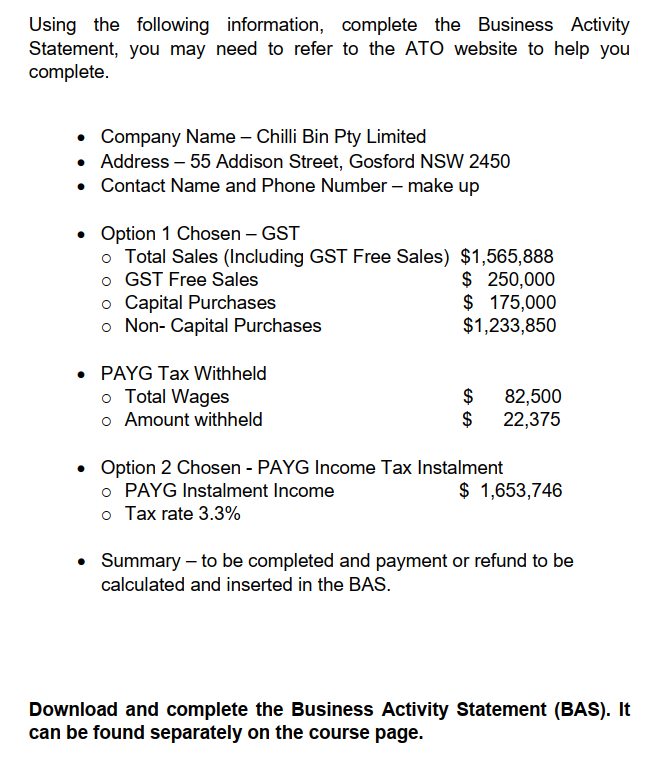

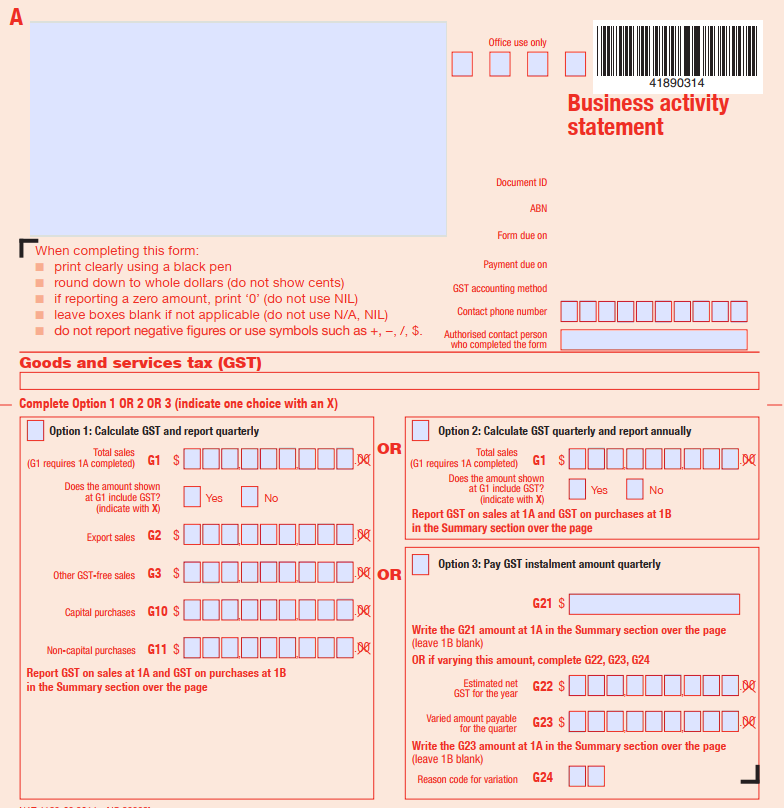

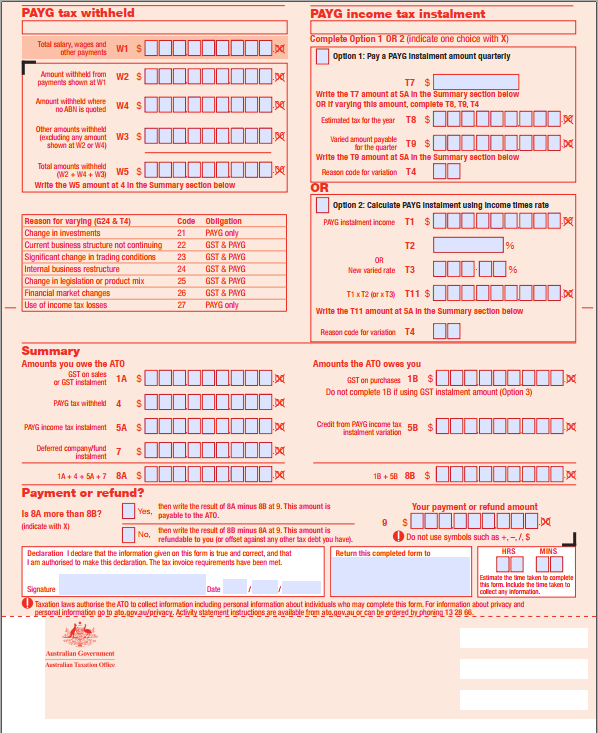

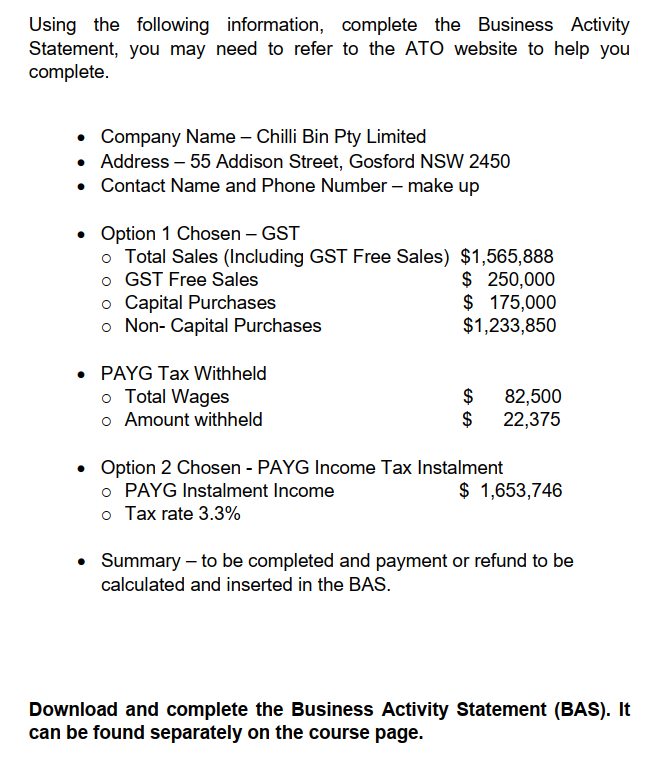

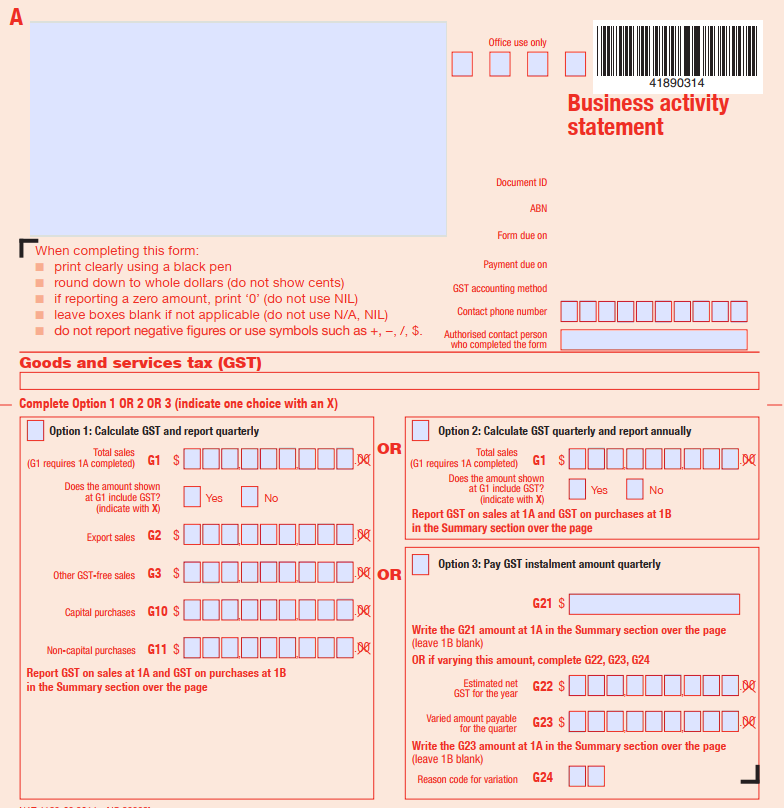

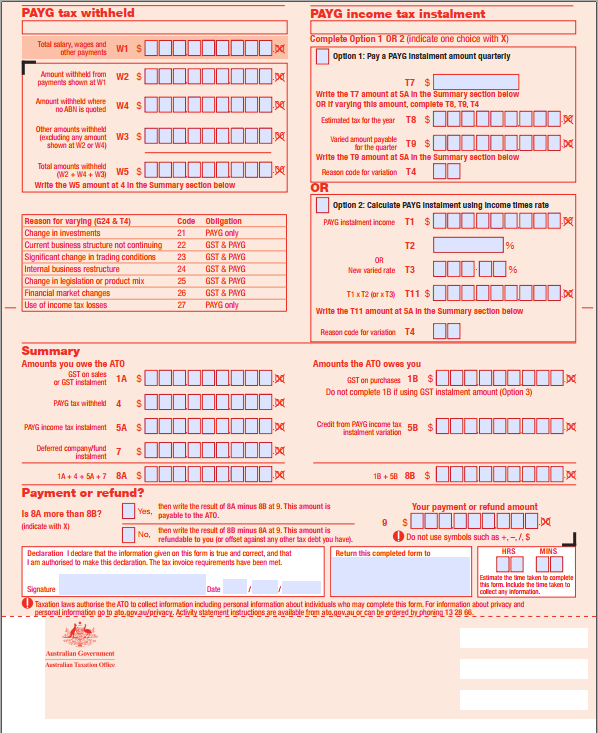

Using the following information, complete the Business Activity Statement, you may need to refer to the ATO website to help you complete. Company Name - Chilli Bin Pty Limited Address - 55 Addison Street, Gosford NSW 2450 Contact Name and Phone Number - make up Option 1 Chosen - GST o Total Sales (Including GST Free Sales) $1,565,888 O GST Free Sales $ 250,000 Capital Purchases $ 175,000 o Non- Capital Purchases $1,233,850 PAYG Tax Withheld o Total Wages o Amount withheld AA $ $ 82,500 22,375 Option 2 Chosen - PAYG Income Tax Instalment o PAYG Instalment Income $ 1,653,746 o Tax rate 3.3% Summary - to be completed and payment or refund to be calculated and inserted in the BAS. Download and complete the Business Activity Statement (BAS). It can be found separately on the course page. A Office use only 41890314 Business activity statement Document ID ABN Form due on When completing this form: print clearly using a black pen round down to whole dollars (do not show cents) if reporting a zero amount, print 'O' (do not use NIL) leave boxes blank if not applicable (do not use N/A, NIL) do not report negative figures or use symbols such as +, -,/, $. Goods and services tax (GST) Payment due on GST accounting method Contact phone number Authorised contact person who completed the form 1.00 Complete Option 1 OR 2 OR 3 (indicate one choice with an X) Option 1: Calculate GST and report quarterly Total sales OR (G1 requires 1A completed G1 $ 000000 1.00 Does the amount shown at G1 include GST? (indicate with X) Export sales G2 $ .00 Option 2: Calculate GST quarterly and report annually Total sales (1 requires 1A completed) G1 $ Does the amount shown at G1 include GST? Yes No (indicate with X) Report GST on sales at 1A and GST on purchases at 1B in the Summary section over the page Yes No Other GST-free sales G3 $ 1.BR OR Option 3: Pay GST instalment amount quarterly Capital purchases G10 $ .00 .00 Non-capital purchases G11 $ Report GST on sales at 1A and GST on purchases at 18 in the Summary section over the page G21 $ Write the G21 amount at 1A in the Summary section over the page (leave 1B blank) OR if varying this amount, complete G22, G23, G24 Estimated net G22 GST for the year Varied amount payable G23 $ for the quarter Write the G23 amount at 1A in the Summary section over the page (leave 1B blank) Reason code for variation G24 1.00 1.00 PAYG tax withheld PAYG income tax instalment Total salary, wages and wis other payments Complete Option 1 OR 2 indicate one choice with X Option 1: Pay a PAYG Instalment amount