Answered step by step

Verified Expert Solution

Question

1 Approved Answer

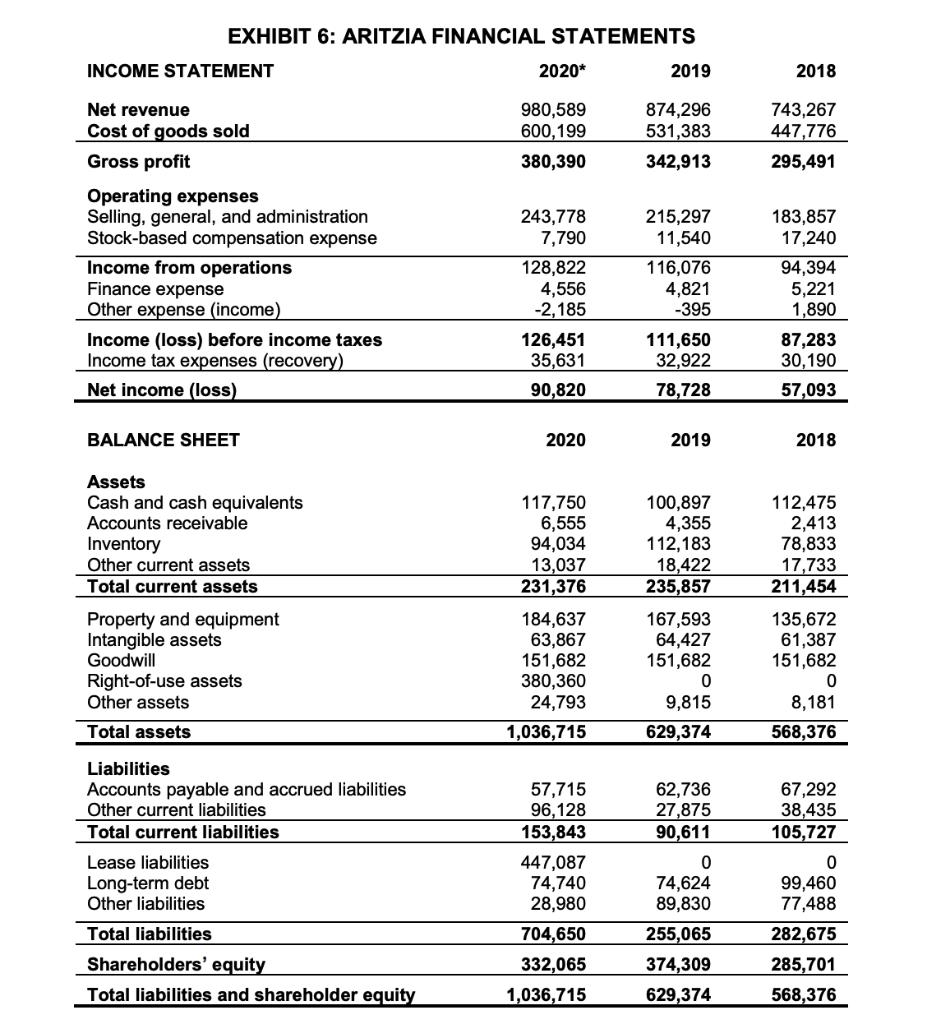

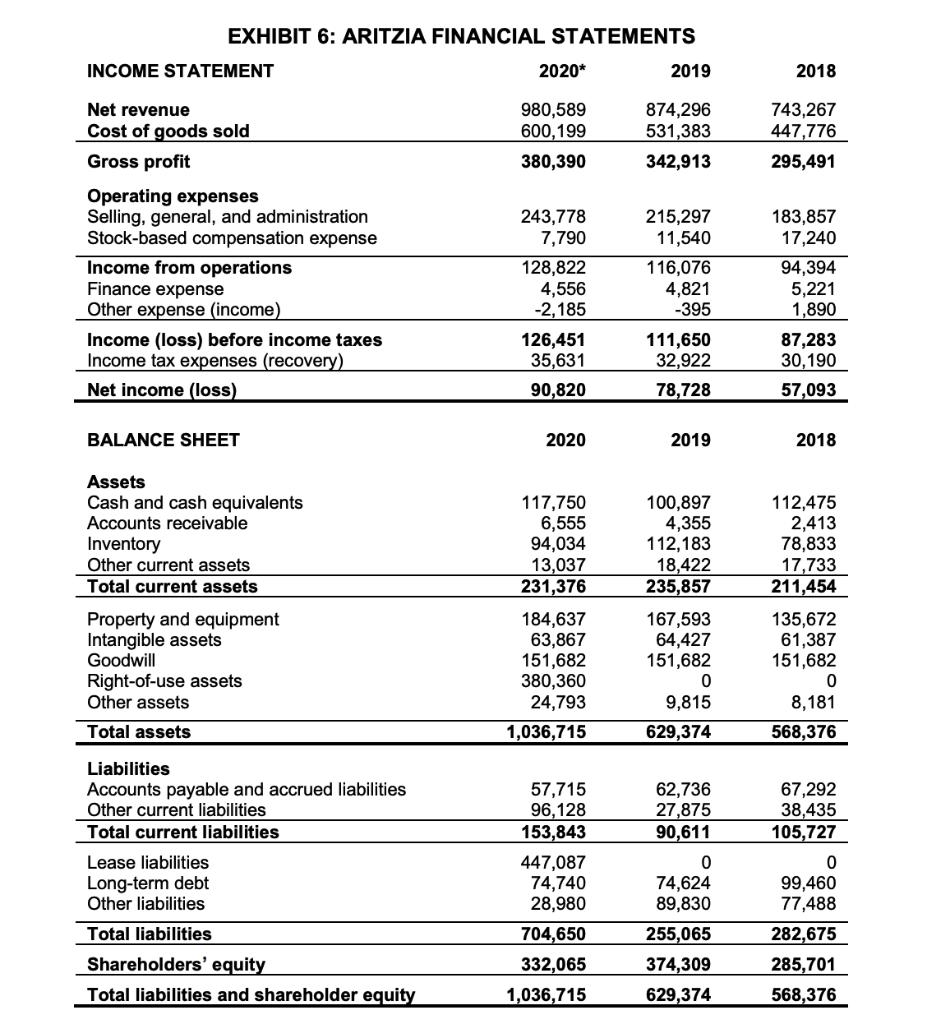

Using the financial statements provided in Exhibit 6, calculate the following financial ratios for 2018, 2019 and 2020 and write a brief analysis and interpretation

Using the financial statements provided in Exhibit 6, calculate the following financial ratios for 2018, 2019 and 2020 and write a brief analysis and interpretation of each: Current ratio, Quick ratio, Debt-to total assets ratio, Debt-to-Equity ratio, Long-Term Debt-to-Equity ratio , Times-interest-earned ratio (note: take "finance expenses" to be interest charges and "income from operations" to be profit before interests and taxes), Return on total assets ratio, Return on total equity ratio.

EXHIBIT 6: ARITZIA FINANCIAL STATEMENTS INCOME STATEMENT 2020* 2019 2018 Net revenue 980,589 874,296 Cost of goods sold 743,267 447,776 600,199 531,383 Gross profit 380,390 342,913 295,491 Operating expenses Selling, general, and administration Stock-based compensation expense 243,778 7,790 215,297 11,540 183,857 17,240 Income from operations Finance expense Other expense (income) 128,822 4,556 -2,185 116,076 4,821 -395 94,394 5,221 