Using the financial statements below, answer the following questions:

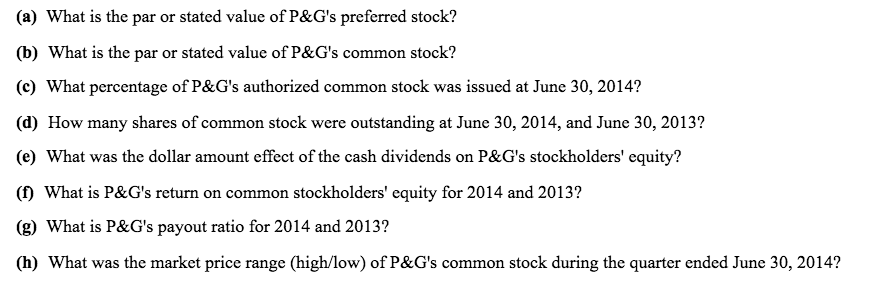

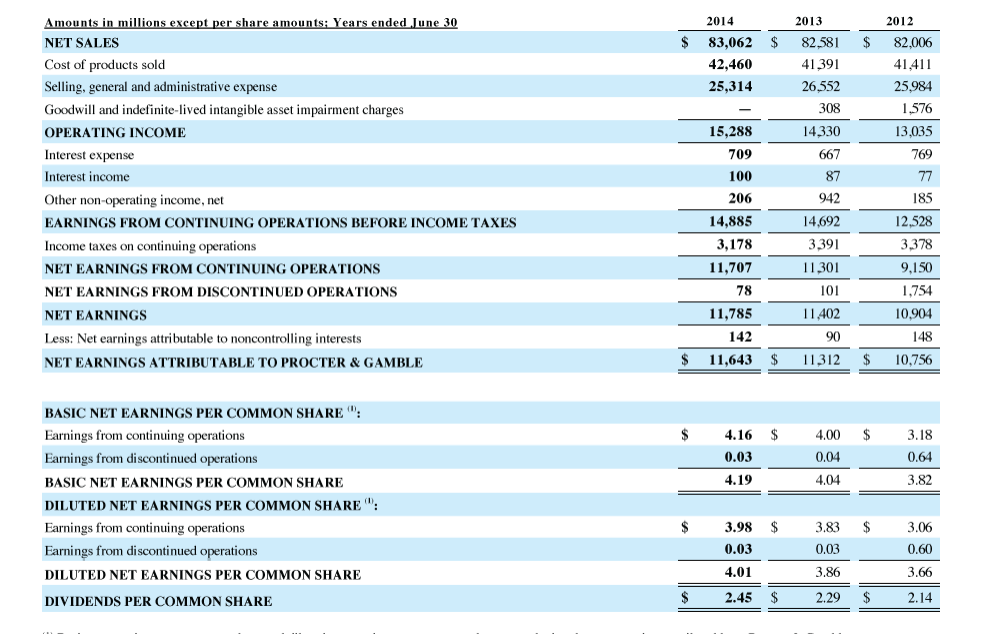

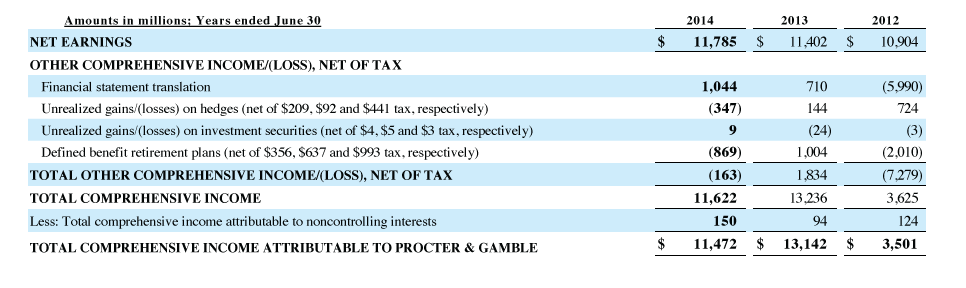

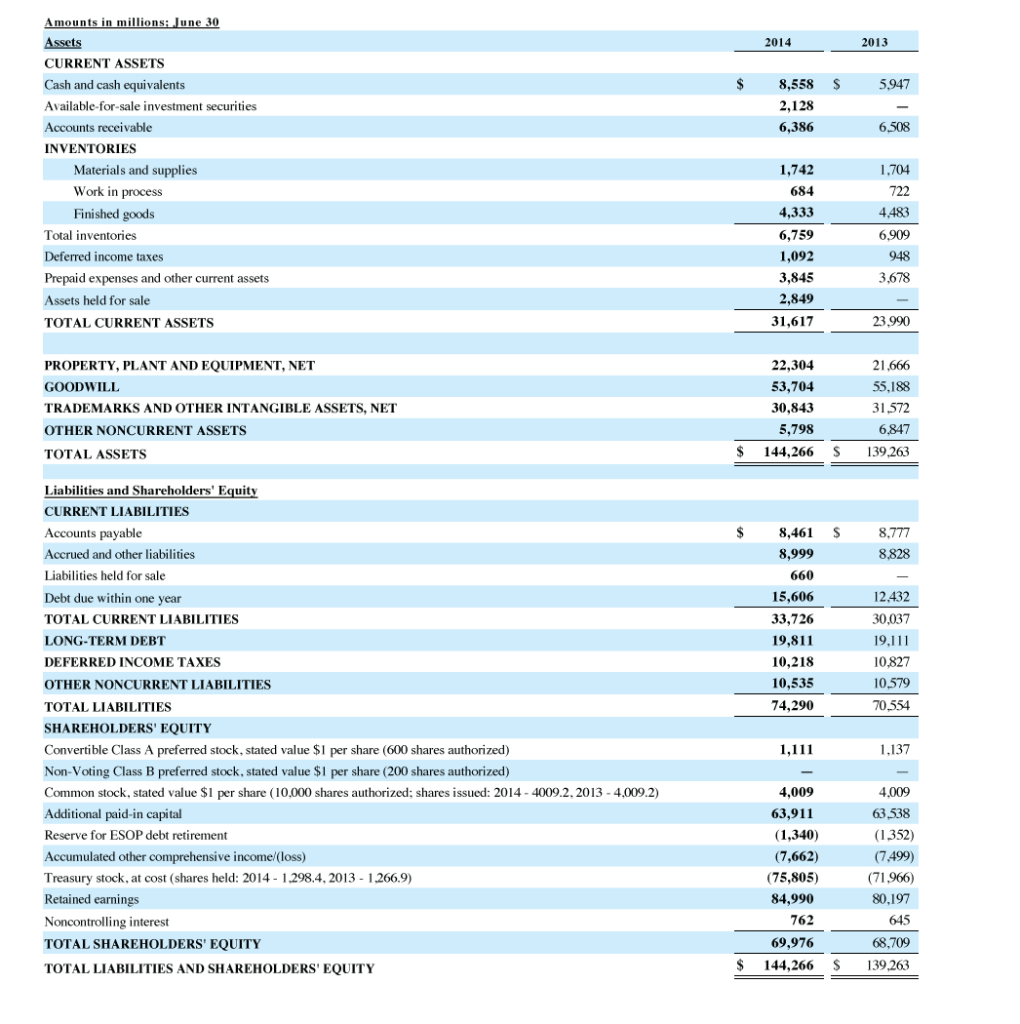

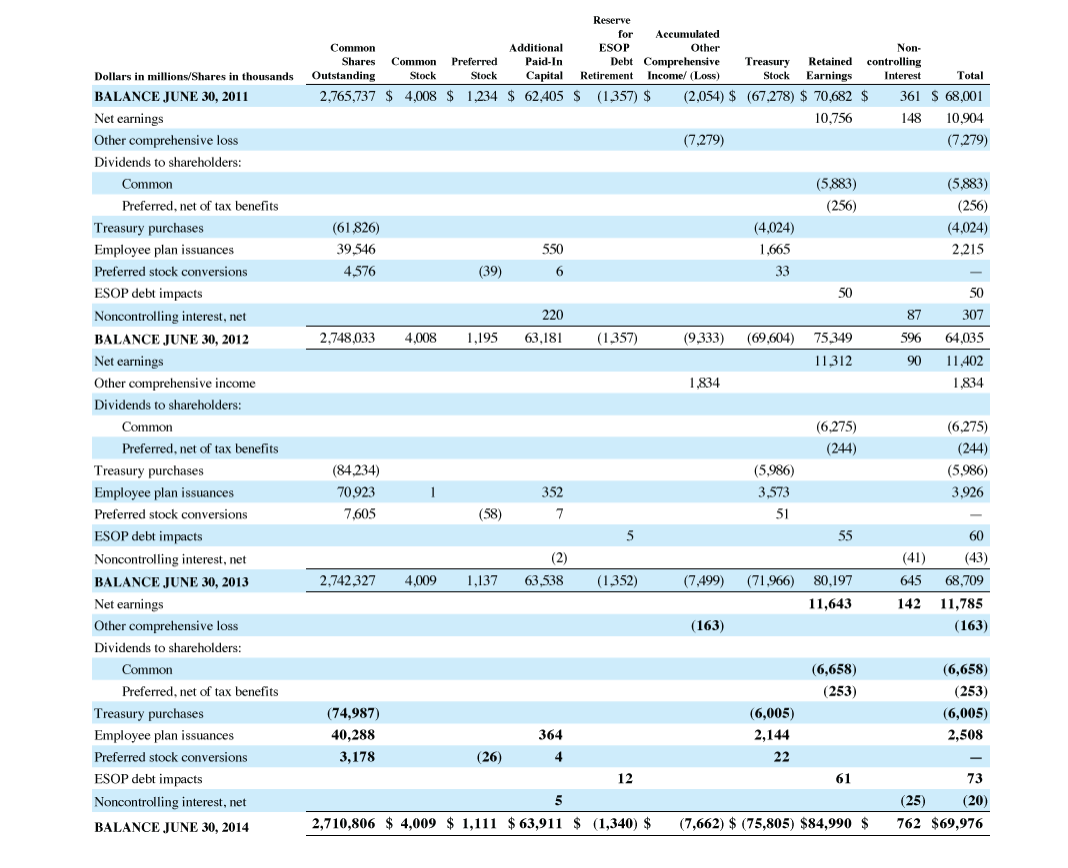

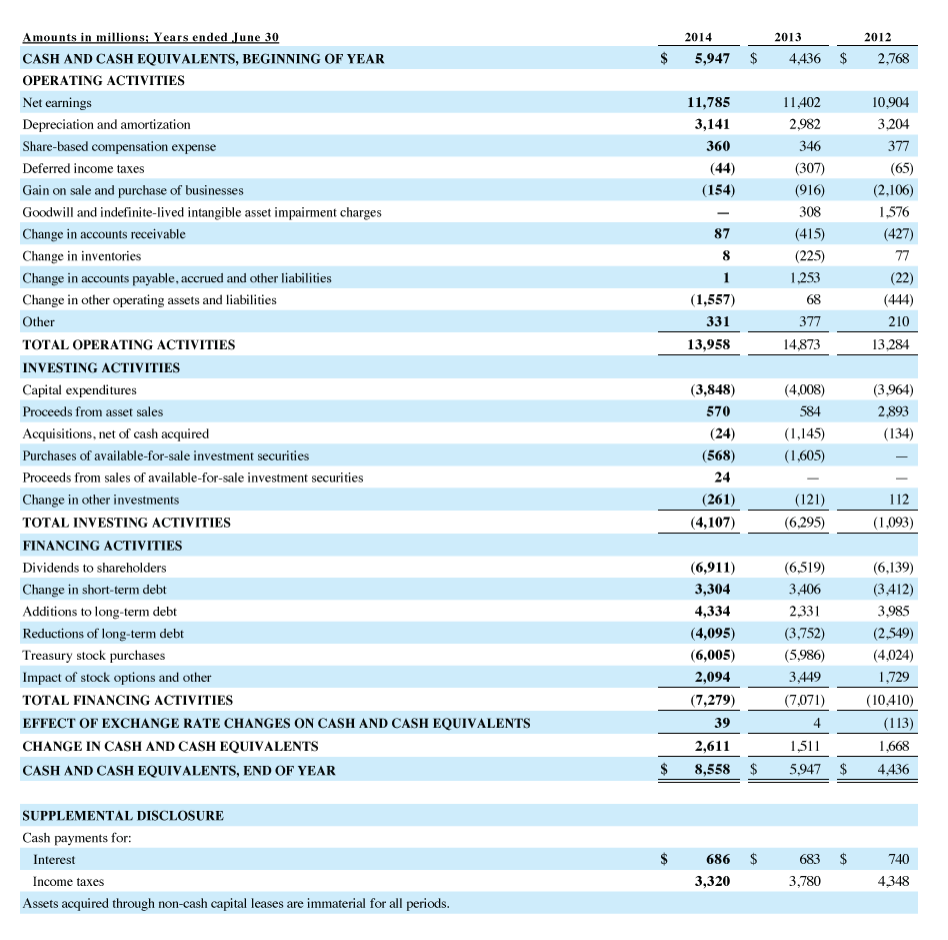

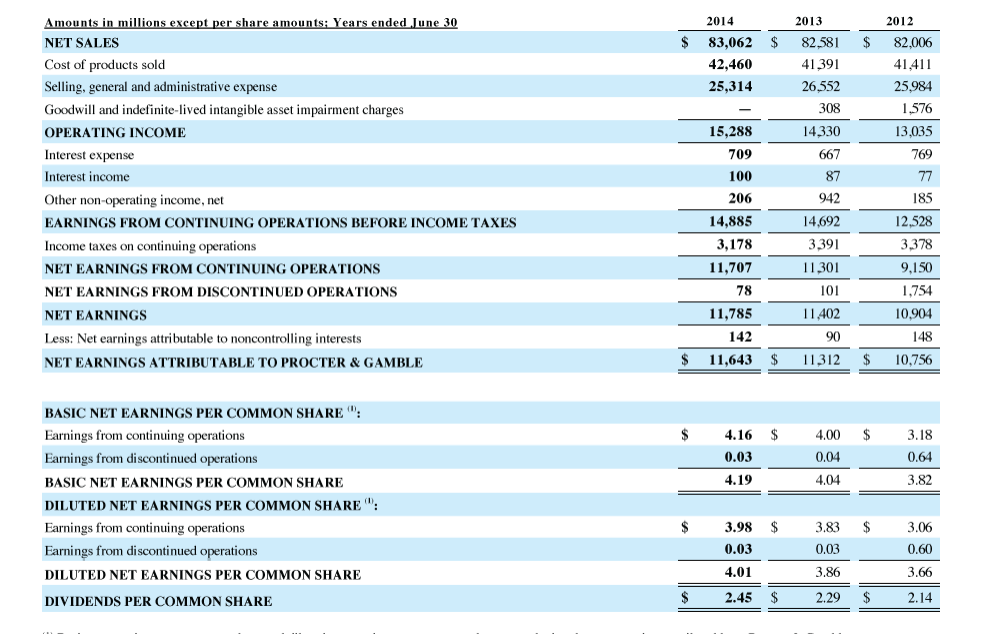

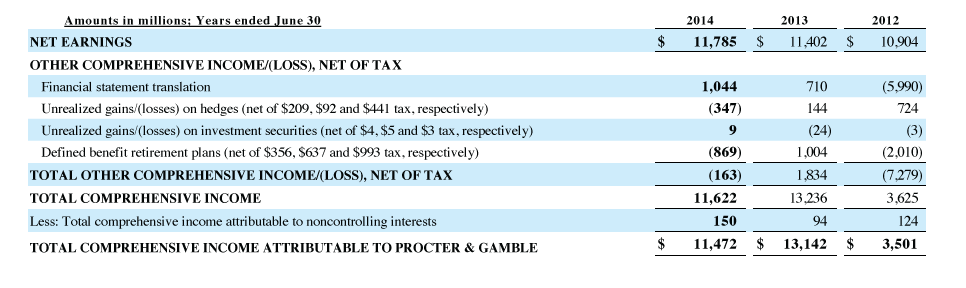

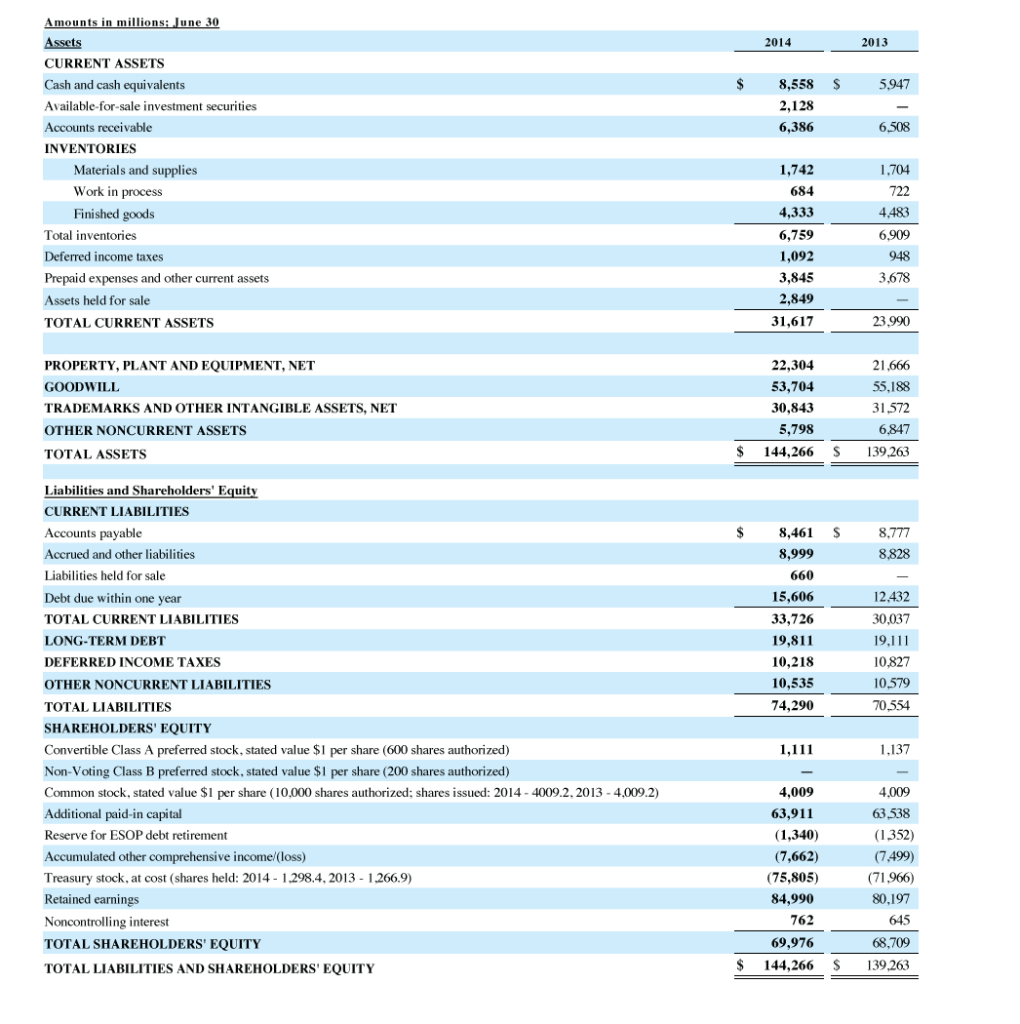

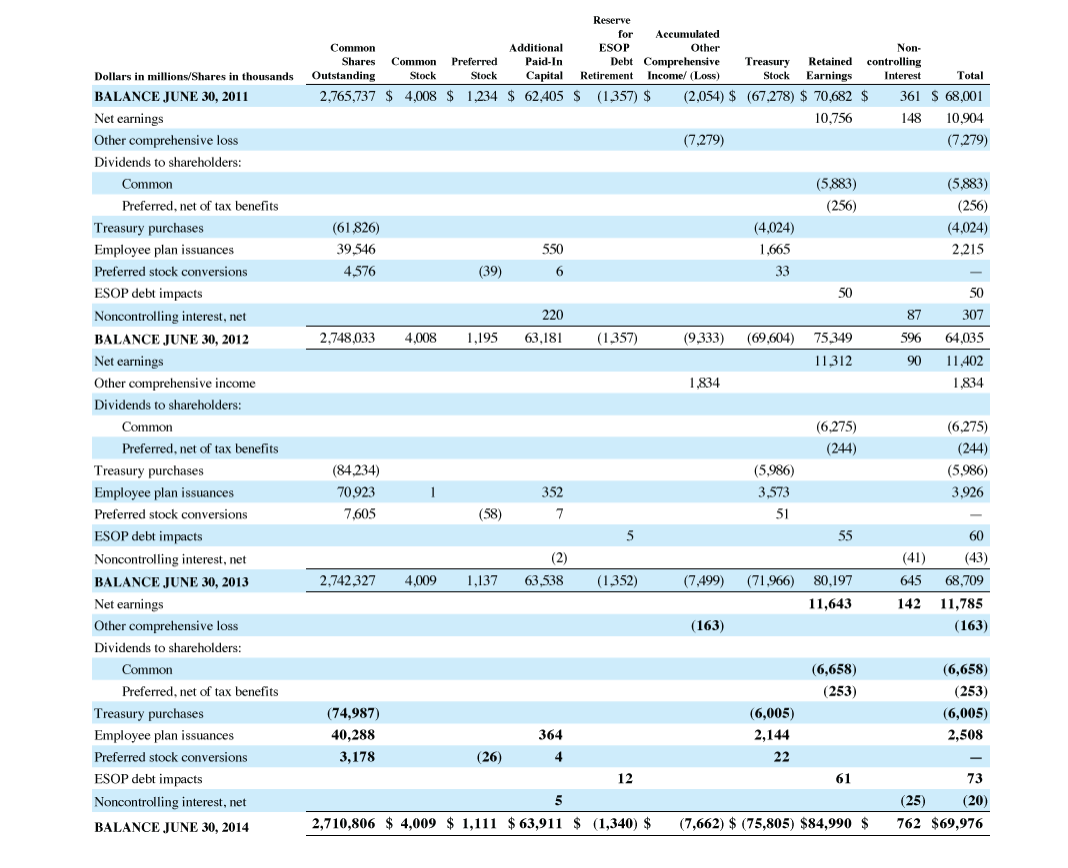

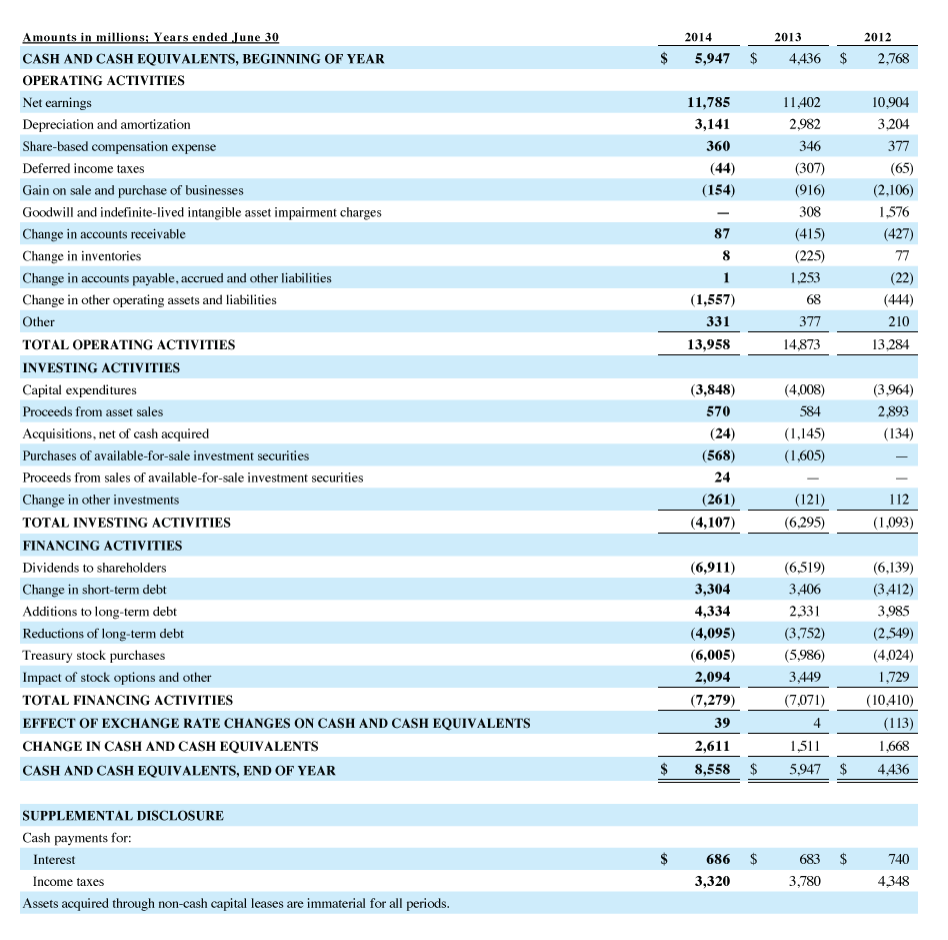

(a) What is the par or stated value of P&G's preferred stock? (b) What is the par or stated value of P&G's common stock? (c) What percentage of P&G's authorized common stock was issued at June 30, 2014? (d) How many shares of common stock were outstanding at June 30, 2014, and June 30, 2013? (e) What was the dollar amount effect of the cash dividends on P&G's stockholders' equity? (f) What is P&G's return on common stockholders' equity for 2014 and 2013? (g) What is P&G's payout ratio for 2014 and 2013? (h) What was the market