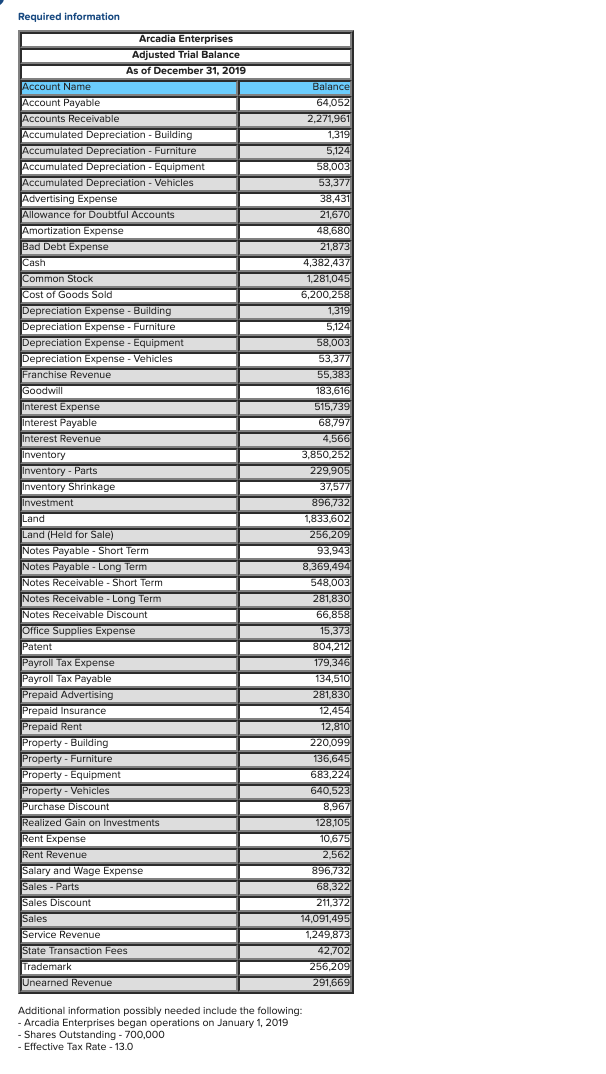

USING THE DATA PROVIDED IN THE ADJUSTED TRIAL BALANCE (GIANT LIST OF VALUES), please help me create a closing entry.

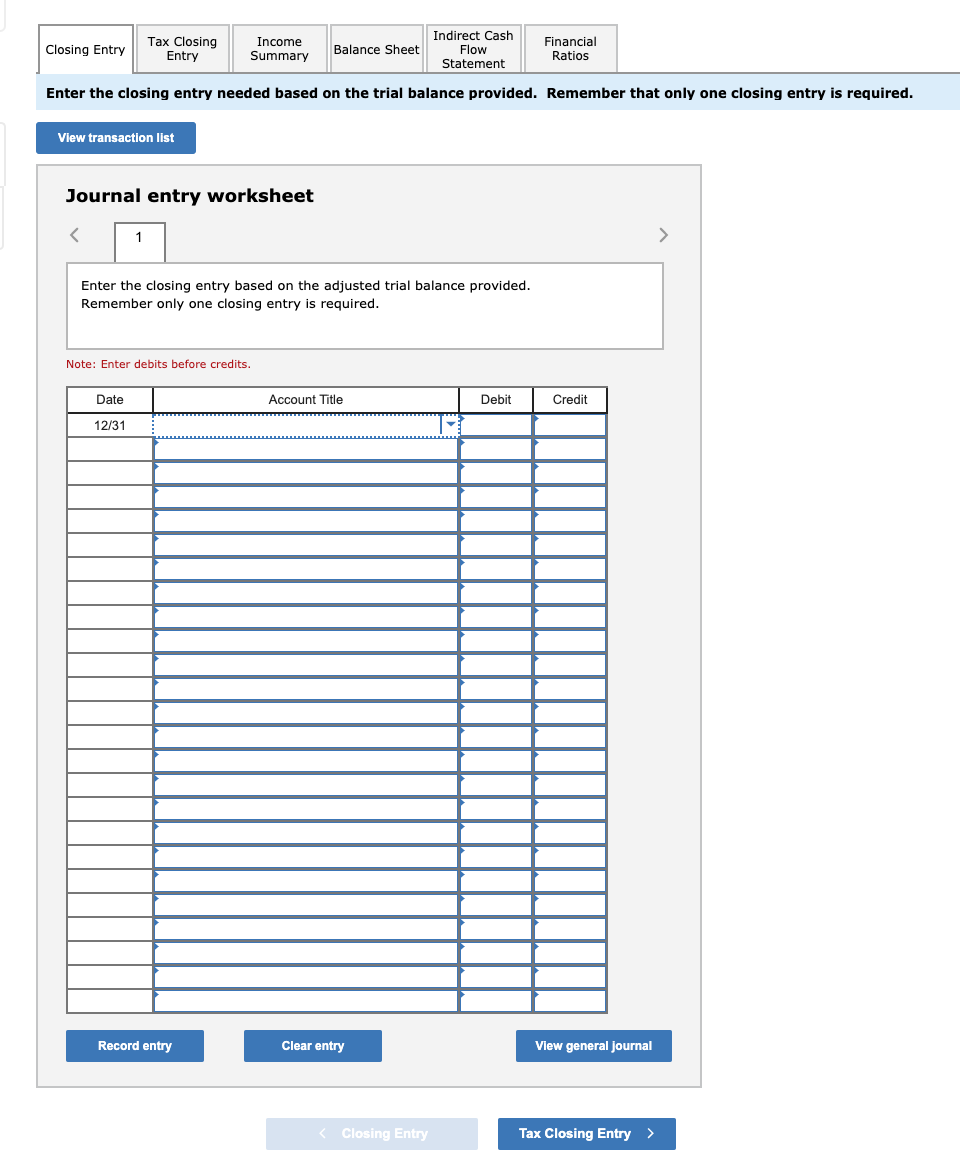

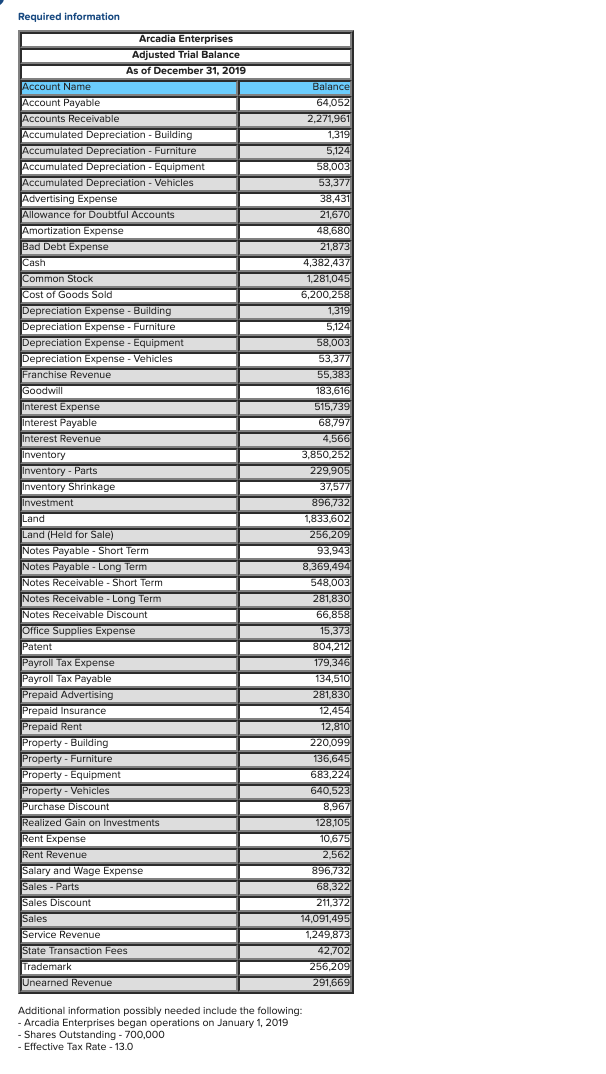

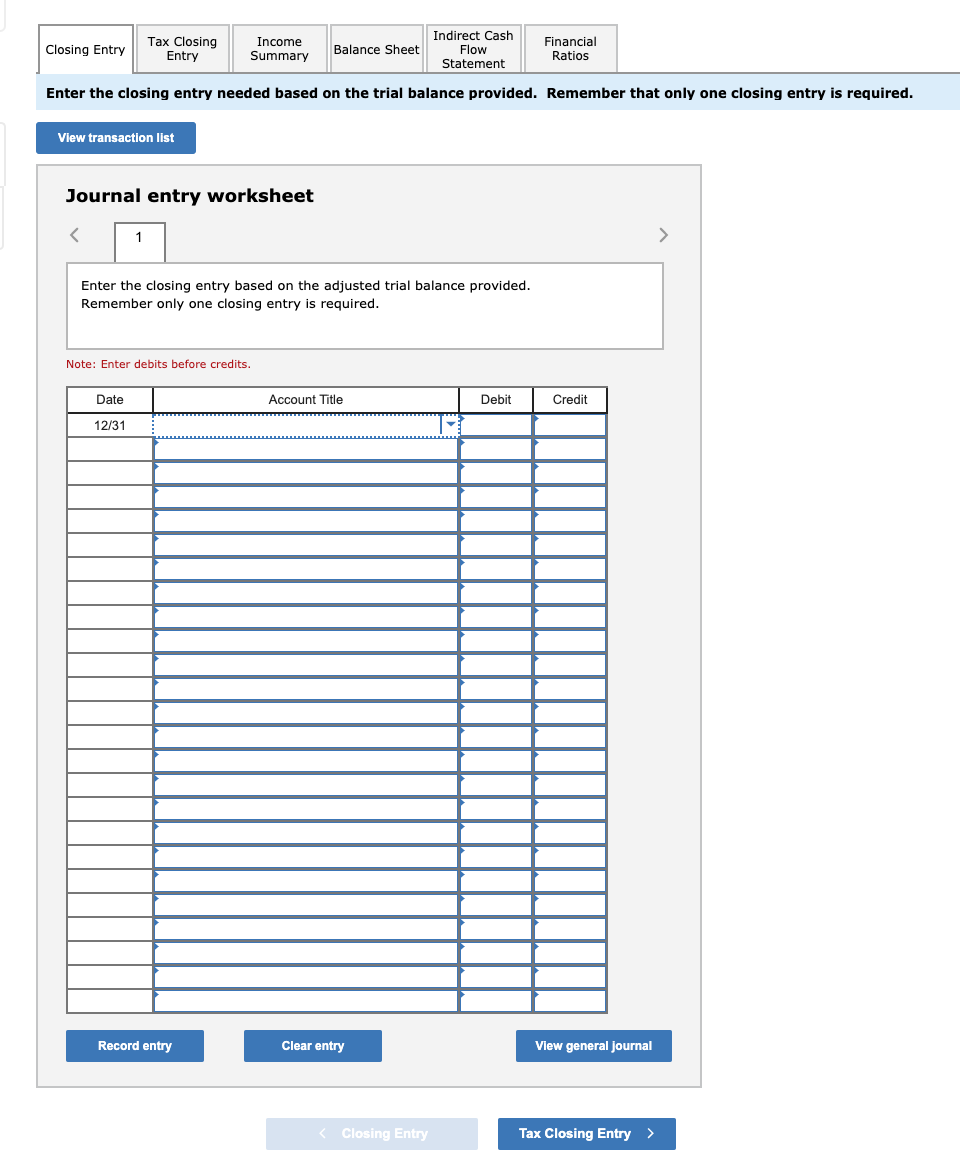

Closing Entry Tax Closing Entry Income Summary Balance Sheet Indirect Cash Flow Statement Financial Ratios Enter the closing entry needed based on the trial balance provided. Remember that only one closing entry is required. View transaction list Journal entry worksheet Enter the closing entry based on the adjusted trial balance provided. Remember only one closing entry is required. Note: Enter debits before credits. Date Account Title Debit Credit 12/31 Record entry Clear entry View general Journal 000 - Required information Arcadia Enterprises Adjusted Trial Balance As of December 31, 2019 Account Name Account Payable Accounts Receivable ALLOON Accumulated Depreciation - Building andere Accumulated Depreciation - Furniture canadie Deprecia Accumulated Depreciation - Equipment Accumulated Depreciation - Vehicles Advertising Expense Allowance for Doubtful Accounts Amortization Expense Bad Debt Expense Cash Common Stock Cost of Goods Sold Depreciation Expense - Building Depreciation Expense - Furniture