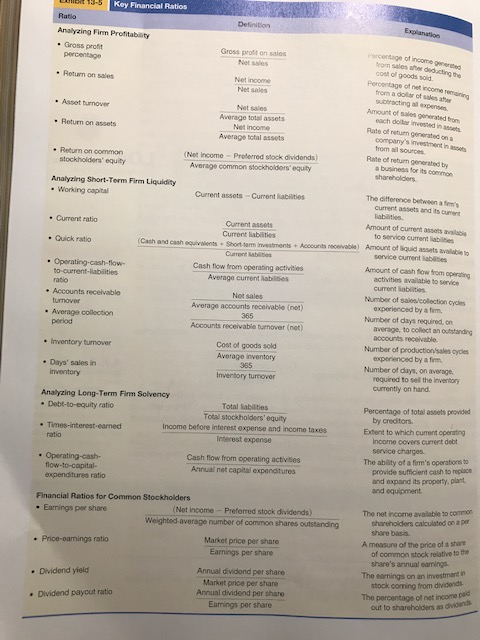

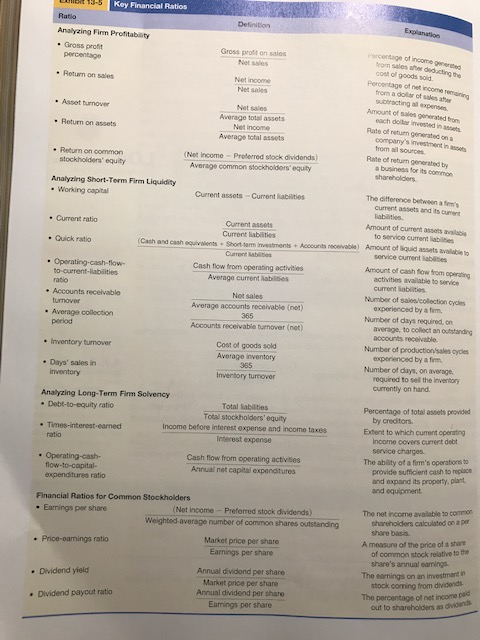

Using the chart on pages 642, pick a ratio from each of the four categories: Liquidity, Solvency, Profitability orMarket Indicators (Common Stockholders).

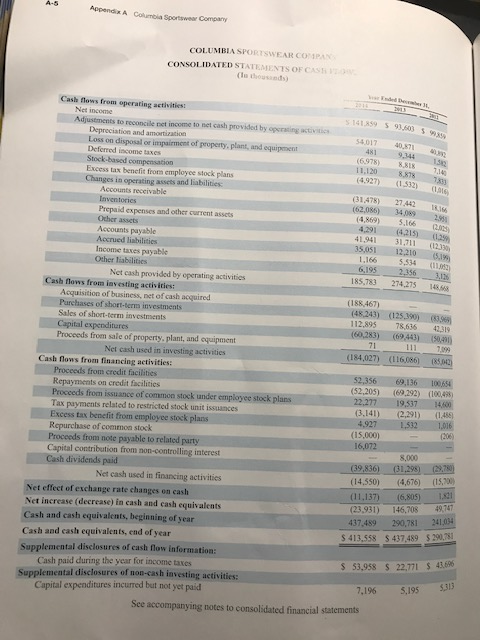

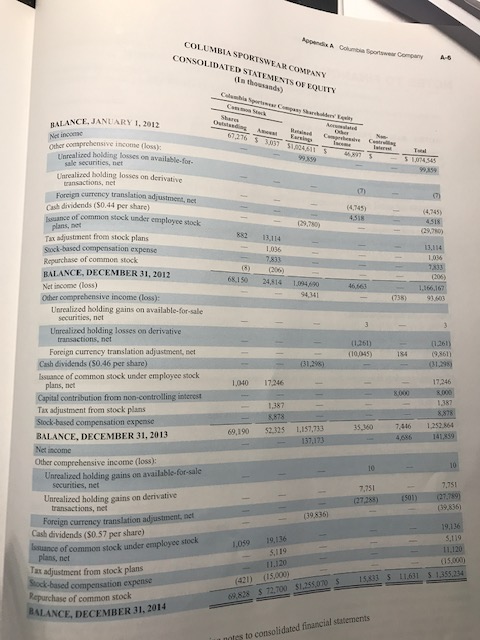

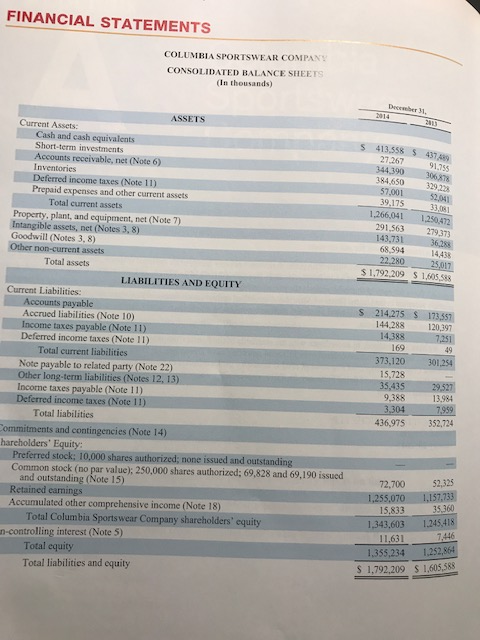

Evaluate the financial statements from Columbia Sportswear Company found in Appendix A of your book. What do you each of your four ratios indicate about the financial performance of the company. If you had $100,000 to invest in this company, would you do it? Why or why not?

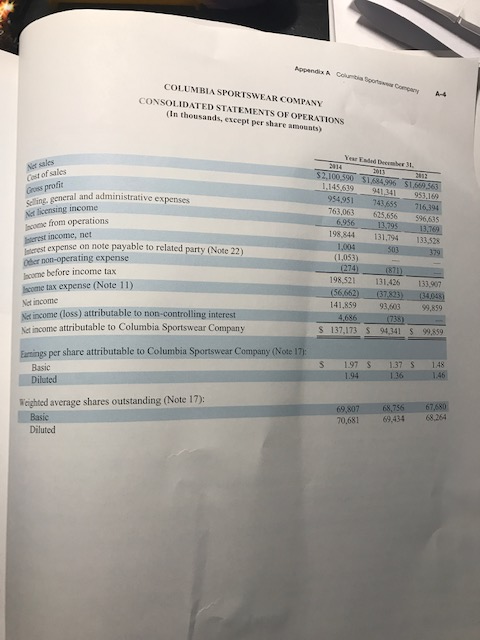

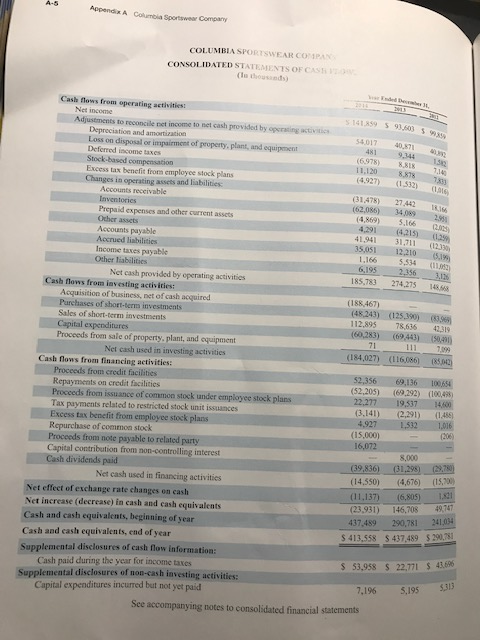

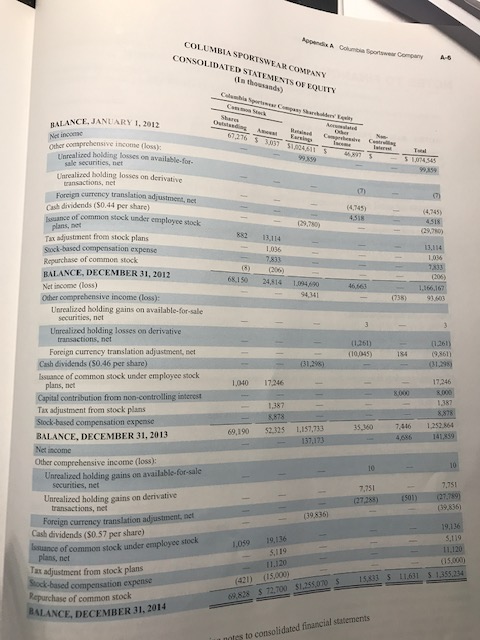

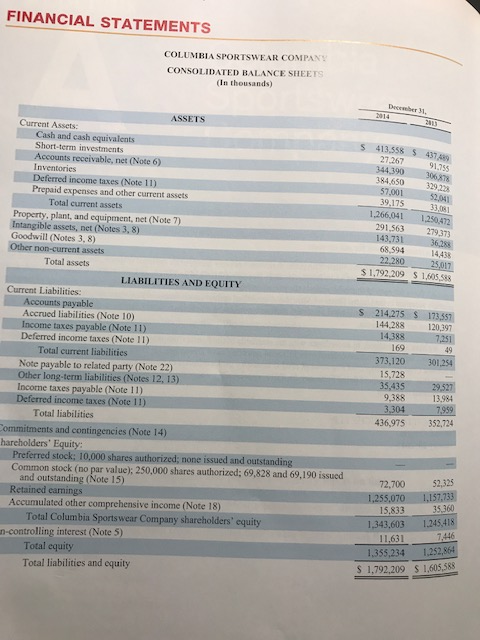

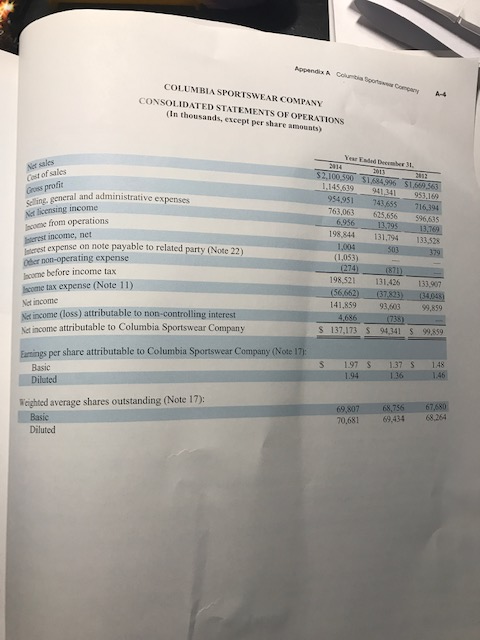

Key Financial Ratios Def Analyzing Firm Profitablity Gross proft Gross proft on sales Net saes ron sales after deducting the cost of goods sold . Return on sales Percentage of net income Amount of sales generated from Rate of return generated on a frorm a dollar of sales ae Net sales subtracting all expenes each deilar invested in assets company's investment in asst . Asset burnover Average total assets Average total assets (Net income - Preterred stock dividends) . Return on assets Rate of return generated by common . Return on a business Sor its stockholders equity Average common slockholdors equity Analyzing Short-Term Firm Liquidity The difference between a tem's Working capital Current assots -Current iabilities current assets and its cument labilities Amount of current assets avalabie Current ratio Current assets to service current liabites Current Sabilities Short sem nestments+ Accounts receable) Amount of liquid assets availabile to Cash and cash equiraslents . Quick ratio service cument lablties Current labilies Cash flow from operating activities Average current abilises Not sales Average accounts receivable (net) Amount of cash Sow from operating Number of sales/colection cycles Number of days required, orn Operating-cash-flow activities available to service current liabiities experienced by a fim average, to collect an oufstanding rato . Accounts receivable 365 Accounts receivable turnover (net) Cost of goods sold Average inventory e Average collection accounts recelvable. experienced by a fim required to sell the inventory Number of production'sales cycles Number of days, on average 355 Invenbory tumover Days' sales in inventory currently on hand. Analyzing Long-Term Firm Solvency Total labilities Total stockholders equity Income before interest expense and income taxes Interest expense Percentage