Answered step by step

Verified Expert Solution

Question

1 Approved Answer

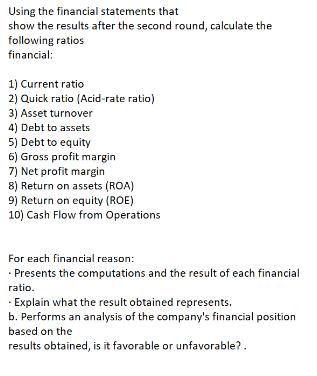

Using the financial statements that show the results after the second round, calculate the following ratios financial: 1) Current ratio 2) Quick ratio (Acid-rate

Using the financial statements that show the results after the second round, calculate the following ratios financial: 1) Current ratio 2) Quick ratio (Acid-rate ratio) 3) Asset turnover 4) Debt to assets 5) Debt to equity 6) Gross profit margin 7) Net profit margin 8) Return on assets (ROA) 9) Return on equity (ROE) 10) Cash Flow from Operations For each financial reason: Presents the computations and the result of each financial ratio. - Explain what the result obtained represents. b. Performs an analysis of the company's financial position based on the results obtained, is it favorable or unfavorable?. Cash Flow Statement for December, End of Month Alldaycafe-Week 2 Cash Flow From Operations Net Income Depreciation Increase (Decrease) in Payables Decrease (Increase) in Inventory Decrease (Increase) in Deposits Decrease (Increase) in Prepaid Expenses Net Cash From Operations Investment Activities Furniture and Equipment Net Investment Financing Activities Increase (Decrease) in Short-Term Debt Net Financing Net Increase (Decrease) in Cash Income Statement for January, Month to Date Alldaycafe - Week 2 Revenue COGS Gross Margin Management Staff Adv./Promo. Rent Utilities Depreciation Expense Interest on Loan Other Total Expenses Net Income January to Date % of Rev. $5,027.00 100% $610.82 12% $4,416.18 88% $2,580.00 $774.00 $1,120.00 $2,000.00 $0.00 $0.00 $0.00 $600.00 $7,074.00 -$2,657.82 51% 15% 22% 40% 0% 0% 0% 12% 141% -53% -$2,500.00 $0.00 -$2,500.00 $0.00 $0.00 Deposits $0.00 Equipment $0.00 Accumulated Depreciation Inventory Total Assets -$8,000.00 -$8,000.00 Balance Sheet for December Alldaycafe - Week 2 $25,000.00 $25,000.00 $14,500.00 Assets Cash Liabilities Taxes Payable Loans Total Liabilities Equity Retained Earnings Total Equity Total Liab. & Eq. Year to Date % of Rev. $5,027.00 100% $610.82 12% $4,416.18 88% $2,580.00 $774.00 $1,120.00 $2,000.00 $0.00 $0.00 $0.00 $600.00 $7,074.00 -$2,657.82 51% 15% 22% 40% 0% 0% 0% 12% 141% -53% Amount $14,500.00 $2,500.00 $8,000.00 $0.00 $0.00 $25,000.00 Amount $0.00 $25,000.00 $25,000.00 Amount $0.00 $0.00 $25,000.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the requested financial ratios well use the information provided in the Balance Sheet and Income Statement Lets go through each ratio step by step 1 Current Ratio Current Ratio Current As...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started