Answered step by step

Verified Expert Solution

Question

1 Approved Answer

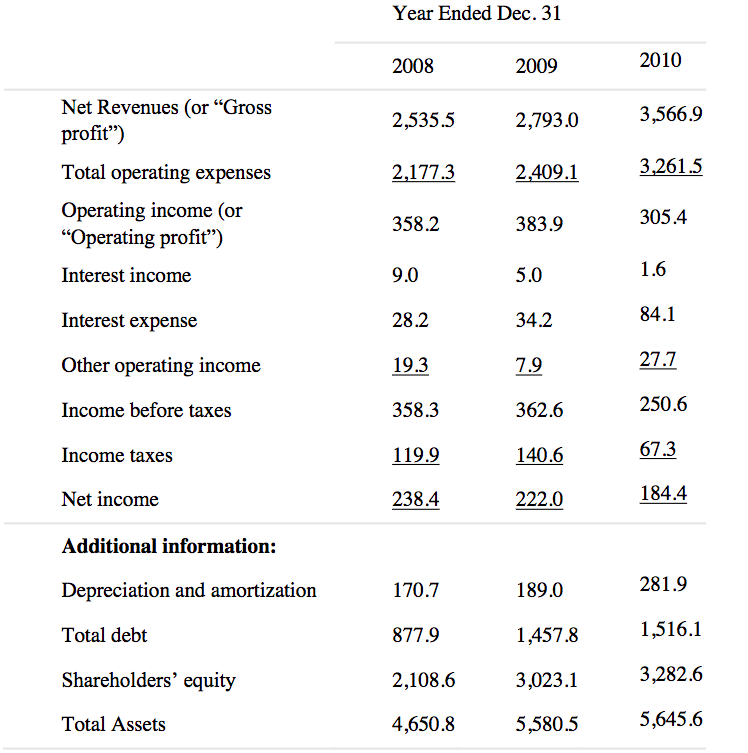

Using the financial statements provided in next page for the three years ending 31 December 2008, 2009, and 2010, answer the following questions. (1)Calculate this

Using the financial statements provided in next page for the three years ending 31 December 2008, 2009, and 2010, answer the following questions.

(1)Calculate this companys operating profit margin, debt/capital, and EBITDA/Interest expensefor every year.

(2)Compared to the creditworthiness in 2008, did the creditworthiness of this company in 2010 increase, decrease or stay the same? Provide explanationsto support your argument.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started