Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Using the chart of accounts provided on page 2 of the Exam 3 format document, journalize the following transactions for the month of June.

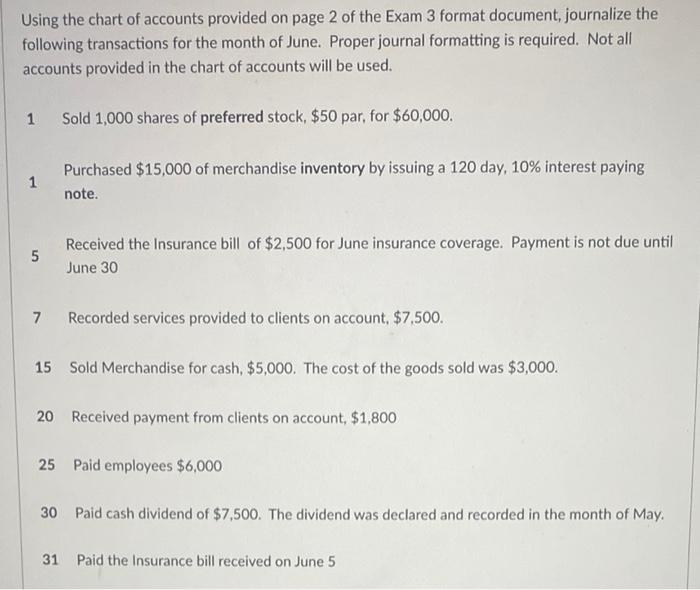

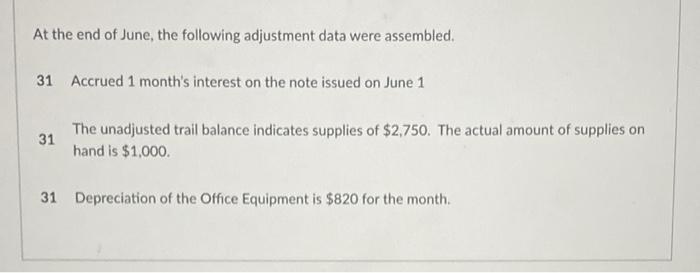

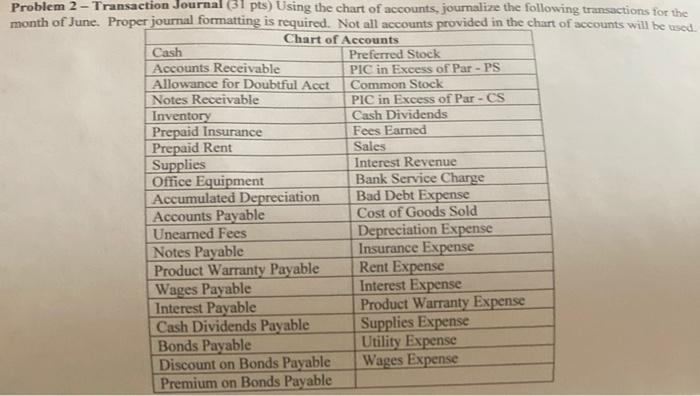

Using the chart of accounts provided on page 2 of the Exam 3 format document, journalize the following transactions for the month of June. Proper journal formatting is required. Not all accounts provided in the chart of accounts will be used. 1 Sold 1,000 shares of preferred stock, $50 par, for $60,000. Purchased $15,000 of merchandise inventory by issuing a 120 day, 10% interest paying 1 note. 5 Received the Insurance bill of $2,500 for June insurance coverage. Payment is not due until June 30 7 Recorded services provided to clients on account, $7,500. 15 Sold Merchandise for cash, $5,000. The cost of the goods sold was $3,000. 20 Received payment from clients on account, $1,800 25 Paid employees $6,000 30 Paid cash dividend of $7,500. The dividend was declared and recorded in the month of May. 31 Paid the Insurance bill received on June 5 At the end of June, the following adjustment data were assembled. 31 Accrued 1 month's interest on the note issued on June 1 31 The unadjusted trail balance indicates supplies of $2,750. The actual amount of supplies on hand is $1,000. 31 Depreciation of the Office Equipment is $820 for the month. Problem 2-Transaction Journal (31 pts) Using the chart of accounts, journalize the following transactions for the month of June. Proper journal formatting is required. Not all accounts provided in the chart of accounts will be used. Chart of Accounts Cash Preferred Stock Accounts Receivable Allowance for Doubtful Acct PIC in Excess of Par-PS Common Stock Notes Receivable PIC in Excess of Par - CS Cash Dividends Inventory Prepaid Insurance Fees Earned Prepaid Rent Sales Supplies Interest Revenue Office Equipment Accumulated Depreciation Accounts Payable Bank Service Charge Bad Debt Expense Cost of Goods Sold Depreciation Expense Insurance Expense Rent Expense Unearned Fees Notes Payable Product Warranty Payable Wages Payable Interest Expense Interest Payable Product Warranty Expense Cash Dividends Payable Supplies Expense Bonds Payable Utility Expense Discount on Bonds Payable Wages Expense Premium on Bonds Payable

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Journal Entry Date Particulars 1Jun Cash Preferred Stock PIC in excess of ParPS Being record of rece...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started