price range (high/low) of P&G's common stock during the quarter ended June 30, 2014? Amounts in millions except per share amounts; Years ended June 30 2013 2014 2012 $ NET SALES 83,062 82,581 82,006 4139 41,411 Cost of products sold 42,460 Selling, general and administrative expense Goodwill and indefinite-lived intangible asset impairment charges 25,314 26,552 25,984 308 1,576 14330 13,035 15,288 OPERATING INCOME Interest expense 709 667 769 Interest income 100 87 77 Other non-operating income, net 206 942 185 14,885 14,692 12,528 EARNINGS FROM CONTINUING OPERATIONS BEFORE INCOME TAXES Income taxes on continuing operations 3,178 3391 3378 NET EARNINGS FROM CONTINUING OPERATIONS 11,707 1130 9,150 78 101 1,754 NET EARNINGS FROM DISCONTINUED OPERATIONS 11,402 11,785 10,904 NET EARNINGS 148 142 90 Less: Net earnings attributable to noncontrolling interests 11,643 11312 10,756 NET EARNINGS ATTRIBUTABLE TO PROCTER& GAMBLE BASIC NET EARNINGS PER COMMON SHARE ": Earnings from continuing operations $ 4.16 4.00 3.18 Earnings from di scontinued operations 0.03 0.04 