Answered step by step

Verified Expert Solution

Question

1 Approved Answer

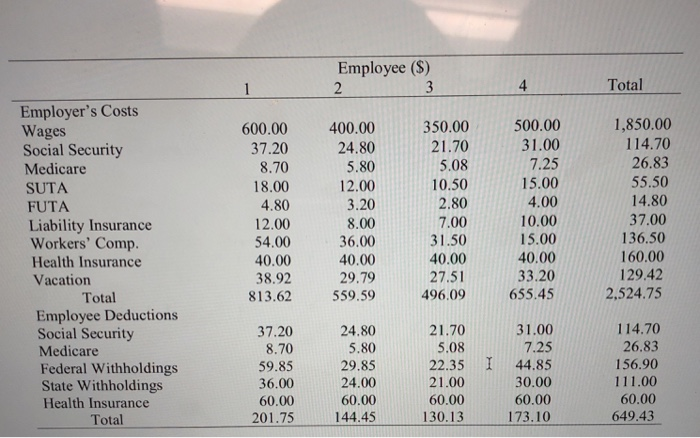

using the chart of accounts in 2 - 1 determine the changes to the balance sheet, income statemnent, job cost ledger, and equipment ledger as

using the chart of accounts in determine the changes to the balance sheet, income statemnent, job cost ledger, and equipment ledger as a result of paying employees one weeks work CHART OF ACCOUNTS

Cash

Accounts ReceivableTrade

Accounts ReceivableRetention

Inventory

Costs and Profits in Excess of Billings

Notes Receivable

Due From Construction Loans

Prepaid Expenses

Other Current Assets

Building and Land

Construction Equipment

Trucks and Autos

Olfice Equipment

Less Acc. Depreciation

Capital Leases

Other Assets

Accounts PayableTrade

Accounts PayableRetention

Billings in Excess of Costs and Profits

Notes Payable

Accrued Payroll

Accrued Payables

Accrued Taxes

Accrued Insurance

Accrued Vacation

Capital Leases Payable

Warranty Reserves

Other Current Liabilities

LongTerm Liabilities

Capital Stock

Retained Earnings

Current Period Net Income

Revenue

Materials

Labor

Subcontract

Equipment

Other

Rent and Lease Payments

Depreciation

Repairs and Maintenance

Fuel and Lubrication

Taxes, Licenses, and Insurance

Equipment Costs Charged to Employees

Equipment Costs Charged to Jobs

Advertising

Promotion

Car and Truck Expenses

Computer and Office Furniture

Repairs and Maintenance

Depreciation

Employee Wages and Salaries

Employee Benefits

Employee Retirement

Employee Recruiting

Employee Training

Employee Taxes

Insurance

Taxes and Licenses

Office Supplies

Office Purchase

Office Rent

Office Utilities

Postage and Delivery

Janitorial and Cleaning

Telephone

Charitable Contributions

Dues and Memberships

Publications and Subscriptions

Legal and Professional Services

Meals and Entertainment

Travel

Bank Fees

Interest Expense

Bad Debts

Unallocated Labor

Unallocated Materials

Warranty Expense

Miscellaneous

Overhead Charged to Jobs

Other Income

Other Expense

Income Tax

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started