of total assets provided by creditors. Extent to which current operating Times-interest-earned income covers current debt service charges Cash flow from operating activities Annuali net capital expenditures The ablity of a firm's operations to provide sufficient cash to replace and expand its property.plant and equipment Flnancial Ratios for Common Stockholders - Earnings per share (Net income Preferred stock dividends) Weighted-average number of common shares outstanding The net income available to comn share basis. Market price per share Eamings per share A measure of the price of a shae Price-oamings ratio of common stock relative to the share's annual eamings The eamings on an investment n Annual dividond per share Market price per share Annual dividend per share Eamings per share . Dividend yield stock coming from dividends The percentage of net incoma out to shareholders as . Dividend payout ratio At cy COLUMBIA SPORTSWEAR CO/IP CONSOLIDATED STATEMENTS OF CAS lu thoussnds) Cash flows from operating activities: Net income Adjustments to reconcile net income to net cash provided by operaing activities Depreciation and amortizacion Deferred income taxes Excess tax benefit from employce stock plans Loss on disposal or impairmont of property, plant, and equipment 6,978 1,332 Changes in operating assets and liabilities: Accounts receivable Inventorics Prepaid expenses and other curent assets Other assets Accounts payable Accrued liabilities Income taxes payable 1,166 Net cash provided by operating activities Cash flows from iavesting activicies: Acquisition of business, net of cash acquired (188,467) Purchases of short-terns investments Sales of short-term investments 78,636 42,319 (60,283) (69443) (50491 111 7.399 Capital expenditures Proceeds from sale of property, plant, and equijpment 71 (184,027) Net cash used in investing activities (116086) (83 (042) Cash flows from financing activities: Proceeds from credit facilities 52,356 69,136 100654 (52,205) (69,292) (100,498 Repayments on credit facilities Procceds from issuance of common stock under employee stock plans Tax payments related to restricted stock unit issuances Excess tax benefit from employee stock plans Repurchase of common stock 3,141) (2,291) (1.488 4,927 (15,000) 16,072 (206) Proceeds from note payable to related party 8,000 Capital contribution from non-controlling interest (39,836) (31.298) (14,550) (4,676) (15,00 Net cash used in financing activities (11,13) (6,805) (23,931) 146,708 49,747 437,489 290,781 241,0 Net effect of exchange rate changes on cash Net increase (decrease) in cash and cash equivalents Cash and cash equivalents, beginning of year Cash and cash equivalents, end