0.64 4.19 4.04 3.82 BASIC NET EARNINGS PER COMMON SHARE DILUTED NET EARNINGS PER COMMON SHARE": Earnings from continuing operations $ 3.98 3.83 3.06 0.03 0.03 0.60 Earnings from di scontinued operations 4.01 3.86 3.66 DILUTED NET EARNINGS PER COMMON SHARE $ 2.45 2.29 2.14 DIVIDENDS PER COMMON SHARE Amounts in millions; Years ended June 30 2014 2013 2012 NET EARNINGS 11,785 S 11,402 $ 10,904 OTHER COMPREHENSIVE INCOME/(LOSS), NET OF TAX 1,044 710 (5,990) Financial statement translation Unrealized gains/(losses) on hedges (net of $209, $92 and $441 tax, respectively) (347) 144 724 Unrealized gains/(losses) on investment securities (net of $4, $5 and $3 tax, respectively) 9 (24) (3) (2,010 1,004 Defined benefit retirement plans (net of $356, $637 and $993 tax, respectively) (869) TOTAL OTHER COMPREHENSIVE INCOME/(LOSS), NET OF TAX (163) 1834 (7,279) TOTAL COMPREHENSIVE INCOME 11,622 13,236 3,625 Less: Total comprehensive income attributable to noncontrolling interests 150 94 124 11,472 $ 13,142 3,501 TOTAL COMPREHENSIVE INCOME ATTRIBUTABLE TO PROCTER & GAMBLE Amounts in millions; June 30 Assets 2014 2013 CURRENT ASSETS 5,947 Cash and cash equivalents 8,558 2,128 Available-for-sale investment securities Accounts receivable 6,386 6,508 INVENTORIES Materials and supplies 1,704 1,742 Work in process 684 722 Finished goods 4,333 4,483 6,759 Total inventories 6,909 1,092 948 Deferred income taxes 3,845 3,678 Prepaid expenses and other current assets 2,849 Assets held for sale 31,617 23,990 TOTAL CURRENT ASSETS 22,304 21,666 PROPERTY, PLANT AND EQUIPMENT, NET GOODWILL 53,704 55,188 31,572 TRADEMARKS AND OTHER INTANGIBLE ASSETS, NET 30,843 5,798 6,847 OTHER NONCURRENT ASSETS 144,266 139,263 TOTAL ASSETS Liabilities and Shareholders' Equity CURRENT LIABILITIES Accounts payable 8,461 8,777 Accrued and other liabilities 8,999 8,828 Liabilities held for sale 660 15,606 12,432 Debt due within one year TOTAL CURRENT LIABILITIES 33,726 30,037 19,811 19,111 LONG-TERM DEBT 10,218 DEFERRED INCOME TAXES 10,827 10,535 10,579 OTHER NONCURRENT LIABILITIES 74,290 70,554 TOTAL LIABILITIES SHAREHOLDERS' EQUITY Convertible Class