Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Using the financial data for Coca Cola Company calculate the ratios below for both 2017 and 2018. current ratio return on sales return on equity

Using the financial data for Coca Cola Company calculate the ratios below for both 2017 and 2018. current ratio

return on sales

return on equity

return on assets

Basic EPS

Diluted EPS

Average Day's sales (average collection period)

asset turnover

dividend payout receivables turnover

debt to equity

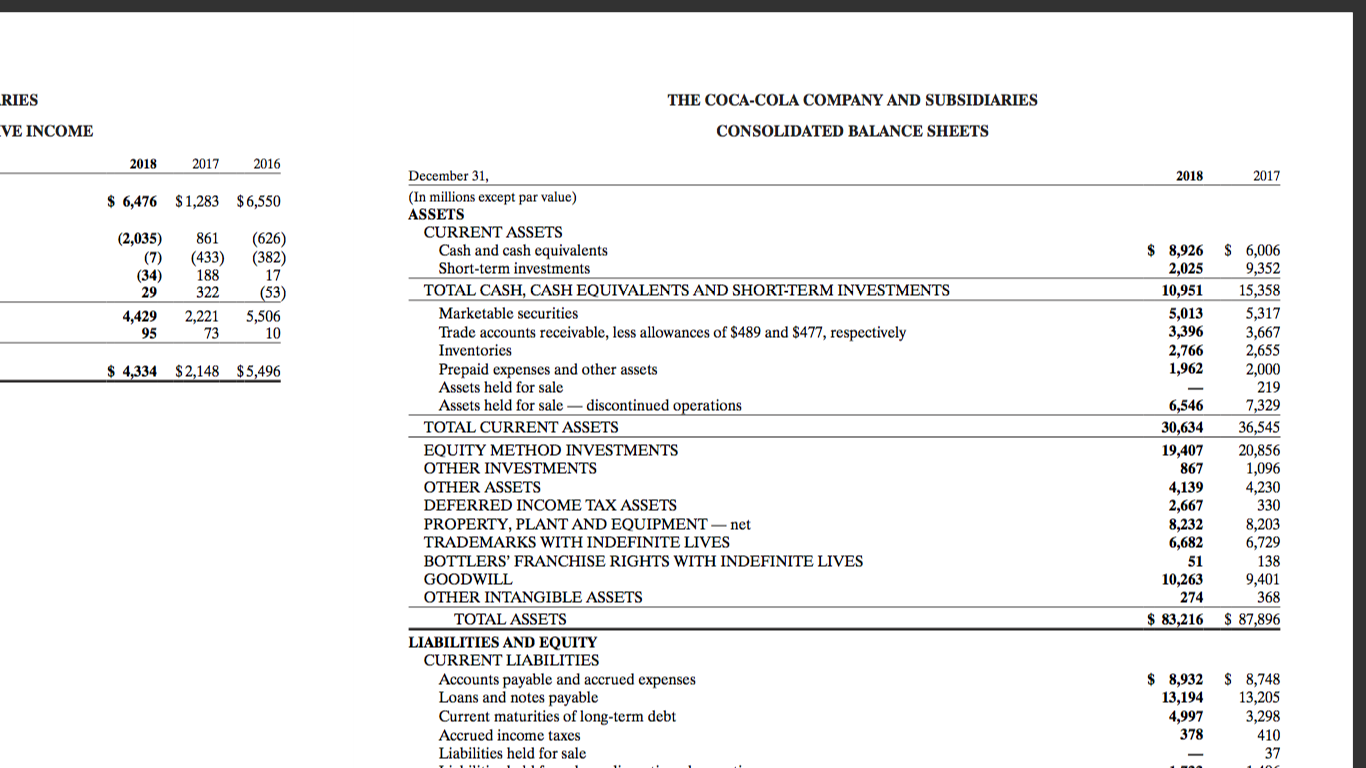

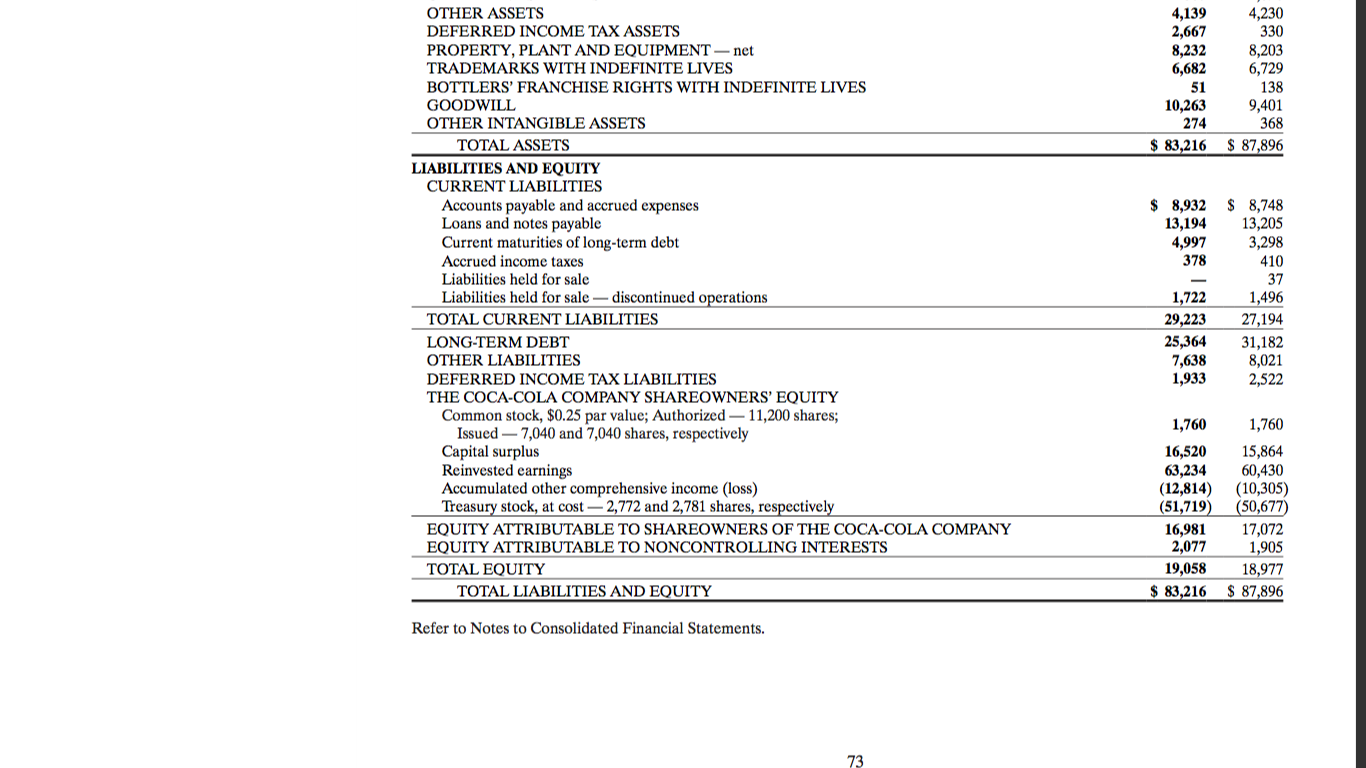

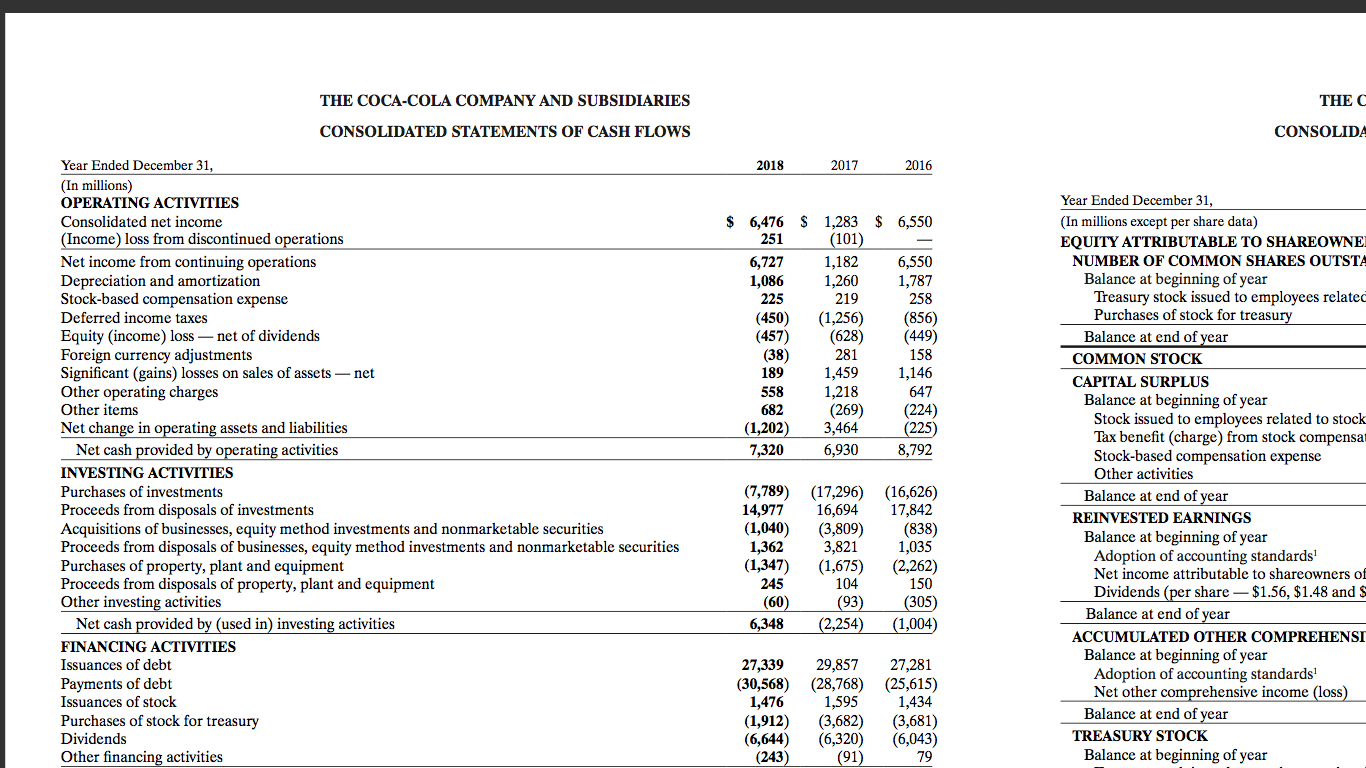

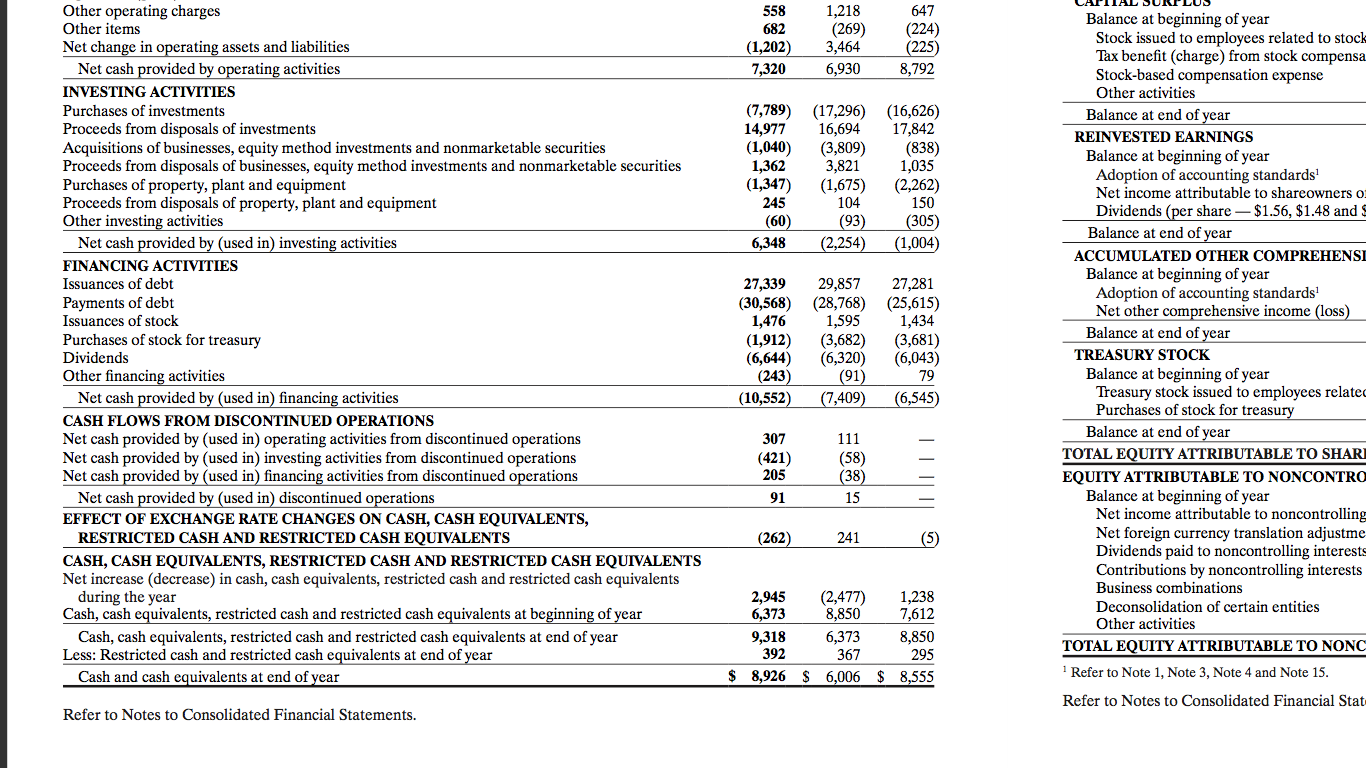

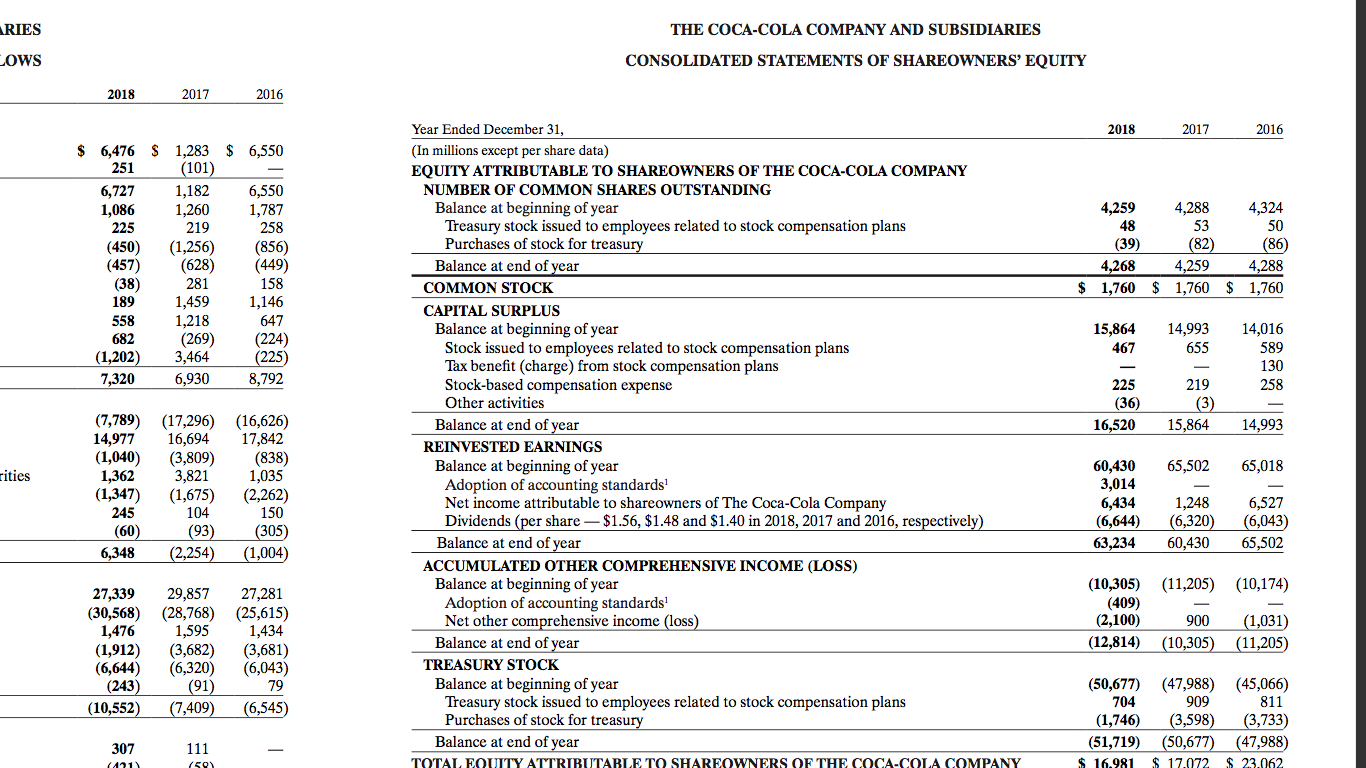

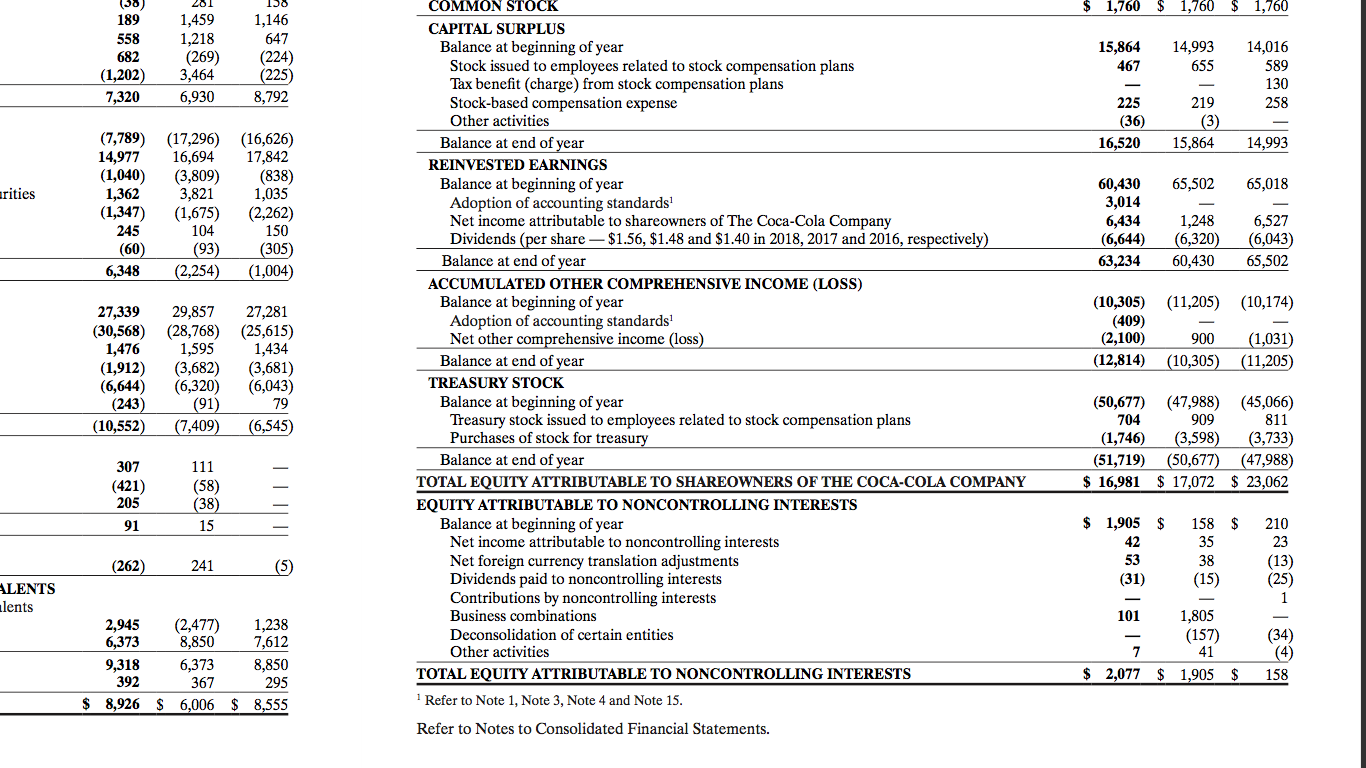

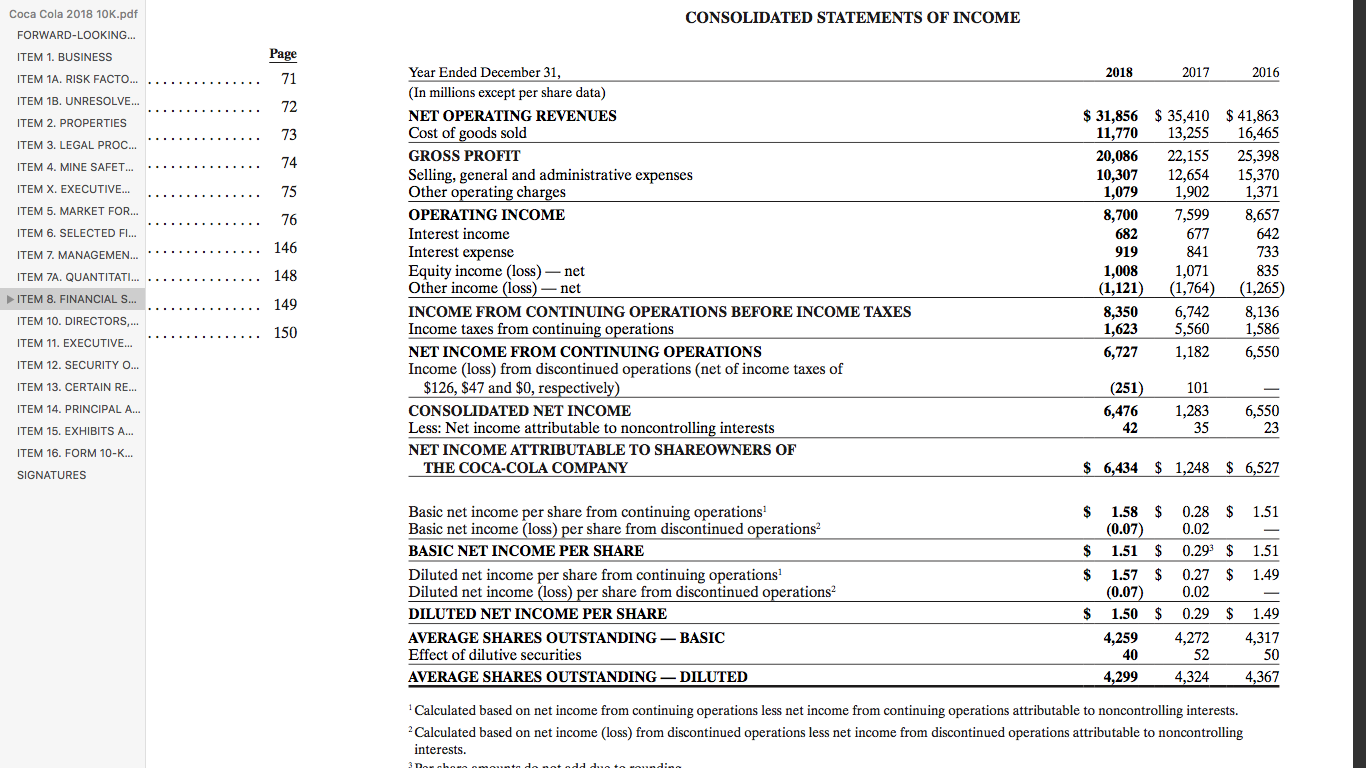

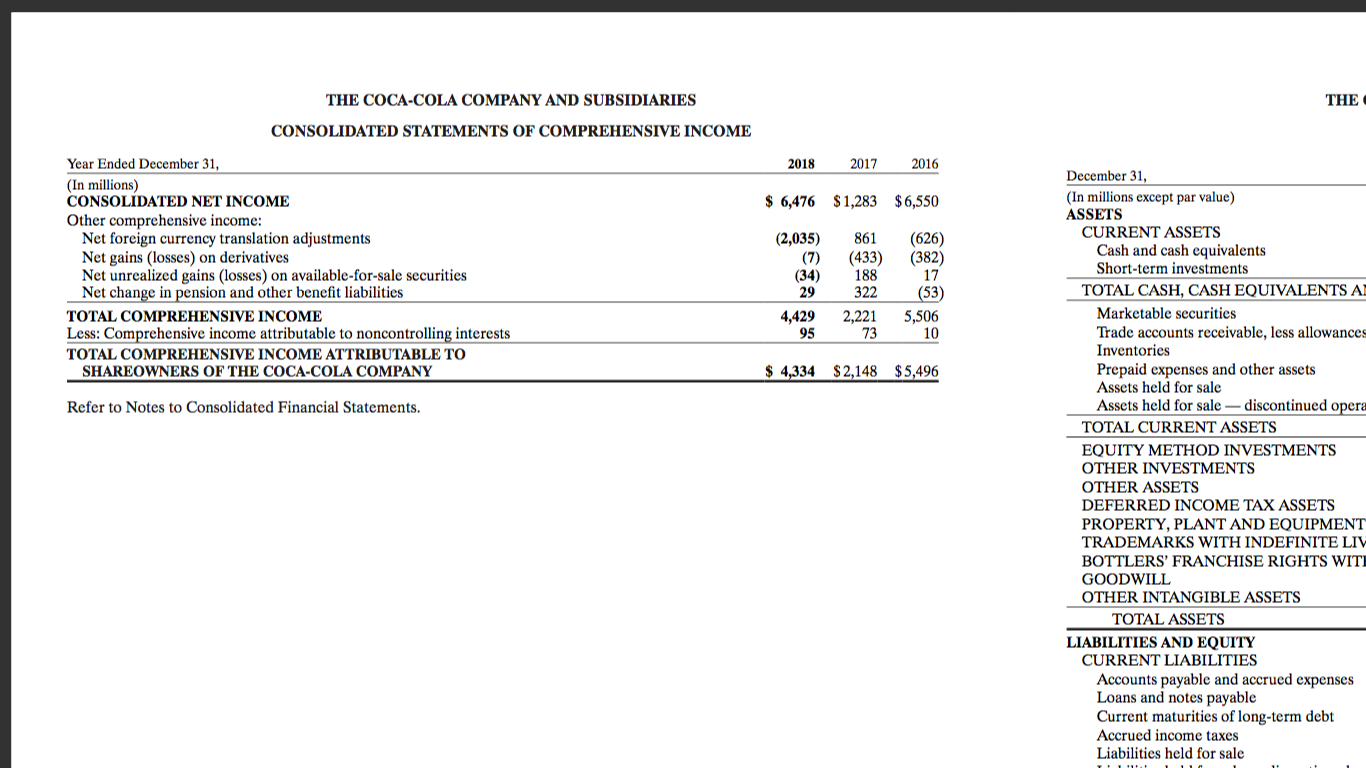

RIES VE INCOME THE COCA-COLA COMPANY AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS 2018 2017 2016 2018 2017 $ 6,476 $1,283 $ 6,550 $ (2,035) (7) (34) 29 861 (433) 188 322 (626) (382) 17 (53) 4,429 2,273 5.90 8,926 2,025 10,951 5,013 3,396 2,766 1,962 95 $ 4,334 $2,148 $5,496 December 31, (In millions except par value) ASSETS CURRENT ASSETS Cash and cash equivalents Short-term investments TOTAL CASH, CASH EQUIVALENTS AND SHORT-TERM INVESTMENTS Marketable securities Trade accounts receivable, less allowances of $489 and $477, respectively Inventories Prepaid expenses and other assets Assets held for sale Assets held for sale - discontinued operations TOTAL CURRENT ASSETS EQUITY METHOD INVESTMENTS OTHER INVESTMENTS OTHER ASSETS DEFERRED INCOME TAX ASSETS PROPERTY, PLANT AND EQUIPMENT - net TRADEMARKS WITH INDEFINITE LIVES BOTTLERS' FRANCHISE RIGHTS WITH INDEFINITE LIVES GOODWILL OTHER INTANGIBLE ASSETS TOTAL ASSETS LIABILITIES AND EQUITY CURRENT LIABILITIES Accounts payable and accrued expenses Loans and notes payable Current maturities of long-term debt Accrued income taxes Liabilities held for sale 6,546 30,634 19,407 867 4,139 2,667 8,232 6,682 51 10,263 274 $ 83,216 $ 6,006 9,352 15,358 5,317 3,667 2,655 2,000 219 7,329 36,545 20,856 1,096 4,230 330 8,203 6,729 138 9,401 368 $ 87,896 $ $ 8,932 13,194 8,748 13,205 3,298 410 4,997 378 37 4,139 2,667 8,232 6,682 4,230 330 8,203 6,729 138 9,401 368 $ 87,896 