seven inonths remaining Worth: $38,000 Home. Single-lamily dwelling Insured value: $245,000 Replacement value: S315,000 Deductible: 5500 Personal property 50 percent of dwelling Bodily injury: $100,000 Personal injurv: 50 Other endorsements: None Umbrella: None Professional liability: None Business: None Life and Health Life. Haley owns a $50,000 universal life policy with XYZ Insurance Co. She pays the annual premium of $100. The policy has a current cash value of $3,800 (the cash value at the beginning of the period was $3,600). John is the primary beneficiary and Halcy is the owner. Al the time of purchase, policy projections were based on after-tax U.S. Treasury rates of 6 percent. John has an employer provided term policy that pays one times his annual salary. The face amount of the policy is reduced by 50 percent, regardless of his salary, at age sixiv-live and terminales alage sevenly. Other life assumptions: Chapter 14 - Moving From Strategies to Plan Development 459 . Tor planning purposes, the Butlerfields would like to use 80 percent of their combined incomes, before taxes, to represent their total household expenses in the event of a death. Tinal illness and burial expenses are estimated to be $15,000 each. Estate aclininistration expenses are expected to be approxiinately $5,200 Cach. . . Child care expenses will be $10,000. Full retirement age, for insurance purposes, is assumed to be age sixty- seven. The Butterfields need $100,000 in annual income per year, before taxes, while retired. They would like to use this assumption for both insurance and retirement planning purposes. Social Security benefit while children are still at home is $32,000 if lohn dies, and $29,000 if Haley dies, in loday's dollars. At age sixty, Haley is cligible for a $13,000 annual Social Security survivor benefit, while John is entitled to a $10,000 annual survivor benefit (in today's dollars) . In the event of either spouse's death, the other spouse plans to stop working at age sixty and begin taking early retirement survivor benefits (if available). For conservative planning purposes, the Hutterfields do not plan on using interest and/or dividends as an income source when planning insurance needs. . At full retirement (i.e. at age sixty-seven) John will receive $18,000 per year in Social Security benefits; Haley will receive $16,500 in benefits (in Today's dollars) Assuned ages at death for John and Haley are ninety and ninety-two, respectively. The assumed gross rate of relurn on insurance assels, in the event of death, is 9 percent. Health. The Butterfields' health insurance is provided by Blue Cross/Blue Shield. Coverage currently includes everyone in the immediate family. The inonthly premium of S600 is paid 66 percent by John's employer, with the remainder paid out of pockel by John. The plan has a deductible of $250 per person and a family co-insurance provision of 20 percent. The out of pocket per family cap on co paynents is $1,000 per year. Long-term care. None. 460 Case Approach to Financial Planning Disability. John's disability coverage is a group disability contract provided by his employer. The policy pays a $5,000 monthly benefit until age sixty-five. The contract has a liberal "own occupation" definition. The climination period is 120 days. Haley does not have a disability policy. In the event of a disability the Butterfields would like to continue saving for other goals; however, Jolin and IIaley do not want to rely on Social Security disability benefits when estimating disability income needs. Vacation/medical leave. John has accumulated thirty sick days, which is the maximum he is allowed to carry. Ile is eligible to accre one week per year if he falls below the maximum. He also is eligible for three weeks of vacation per year. He can carry over one week, but this has not previously been done. Education Funding Goals The Butterfields would like to assume that education expenses will increase 6.50 percent per year. John and Ilaley are comfortable assuming a growth rate of 9.00 percent per year for educational assels and savings in a lax-advantaged account before and after college begins (6.75 percent if assets are held in a taxable account). Each of the children is talented academically (GPA > 3.5) and cach participates actively in extracurricular activities . . . Troy is currently enrolled at University of Anystate. Current cost: $14,700/year (waiver). He is on a 3/4 baseball scholarship. His parents budgel $5,000 per year in extra support. John and Haley pay tuition not covered in the scholarship and give Troywhat is left from their $5,000 budget asa spending allowance. The Butterfields have also allocated $1,200 per year to help pay for Troy's Travel expenses. Troy has completed one year of college. Troy's health insurance is provided under lolin's group health insurance plan. Holly wants to attend State University; current cost: $10,500/year possible tuition waiver). Holly would like to go to school on an ROTC scholarship and find any additional expenses out of pocket from money carned during summer Vacations. Naomi's college funding goals have not yet been forinalized; however, John and Haley want to plan for college costs of $16,500 per year (in today's dollars) John and Haley preler lo use lax-advantaged savings plans lo lund current and