Question

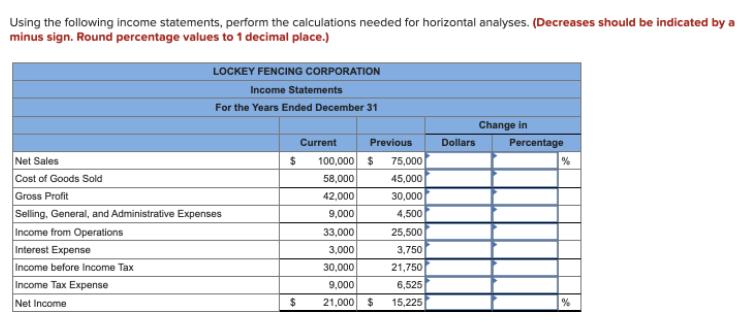

Using the following income statements, perform the calculations needed for horizontal analyses. (Decreases should be indicated by a minus sign. Round percentage values to

Using the following income statements, perform the calculations needed for horizontal analyses. (Decreases should be indicated by a minus sign. Round percentage values to 1 decimal place.) LOCKEY FENCING CORPORATION Income Statements For the Years Ended December 31 Change in Percentage Current Previous Dollars 100,000 $ 75,000 58,000 Net Sales %24 Cost of Goods Sold 45,000 30,000 4,500 Gross Profit 42,000 Selling, General, and Administrative Expenses 9,000 Income from Operations Interest Expense 33,000 25,500 3,000 3,750 30,000 21,750 6,525 Income before Income Tax Income Tax Expense 9,000 Net Income 21,000 15,225

Step by Step Solution

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

A C D E 1 Lockey Fencing Corporation Income statement ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Managerial Accounting

Authors: Stacey Whitecotton, Robert Libby, Fred Phillips

2nd edition

9780077493677, 78025516, 77493672, 9780077826482, 978-0078025518

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App