Answered step by step

Verified Expert Solution

Question

1 Approved Answer

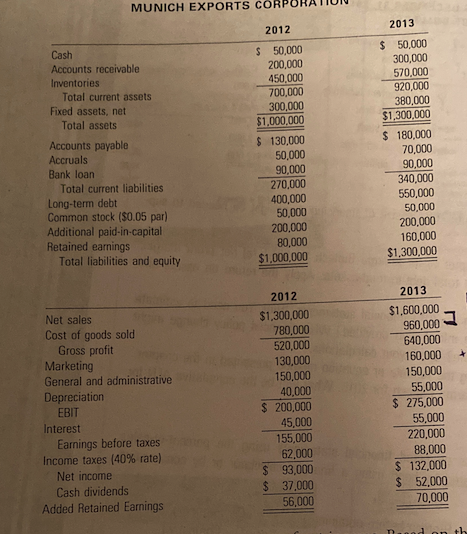

Using the financial statements for Munich Exports Corporation provided below. Build a proforma income statement, budget, for 2014, 2015, and 2016. Assume the same percentage

Using the financial statements for Munich Exports Corporation provided below.

- Build a proforma income statement, budget, for 2014, 2015, and 2016.

- Assume the same percentage of growth in sales the firm experienced in 2013 continues in following years.

- Assume COGS as a percentage of sales from 2013 continues constant in following years.

- Assume that after 2013, marketing costs increase by 5% annually.

- Assume general and administrative, depreciation, and interest costs from 2013 remain the same in following years.

- The tax rate will not change.

2. For each of your annual budgets (2014, 2015, and 2016), calculate net income as a percentage of sales.

3. For 2014 through 2016, does net income as a percentage of sales increase? Why or why not?

MUNICH EXPORTS CORPORATION 2013 Cash Accounts receivable Inventories Total current assets Fixed assets, net Total assets Accounts payable Accruals Bank loan Total current liabilities Long-term debt Common stock ($0.05 par) Additional paid-in-capital Retained earnings Total liabilities and equity 2012 $ 50,000 200,000 450,000 700,000 300,000 $1,000,000 $ 130,000 50,000 90,000 270,000 400,000 50,000 200.000 80,000 $1,000,000 $ 50,000 300,000 570,000 920,000 380,000 $1,300,000 $ 180,000 70,000 90,000 340,000 550,000 50,000 200.000 160.000 $1,300,000 2013 $1,600,000 - 960,000 Net sales Cost of goods sold Gross profit Marketing General and administrative Depreciation EBIT Interest Earnings before taxes Income taxes (40% rate) Net income Cash dividends Added Retained Earnings 2012 $1,300,000 780,000 520,000 130,000 150.000 40,000 $ 200,000 45,000 155,000 62.000 $ 93,000 $ 37,000 56,000 640,000 160,000 150,000 55,000 $ 275,000 55,000 220,000 88,000 $ 132,000 $ 52,000 70,000 danhStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started