of year S 413,558 $437,489 $290,78 Supplemental disclosures of cash flow information: Cash paid during the year for income taxes S 53,958 s 22,771 $ 43.66 Supplemental disclosures of non-cash investing activities 53 7,196 Capital expenditures incurred but not yet paid See accompanying notes to consolidated financial statements A Columbia Sportswear Company A-6 CONSOLIDATED STATEMENTS OF EQUITY BALANCE, JANUARY 1, 2012 67276 3,037 51024,611 Other coaprehensive income (loss): Unrealized holding losses on ties, net sale securit 99359 Uarealizod holding losses on derivative Foreign currency translation adjust Cash dividends (S0.44 per share) (4,745) 4,518 4,745) 29,780) 3,114 of common stock under employee stock 29,780) plans, net Tax adjustrment froem stock plans Sock-based compensation expense Repurchase of common stock BALANCE, DECEMBER 31, 2012 Net income (loss) Other comprehensive income (loss) 882 13,114 1,036 7833 3) (206) 006) 1,66,167 93603 68150 24,814 1.09490 94,341 (738) Unrealized holding gains on available-for-sale sccurities, net Unrcalized holding losses on derivative transactions, net (1261) 98611 Foreign currency translation adjastment, net 10,045) dividends (S0.46 per share) Essuance of common stock under employee stock 1040 17246 17246 plans, net Copital contribution from non-controlling intercst Tax adjustment from stock plans Stock-based compensation expense BALANCE, DECEMBER 31, 2013 1387 1,387 35,00 7,446 1,251%4 4,686 141859 69,190 $2.325 1,157,733 137,173 Other comprehensive income (loss) 10 Unrealized I bolding gains on available-for-sale .751 7,751 derivative Unrealized holding gains on 501) (39,835) transactions, net (39,836) ign currency translation adjustment, act Cash dividends (S0.57 per share) 1,059 19,136 11,120 (421) (15,000) of common stock under employee stocik 11,120 plans, net lax adjustment from stock plans compensation expense of common stock 28 s 72.700 $1255,0701533 11.631 1,355.234 69,828 S LANCE, DECEMBER 31, 2014 FINANCIAL STATEMENTS COLUMBIA SPORTSWEAR COMPAN CONSOLIDATED BALANCE SHEETS (In thousands) ASSETS Current Assets: s 413,558 S 43789 91355 Cash and cash equivalents Short-term investments 27.267 344390 306878 ccounts receivable, net (Note 6) Inventories Deferred income taxes (Note 11) Prepaid expenses and other current assets 384,650 329,2 57,001 52,041 33,081 ,266041 1250472 291,563 279,373 3,731 36,288 14,438 22.280 25.017 $ 1,792,209 1,605,588 Total current assets Property, plant, and equipment, net (Note Intangible assets, net (Notes 3, 8) Goodwill (Notes 3, 8) Other non-current assets 68,594 Total assets LIABILITIES AND EQUITY Current Liabilities: s 214,275 S 173,557 144,288 120,397 Accounts