Question: and here is the answers to the question. I just need help with showing my work. ratios for 2017 and indicate whether they are better

and here is the answers to the question. I just need help with showing my work.

and here is the answers to the question. I just need help with showing my work.

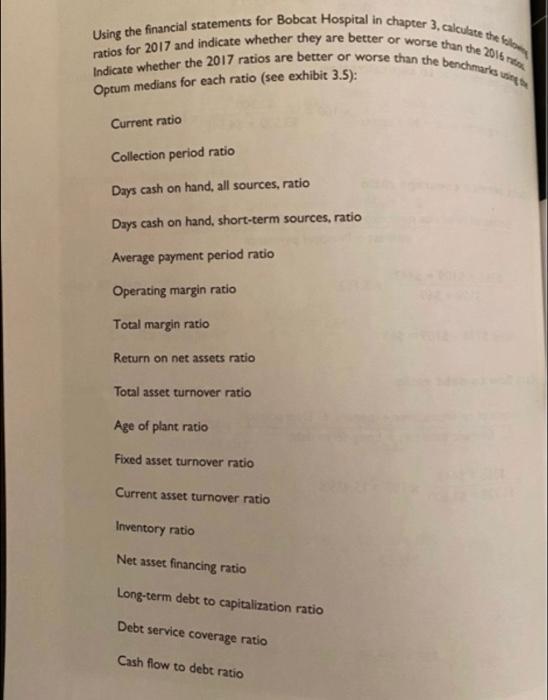

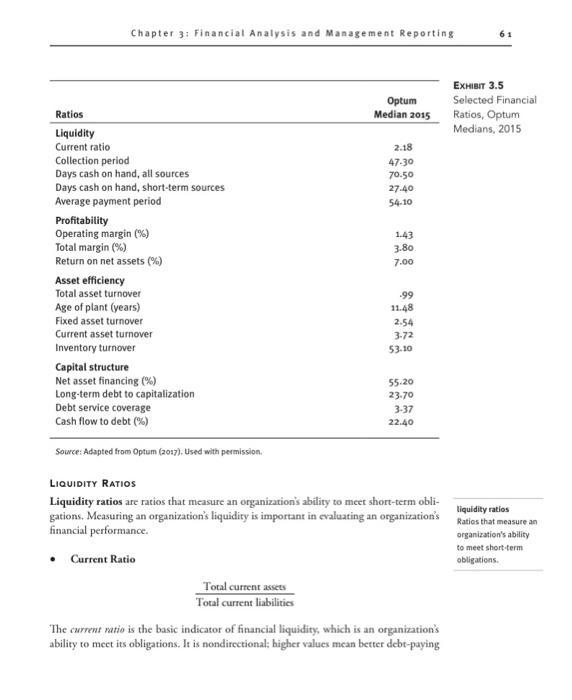

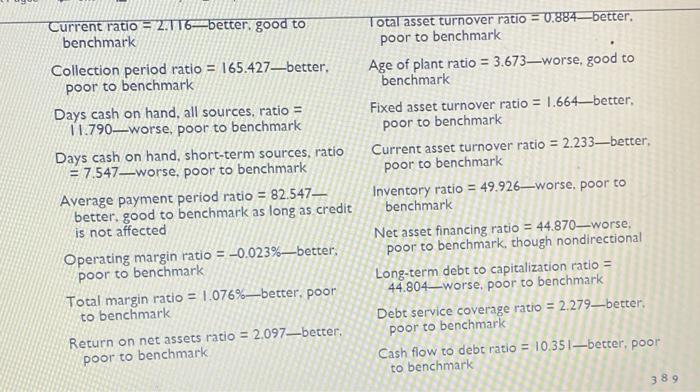

ratios for 2017 and indicate whether they are better or worse than the 2016 rt. Using the financial statements for Bobcat Hospital in chapter 3, calculate the falo Indicate whether the 2017 ratios are better or worse than the benchmarks uing t Optum medians for each ratio (see exhibit 3.5): Current ratio Collection period ratio Days cash on hand, all sources, ratio Days cash on hand, short-term sources, ratio Average payment period ratio Operating margin ratio Total margin ratio Return on net assets ratio Total asset turnover ratio Age of plant ratio Fixed asset turnover ratio Current asset turnover ratio Inventory ratio Net asset financing ratio Long-term debt to capitalization ratio Debt service coverage ratio Cash flow to debt ratio