A preferred stock, stated value $1 per share (600 shares authorized 1,137 1,111 Non-Voting Class B preferred stock, stated value $1 per share (200 shares authorized) Common stock, stated value $1 per share (10,000 shares authorized; shares issued: 2014- 4009.2, 2013 - 4,009.2) 4,009 4,009 63,538 63,911 Additional paid-in capital (1352) Reserve for ESOP debt retirement (1,340) Accumulated other comprehensive income/(loss) (7,662) (7,499) Treasury stock, at cost (shares held: 2014- 1,298.4, 2013 1266.9) (75,805) (71,966) Retained earnings 80,197 84,990 762 645 Noncontrolling interest 69,976 68,709 TOTAL SHAREHOLDERS' EQUITY 144,266 139,263 TOTAL LIABILITIES AND SHAREHOLDERS ' EQUITY Reserve for Accumulated Non- Common Additional ESOP Other Retained controlling Earnings Shares Common Preferred Paid-In Debt Comprehensive Income/ (Loss) Treasury Outstanding Capital Retirement Total Dollars in millions/Shares in thousands Stock Stock Stock Interest BALANCE JUNE 30, 2011 1,234 62,405 S (1357) $ (2,054) (67,278) 70,682 $ 2,765,737 4,008 $ 361 68,001 Net