payable Accrued liabilities (Note 10) 14,388 169 me taxes payable (Note 11) 49 Deferred income taxes (Note 11) 373,120 301254 Total current liabilities 15,728 35,435 Note payable to related party (Note 22) long-term liabilities (Notes 12, 13) Incorne taxes payable (Note 11) 13,984 3,3047.959 436,975 352,724 erred income taxes (Note 11) Total liabilities ommitments and contingencies (Note 14) hareholders' Equity: Preferred stock: 10,000 shares authorized; none issued and outstanding Common stock (no par value); 250,000 shares authorized; 69,828 and 69,190 issued 72,700 52,325 1,255,070 I,157,233 1,343,603 1.245,418 .355,234 1.252,864 S 1,792,209 $ 1.605,588 and outstanding (Note 15) Retained canings Accumulated other comprehensive income (Note 18) Total Columbia Sports wear Company shareholders' equity Total equity Total liabilities and equity 11,631 n-controlling interest (Note 5) Appendix A COLUMBIA SPORTSWEAR COMPANY CONSOLIDATED STATEMENTS OF OPERATIONS (In thousands, except per share amounts ales Cost of sales Gross profit $2,1 l /849% 1,145,639 941341 953.169 954951 743655 16,394 763,063 625,656 596,635 general and administrative expenses licensing income aooe from operations Istcrest income, net 198,844 131,794133,528 erest expense on note payable to related party (Note 22) oher non-operating expense acome before income tax come tax expense (Note 11) Net income Nar income (loss) attributable to non-controlling interest Nat income attributable to Columbia Sportswear Company (1,053) 198,52 131.426 133,907 141,859 93,03 99,859 S 137,173 S 94,341 99.859 gs per share attributable to Columbia Sportswear Company (Note 17 S 197 137 S 148 Basic ibuted Wcighted average shares outstanding (Note 17): 67,680 69,807 70,681 69,434 68,264 Basic Diluted Key Financial Ratios Def Analyzing Firm Profitablity Gross proft Gross proft on sales Net saes ron sales after deducting the cost of goods sold . Return on sales Percentage of net income Amount of sales generated from Rate of return generated on a frorm a dollar of sales ae Net sales subtracting all expenes each deilar invested in assets company's investment in asst . Asset burnover Average total assets Average total assets (Net income - Preterred stock dividends) . Return on assets Rate of return generated by common . Return on a business Sor its stockholders equity Average common slockholdors equity Analyzing Short-Term Firm Liquidity The difference between a tem's Working capital Current assots -Current iabilities current assets and its cument labilities Amount of current assets avalabie Current ratio Current assets to service current liabites Current Sabilities Short sem nestments+ Accounts receable) Amount