Answered step by step

Verified Expert Solution

Question

1 Approved Answer

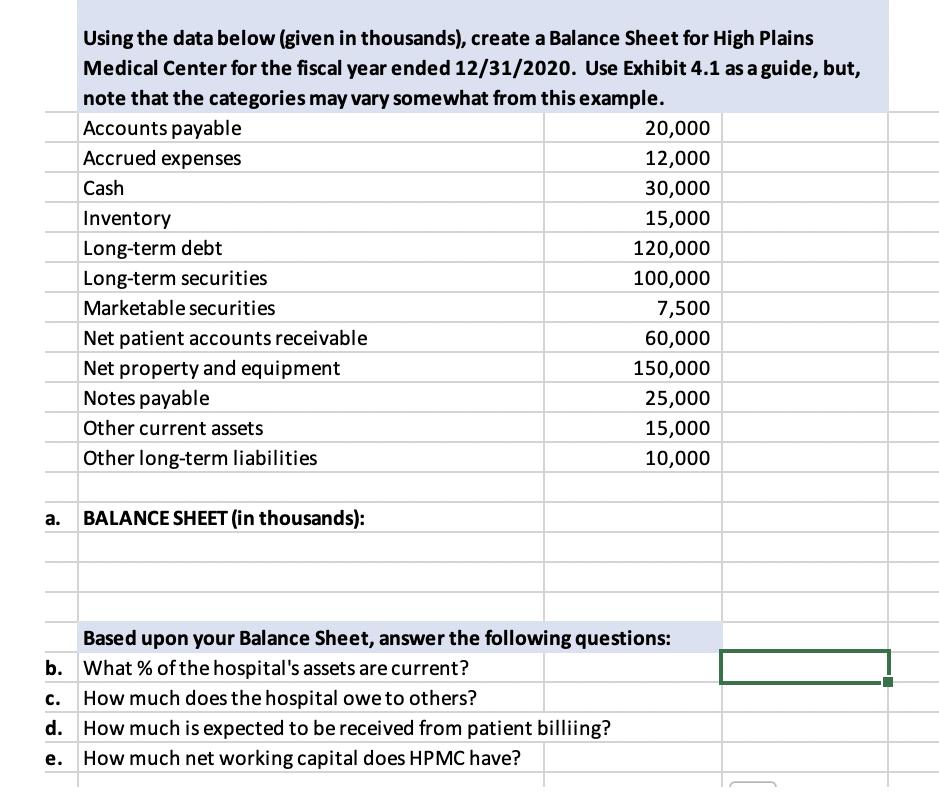

Using the data below (given in thousands), create a Balance Sheet for High Plains Medical Center for the fiscal year ended 12/31/2020. Use Exhibit

Using the data below (given in thousands), create a Balance Sheet for High Plains Medical Center for the fiscal year ended 12/31/2020. Use Exhibit 4.1 as a guide, but, note that the categories may vary somewhat from this example. Accounts payable Accrued expenses Cash Inventory Long-term debt Long-term securities Marketable securities Net patient accounts receivable Net property and equipment Notes payable Other current assets Other long-term liabilities a. BALANCE SHEET (in thousands): 20,000 12,000 30,000 15,000 120,000 100,000 7,500 60,000 150,000 25,000 15,000 10,000 Based upon your Balance Sheet, answer the following questions: b. What % of the hospital's assets are current? How much does the hospital owe to others? d. How much is expected to be received from patient billiing? How much net working capital does HPMC have?

Step by Step Solution

★★★★★

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Based on the provided data the Balance Sheet for High Plains Medical Center for the fiscal year ende...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started