Answered step by step

Verified Expert Solution

Question

1 Approved Answer

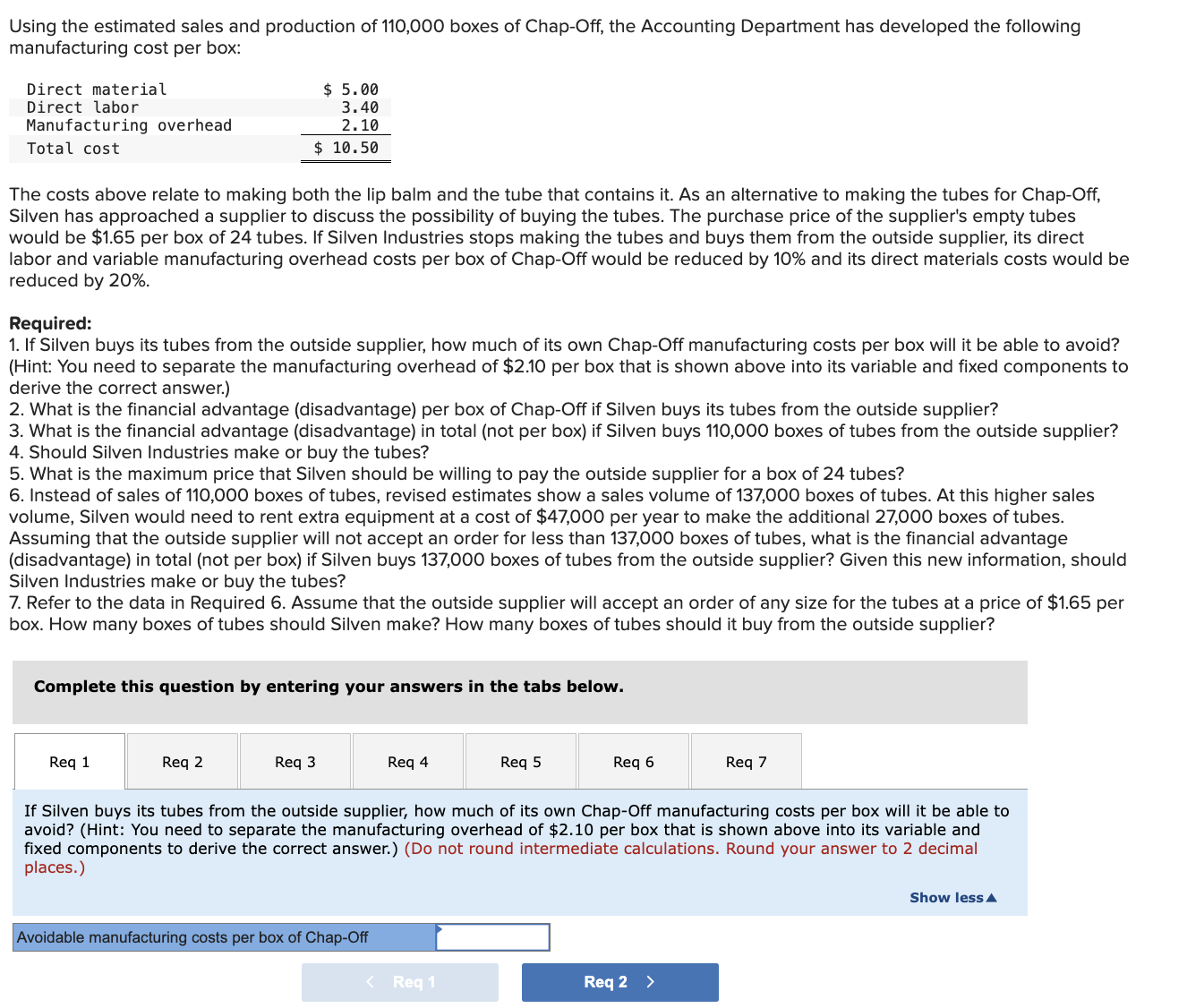

Using the estimated sales and production of 110,000 boxes of Chap-Off, the Accounting Department has developed the following manufacturing cost per box: Direct material

Using the estimated sales and production of 110,000 boxes of Chap-Off, the Accounting Department has developed the following manufacturing cost per box: Direct material Direct labor Manufacturing overhead Total cost $ 5.00 3.40 2.10 $ 10.50 The costs above relate to making both the lip balm and the tube that contains it. As an alternative to making the tubes for Chap-Off, Silven has approached a supplier to discuss the possibility of buying the tubes. The purchase price of the supplier's empty tubes would be $1.65 per box of 24 tubes. If Silven Industries stops making the tubes and buys them from the outside supplier, its direct labor and variable manufacturing overhead costs per box of Chap-Off would be reduced by 10% and its direct materials costs would be reduced by 20%. Required: 1. If Silven buys its tubes from the outside supplier, how much of its own Chap-Off manufacturing costs per box will it be able to avoid? (Hint: You need to separate the manufacturing overhead of $2.10 per box that is shown above into its variable and fixed components to derive the correct answer.) 2. What is the financial advantage (disadvantage) per box of Chap-Off if Silven buys its tubes from the outside supplier? 3. What is the financial advantage (disadvantage) in total (not per box) if Silven buys 110,000 boxes of tubes from the outside supplier? 4. Should Silven Industries make or buy the tubes? 5. What is the maximum price that Silven should be willing to pay the outside supplier for a box of 24 tubes? 6. Instead of sales of 110,000 boxes of tubes, revised estimates show a sales volume of 137,000 boxes of tubes. At this higher sales volume, Silven would need to rent extra equipment at a cost of $47,000 per year to make the additional 27,000 boxes of tubes. Assuming that the outside supplier will not accept an order for less than 137,000 boxes of tubes, what is the financial advantage (disadvantage) in total (not per box) if Silven buys 137,000 boxes of tubes from the outside supplier? Given this new information, should Silven Industries make or buy the tubes? 7. Refer to the data in Required 6. Assume that the outside supplier will accept an order of any size for the tubes at a price of $1.65 per box. How many boxes of tubes should Silven make? How many boxes of tubes should it buy from the outside supplier? Complete this question by entering your answers in the tabs below. Req 1 Req 2 Req 3 Req 4 Req 5 Req 6 Req 7 If Silven buys its tubes from the outside supplier, how much of its own Chap-Off manufacturing costs per box will it be able to avoid? (Hint: You need to separate the manufacturing overhead of $2.10 per box that is shown above into its variable and fixed components to derive the correct answer.) (Do not round intermediate calculations. Round your answer to 2 decimal places.) Avoidable manufacturing costs per box of Chap-Off < Req 1 Req 2 > Show less

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Req 1 To determine the avoidable manufacturing costs per box of ChapOff if Silven buys its tubes from the outside supplier we need to separate the manufacturing overhead of 210 per box into its variab...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663e5bfe944b4_957556.pdf

180 KBs PDF File

663e5bfe944b4_957556.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started