earnings 10,756 148 10,904 Other comprehensive loss (7,279) (7,279) Dividends to shareholders: (5,883) (5,883) Common (256) (256) Preferred, net of tax benefits Treasury purchases (4,024) (4,024) (61826) 39546 1,665 2,215 Employee plan issuances 550 Preferred stock conversions 4.576 (39) 6 33 ESOP debt impacts 50 50 220 87 307 Noncontrolling interest, net (9,333 2,748,033 4,008 1,195 63,181 (1357) (69,604) 75349 596 64,035 BALANCE JUNE 30, 2012 Net earnings 11312 90 11402 Other comprehensive income 834 834 Dividends to shareholders: (6,275) (6,275) Common Preferred, net of tax benefits (244) (244) (84,234) (5,986) (5,986) Treasury purchases 70,923 3,573 3,926 Employee plan issuances 352 Preferred stock conversions 7,605 (58) 7 51 ESOP debt impacts 5 55 60 (2) (41) (43) Noncontrolling interest, net 80,197 2,742327 4,009 1,137 63,538 (1,352) (7,499) (71,966) 645 68,709 BALANCE JUNE 30, 2013 Net earnings 142 11,785 11,643 (163) (163) Other comprehensive loss Dividends to shareholders: Common (6,658) (6,658) Preferred, net of tax benefits (253) (253) (6,005) Treasury