10,263 274 $ 83,216 $ 8,932 13,194 4,997 378 OTHER ASSETS DEFERRED INCOME TAX ASSETS PROPERTY, PLANT AND EQUIPMENT - net TRADEMARKS WITH INDEFINITE LIVES BOTTLERS' FRANCHISE RIGHTS WITH INDEFINITE LIVES GOODWILL OTHER INTANGIBLE ASSETS TOTAL ASSETS LIABILITIES AND EQUITY CURRENT LIABILITIES Accounts payable and accrued expenses Loans and notes payable Current maturities of long-term debt Accrued income taxes Liabilities held for sale Liabilities held for sale - discontinued operations TOTAL CURRENT LIABILITIES LONG-TERM DEBT OTHER LIABILITIES DEFERRED INCOME TAX LIABILITIES THE COCA-COLA COMPANY SHAREOWNERS' EQUITY Common stock, $0.25 par value; Authorized - 11,200 shares; Issued - 7,040 and 7,040 shares, respectively Capital surplus Reinvested earnings Accumulated other comprehensive income (loss) Treasury stock, at cost - 2,772 and 2,781 shares, respectively EQUITY ATTRIBUTABLE TO SHAREOWNERS OF THE COCA-COLA COMPANY EQUITY ATTRIBUTABLE TO NONCONTROLLING INTERESTS TOTAL EQUITY TOTAL LIABILITIES AND EQUITY 1,722 29,223 25,364 $ 8,748 13,205 3,298 410 37 1,496 27,194 31,182 8,021 2,522 7,638 1,933 1,760 1,760 16,520 63,234 (12,814) (51,719) 16,981 2,077 19,058 $ 83,216 15,864 60,430 (10,305) (50,677) 17,072 1,905 18,977 $ 87,896 Refer to Notes to Consolidated Financial Statements. THE COCA-COLA COMPANY AND SUBSIDIARIES THE C CONSOLIDA CONSOLIDATED STATEMENTS OF CASH FLOWS 2018 2017 2016 $ $ $ 6,550 6,550 1,787 258 (856) 6,476 251 6,727 1,086 225 (450) (457) (38) 189 558 682 (1,202) 7,320 1,283 (101) 1,182 1,260 219 (1,256) (628) 281 1,459 1,218 (269) 3,464 6,930 (449) 158 1,146 647 (224) (225) 8,792 Year Ended December 31, (In millions) OPERATING ACTIVITIES Consolidated net income (Income) loss from discontinued operations Net income from continuing operations Depreciation and amortization Stock-based compensation expense Deferred income taxes Equity (income) loss net of dividends Foreign currency adjustments Significant (gains) losses on sales of assets-net Other operating charges Other items Net change in operating assets and liabilities Net cash provided by operating activities INVESTING ACTIVITIES Purchases of investments Proceeds from disposals of investments Acquisitions of businesses, equity method investments and nonmarketable