future college expenses. . Chapter 14 - Moving From Strategies to Plan Development 461 Retirement Information John and Haley would like to retire when John turns age sixty-seven. Based on today's dollars, John and Haley are willing to reduce their income by 80 percent of current income while retired. Al full retirement, John will receive $18,000 per year in Social Securily benefits in today's dollars); Ilaley will receive $16,500 in Social Security benefits (in today's dollars) at age sixty-seven. When planning for retirement, John and Halcy are comfortable assuming a 9.00 percent rate of return before retirement, and a 5.75 percent return after retirement . . Contributions to defined contribution plans are anticipated to increase 3 percent annually . John and IIaley anticipate being in a combined federal and state tax bracket of 25 percent in retirement Inflation before and after retirement will be 3.50 percent; their incomes should keep pace with inilation. John's employer matches 101(k) contributions $0.50 cents on the dollar. TRA assets are held in Roth accounts. Assumed age at death for lohn is age ninely and age ninely-two for Haley. Estate Information John and Ilaley have simple wills. John's will leaves his estate to Ilaley, whereas Haley's will leaves her estale to John. They believe that, on average, the surviving spouse's estate will grow by 1 percent after the first spouse's death. Other assumptions include: . Funeral expenses are expected to be approximately $12,000 each. Estate administrative expenses will be $5,200 cach. The Butterfield do nol expect to pay any executor lees, . Specific Client Goals Under any circuinstance, lohn and Haley want to provide 50 percent of The cost of Holly's and Naomi's college education costs, and all of Troy's education costs that are not covered by scholarships. John and Haley want to maintain their current standard of living in retirement or in the event or either spouse's premature death. . Chapter 14 - Moving From Strategies to Plan Development 453 Case 5 The John and Haley Butterfield Case AN INSURANCE PLANNING CASE John Butterfield, age forty-nine, and his wife Haley Butterfield, age forty-four, live in a relatively new home on the outskirts of Anycity, Anystate. John and Llaley have been married for twenty-three years and have three children. Both John and Haley are in excellent health. Their son Troy, age twenty, is a baseball player on scholarship at the University of Anystate. Daughter Holly, age seventeen, hopes to attend Stato University next fall as a cadet to begin pursuing a career in the Marine Corps The choices of their first two children have allowed the Butterfields to concentrate their college saving goals on Naomi, the youngest, at age thirteen. John and Haley have come to you for help in addressing several insurance planning questions and concerns. Use the following information to conducta review of their financial situation and use your analyses to answer the questions that follow the case narrative. Global Assumptions (Valid unless otherwise specified in Certain Instances) Inflation: 3.5 percent All income and expense figures are given in today's dollars. Federal marginal tax bracket: 22 percent State marginal tax bracket: 5.75 percent Any qualified plan or IRA contribution growth rates are assumed to stop at the federally mandated limit unless otherwise restricted. . All nominal rates of relurn are prelax returns. Income Issues John has worked for the last fourteen years as an engineer for CNS Design. He has an $81,000 salary. He would like to retire at age sixty seven. Haley has worked as a CPA for seventeen years, the last fourteen of which have been out of their home. She also does consulting work from home. Though her earnings vary from month to month, she estimates that she will carn S65,000 this year. She wants to retire at the same time as lohn. 454 Case Approach to Financial Planning . John and Haley also assume that their salaries will increase, on average, by 3.5 percent per year over their working lives. This year John and Haley anticipate carning $600 in interest and non qualified mutual fund dividend distributions, which will be reinvested. Expense Issues Table V.1 provides a summary of the Butterfields fixed (non discretionary) and variable discretionary) expenses. Table V.1. Summary of Income and Expenses Expenses Pretax health care premiums 401(k) contributions Keogh contributions Mortgage Home equity loan Auto loan #1 Auto loan 2 Credit cards and installment debt Auto insurance Homeowner's insurance Disability insurance (pretax) Life insurance IRA contributions (Haley) IRA contributions (John) Subscriptions Telephone Digital cable television Ilobbies Entertainment Education payments (spending money Troy) Travel costs for first child while in college Amount $200 $50 S7,800 S1,600 $625 $310 $500 S2,100 S1,100 $825 $200 $400 $750 $750 $650 S1,560 $125 $750 $1,500 S5.000 $1,200 Frequency Monthly Monthly Annually Monthly Monthly Monthly Monthly Annual Semiannual Annual Monthly Annual Quarterly Quarterly Annual Annual Monthly Annual Annual Annual Annual Chapter 14 - Moving From Strategies to Plan Development 455 Expenses Groceries Tood away from home Real estate taxes Household maintenance Utilities Clothing Dry cleaning Personal care Furnishing Allowances Medical copayments