Answered step by step

Verified Expert Solution

Question

1 Approved Answer

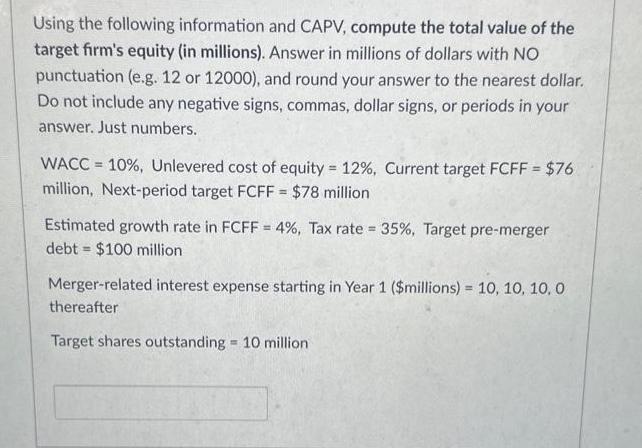

Using the following information and CAPV, compute the total value of the target firm's equity (in millions). Answer in millions of dollars with NO

Using the following information and CAPV, compute the total value of the target firm's equity (in millions). Answer in millions of dollars with NO punctuation (e.g. 12 or 12000), and round your answer to the nearest dollar. Do not include any negative signs, commas, dollar signs, or periods in your answer. Just numbers. WACC = 10%, Unlevered cost of equity = 12 %, Current target FCFF = $76 million, Next-period target FCFF = $78 million Estimated growth rate in FCFF = 4%, Tax rate = 35%, Target pre-merger debt $100 million Merger-related interest expense starting in Year 1 ($millions) = 10, 10, 10, 0 thereafter Target shares outstanding = 10 million

Step by Step Solution

★★★★★

3.48 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

To compute the total value of the target firms equity we can use the Capital Asset Pricing Model CAP...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started