Answered step by step

Verified Expert Solution

Question

1 Approved Answer

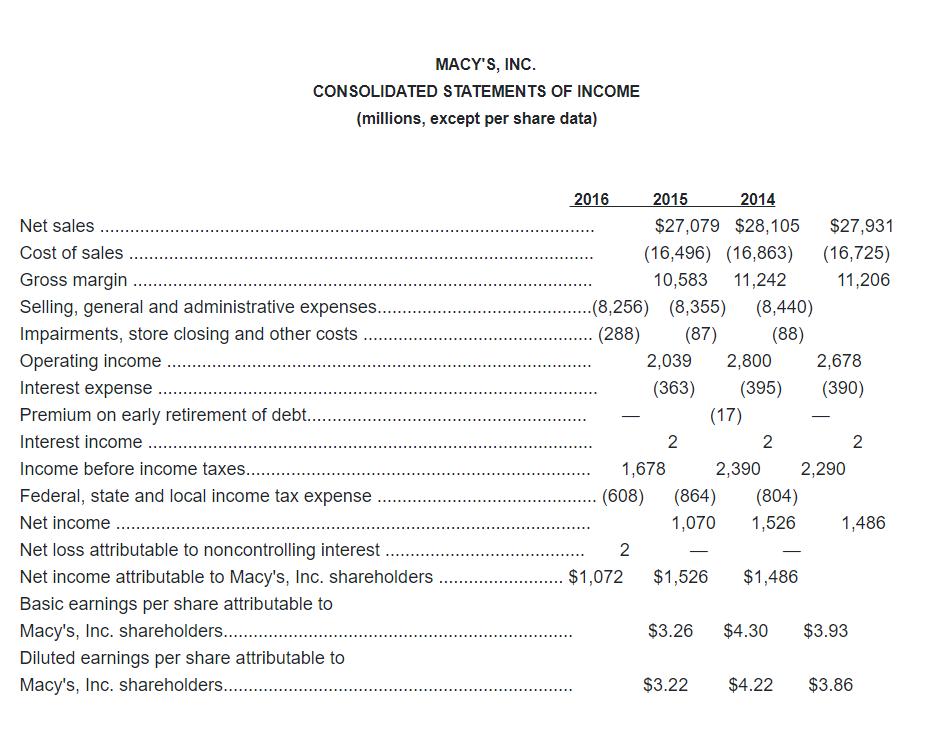

Using the financial ratios provided in the Key Financial Ratios file and the financial statement information for Macy's, Inc., calculate the following ratios for Macy's

1.Gross profit margin. 2.Operating profit margin. 3.Net profit margin. 4.Times interest earned coverage. 5.Net Return on shareholder's equity. 6.Net Return on assets. 7.Debt-to-equity ratio. 8.Days of inventory. 9.Inventory turnover ratio. 10.Average collection period.

MACY'S, INC. CONSOLIDATED STATEMENTS OF INCOME (millions, except per share data) Net sales....... Cost of sales Gross margin Selling, general and administrative expenses....... Impairments, store closing and other costs Operating income Interest expense..... Premium on early retirement of debt........ Interest income ............ Income before income taxes...... Federal, state and local income tax expense 2016 2015 2014 $27,079 $28,105 $27,931 (16,496) (16,863) (16,725) 10,583 11,242 11,206 (8,256) (8,355) (8,440) (288) (87) (88) - 2,039 2,800 (363) (395) (17) 1,678 2 2 - 2,390 2,290 (608) (864) (804) 2,678 (390) 2 Net income...... Net loss attributable to noncontrolling interest.... 1,070 1,526 1,486 2 - Net income attributable to Macy's, Inc. shareholders _ $1,072 $1,526 $1,486 Basic earnings per share attributable to Macy's, Inc. shareholders.... Diluted earnings per share attributable to Macy's, Inc. shareholders...... $3.26 $4.30 $3.93 $3.22 $4.22 $3.86

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started