Question

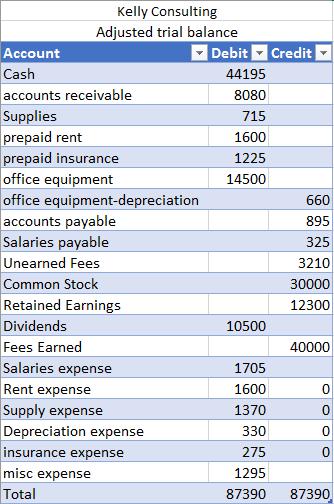

Using the following Adjusted trial balance, create an income statement, retained earnings statement, and balance sheet for Kelly Consulting, for the month of May 31,

Using the following Adjusted trial balance, create an income statement, retained earnings statement, and balance sheet for Kelly Consulting, for the month of May 31, 2018

Kelly Consulting Adjusted trial balance Account Cash accounts receivable Supplies prepaid rent prepaid insurance office equipment office equipment-depreciation accounts payable Salaries payable Unearned Fees Common Stock Retained Earnings Dividends Fees Earned Salaries expense Rent expense Supply expense Depreciation expense insurance expense misc expense Total Debit Credit 44195 8080 715 1600 1225 14500 10500 1705 1600 1370 330 275 1295 87390 660 895 325 3210 30000 12300 40000 0 0 0 87390

Step by Step Solution

3.39 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Kelly Consulting Income Statement For the Month of May 31 2018 Revenues Fees earned Expenses Salarie...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Corporate Financial Accounting

Authors: Carl S. Warren, James M. Reeve, Jonathan E. Duchac

12th edition

1305041399, 1285078586, 978-1-133-9524, 9781133952428, 978-1305041394, 9781285078588, 1-133-95241-0, 978-1133952411

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App