of liquid assets availabile to Cash and cash equiraslents . Quick ratio service cument lablties Current labilies Cash flow from operating activities Average current abilises Not sales Average accounts receivable (net) Amount of cash Sow from operating Number of sales/colection cycles Number of days required, orn Operating-cash-flow activities available to service current liabiities experienced by a fim average, to collect an oufstanding rato . Accounts receivable 365 Accounts receivable turnover (net) Cost of goods sold Average inventory e Average collection accounts recelvable. experienced by a fim required to sell the inventory Number of production'sales cycles Number of days, on average 355 Invenbory tumover Days' sales in inventory currently on hand. Analyzing Long-Term Firm Solvency Total labilities Total stockholders equity Income before interest expense and income taxes Interest expense Percentage of total assets provided by creditors. Extent to which current operating Times-interest-earned income covers current debt service charges Cash flow from operating activities Annuali net capital expenditures The ablity of a firm's operations to provide sufficient cash to replace and expand its property.plant and equipment Flnancial Ratios for Common Stockholders - Earnings per share (Net income Preferred stock dividends) Weighted-average number of common shares outstanding The net income available to comn share basis. Market price per share Eamings per share A measure of the price of a shae Price-oamings ratio of common stock relative to the share's annual eamings The eamings on an investment n Annual dividond per share Market price per share Annual dividend per share Eamings per share . Dividend yield stock coming from dividends The percentage of net incoma out to shareholders as . Dividend payout ratio At cy COLUMBIA SPORTSWEAR CO/IP CONSOLIDATED STATEMENTS OF CAS lu thoussnds) Cash flows from operating activities: Net income Adjustments to reconcile net income to net cash provided by operaing activities Depreciation and amortizacion Deferred income taxes Excess tax benefit from employce stock plans Loss on disposal or impairmont of property, plant, and equipment 6,978 1,332 Changes in operating assets and liabilities: Accounts receivable Inventorics Prepaid expenses and other curent assets Other assets Accounts payable Accrued liabilities Income taxes payable 1,166 Net cash provided by operating activities Cash flows from iavesting activicies: Acquisition of business, net of cash acquired (188,467) Purchases of short-terns investments Sales of short-term investments 78,636 42,319 (60,283) (69443) (50491 111 7.399 Capital expenditures Proceeds