securities Proceeds from disposals of businesses, equity method investments and nonmarketable securities Purchases of property, plant and equipment Proceeds from disposals of property, plant and equipment Other investing activities Net cash provided by (used in) investing activities FINANCING ACTIVITIES Issuances of debt Payments of debt Issuances of stock Purchases of stock for treasury Dividends Other financing activities Year Ended December 31, (In millions except per share data) EQUITY ATTRIBUTABLE TO SHAREOWNE NUMBER OF COMMON SHARES OUTSTA Balance at beginning of year Treasury stock issued to employees related Purchases of stock for treasury Balance at end of year COMMON STOCK CAPITAL SURPLUS Balance at beginning of year Stock issued to employees related to stock Tax benefit (charge) from stock compensat Stock-based compensation expense Other activities Balance at end of year REINVESTED EARNINGS Balance at beginning of year Adoption of accounting standards! Net income attributable to shareowners of Dividends (per share - $1.56, $1.48 and $ Balance at end of year ACCUMULATED OTHER COMPREHENSI Balance at beginning of year Adoption of accounting standards Net other comprehensive income (loss) Balance at end of year TREASURY STOCK Balance at beginning of year (7,789) 14,977 (1,040) 1,362 (1,347) 245 (60) 6,348 (17,296) 16,694 (3,809) 3,821 (1,675) 104 (93) (2,254) (16,626) 17,842 (838) 1,035 (2,262) 150 (305) (1,004) 27,339 (30,568) 1,476 (1,912) (6,644) (243) 29,857 (28,768) 1,595 (3,682) (6,320) (91) 27,281 (25,615) 1,434 (3,681) (6,043) 79 LAPITAL SURPLUS 558 682 (1,202) 7,320 1,218 (269) 3,464 6,930 647 (224) (225) 8,792 (7,789) 14,977 (1,040) 1,362 (1,347) 245 (60) 6,348 (17,296) 16,694 (3,809) 3,821 (1,675) 104 (93) (2,254) (16,626) 17,842 (838) 1,035 (2,262) 150 (305) (1,004) Other operating charges Other items Net change in operating assets and liabilities Net cash provided by operating activities INVESTING ACTIVITIES Purchases of investments Proceeds from disposals of investments Acquisitions of businesses, equity method investments and nonmarketable securities Proceeds from disposals of businesses, equity method investments and nonmarketable securities Purchases of property, plant and equipment Proceeds from disposals of property, plant