Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Using the following account balances for Delray Manufacturing, calculate Delray's Cost of Goods Manufactured. Sales $1,250,000 Beginning inventories: Raw materials Work in process Finished goods

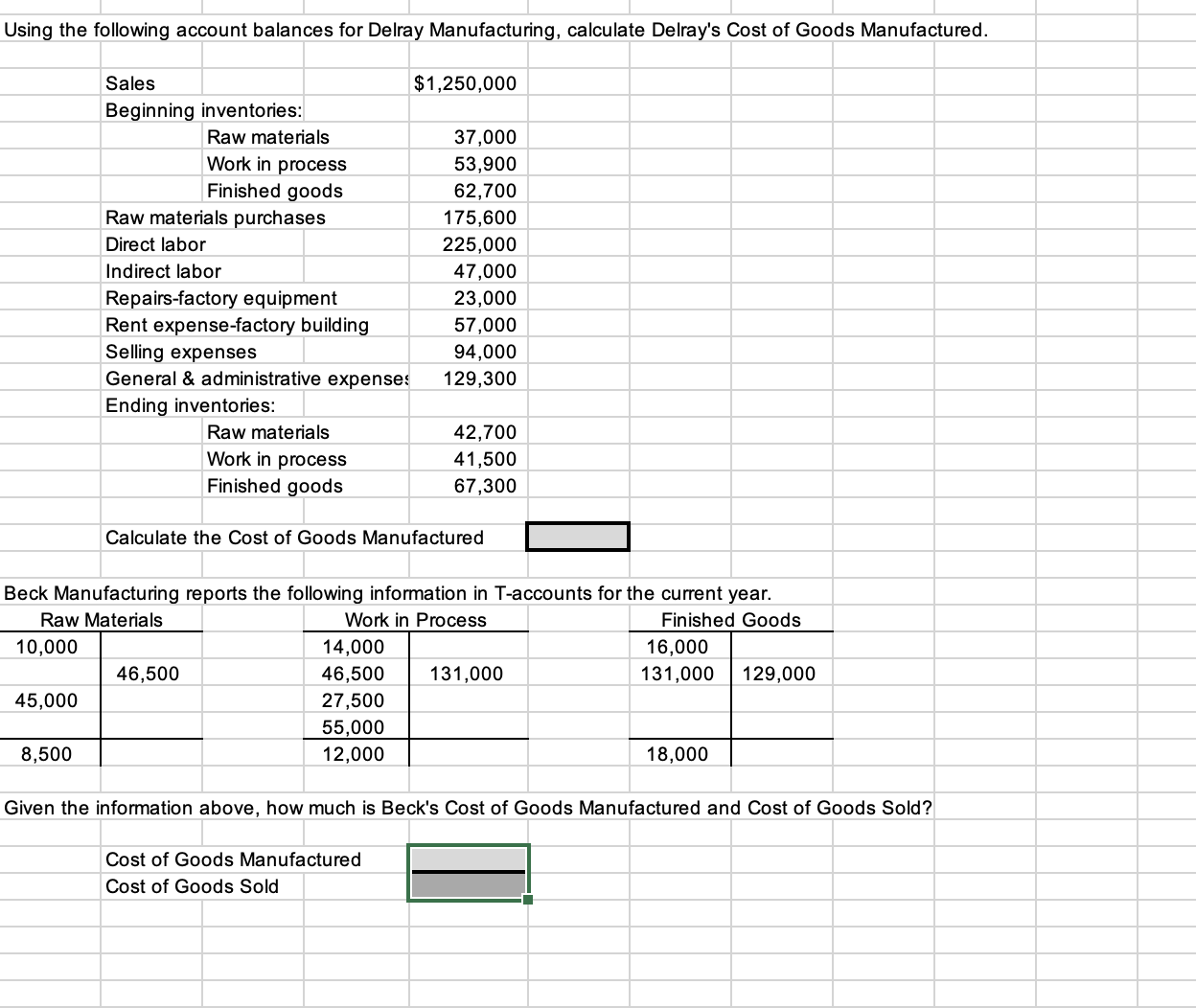

Using the following account balances for Delray Manufacturing, calculate Delray's Cost of Goods Manufactured. Sales $1,250,000 Beginning inventories: Raw materials Work in process Finished goods Raw materials purchases Direct labor Indirect labor Repairs-factory equipment Rent expense-factory building Selling expenses General \& administrative expense: Ending inventories: Raw materials Work in process Finished goods 37,000 53,900 62,700 175,600 225,000 47,000 23,000 57,000 94,000 129,300 42,700 41,500 67,300 Calculate the Cost of Goods Manufactured Beck Manufacturing reports the following information in T-accounts for the current year. Raw Materials \begin{tabular}{c|c} \hline 10,000 & \\ \hline 45,000 & 46,500 \\ \hline 8,500 & \\ \hline \end{tabular} Work in Process \begin{tabular}{|l|l|} \hline 14,000 & \\ 46,500 & 131,000 \\ \hline 27,500 & \\ 55,000 & \\ \hline 12,000 & \\ \hline \end{tabular} Finished Goods 16,000 \begin{tabular}{c|c} 131,000 & 129,000 \end{tabular} Given the information above, how much is Beck's Cost of Goods Manufactured and Cost of Goods Sold? Cost of Goods Manufactured Cost of Goods Sold

Using the following account balances for Delray Manufacturing, calculate Delray's Cost of Goods Manufactured. Sales $1,250,000 Beginning inventories: Raw materials Work in process Finished goods Raw materials purchases Direct labor Indirect labor Repairs-factory equipment Rent expense-factory building Selling expenses General \& administrative expense: Ending inventories: Raw materials Work in process Finished goods 37,000 53,900 62,700 175,600 225,000 47,000 23,000 57,000 94,000 129,300 42,700 41,500 67,300 Calculate the Cost of Goods Manufactured Beck Manufacturing reports the following information in T-accounts for the current year. Raw Materials \begin{tabular}{c|c} \hline 10,000 & \\ \hline 45,000 & 46,500 \\ \hline 8,500 & \\ \hline \end{tabular} Work in Process \begin{tabular}{|l|l|} \hline 14,000 & \\ 46,500 & 131,000 \\ \hline 27,500 & \\ 55,000 & \\ \hline 12,000 & \\ \hline \end{tabular} Finished Goods 16,000 \begin{tabular}{c|c} 131,000 & 129,000 \end{tabular} Given the information above, how much is Beck's Cost of Goods Manufactured and Cost of Goods Sold? Cost of Goods Manufactured Cost of Goods Sold Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started