Answered step by step

Verified Expert Solution

Question

1 Approved Answer

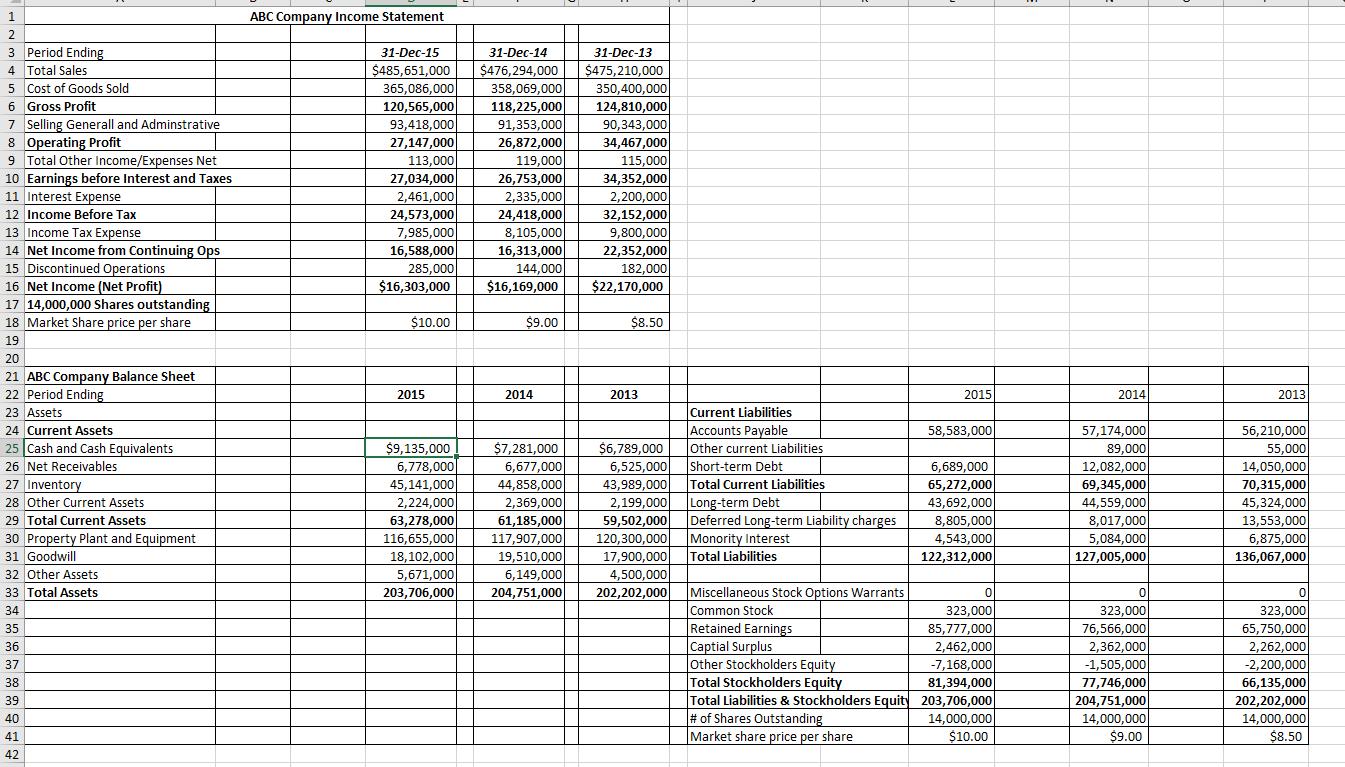

Using the data from the Income Statement and Balance Sheet, provide the correct calculation of the liquidity ratios and an assessment of the companys ability

- Using the data from the Income Statement and Balance Sheet, provide the correct calculation of the liquidity ratios and an assessment of the company’s ability to maintain liquidity and the management of current assets and current liabilities. Include the proper assessment of outcomes as positive or negative trends when all ratio outcomes are factored as a group.

- Inventory Turnover

- Accounts Receivables Turnover

1 2 ABC Company Income Statement 3 Period Ending 4 Total Sales 5 Cost of Goods Sold 6 Gross Profit 7 Selling Generall and Adminstrative 31-Dec-15 $485,651,000 365,086,000 31-Dec-14 31-Dec-13 $476,294,000 $475,210,000 358,069,000 350,400,000 120,565,000 118,225,000 124,810,000 93,418,000 91,353,000 90,343,000 8 Operating Profit 27,147,000 26,872,000 34,467,000 9 Total Other Income/Expenses Net 113,000 119,000 10 Earnings before Interest and Taxes 27,034,000 26,753,000 115,000 34,352,000 11 Interest Expense 2,461,000 2,335,000 2,200,000 12 Income Before Tax 24,573,000 24,418,000 13 Income Tax Expense 7,985,000 8,105,000 14 Net Income from Continuing Ops 16,588,000 15 Discontinued Operations 285,000 16 Net Income (Net Profit) $16,303,000 16,313,000 144,000 $16,169,000 32,152,000 9,800,000 22,352,000 182,000 $22,170,000 17 14,000,000 Shares outstanding 18 Market Share price per share 19 $10.00 $9.00 $8.50 20 21 ABC Company Balance Sheet 22 Period Ending 23 Assets 24 Current Assets 25 Cash and Cash Equivalents 26 Net Receivables 27 Inventory 28 Other Current Assets 2015 2014 2013 2015 2014 2013 Current Liabilities Accounts Payable 58,583,000 57,174,000 56,210,000 $9,135,000 6,778,000 45,141,000 $7,281,000 6,677,000 44,858,000 $6,789,000 Other current Liabilities 89,000 55,000 6,525,000 Short-term Debt 6,689,000 12,082,000 14,050,000 43,989,000 Total Current Liabilities 65,272,000 69,345,000 70,315,000 2,224,000 29 Total Current Assets 63,278,000 30 Property Plant and Equipment 116,655,000 2,369,000 61,185,000 117,907,000 2,199,000 Long-term Debt 43,692,000 44,559,000 45,324,000 31 Goodwill 32 Other Assets 18,102,000 5,671,000 33 Total Assets 203,706,000 19,510,000 6,149,000 204,751,000 59,502,000 120,300,000 17,900,000 Deferred Long-term Liability charges 8,805,000 8,017,000 13,553,000 Monority Interest 4,543,000 5,084,000 Total Liabilities 122,312,000 127,005,000 6,875,000 136,067,000 4,500,000 202,202,000 Miscellaneous Stock Options Warrants 0 0 34 Common Stock 323,000 35 Retained Earnings 85,777,000 323,000 76,566,000 0 323,000 65,750,000 36 Captial Surplus 2,462,000 2,362,000 2,262,000 37 Other Stockholders Equity -7,168,000 -1,505,000 -2,200,000 38 Total Stockholders Equity 81,394,000 77,746,000 66,135,000 39 Total Liabilities & Stockholders Equity 203,706,000 40 # of Shares Outstanding 14,000,000 204,751,000 14,000,000 41 Market share price per share $10.00 $9.00 202,202,000 14,000,000 $8.50 42

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started