Depreciation Expense - Equipment Depreciation Expense - Vehicles Franchise Revenue Goodwill Interest Expense Interest Payable Interest Revenue Inventory Inventory - Parts Inventory Shrinkage Investment Land od Land (Held for Sale) NA Notes Payable - Short Term Notes Payable - Long Term Notes Receivable - Short Term ol Notes Receivable - Long Term Notes Receivable Discount helic Office Supplies Expense Patent . Payroll Tax Expense Payroll Tax Payable Prepaid Advertising Prepaid Insurance Breid Prepaid Rent Midi Property - Building Property - Furniture Property - Equipment Property - Vehicles Purchase Discount Realized Gain on Investments Rent Expense Rent Revenue Salary and Wage Expense Sales Discount Sales Balance 64,052 2,271,961 1,319 le 5,124 58,003 53,377 . 38,431 sonte 21,670 48,680 21,873 er 4,382,437 1,281,045 6,200.258 1,319 5,124 58,003 53.377 55,383 183,616 515,739 . 68,797 4,566 3,850,252 229,905 37,577 896,732 1,833,602 256,209 93,943 8,369,494 10 548,003 281,830 2 66,858 15,373 804,212 179,346 134,510 w 281,830 12,454 11 12,810 220,099 TOGGAE 136,645 683,224 640,523 8,967 040 128,105 10.675 TER 2,562 896,732 2014 68,322 211,372 14,091,495 1,249,873 er 42,702 256,209 291,669 Service Revenue Pervice State Transaction Fees Trademark Unearned Revenue Additional information possibly