1,890 Income (loss) before income taxes Income tax expenses (recovery) 126,451 35,631 111,650 32,922 87,283 30,190 Net income (loss) 90,820 78,728 57,093 BALANCE SHEET 2020 2019 2018 Assets Cash and cash equivalents Accounts receivable Inventory Other current assets Total current assets 117,750 6,555 94,034 13,037 231,376 100,897 4,355 112,183 18,422 235,857 112,475 2,413 78,833 17,733 211,454 Property and equipment Intangible assets Goodwill 184,637 63,867 151,682 380,360 24,793 167,593 64,427 151,682 135,672 61,387 151,682 Right-of-use assets Other assets 9,815 8,181 Total assets 1,036,715 629,374 568,376 Liabilities Accounts payable and accrued liabilities Other current liabilities 57,715 96,128 62,736 27,875 90,611 67,292 38,435 105,727 Total current liabilities 153,843 Lease liabilities Long-term debt Other liabilities 447,087 74,740 28,980 74,624 89,830 99,460 77,488 Total liabilities 704,650 255,065 282,675 Shareholders' equity 332,065 374,309 285,701 Total liabilities and shareholder equity 1,036,715 629,374 568,376

Step by Step Solution

There are 3 Steps involved in it

Step: 1

All figure are rounded to 3rd decimal Year Particulars Formula 2020 2019 2018 Current Ratio Current ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started