Using the data given, please answer the following question. Thanks!

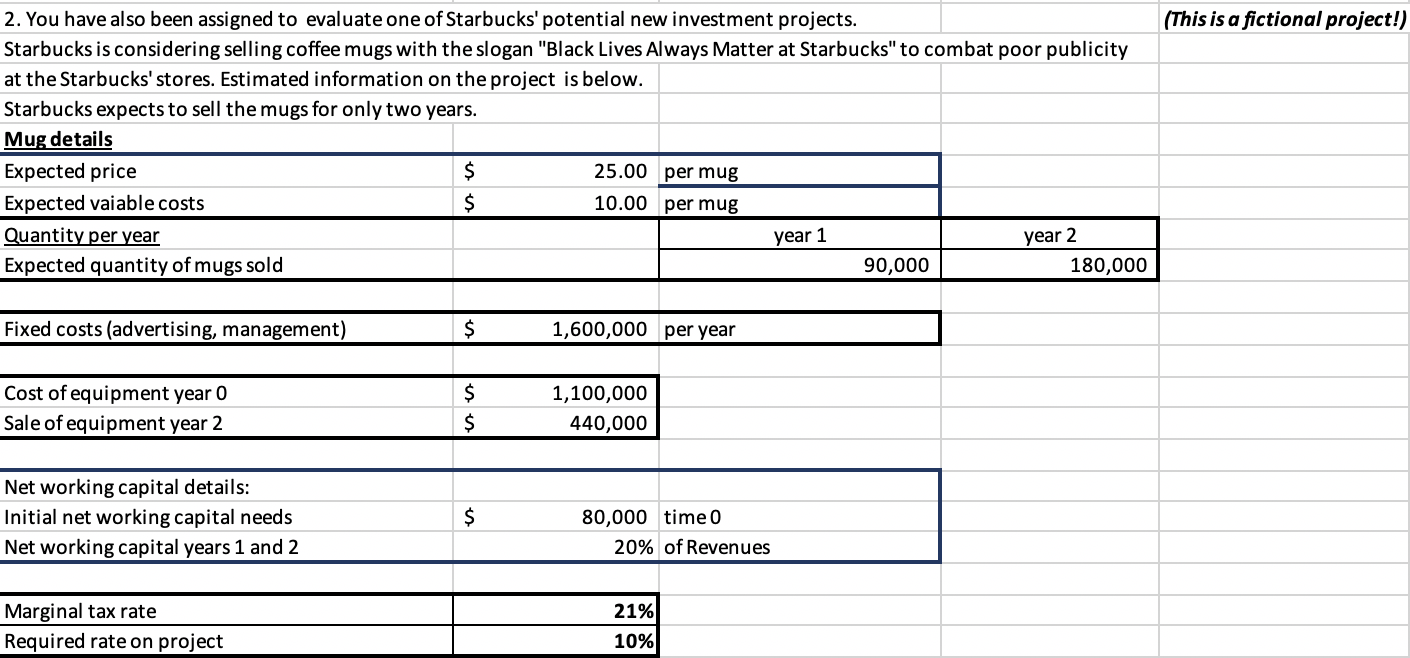

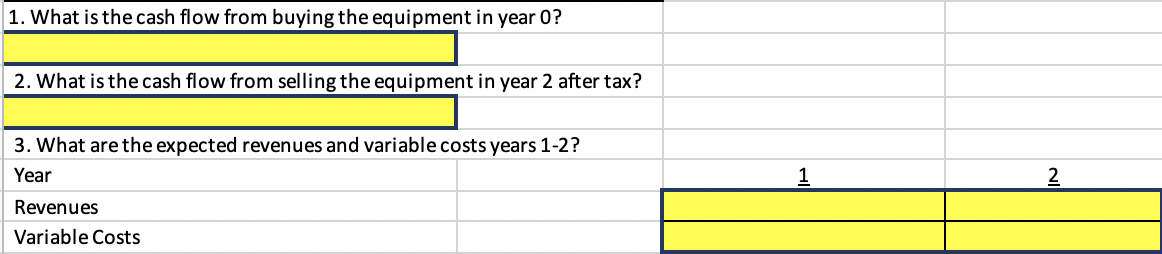

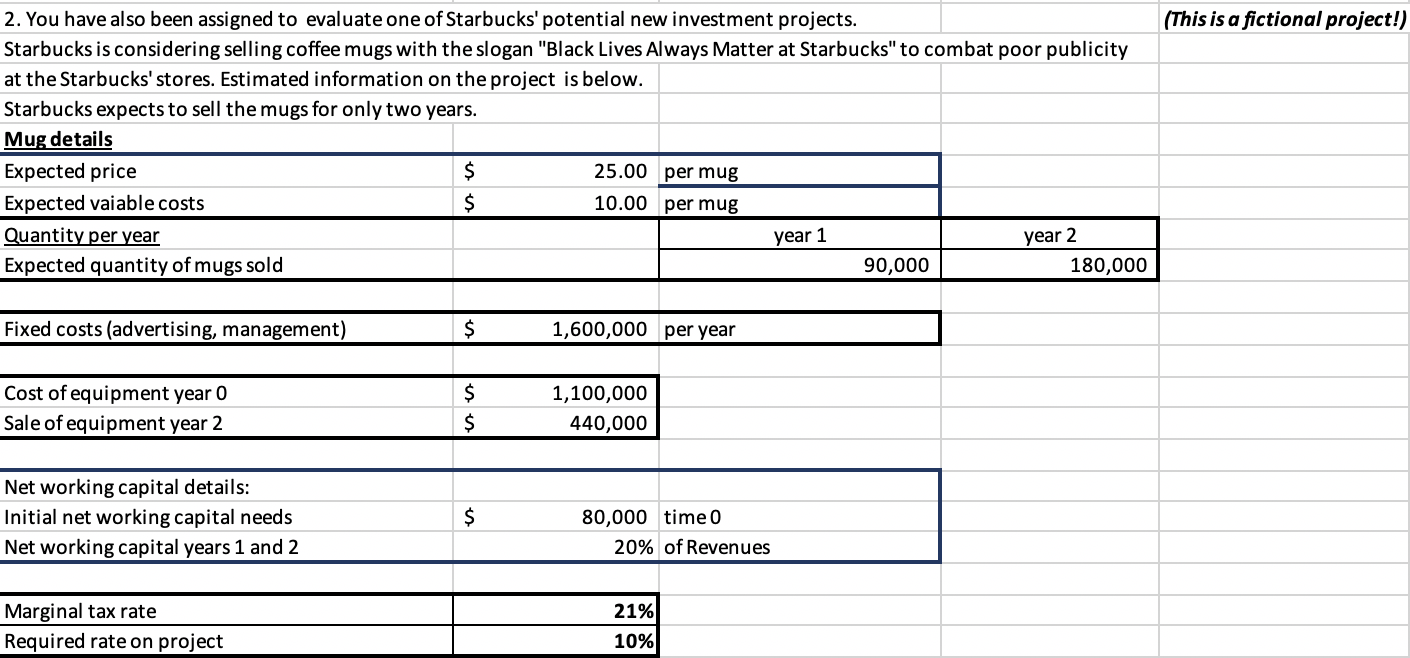

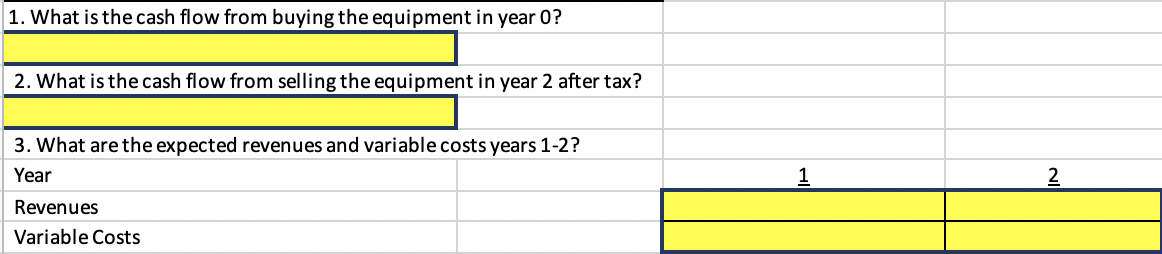

(This is a fictional project!) 2. You have also been assigned to evaluate one of Starbucks' potential new investment projects. Starbucks is considering selling coffee mugs with the slogan "Black Lives Always Matter at Starbucks" to combat poor publicity at the Starbucks' stores. Estimated information on the project is below. Starbucks expects to sell the mugs for only two years. Mug details Expected price $ 25.00 per mug Expected vaiable costs $ 10.00 per mug Quantity per year Expected quantity of mugs sold 90,000 180,000 year 1 year 2 Fixed costs (advertising, management) $ 1,600,000 per year Cost of equipment year 0 Sale of equipment year 2 $ $ 1,100,000 440,000 Net working capital details: Initial net working capital needs Net working capital years 1 and 2 $ 80,000 timeo 20% of Revenues Marginal tax rate Required rate on project 21% 10% 1. What is the cash flow from buying the equipment in year 0? 2. What is the cash flow from selling the equipment in year 2 after tax? 3. What are the expected revenues and variable costs years 1-2? Year 1 2 Revenues Variable Costs (This is a fictional project!) 2. You have also been assigned to evaluate one of Starbucks' potential new investment projects. Starbucks is considering selling coffee mugs with the slogan "Black Lives Always Matter at Starbucks" to combat poor publicity at the Starbucks' stores. Estimated information on the project is below. Starbucks expects to sell the mugs for only two years. Mug details Expected price $ 25.00 per mug Expected vaiable costs $ 10.00 per mug Quantity per year Expected quantity of mugs sold 90,000 180,000 year 1 year 2 Fixed costs (advertising, management) $ 1,600,000 per year Cost of equipment year 0 Sale of equipment year 2 $ $ 1,100,000 440,000 Net working capital details: Initial net working capital needs Net working capital years 1 and 2 $ 80,000 timeo 20% of Revenues Marginal tax rate Required rate on project 21% 10% 1. What is the cash flow from buying the equipment in year 0? 2. What is the cash flow from selling the equipment in year 2 after tax? 3. What are the expected revenues and variable costs years 1-2? Year 1 2 Revenues Variable Costs