Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Using the expectation model of capital asset pricing model, describe and justify what the value of the beta of an Australian government bond should

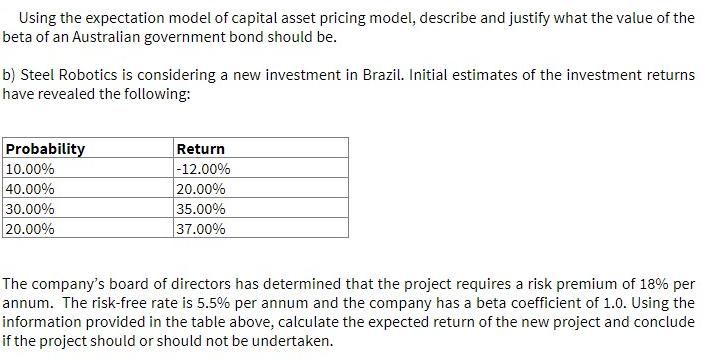

Using the expectation model of capital asset pricing model, describe and justify what the value of the beta of an Australian government bond should be. b) Steel Robotics is considering a new investment in Brazil. Initial estimates of the investment returns have revealed the following: Probability 10.00% 40.00% 30.00% 20.00% Return -12.00% 20.00% 35.00% 37.00% The company's board of directors has determined that the project requires a risk premium of 18% per annum. The risk-free rate is 5.5% per annum and the company has a beta coefficient of 1.0. Using the information provided in the table above, calculate the expected return of the new project and conclude if the project should or should not be undertaken.

Step by Step Solution

★★★★★

3.54 Rating (171 Votes )

There are 3 Steps involved in it

Step: 1

a The Capital Asset Pricing Model CAPM is used to estimate the expected return on an investment by taking into account its systematic risk which is me...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started