Prescriptions Gas Personal property tax Banking fees IRA lees Travel Contributions to church Vacations Christinas gifts Amount 575 $3,400 $1,300 $2,700 $175 $1,500 S50 $500 $1,000 $2.000 $700 $250 $2.500 S400 $75 Frequency Weekly Annual Annual Annual Month Annual Month Annual Annual Annual Annual Annual Annual Semiannual Annual Annual Monthly Monthly Annual Annual 580 $100 $125 $3,000 52.400 Home mortgage. Tohn and Haley are eight years into a thirty-year 7.5 percent mortgage that had an original balance of $228,850. The loan has a current outstanding balance of S206,602 Home equity loan. The loan balance was used to make an addition to their home. The monthly payment is approximately 2 percent of the outstanding balance. The credit line expires and will be due and payable in seven years. John and Ilaley have paid $3,000 in interest over the past year. Auto Payments. Auto 1: Balance is $8,500 with thirty months remaining Auto 2: Balance is $25,000 with fly-seven months remaining. . 456 Case Approach to Financial Planning Tax Issues After reviewing their pay stubs, John and Haley calculated that their total annual federal withholdings and/or estimated taxpayments total $20,250. State withholdings amount to $8,000. Social Security withheld is $10,985. The Butterfields file taxes as "married filing jointly" and have 530,241 in itemized deductions for the year. The Butterfields are eligible for a $5,000 state income tax deduction, and five $1,000 state level personal exemptions. The marginal state tax bracket is 5.75 percent. Information about the Butterfields' assets and liabilities is shown in Table V.2. Table V.2. The Butterfields' Asset and Liability Situation Asset Checking account Large cap mutual fund Checking account Small cap mutual fund Life insurance cash value Checking account Savings account Money market account Mid-cap mulual lund Artwork 401(k) Keogh retirement plan Individual retirement account (RA) Individual retirement account (IRA) Home Amount $950 $9,000 $1,200 517,250 $3,800 $2,800 $7,500 $10,050 $40,000 $25,000 S62,000 $125,000 $38.000 S41,500 $315,000 Ownership Client Client Co-client Co client Co client Joint Joint Joint Joint Joint Client Co-client Client Co-client Chapter 14 - Moving From Strategies to Plan Development 457 Asset Honda Toyota Collectibles Furniture Other assets Misc, assets Liabilities Visa credit card MasterCard Mortgage Home equily loan Honda Toyota Short-term installment debt Amount $17.500 S38,000 $13,000 S17,500 S69,000 S39,000 Amount $2,500 $1,900 $206,602 S32,000 $8,500 S25,000 S21.000 Ownership Joint Toint Co client Client Toint loint Ownership Co-client Joint 3 loint Toint Joint Toint Client Current Insurance Data Property and Casualty Aulo. All vehicles Liability: $300,000 single limit (including uninsured motorist) Medical payments coverage: $1,000 limit per person Deductible: $250 collision: $100 comprehensive Premium: $1,100 every six months Aulo 1: 20XX Honda Accord LX Sedan Mileage: 30,000 Color: light blue Engine: 6 cylinder Transmission: manual Payment: $310/month Balance: $8,500 with 2.5 years renaining Worth: $ 17,500 458 Case Approach to Financial Planning Auto 2:20XX Toyola Sequoia Limited (4x4) Mileage: 5,500 Color: silver Engine: 8-cylinder Transmission: automatic Payment: $500/month Balance: $25,000 with fifty-seven inonths remaining Worth: $38,000 Home. Single-lamily dwelling Insured value: $245,000 Replacement value: S315,000 Deductible: 5500 Personal property 50 percent of dwelling Bodily injury: $100,000 Personal injurv: 50 Other endorsements: None Umbrella: None Professional liability: None Business: None Life and Health Life. Haley owns a $50,000 universal life policy with XYZ Insurance Co. She pays the annual premium of $100. The policy has a current cash value of $3,800 (the cash value at the beginning of the period was $3,600). John is the primary beneficiary and Halcy is the owner. Al the time of purchase, policy projections were based on after-tax U.S. Treasury rates of 6 percent. John has an employer provided term policy that pays one times his annual salary. The face amount of the policy is reduced by 50 percent, regardless of his salary, at age sixiv-live and terminales alage sevenly. Other life assumptions: Chapter 14 - Moving From Strategies to Plan Development 459 . Tor planning purposes, the Butlerfields would like to use 80 percent of their combined incomes, before taxes, to represent their total household expenses in the event of a death. Tinal illness and burial expenses are estimated to be $15,000 each. Estate aclininistration expenses are expected to be approxiinately $5,200 Cach. . . Child care expenses will be $10,000. Full retirement age, for insurance purposes, is assumed to be age sixty- seven. The Butterfields need $100,000 in annual income per year, before taxes, while retired. They would like to use this assumption for both insurance and retirement planning purposes. Social Security benefit while children are still at home is $32,000 if lohn dies, and $29,000 if Haley dies, in loday's dollars. At age sixty, Haley is cligible for a $13,000 annual Social Security survivor benefit, while John is entitled to a $10,000 annual survivor benefit (in today's dollars) . In the event of either spouse's death, the other spouse plans to stop working at age sixty and begin taking