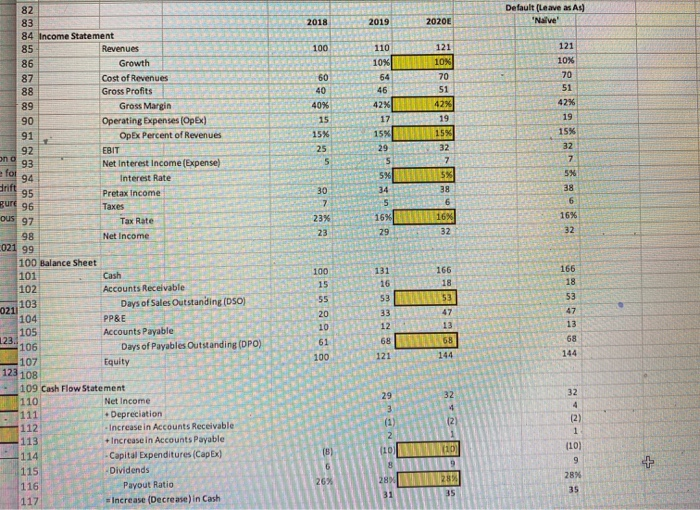

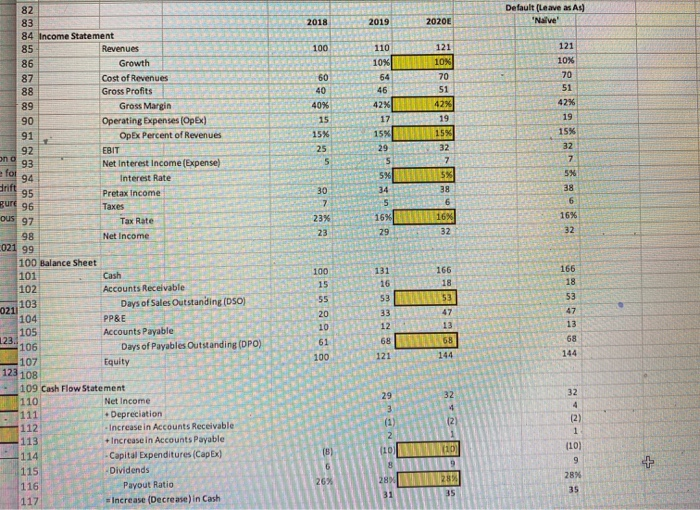

using the first picture, how would one answer the scenario questions

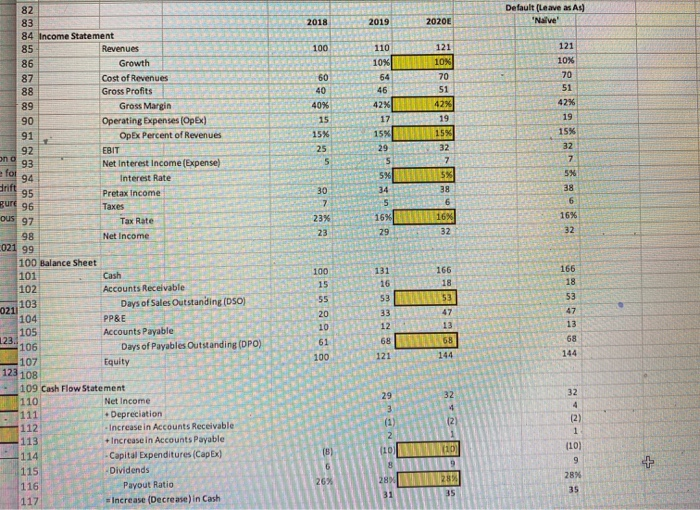

Default (Leave as As) "Nive 2018 2019 2020E 100 121 110 10% 10 - 40 84 Income Statement Revenues Growth Cost of Revenues Gross Profits Gross Margin Operating Expenses (Opex) Opex Percent of Revenues EBIT Net Interest Income (Expense) Interest Rates Pretax Income Taxes Tax Rate Net Income VN Balance Sheet Cash Accounts Receivable Days of Sales Outstanding (DSO) PP&E Accounts Payable Days of Puyables Outstanding (DPO) Equity Cash Flow Statement Net Income + Depreciation Increase in Accounts Receivable + Increase in Accounts Payable - Capital Expenditures (CapEx) Dividends Payout Ratio Increase (Decrease) in Cash 1 We have created hypothesized scenarios for you to forecast: Hypothesized Scenario 1 Assume a new competitor enters the market and that drivers Gross Margin to 25% What is the forecasted Net Income? What is the forecasted Cash balance? own 600 WowNO Hypothesized Scenario 2 Set the DSO equal to 10 days Leave the Gross Margin at 25% What is the forecasted Cash balance? See how the: Reduction of DSOs reduced Accounts Receivable on the Balance Sheet and Impacted Increase in Accounts Receivable' on the Cash Flow Statement, Which impacts 'Cash'on the Balance Sheet 41 Hypothesized Scenario 3 Construct a new plant increasing CapEx to $100 (remember that this is a-100 in the model as it is a use of cash Leave the Gross Margin at 25% and the DSO at 10% What is the forecasted Cash balance? 43 What is the forecasted PP&E balance? 47 49 See how the: Investment in Capex has an impact on PP&E, Affects Cash Flow on the Cash Flow Statement, Reduces the Cash Balance on the Balance Sheet and Lowers GAAP Net Income as Depreciation rises Default (Leave as As) "Nive 2018 2019 2020E 100 121 110 10% 10 - 40 84 Income Statement Revenues Growth Cost of Revenues Gross Profits Gross Margin Operating Expenses (Opex) Opex Percent of Revenues EBIT Net Interest Income (Expense) Interest Rates Pretax Income Taxes Tax Rate Net Income VN Balance Sheet Cash Accounts Receivable Days of Sales Outstanding (DSO) PP&E Accounts Payable Days of Puyables Outstanding (DPO) Equity Cash Flow Statement Net Income + Depreciation Increase in Accounts Receivable + Increase in Accounts Payable - Capital Expenditures (CapEx) Dividends Payout Ratio Increase (Decrease) in Cash 1 We have created hypothesized scenarios for you to forecast: Hypothesized Scenario 1 Assume a new competitor enters the market and that drivers Gross Margin to 25% What is the forecasted Net Income? What is the forecasted Cash balance? own 600 WowNO Hypothesized Scenario 2 Set the DSO equal to 10 days Leave the Gross Margin at 25% What is the forecasted Cash balance? See how the: Reduction of DSOs reduced Accounts Receivable on the Balance Sheet and Impacted Increase in Accounts Receivable' on the Cash Flow Statement, Which impacts 'Cash'on the Balance Sheet 41 Hypothesized Scenario 3 Construct a new plant increasing CapEx to $100 (remember that this is a-100 in the model as it is a use of cash Leave the Gross Margin at 25% and the DSO at 10% What is the forecasted Cash balance? 43 What is the forecasted PP&E balance? 47 49 See how the: Investment in Capex has an impact on PP&E, Affects Cash Flow on the Cash Flow Statement, Reduces the Cash Balance on the Balance Sheet and Lowers GAAP Net Income as Depreciation rises