Answered step by step

Verified Expert Solution

Question

1 Approved Answer

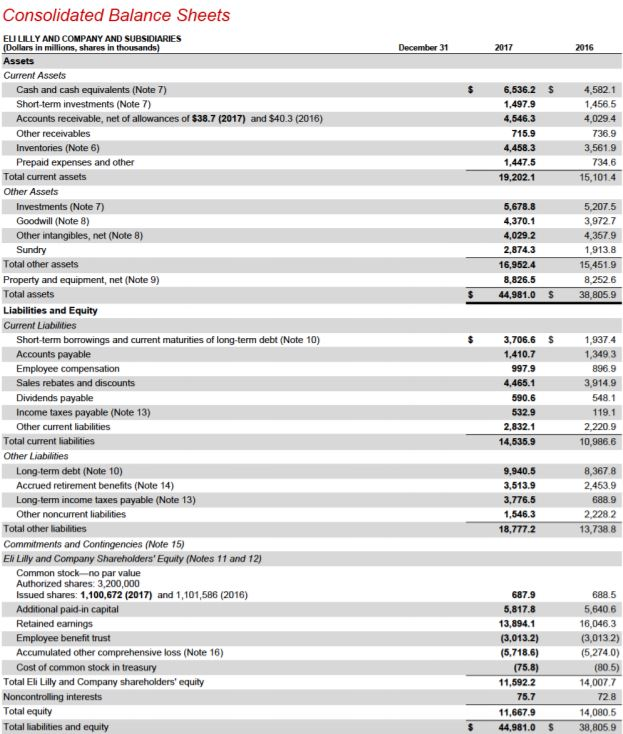

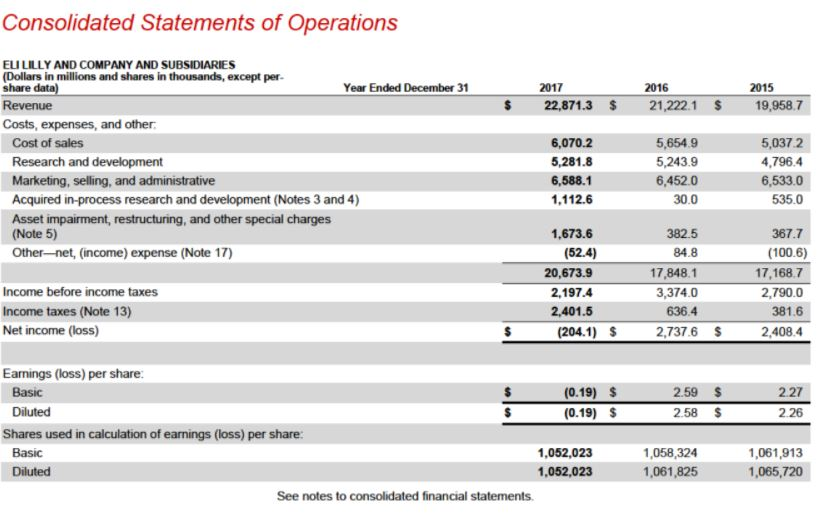

Using the following Balance Sheet and income statement please give the following: -Recievables turover ratio -Average collection period -Inventory turnover ratio -Average days in invintory

Using the following Balance Sheet and income statement please give the following:

-Recievables turover ratio

-Average collection period

-Inventory turnover ratio

-Average days in invintory

-Current Ratio

-Acid-test ratio

-Debt to equity ratio

-Times interest earned ratio

-Gross profir ratio

-Return on assets

-Profit margin

-Asset turnover

-Return on equity

-Dividend yield

-Earnings per share

-Price-earnings ratio.

Thank You!

Consolidated Balance Sheets ELI LILLY AND COMPANY AND SUBSIDIARIES Assets Current Assets in millions, shares in 2017 016 Cash and cash equivalents (Note 7) Short-term investments (Note 7) Accounts receivable, net of allowances of $38.7 (2017) and $40.3 (2016) Other receivables Inventories (Note 6) Prepaid expenses and other 4,582.1 1456.5 4,029.4 36.9 3,561.9 734.6 15,101.4 6,536.2 S 1,497.9 4,546.3 715.9 4,458.3 1,447.5 19,202.1 Total current assets Other Assets Investments (Note 7) 5,678.8 4,370.1 4,029.2 2,874.3 16,952.4 8,826.5 Goodwill (Note 8) 3,972.7 4,357.9 ,913.8 15,451.9 Other intangibles, net (Note 8) Sundry Total other assets Property and equipment, net (Note 9) Total assets Liabilities and Equity Current Liabilities 44,981.0 S 38,805.9 1,937.4 1,349.3 896.9 3,914.9 548.1 119.1 3,706.6 S Short-term borrowings and current maturities of long-term debt (Note 10) Accounts payable Sales rebates and discounts Dividends payable Income taxes payable (Note 13) Other current liabilities 1,410.7 997.9 4,465.1 590.6 532.9 2,832.1 14,535.9 Total current liabilities Other Liabiliies 10,986.6 Long-term debt (Note 10) Accrued retirement benefits (Note 14) Long-term income taxes payable (Note 13) Other noncurrent liabilities 9,940.5 3,513.9 3,776.5 1,546.3 18,777.2 8,367.8 2,453.9 688.9 2,228.2 13,738.8 Total other labilities Commitments and Contingencies (Note 15) Ei Lily and Company Shareholders' Equity (Notes 11 and 12) Common stock no par value Authorized shares: 3,200,000 Issued shares: 1,100,672 (2017) and 1,101,586 (2016) Additional paid-in capital Retained earnings Employee benefit trust Accumulated other comprehensive loss (Note 16) Cost of common stock in treasury 687.9 5,817.8 13,894.1 688.5 5,640.6 16,046.3 (3,013 2) (5,2740) (5,718.6) Total Eli Lilly and Company shareholders' equity 11,592.2 14,007.7 interests Total equity Total iabilities and equity 11,667.9 44,981.0 $ 14,080.5 38,805.9

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started