and equipment Other investing activities Net cash provided by (used in) investing activities FINANCING ACTIVITIES Issuances of debt Payments of debt Issuances of stock Purchases of stock for treasury Dividends Other financing activities Net cash provided by used in financing activities CASH FLOWS FROM DISCONTINUED OPERATIONS Net cash provided by (used in) operating activities from discontinued operations Net cash provided by (used in) investing activities from discontinued operations Net cash provided by used in) financing activities from discontinued operations Net cash provided by (used in) discontinued operations EFFECT OF EXCHANGE RATE CHANGES ON CASH, CASH EQUIVALENTS, RESTRICTED CASH AND RESTRICTED CASH EQUIVALENTS CASH, CASH EQUIVALENTS, RESTRICTED CASH AND RESTRICTED CASH EQUIVALENTS Net increase (decrease) in cash, cash equivalents, restricted cash and restricted cash equivalents during the year Cash, cash equivalents, restricted cash and restricted cash equivalents at beginning of year Cash, cash equivalents, restricted cash and restricted cash equivalents at end of year Less: Restricted cash and restricted cash equivalents at end of year Cash and cash equivalents at end of year 27,339 (30,568) 1,476 (1,912) (6,644) (243) (10,552) 29,857 (28,768) 1,595 (3,682) (6,320) (91) (7,409) 27,281 (25,615) 1,434 (3,681) (6,043) Balance at beginning of year Stock issued to employees related to stock Tax benefit (charge) from stock compensa Stock-based compensation expense Other activities Balance at end of year REINVESTED EARNINGS Balance at beginning of year Adoption of accounting standards Net income attributable to shareowners o Dividends (per share - $1.56, $1.48 and Balance at end of year ACCUMULATED OTHER COMPREHENSE Balance at beginning of year Adoption of accounting standards! Net other comprehensive income (loss) Balance at end of year TREASURY STOCK Balance at beginning of year Treasury stock issued to employees relate Purchases of stock for treasury Balance at end of year TOTAL EQUITY ATTRIBUTABLE TO SHARI EQUITY ATTRIBUTABLE TO NONCONTRO Balance at beginning of year Net income attributable to noncontrolling Net foreign currency translation adjustme Dividends paid to noncontrolling interests Contributions by noncontrolling