early retirement survivor benefits (if available). For conservative planning purposes, the Hutterfields do not plan on using interest and/or dividends as an income source when planning insurance needs. . At full retirement (i.e. at age sixty-seven) John will receive $18,000 per year in Social Security benefits; Haley will receive $16,500 in benefits (in Today's dollars) Assuned ages at death for John and Haley are ninety and ninety-two, respectively. The assumed gross rate of relurn on insurance assels, in the event of death, is 9 percent. Health. The Butterfields' health insurance is provided by Blue Cross/Blue Shield. Coverage currently includes everyone in the immediate family. The inonthly premium of S600 is paid 66 percent by John's employer, with the remainder paid out of pockel by John. The plan has a deductible of $250 per person and a family co-insurance provision of 20 percent. The out of pocket per family cap on co paynents is $1,000 per year. Long-term care. None. 460 Case Approach to Financial Planning Disability. John's disability coverage is a group disability contract provided by his employer. The policy pays a $5,000 monthly benefit until age sixty-five. The contract has a liberal "own occupation" definition. The climination period is 120 days. Haley does not have a disability policy. In the event of a disability the Butterfields would like to continue saving for other goals; however, Jolin and IIaley do not want to rely on Social Security disability benefits when estimating disability income needs. Vacation/medical leave. John has accumulated thirty sick days, which is the maximum he is allowed to carry. Ile is eligible to accre one week per year if he falls below the maximum. He also is eligible for three weeks of vacation per year. He can carry over one week, but this has not previously been done. Education Funding Goals The Butterfields would like to assume that education expenses will increase 6.50 percent per year. John and Ilaley are comfortable assuming a growth rate of 9.00 percent per year for educational assels and savings in a lax-advantaged account before and after college begins (6.75 percent if assets are held in a taxable account). Each of the children is talented academically (GPA > 3.5) and cach participates actively in extracurricular activities . . . Troy is currently enrolled at University of Anystate. Current cost: $14,700/year (waiver). He is on a 3/4 baseball scholarship. His parents budgel $5,000 per year in extra support. John and Haley pay tuition not covered in the scholarship and give Troywhat is left from their $5,000 budget asa spending allowance. The Butterfields have also allocated $1,200 per year to help pay for Troy's Travel expenses. Troy has completed one year of college. Troy's health insurance is provided under lolin's group health insurance plan. Holly wants to attend State University; current cost: $10,500/year possible tuition waiver). Holly would like to go to school on an ROTC scholarship and find any additional expenses out of pocket from money carned during summer Vacations. Naomi's college funding goals have not yet been forinalized; however, John and Haley want to plan for college costs of $16,500 per year (in today's dollars) John and Haley preler lo use lax-advantaged savings plans lo lund current and future college expenses. . Chapter 14 - Moving From Strategies to Plan Development 461 Retirement Information John and Haley would like to retire when John turns age sixty-seven. Based on today's dollars, John and Haley are willing to reduce their income by 80 percent of current income while retired. Al full retirement, John will receive $18,000 per year in Social Securily benefits in today's dollars); Ilaley will receive $16,500 in Social Security benefits (in today's dollars) at age sixty-seven. When planning for retirement, John and Halcy are comfortable assuming a 9.00 percent rate of return before retirement, and a 5.75 percent return after retirement . . Contributions to defined contribution plans are anticipated to increase 3 percent annually . John and IIaley anticipate being in a combined federal and state tax bracket of 25 percent in retirement Inflation before and after retirement will be 3.50 percent; their incomes should keep pace with inilation. John's employer matches 101(k) contributions $0.50 cents on the dollar. TRA assets are held in Roth accounts. Assumed age at death for lohn is age ninely and age ninely-two for Haley. Estate Information John and Ilaley have simple wills. John's will leaves his estate to Ilaley, whereas Haley's will leaves her estale to John. They believe that, on average, the surviving spouse's estate will grow by 1 percent after the first spouse's death. Other assumptions include: . Funeral expenses are expected to be approximately $12,000 each. Estate administrative expenses will be $5,200 cach. The Butterfield do nol expect to pay any executor lees, . Specific Client Goals Under any circuinstance, lohn and Haley want to provide 50 percent of The cost of Holly's and Naomi's college education costs, and all of Troy's education costs that are not covered by scholarships. John and Haley want to maintain their current standard of living in retirement or in the event or either spouse's premature deathStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started