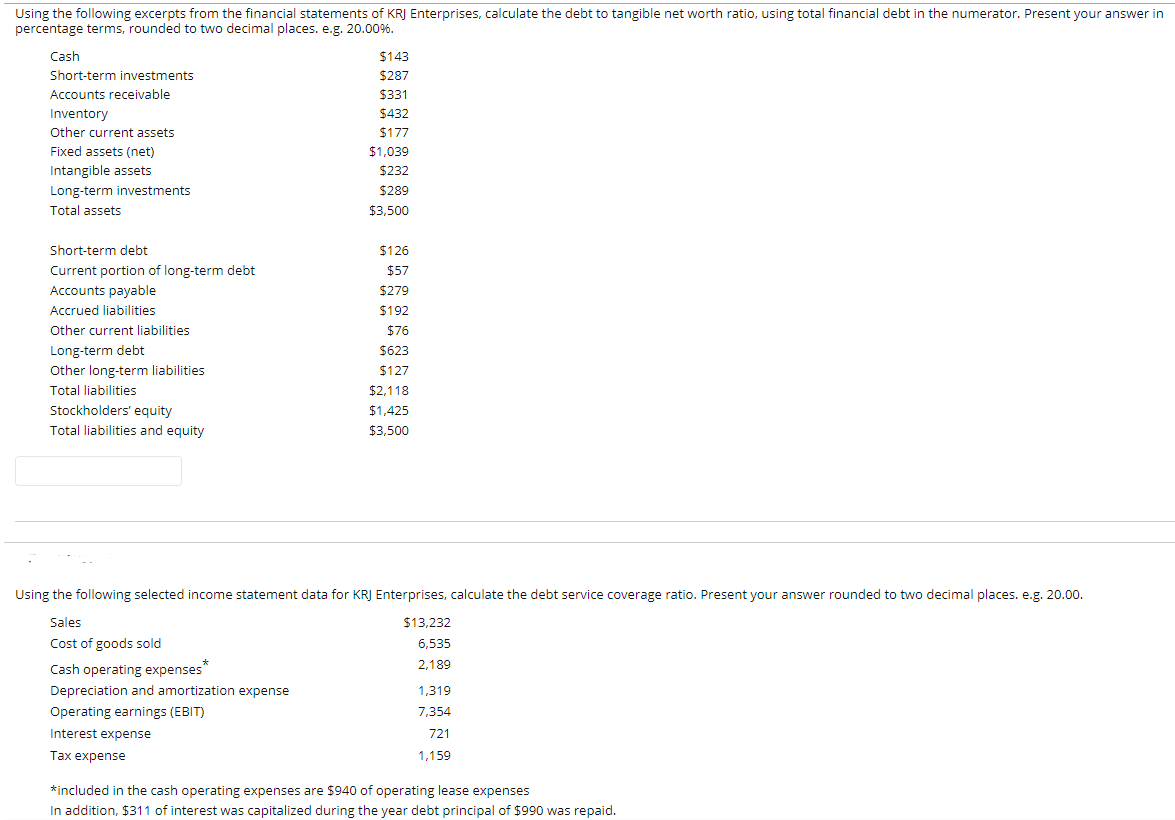

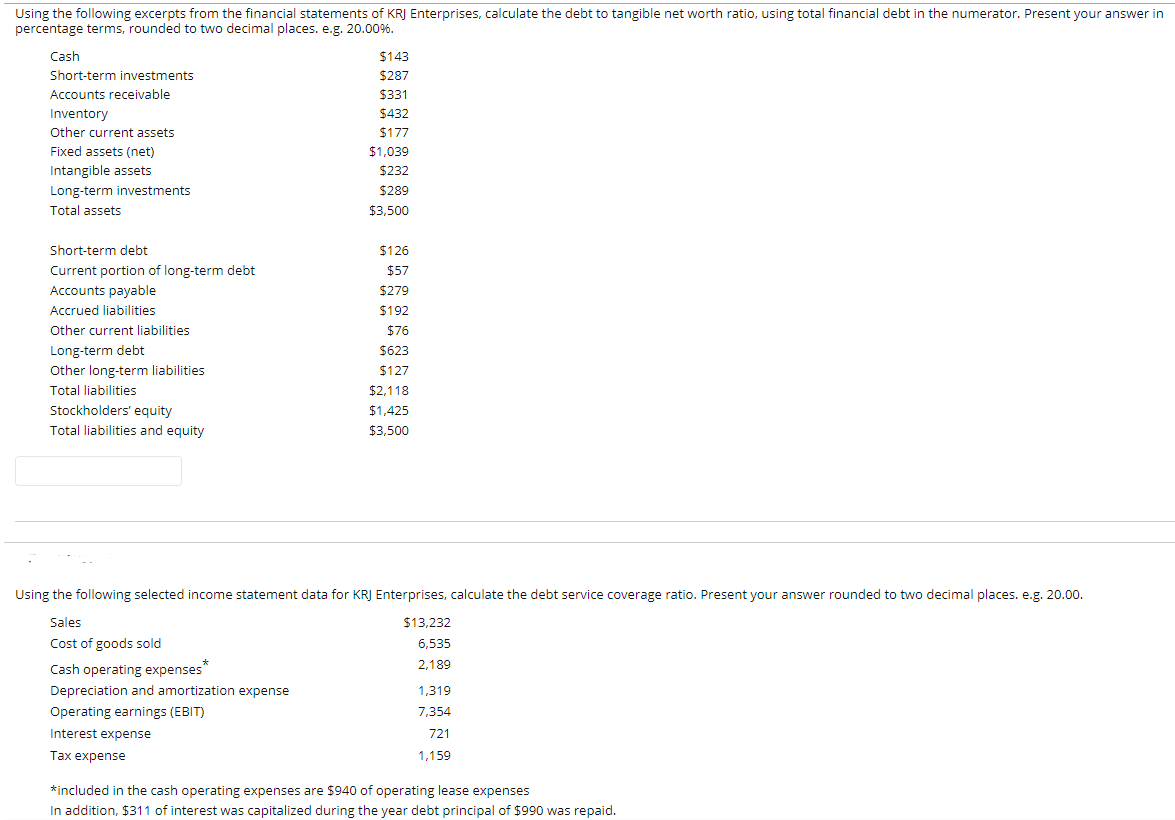

Using the following excerpts from the financial statements of KRJ Enterprises, calculate the debt to tangible net worth ratio, using total financial debt in the numerator. Present your answer in percentage terms, rounded to two decimal places. e.g. 20.0096. Cash Short-term investments Accounts receivable Inventory Other current assets Fixed assets (net) Intangible assets Long-term investments Total assets $143 $287 $331 $432 $177 $1,039 $232 $289 $3,500 $126 $57 $279 $192 $76 Short-term debt Current portion of long-term debt Accounts payable Accrued liabilities Other current liabilities Long-term debt Other long-term liabilities Total liabilities Stockholders' equity Total liabilities and equity $623 $127 $2,118 $1,425 $3,500 Using the following selected income statement data for KRJ Enterprises, calculate the debt service coverage ratio. Present your answer rounded to two decimal places. e.g. 20.00. $13,232 6,535 2,189 Sales Cost of goods sold Cash operating expenses* Depreciation and amortization expense Operating earnings (EBIT) Interest expense Tax expense 1,319 7,354 721 1,159 #included in the cash operating expenses are $940 of operating lease expenses In addition, $311 of interest was capitalized during the year debt principal of $990 was repaid. Using the following excerpts from the financial statements of KRJ Enterprises, calculate the debt to tangible net worth ratio, using total financial debt in the numerator. Present your answer in percentage terms, rounded to two decimal places. e.g. 20.0096. Cash Short-term investments Accounts receivable Inventory Other current assets Fixed assets (net) Intangible assets Long-term investments Total assets $143 $287 $331 $432 $177 $1,039 $232 $289 $3,500 $126 $57 $279 $192 $76 Short-term debt Current portion of long-term debt Accounts payable Accrued liabilities Other current liabilities Long-term debt Other long-term liabilities Total liabilities Stockholders' equity Total liabilities and equity $623 $127 $2,118 $1,425 $3,500 Using the following selected income statement data for KRJ Enterprises, calculate the debt service coverage ratio. Present your answer rounded to two decimal places. e.g. 20.00. $13,232 6,535 2,189 Sales Cost of goods sold Cash operating expenses* Depreciation and amortization expense Operating earnings (EBIT) Interest expense Tax expense 1,319 7,354 721 1,159 #included in the cash operating expenses are $940 of operating lease expenses In addition, $311 of interest was capitalized during the year debt principal of $990 was repaid