interests Business combinations Deconsolidation of certain entities Other activities TOTAL EQUITY ATTRIBUTABLE TO NONC Refer to Note 1, Note 3, Note 4 and Note 15. Refer to Notes to Consolidated Financial Stat 6,545) 307111 (421) (58) 205 (38) 9115 - (262) 241 2,945 6,373 9,318 392 8,926 (2,477) 8,850 6,373 367 $ 6,006 1,238 7,612 8,850 295 $ 8,555 $ Refer to Notes to Consolidated Financial Statements. RIES THE COCA-COLA COMPANY AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF SHAREOWNERS' EQUITY LOWS 2018 2017 2016 2018 2017 2016 $ $ $ 6,550 6,476 251 6,727 1,086 225 (450) (457) 4,259 48 1,283 (101) 1,182 1,260 219 (1,256) (628) 281 1,459 1,218 (269) 3,464 6,930 6,550 1,787 258 (856) (449) 158 1,146 647 (224) (225) 8,792 (39) 4,268 1,760 4,288 4,324 53 50 (82) (86) 4,2594,288 1,760 $ 1,760 (38) $ $ 189 558 682 (1,202) 7,320 15,864 467 14,993 655 14,016 589 130 258 225 (36) 219 (3) 15,864 16,520 14,993 65,502 65,018 Year Ended December 31, (In millions except per share data) EQUITY ATTRIBUTABLE TO SHAREOWNERS OF THE COCA-COLA COMPANY NUMBER OF COMMON SHARES OUTSTANDING Balance at beginning of year Treasury stock issued to employees related to stock compensation plans Purchases of stock for treasury Balance at end of year COMMON STOCK CAPITAL SURPLUS Balance at beginning of year Stock issued to employees related to stock compensation plans Tax benefit (charge) from stock compensation plans Stock-based compensation expense Other activities Balance at end of year REINVESTED EARNINGS Balance at beginning of year Adoption of accounting standards Net income attributable to shareowners of The Coca-Cola Company Dividends (per share - $1.56, $1.48 and $1.40 in 2018, 2017 and 2016, respectively) Balance at end of year ACCUMULATED OTHER COMPREHENSIVE INCOME (LOSS) Balance at beginning of year Adoption of accounting standards Net other comprehensive income (loss) Balance at end of year TREASURY STOCK Balance at beginning of year Treasury stock issued to employees related to stock compensation plans Purchases of stock for treasury Balance at end of year TOTAL EQUITY ATTRIBUTABLE TO SHAREOWNERS OF THE COCA-COLA COMPANY (7,789) 14,977 (1,040) 1,362 (1,347) 245 (60) 6,348 rities (17,296) 16,694 (3,809) 3,821 (1,675) 104 (93) (2,254) (16,626) 17,842 (838) 1,035 (2,262) 150 (305) (1,004) 60,430 3,014 6,434 (6,644) 63,234 1.248 (6,320) 60,430 6,527 (6,043) 65,502 (11,205) (10,174) 27,339 (30,568) 1,476 (1,912) (6,644) (243) (10,552) 29,857 (28,768) 1,595 (3,682) (6,320) (91) (7,409) 27,281 (25,615) 1,434 (3,681) (6,043) 79 (6,545) (10,305) (409) (2,100) (12,814) 900 (10,305) (1,031) (11,205) (50,677) 704 (1,746) (51,719) $16.981 (47,988) 909 (3,598) (50,677) $17.972 (45,066) 811 (3,733) (47,988) $23.062 307 1 11 - $ 1,760 $ 1,760 $ 1,760 (38) 189 558 682 (1,202) 7,320 281 1,459 1,218 (269) 3,464 6,930 158 1,146 647 (224) (225) 8,792 15,864 467 14,016 589 655 130 258 225 (36) 16,520 219 (3) 15,864 14,993 65,502 65,018 arities (7,789) 14,977 (1,040) 1,362 (1,347) 245 (60) 6,348 (17,296) 16,694 (3,809) 3,821 (1,675) 104 (93) (2,254) (16,626) 17,842 (838) 1,035 (2,262) 150 (305) (1,004) 60,430 3,014 6,434 (6,644) 63,234 1,248 (6,320) 60,430 6,527 (6,043) 65,502 (11,205) (10,174) 27,339 (30,568) 1,476 (1,912) (6,644) (243) (10,552) 29,857 (28,768) 1,595 (3,682) (6,320) (91) (7,409) 27,281 (25,615) 1,434 (3,681) (6,043) COMMON STOCK CAPITAL SURPLUS Balance at beginning of year Stock issued to employees related to stock compensation plans Tax benefit (charge) from stock compensation plans Stock-based compensation expense Other activities Balance at end of year REINVESTED EARNINGS Balance at beginning of year Adoption of accounting standards Net income attributable to shareowners of The Coca-Cola Company Dividends (per share - $1.56, $1.48 and $1.40 in 2018, 2017 and 2016, respectively) Balance at end of year ACCUMULATED OTHER COMPREHENSIVE INCOME (LOSS) Balance at beginning of year Adoption of accounting standards Net other comprehensive income (loss) Balance at end of year TREASURY STOCK Balance at beginning of year Treasury stock issued to employees related to stock compensation plans Purchases of stock for treasury Balance at end of year TOTAL EQUITY ATTRIBUTABLE TO SHAREOWNERS OF THE COCA-COLA COMPANY EQUITY ATTRIBUTABLE TO NONCONTROLLING INTERESTS Balance at beginning of year Net income attributable to noncontrolling interests Net foreign currency translation adjustments Dividends paid to noncontrolling interests Contributions by noncontrolling interests Business combinations Deconsolidation