Answered step by step

Verified Expert Solution

Question

1 Approved Answer

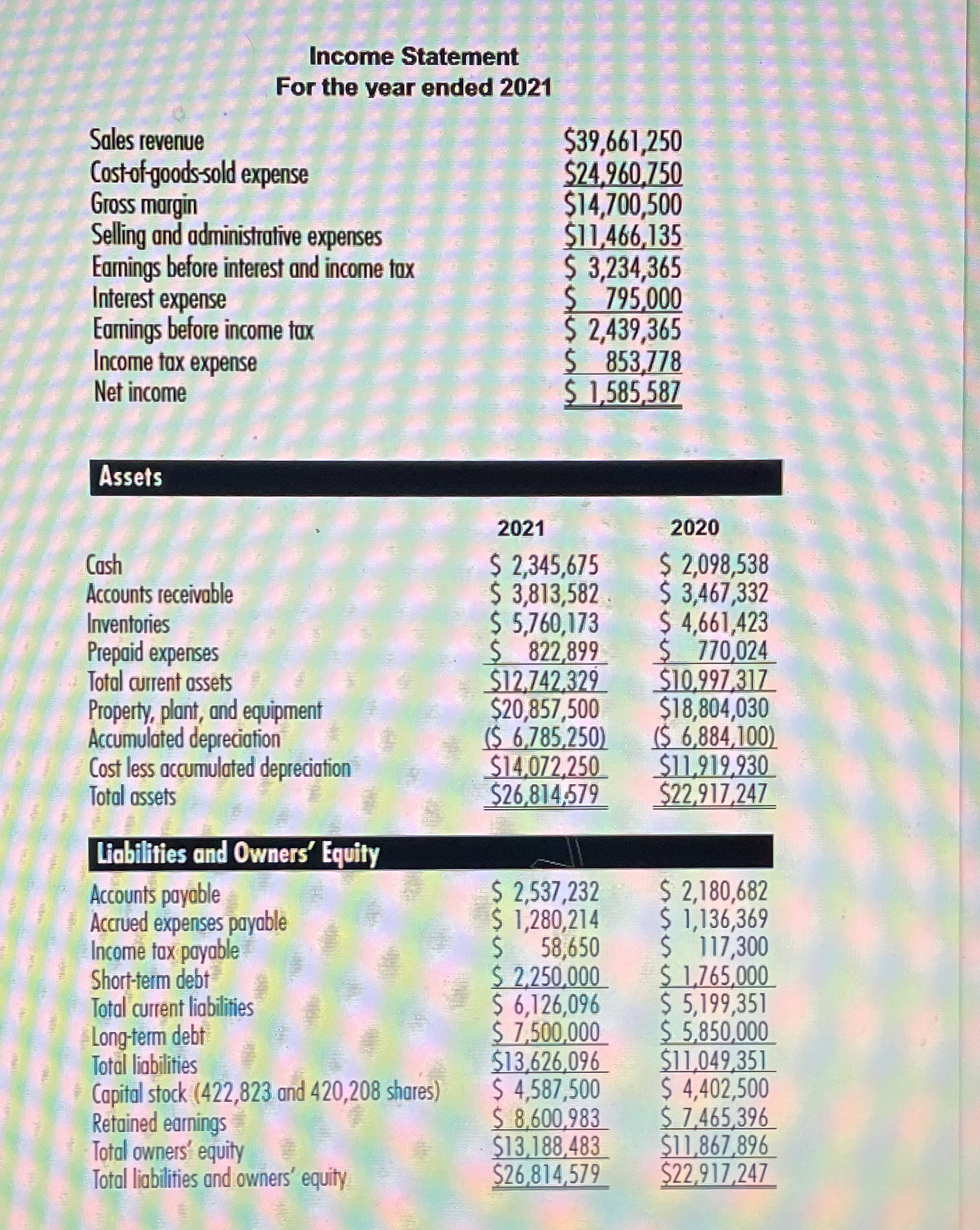

Using the financial statements provided , calculate the following ratios for years 2021 and 2020.1. Gross Profit Ratio2. Net Income Ratio3. Current Ratio4. Quick Ratio5.

Using the financial statements provided , calculate the following ratios for years 2021 and 2020.1. Gross Profit Ratio2. Net Income Ratio3. Current Ratio4. Quick Ratio5. Debt-to-Equity Ratio6. Return of Equity Ratio7. Interest cover Ratio8. Earnings per Share Ratio

Income Statement For the year ended 2021 Sales revenue $39,661,250 Cost-of-goods-sold expense Gross margin Selling and administrative expenses $24,960,750 $14,700,500 $11,466,135 Earnings before interest and income tax $ 3,234,365 Interest expense Earnings before income tax Income tax expense Net income $ 795,000 $ 2,439,365 $ 853,778 $ 1,585,587 Assets Cash Accounts receivable Inventories Prepaid expenses Total current assets Property, plant, and equipment Accumulated depreciation Cost less accumulated depreciation Total assets Liabilities and Owners' Equity 2021 2020 $ 2,345,675 $ 2,098,538 $ 3,813,582 $ 3,467,332 $ 5,760,173 $ 4,661,423 $ 822,899 $770,024 $10,997,317 $12,742,329 $20,857,500 ($ 6,785,250) $14,072,250 $26,814,579 $18,804,030 ($ 6,884,100) $11,919,930 $22,917,247 Accounts payable Accrued expenses payable $ 2,537,232 $ 2,180,682 $ 1,280,214 Income tax payable Short-term debt Total current liabilities Long-term debt Total liabilities $13,626,096 Capital stock (422,823 and 420,208 shares) Retained earnings $ 4,587,500 $ 8,600,983 Total owners' equity Total liabilities and owners' equity $13,188,483 $26,814,579 $ 58,650 $2,250,000 $ 6,126,096 $ 7,500,000 $ 1,136,369 $ 117,300 $1,765,000 $ 5,199,351 $ 5,850,000 $11,049,351 $ 4,402,500 $ 7,465,396 $11,867,896 $22,917,247

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started