purchases (74,987) (6,005) Employee plan issuances 364 2,508 40,288 2,144 (26 Preferred stock conversions 3,178 4 22 ESOP debt impacts 12 61 73 5 (25) (20) Noncontrolling interest, net 2,710,806 4,009 $ 1,111 $63,911 $ (1,340) $ (7,662) $(75,805) $84,990 $ 762 $69,976 BALANCE JUNE 30, 2014 Amounts in millions; Years ended June 30 2014 2013 2012 $ 2,768 5,947 4,436 CASH AND CASSH EQUIVALENTS, BEGINNING OF YEAR OPERATING ACTIVITIES Net earnings 11,785 11,402 10,904 Depreciation and amortization 3,141 2,982 3,204 Share-based compensation expense 360 346 377 (65) Deferred income taxes (44) (307) (916) (2,106) Gain on sale and purchase of businesses (154) 308 1,576 Goodwill and indefinite-lived intangible asset impairment charges 87 (415) (427) Change in accounts receivable (225) 77 Change in inventories 1 1,253 (22) Change in accounts payable, accrued and other liabilities Change in other operating assets and liabilities (1,557 68 (444) Other 331 377 210 13,284 13,958 14,873 TOTAL OPERATING ACTIVITIES INVESTING ACTIVITIES Capital expenditures (3,848) (4,008) (3,964) Proceeds from asset sales 570 584 2,893 (,45 Acquisitions, net of cash acquired (24) (134) Purchases of available-for-sale investment securities (568) (1,605) Proceeds from sales of available-for-sale investment securities 24 Change in other investments (261) (121) 112 (6,295) TOTAL INVESTING ACTIVITIES (4,107) (1,093) FINANCING ACTIVITIES Dividends to shareholders (6,911) (6,519) (6,139) Change in short-term debt (3,412) 3,304 3,406 Additions to long-term debt 4,334 2,33 3,985 Reductions of long-term debt (4,095) (3,752) (2,549) (5,986) Treasury stock purchases (6,005) (4,024) 2,094 Impact of stock options and other 3,449 1,729 TOTAL FINANCING ACTIVITIES (7,279) (7,071) (10,410) EFFECT OF EXCHANGE RATE CHANGES ON CASH AND CASH EQUIVALENTS (113) 39 4 1,668 CHANGE IN CASH AND CASH EQUIVVALENTS 2,611 1,511 $ $ 8,558 5,947 4,436 CASH AND CASH EQUIVALENTS, ENd OF YEAR SUPPLEMENTAL DISCLOSURE Cash payments for: $ 686 683 740 Interest Income taxes 3,320 3,780 4348 Assets acquired through non-cash capital leases are immaterial for all periods