Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Using the current year's CPP and El rates and annual maximums, manually calculate the CPP and El deductions required on the following scenarios. Help

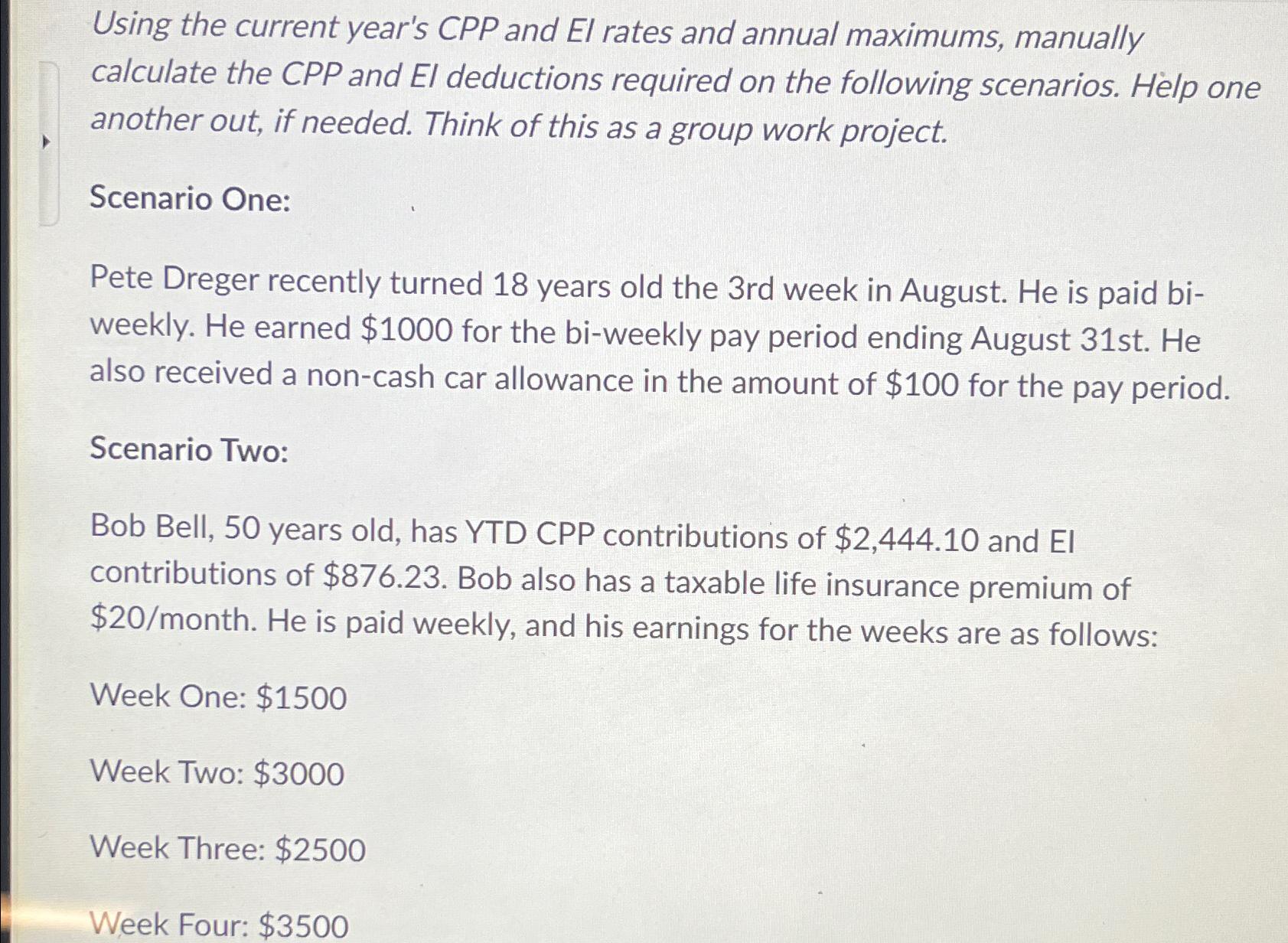

Using the current year's CPP and El rates and annual maximums, manually calculate the CPP and El deductions required on the following scenarios. Help one another out, if needed. Think of this as a group work project. Scenario One: Pete Dreger recently turned 18 years old the 3rd week in August. He is paid bi- weekly. He earned $1000 for the bi-weekly pay period ending August 31st. He also received a non-cash car allowance in the amount of $100 for the pay period. Scenario Two: Bob Bell, 50 years old, has YTD CPP contributions of $2,444.10 and El contributions of $876.23. Bob also has a taxable life insurance premium of $20/month. He is paid weekly, and his earnings for the weeks are as follows: Week One: $1500 Week Two: $3000 Week Three: $2500 Week Four: $3500

Step by Step Solution

★★★★★

3.52 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Answer CPP Deduction for Pete Dreger CPP contribution rate 2024 570 Maximum pensionable earnings 2024 64900 annually Since Petes pay is biweekly we fi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started