Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Using the following assumptions in the pro forma: 108,000 apartment building with 87% efficiency and hard cost per square foot of 192/SF Land cost

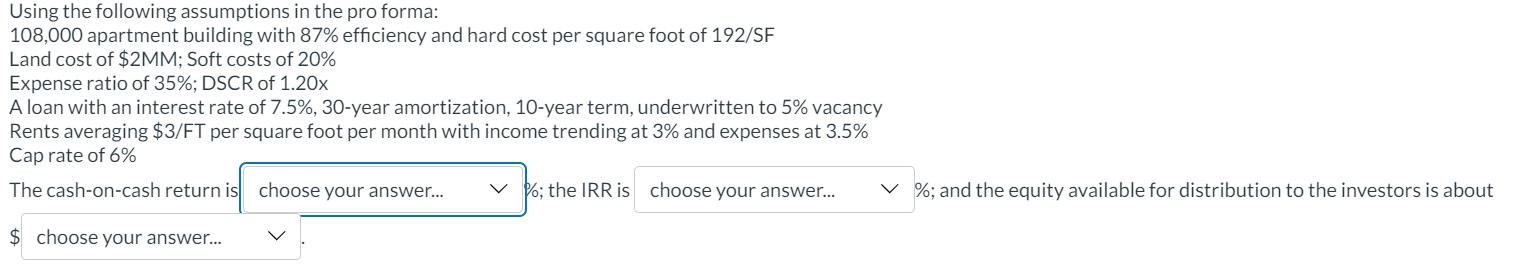

Using the following assumptions in the pro forma: 108,000 apartment building with 87% efficiency and hard cost per square foot of 192/SF Land cost of $2MM; Soft costs of 20% Expense ratio of 35%; DSCR of 1.20x A loan with an interest rate of 7.5%, 30-year amortization, 10-year term, underwritten to 5% vacancy Rents averaging $3/FT per square foot per month with income trending at 3% and expenses at 3.5% Cap rate of 6% The cash-on-cash return is $ choose your answer... choose your answer... %; the IRR is choose your answer... %; and the equity available for distribution to the investors is about

Step by Step Solution

★★★★★

3.51 Rating (171 Votes )

There are 3 Steps involved in it

Step: 1

Solution To determine the IRR we need to calculate the net operating income NOI and the total initia...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started