Step by Step Solution

3.49 Rating (159 Votes )

There are 3 Steps involved in it

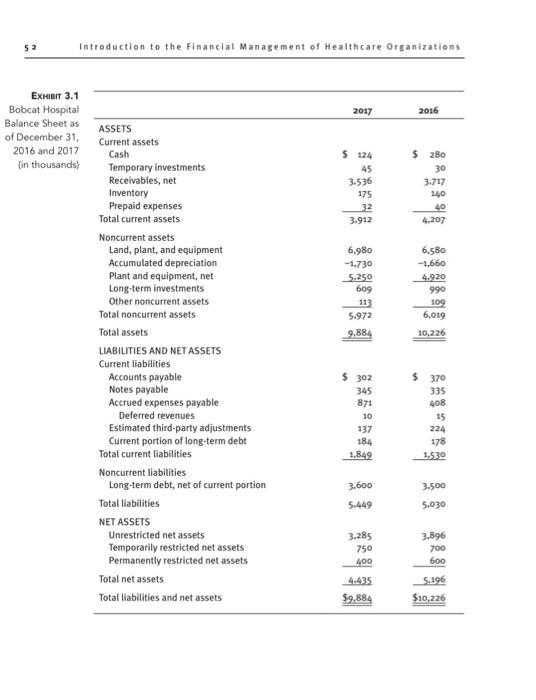

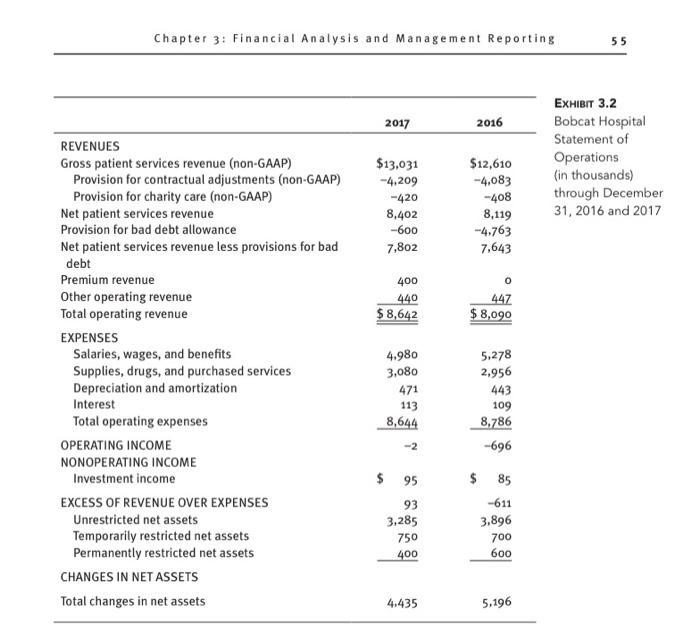

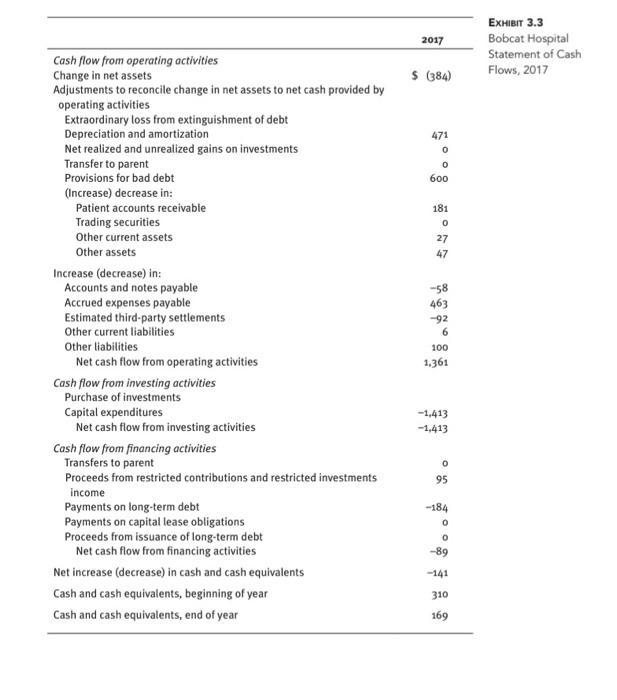

Current ratio Total current assets Total current liabilities 42071530 275 Collection period ratio Ne... View full answer

Get step-by-step solutions from verified subject matter experts