Answered step by step

Verified Expert Solution

Question

1 Approved Answer

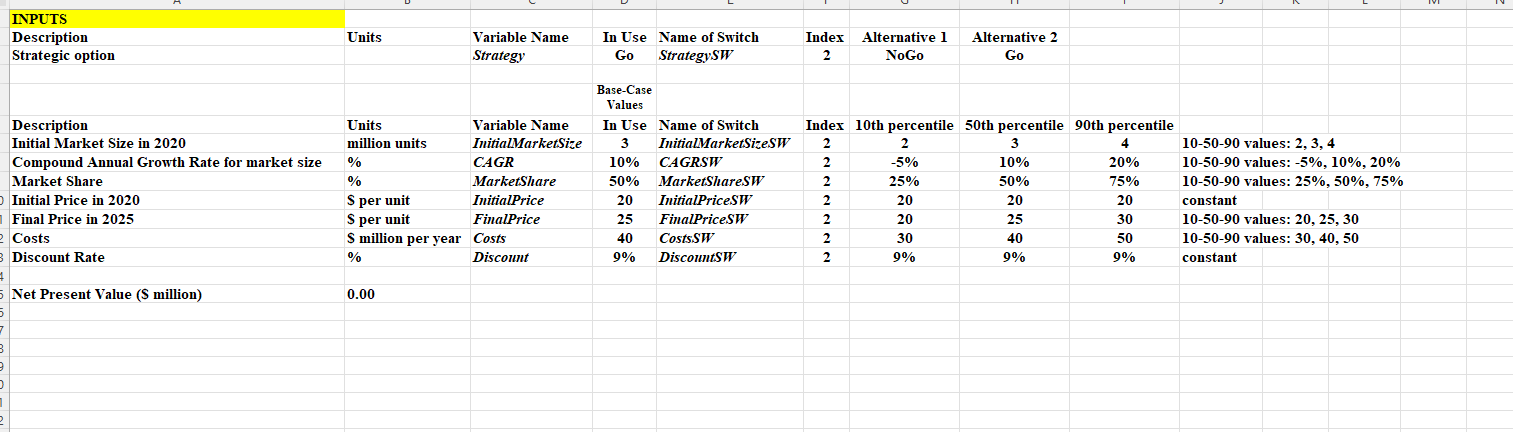

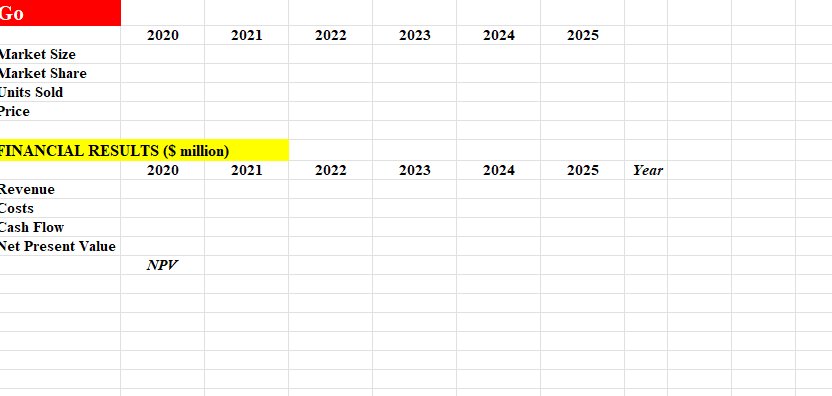

Using the Excel Template (Attached screenshots of the template) and the information provided in the Project 1 description Below, construct an Excel-based model and determine

Using the Excel Template (Attached screenshots of the template) and the information provided in the Project 1 description Below, construct an Excel-based model and determine the base-case NPVs for each alternative.

The following information was obtained from subject matter experts for this Go/NoGo decision.

- Time horizon of analysis is 2020 2025. The discount rate is 9%.

- Market Size is a compound annual growth rate (CAGR) model (see figure below), beginning in 2020 and ending in 2025.

- Initial Market Size in the year 2020 10-50-90 values are 2, 3, and 4 million units.

- CAGR for Market Size 10-50-90 values are -5%, 10%, and 20%.

- Market Share 10-50-90 values are 25%, 50%, and 75%, for the Go strategy in the years 2020-2025.

- Units Sold = Market Size Market Share, for the Go strategy.

- Pricing for the Go strategy is a linear growth model (see figure below), beginning in 2020 and ending in 2025.

- Initial price in year 2020 is $20 per unit.

- Final Price 10-50-90 values in year 2025 are $20 per unit, $25 per unit, and $30 per unit.

- Costs for the Go strategy 10-50-90 values are $30 million per year, $40 million per year, and $50 million per year in the years 2020-2025.

- Revenue = Pricing Units Sold, for the Go strategy.

- Cash Flow = Revenue - Costs.

| Linear growth model: y = y1 + (y2 - y1) / (x2 - x1) * (Year - x1) CAGR model: y = y1 (1 + CAGR)^(Year - x1) |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the basecase NPVs for each alternative follow the steps below using the information pro...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started