Answered step by step

Verified Expert Solution

Question

1 Approved Answer

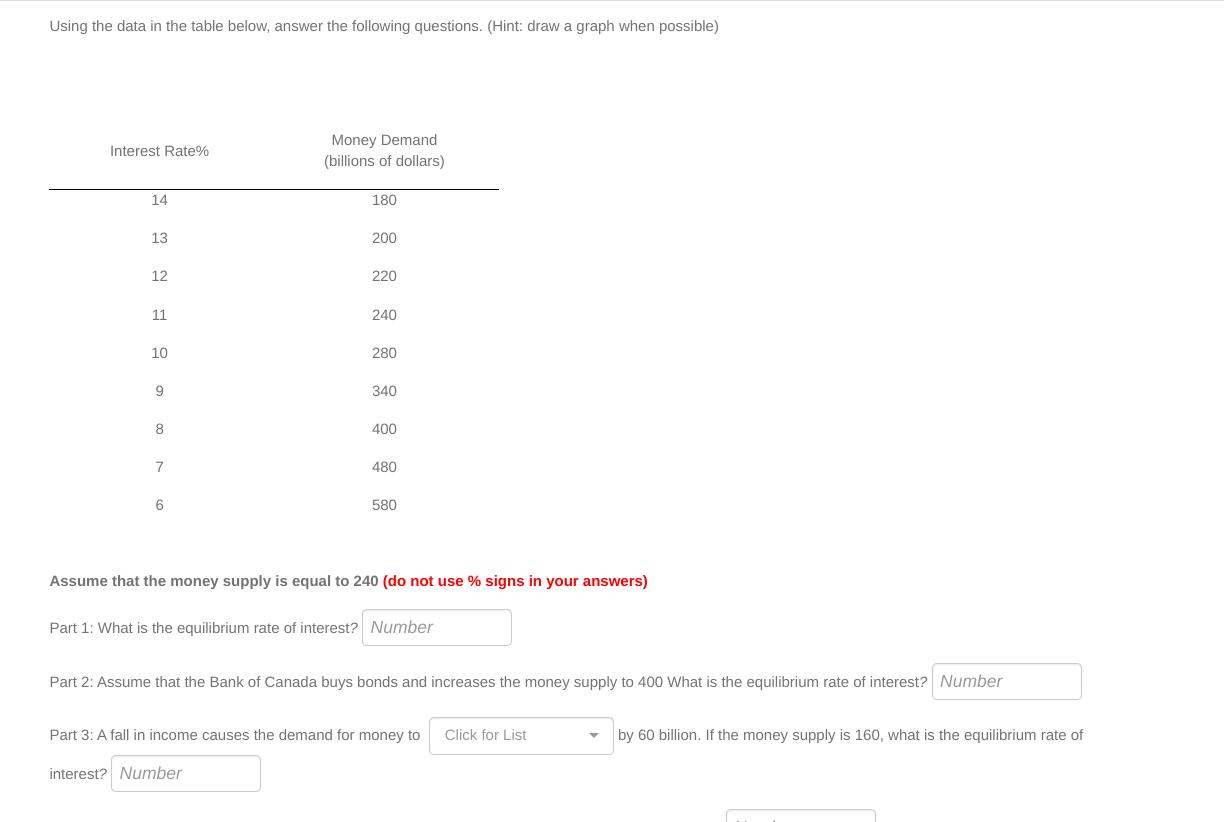

Using the data in the table below, answer the following questions. (Hint: draw a graph when possible) Interest Rate% 14 13 12 11 10

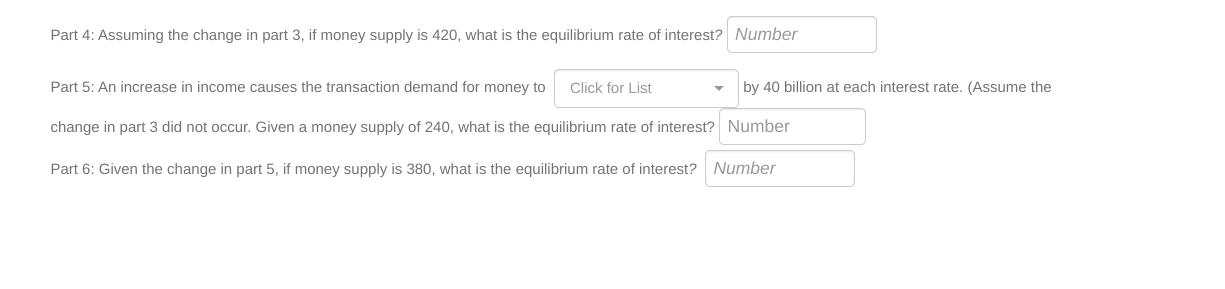

Using the data in the table below, answer the following questions. (Hint: draw a graph when possible) Interest Rate% 14 13 12 11 10 9 8 7 6 Money Demand (billions of dollars) 180 200 220 240 280 340 400 480 580 Assume that the money supply is equal to 240 (do not use % signs in your answers) Part 1: What is the equilibrium rate of interest? Number Part 2: Assume that the Bank of Canada buys bonds and increases the money supply to 400 What is the equilibrium rate of interest? Number Part 3: A fall in income causes the demand for money to Click for List interest? Number by 60 billion. If the money supply is 160, what is the equilibrium rate of Part 4: Assuming the change in part 3, if money supply is 420, what is the equilibrium rate of interest? Number Part 5: An increase in income causes the transaction demand for money to change in part 3 did not occur. Given a money supply of 240, what is the equilibrium rate of interest? Number Part 6: Given the change in part 5, if money supply is 380, what is the equilibrium rate of interest? Number Click for List by 40 billion at each interest rate. (Assume the

Step by Step Solution

★★★★★

3.29 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

To answer the questions provided we will use the data from the table that shows different money demands at various interest rates The equilibrium rate of interest is where the money demand equals the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started