of certain entities Other activities TOTAL EQUITY ATTRIBUTABLE TO NONCONTROLLING INTERESTS Refer to Note 1, Note 3, Note 4 and Note 15. (10,305) (409) (2,100) (12,814) 900 (10,305) (1,031) (11,205) (6,545) (50,677) (47,988) 704 909 (1,746) (3,598) (51,719) (50,677) $ 16,981 $ 17,072 (45,066) 811 (3,733) (47,988) $ 23,062 307 111 (421) (58) 205 (38) 9115 $ $ 38 (262) 241 (5) 1,905 42 53 (31) 101 158 $ 210 3523 (13) (15) (25) 1,805 LENTS ulents z (157) (34) 2,945 6,373 9,318 392 8,926 (2,477) 8,850 6,373 367 6,006 1,238 7,612 8,850 2 95 $ 8,555 $ 2,077 $ 1,905 $ 158 $ $ Refer to Notes to Consolidated Financial Statements. Coca Cola 2018 10K.pdf FORWARD-LOOKING... CONSOLIDATED STATEMENTS OF INCOME ITEM 1. BUSINESS Page 2018 2017 2016 ITEM 1A. RISK FACTO... ITEM 1B. UNRESOLVE... ITEM 2. PROPERTIES ITEM 3. LEGAL PROC... ITEM 4. MINE SAFET... ITEM X. EXECUTIVE... ITEM 5. MARKET FOR.. ITEM 6. SELECTED FL... ITEM 7. MANAGEMEN... ITEM 7A. QUANTITATI... ITEM 8. FINANCIAL S... ITEM 10. DIRECTORS.... ITEM 11. EXECUTIVE... ITEM 12. SECURITY O.. ITEM 13. CERTAIN RE.. ITEM 14. PRINCIPAL A... ITEM 15. EXHIBITS A... Year Ended December 31, (In millions except per share data) NET OPERATING REVENUES Cost of goods sold GROSS PROFIT Selling, general and administrative expenses Other operating charges OPERATING INCOME Interest income Interest expense Equity income (loss) net Other income (loss) net INCOME FROM CONTINUING OPERATIONS BEFORE INCOME TAXES Income taxes from continuing operations NET INCOME FROM CONTINUING OPERATIONS Income (loss) from discontinued operations (net of income taxes of $126, $47 and $0, respectively) CONSOLIDATED NET INCOME Less: Net income attributable to noncontrolling interests NET INCOME ATTRIBUTABLE TO SHAREOWNERS OF THE COCA-COLA COMPANY $ 31,856 11,770 20,086 10,307 1,079 8,700 682 919 1,008 (1,121) 8,350 1,623 6,727 $ 35,410 13,255 22,155 12,654 1,902 7,599 677 841 1,071 (1,764) 6,742 5,560 1,182 ........ $ 41,863 16,465 25,398 15,370 1,371 8,657 642 733 835 (1,265) 8,136 1,586 6,550 ........ (251) 6,476 42 101 1,283 35 6,550 ITEM 16. FORM 10-K... SIGNATURES $ 6,434 $ 1,248 $ 6,527 $ $ $ Basic net income per share from continuing operations! Basic net income (loss) per share from discontinued operations BASIC NET INCOME PER SHARE Diluted net income per share from continuing operations Diluted net income (loss) per share from discontinued operations DILUTED NET INCOME PER SHARE AVERAGE SHARES OUTSTANDING - BASIC Effect of dilutive securities AVERAGE SHARES OUTSTANDING - DILUTED 1.58 $ 0.28 $ 1.51 (0.07) 0.02 1.51 $ 0.293 $ 1.51 1.57 $ 0.27 $ 1.49 (0.07) 0.02 - 1.50 $ 0.29 $ 1.49 4,2594,272 4,317 405250 4,299 4,324 4,367 $ Calculated based on net income from continuing operations less net income from continuing operations attributable to noncontrolling interests. 2 Calculated based on net income (loss) from discontinued operations less net income from discontinued operations attributable to noncontrolling interests. 3 Darabowo dostada de todo THE COCA-COLA COMPANY AND SUBSIDIARIES THE CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME 2018 2017 2016 $ 6,476 $1,283 $ 6,550 Year Ended December 31, (In millions) CONSOLIDATED NET INCOME Other comprehensive income: Net foreign currency translation adjustments Net gains (losses) on derivatives Net unrealized gains (losses) on available-for-sale securities Net change in pension and other benefit liabilities TOTAL COMPREHENSIVE INCOME Less: Comprehensive income attributable to noncontrolling interests TOTAL COMPREHENSIVE INCOME ATTRIBUTABLE TO SHAREOWNERS OF THE COCA-COLA COMPANY (2,035) (7) (34) 861 (433) 188 322 (626) (382) 29 4,422,225,506 $ 4,334 $2,148 $5,496 Refer to Notes to Consolidated Financial Statements. December 31, (In millions except par value) ASSETS CURRENT ASSETS Cash and cash equivalents Short-term investments TOTAL CASH, CASH EQUIVALENTS AL Marketable securities Trade accounts receivable, less allowances Inventories Prepaid expenses and other assets Assets held for sale Assets held for sale - discontinued opera TOTAL CURRENT ASSETS EQUITY METHOD INVESTMENTS OTHER INVESTMENTS OTHER ASSETS DEFERRED INCOME TAX ASSETS PROPERTY, PLANT AND EQUIPMENT TRADEMARKS WITH INDEFINITE LIV BOTTLERS' FRANCHISE RIGHTS WITH GOODWILL OTHER INTANGIBLE ASSETS TOTAL ASSETS LIABILITIES AND EQUITY CURRENT LIABILITIES Accounts payable and accrued expenses Loans and notes payable Current maturities of long-term debt Accrued income taxes Liabilities held for sale

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started