from sale of property, plant, and equijpment 71 (184,027) Net cash used in investing activities (116086) (83 (042) Cash flows from financing activities: Proceeds from credit facilities 52,356 69,136 100654 (52,205) (69,292) (100,498 Repayments on credit facilities Procceds from issuance of common stock under employee stock plans Tax payments related to restricted stock unit issuances Excess tax benefit from employee stock plans Repurchase of common stock 3,141) (2,291) (1.488 4,927 (15,000) 16,072 (206) Proceeds from note payable to related party 8,000 Capital contribution from non-controlling interest (39,836) (31.298) (14,550) (4,676) (15,00 Net cash used in financing activities (11,13) (6,805) (23,931) 146,708 49,747 437,489 290,781 241,0 Net effect of exchange rate changes on cash Net increase (decrease) in cash and cash equivalents Cash and cash equivalents, beginning of year Cash and cash equivalents, end of year S 413,558 $437,489 $290,78 Supplemental disclosures of cash flow information: Cash paid during the year for income taxes S 53,958 s 22,771 $ 43.66 Supplemental disclosures of non-cash investing activities 53 7,196 Capital expenditures incurred but not yet paid See accompanying notes to consolidated financial statements A Columbia Sportswear Company A-6 CONSOLIDATED STATEMENTS OF EQUITY BALANCE, JANUARY 1, 2012 67276 3,037 51024,611 Other coaprehensive income (loss): Unrealized holding losses on ties, net sale securit 99359 Uarealizod holding losses on derivative Foreign currency translation adjust Cash dividends (S0.44 per share) (4,745) 4,518 4,745) 29,780) 3,114 of common stock under employee stock 29,780) plans, net Tax adjustrment froem stock plans Sock-based compensation expense Repurchase of common stock BALANCE, DECEMBER 31, 2012 Net income (loss) Other comprehensive income (loss) 882 13,114 1,036 7833 3) (206) 006) 1,66,167 93603 68150 24,814 1.09490 94,341 (738) Unrealized holding gains on available-for-sale sccurities, net Unrcalized holding losses on derivative transactions, net (1261) 98611 Foreign currency translation adjastment, net 10,045) dividends (S0.46 per share) Essuance of common stock under employee stock 1040 17246 17246 plans, net Copital contribution from non-controlling intercst Tax adjustment from stock plans Stock-based compensation expense BALANCE, DECEMBER 31, 2013 1387 1,387 35,00 7,446 1,251%4 4,686 141859 69,190 $2.325 1,157,733 137,173 Other comprehensive income (loss) 10 Unrealized I bolding gains on available-for-sale .751 7,751 derivative Unrealized holding gains on 501) (39,835) transactions, net (39,836) ign currency translation adjustment, act Cash dividends (S0.57 per share) 1,059 19,136 11,120 (421) (15,000) of common stock under employee stocik 11,120 plans, net lax adjustment from stock plans compensation expense of common stock 28 s 72.700 $1255,0701533 11.631 1,355.234 69,828 S LANCE, DECEMBER 31, 2014 FINANCIAL STATEMENTS COLUMBIA SPORTSWEAR COMPAN CONSOLIDATED BALANCE SHEETS (In thousands) ASSETS Current Assets: s 413,558 S 43789 91355 Cash and cash equivalents Short-term investments 27.267 344390 306878 ccounts receivable, net (Note 6) Inventories Deferred income taxes (Note 11) Prepaid expenses and other current assets 384,650 329,2 57,001 52,041 33,081 ,266041 1250472 291,563 279,373 3,731 36,288 14,438 22.280 25.017 $ 1,792,209 1,605,588 Total current assets Property, plant, and equipment, net (Note Intangible assets, net (Notes 3, 8) Goodwill (Notes 3, 8) Other non-current assets 68,594 Total assets LIABILITIES AND EQUITY Current Liabilities: s 214,275 S 173,557 144,288 120,397 Accounts payable Accrued liabilities (Note 10) 14,388 169 me taxes payable (Note 11) 49 Deferred income taxes (Note 11) 373,120 301254 Total current liabilities 15,728 35,435 Note payable to related party (Note 22) long-term liabilities (Notes 12, 13) Incorne taxes payable (Note 11) 13,984 3,3047.959 436,975 352,724 erred income taxes (Note 11) Total liabilities ommitments and contingencies (Note 14) hareholders' Equity: Preferred stock: 10,000 shares authorized; none issued and outstanding Common stock (no par value); 250,000 shares authorized; 69,828 and 69,190 issued 72,700 52,325 1,255,070 I,157,233 1,343,603 1.245,418 .355,234 1.252,864 S 1,792,209 $ 1.605,588 and outstanding (Note 15) Retained canings Accumulated other comprehensive income (Note 18) Total Columbia Sports wear Company shareholders' equity Total equity Total liabilities and equity 11,631 n-controlling interest (Note 5) Appendix A COLUMBIA SPORTSWEAR COMPANY CONSOLIDATED STATEMENTS OF OPERATIONS (In thousands, except per share amounts ales Cost of sales Gross profit $2,1 l /849% 1,145,639 941341 953.169 954951 743655 16,394 763,063 625,656 596,635 general and administrative expenses licensing income aooe from operations Istcrest income, net 198,844 131,794133,528 erest expense on note payable to related party (Note 22) oher non-operating expense acome before income tax come tax expense (Note 11) Net income Nar income (loss) attributable to non-controlling interest Nat income attributable to Columbia Sportswear Company (1,053) 198,52 131.426 133,907 141,859 93,03 99,859 S 137,173 S 94,341 99.859 gs per share attributable to Columbia Sportswear Company (Note 17 S 197 137 S 148 Basic ibuted Wcighted average shares outstanding (Note 17): 67,680 69,807 70,681 69,434 68,264 Basic Diluted