- Using the financial data provided in the case, conduct a detailed financial analysis.

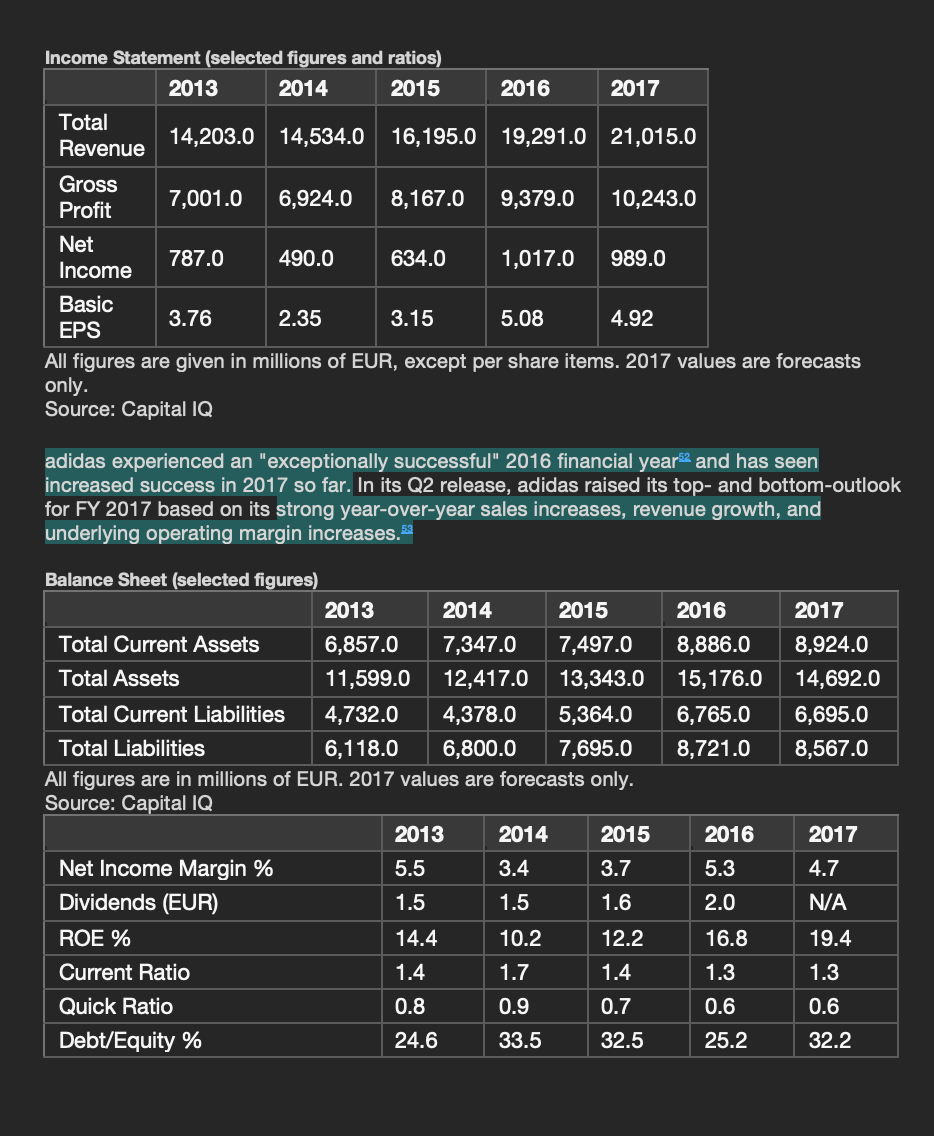

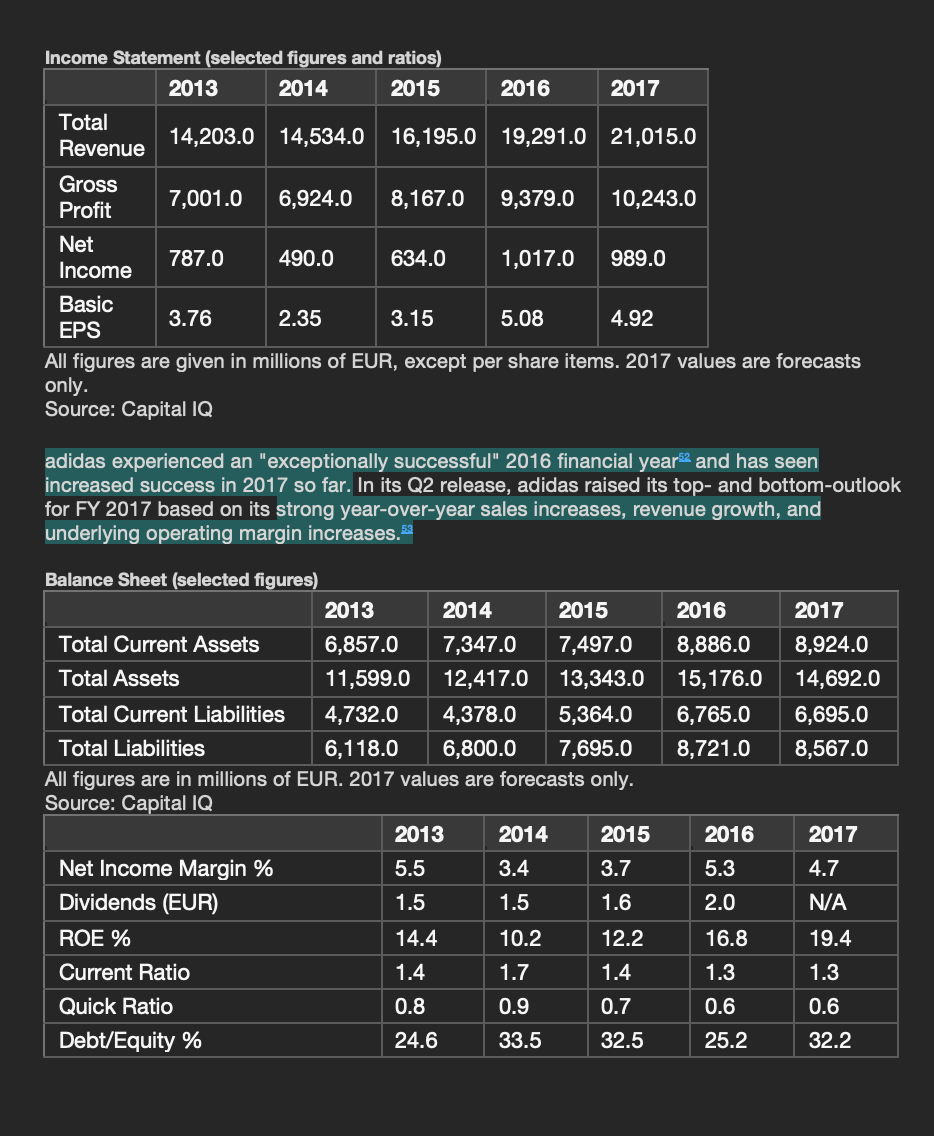

Income Statement (selected figures and ratios) 2013 2014 2015 2016 2017 Total 14,203.0 14,534.0 16,195.0 19,291.0 21,015.0 Revenue Gross 7,001.0 6,924.0 8,167.0 9,379.0 10,243.0 Profit Net 787.0 490.0 634.0 1,017.0 989.0 Income Basic 3.76 2.35 3.15 5.08 4.92 EPS All figures are given in millions of EUR, except per share items. 2017 values are forecasts only. Source: Capital IQ adidas experienced an "exceptionally successful" 2016 financial ar2 and has seen increased success in 2017 so far. In its Q2 release, adidas raised its top- and bottom-outlook for FY 2017 based on its strong year-over-year sales increases, revenue growth, and underlying operating margin increases. 2016 8,886.0 15,176.0 6,765.0 8,721.0 2017 8,924.0 14,692.0 6,695.0 8,567.0 Balance Sheet (selected figures) 2013 2014 2015 Total Current Assets 6,857.0 7,347.0 7,497.0 Total Assets 11,599.0 12,417.0 13,343.0 Total Current Liabilities 4,732.0 4,378.0 5,364.0 Total Liabilities 6,118.0 6,800.0 7,695.0 All figures are in millions of EUR. 2017 values are forecasts only. Source: Capital IQ 2013 2014 2015 Net Income Margin % 5.5 3.4 3.7 Dividends (EUR) 1.5 1.5 1.6 ROE % 14.4 10.2 12.2 Current Ratio 1.4 1.7 1.4 Quick Ratio 0.8 0.9 0.7 