needed include the following: Arcadia Enterprises began operations on January 1, 2019 - Shares Outstanding - 700,000 - Effective Tax Rate - 13.0 Closing Entry Tax Closing Entry Income Summary Balance Sheet Indirect Cash Flow Statement Financial Ratios Enter the closing entry needed based on the trial balance provided. Remember that only one closing entry is required. View transaction list Journal entry worksheet Enter the closing entry based on the adjusted trial balance provided. Remember only one closing entry is required. Note: Enter debits before credits. Date Account Title Debit Credit 12/31 Record entry Clear entry View general Journal 000 - Required information Arcadia Enterprises Adjusted Trial Balance As of December 31, 2019 Account Name Account Payable Accounts Receivable ALLOON Accumulated Depreciation - Building andere Accumulated Depreciation - Furniture canadie Deprecia Accumulated Depreciation - Equipment Accumulated Depreciation - Vehicles Advertising Expense Allowance for Doubtful Accounts Amortization Expense Bad Debt Expense Cash Common Stock Cost of Goods Sold Depreciation Expense - Building Depreciation Expense - Furniture Depreciation Expense - Equipment Depreciation Expense - Vehicles Franchise Revenue Goodwill Interest Expense Interest Payable Interest Revenue Inventory Inventory - Parts Inventory Shrinkage Investment Land od Land (Held for Sale) NA Notes Payable - Short Term Notes Payable - Long Term Notes Receivable - Short Term ol Notes Receivable - Long Term Notes Receivable Discount helic Office Supplies Expense Patent . Payroll Tax Expense Payroll Tax Payable Prepaid Advertising Prepaid Insurance Breid Prepaid Rent Midi Property - Building Property - Furniture Property - Equipment Property - Vehicles Purchase Discount Realized Gain on Investments Rent Expense Rent Revenue Salary and Wage Expense Sales Discount Sales Balance 64,052 2,271,961 1,319 le 5,124 58,003 53,377 . 38,431 sonte 21,670 48,680 21,873 er 4,382,437 1,281,045 6,200.258 1,319 5,124 58,003 53.377 55,383 183,616 515,739 . 68,797 4,566 3,850,252 229,905 37,577 896,732 1,833,602 256,209 93,943 8,369,494 10 548,003 281,830 2 66,858 15,373 804,212 179,346 134,510 w 281,830 12,454 11 12,810 220,099 TOGGAE 136,645 683,224 640,523 8,967 040 128,105 10.675 TER 2,562 896,732 2014 68,322 211,372 14,091,495 1,249,873 er 42,702 256,209 291,669 Service Revenue Pervice State Transaction Fees Trademark Unearned Revenue Additional information possibly needed include the following: Arcadia Enterprises began operations on January 1, 2019 - Shares Outstanding - 700,000 - Effective Tax Rate - 13.0