Debt/Equity % 24.6 33.5 32.5 2016 5.3 2.0 2017 4.7 NA 16.8 19.4 1.3 1.3 0.6 0.6 25.2 32.2 Income Statement (selected figures and ratios) 2013 2014 2015 2016 2017 Total 14,203.0 14,534.0 16,195.0 19,291.0 21,015.0 Revenue Gross 7,001.0 6,924.0 8,167.0 9,379.0 10,243.0 Profit Net 787.0 490.0 634.0 1,017.0 989.0 Income Basic 3.76 2.35 3.15 5.08 4.92 EPS All figures are given in millions of EUR, except per share items. 2017 values are forecasts only. Source: Capital IQ adidas experienced an "exceptionally successful" 2016 financial ar2 and has seen increased success in 2017 so far. In its Q2 release, adidas raised its top- and bottom-outlook for FY 2017 based on its strong year-over-year sales increases, revenue growth, and underlying operating margin increases. 2016 8,886.0 15,176.0 6,765.0 8,721.0 2017 8,924.0 14,692.0 6,695.0 8,567.0 Balance Sheet (selected figures) 2013 2014 2015 Total Current Assets 6,857.0 7,347.0 7,497.0 Total Assets 11,599.0 12,417.0 13,343.0 Total Current Liabilities 4,732.0 4,378.0 5,364.0 Total Liabilities 6,118.0 6,800.0 7,695.0 All figures are in millions of EUR. 2017 values are forecasts only. Source: Capital IQ 2013 2014 2015 Net Income Margin % 5.5 3.4 3.7 Dividends (EUR) 1.5 1.5 1.6 ROE % 14.4 10.2 12.2 Current Ratio 1.4 1.7 1.4 Quick Ratio 0.8 0.9 0.7 Debt/Equity % 24.6 33.5 32.5 2016 5.3 2.0 2017 4.7 NA 16.8 19.4 1.3 1.3 0.6 0.6 25.2 32.2