quarterly . Amount withheld from W2 $ payments shown at W1 Amount withheld where W4S no ABN is quoted T7 $ Write the T7 amount at 5A in the Summary section below OR If varying this amount, complete T8, T3, T4 Estimated tax for the year T8 $ DC Other amounts withheld (excluding any amount W3 $ shown at 12 or 4) 96 O Varied amount payable T9 $ for the quarter Write the T9 amount at 5A in the Summary section below Reason code for variation T4 OR Total amounts withheld (W2 W4+3) WS S Write the W5 amount at 4 In the Summary section below 98 option 2. Calculate PAYG Instalment using Income times rate PAYG instalment income T1 $ DC % Reason for varying (G24 & T4) Change in investments Current business structure not continuing Significant change in trading conditions Internal business restructure Change in legislation or product mix Financial market changes Use of income tax losses Code 21 22 23 24 25 26 27 Obligation PAYG only GST & PAYG GST & PAYG GST & PAYG GST & PAYG GST & PAYG PAYG only T2 OR New varied rate T3 % T1 x T2 qorxT3) T11 $ Write the T11 amount at 5A In the Summary section below Reason code for variation T4 Summary Amounts you owe the ATO GST on sales of GST instalment 1A $ Od Amounts the ATO owes you GST on purchase 1B $ Do not complete 1B if using GST instalment amount (Option 3) PAYG tax withheld 4 S L od $ PAYG income tax instalment 5A S Credit fram PAYG income tax 5B $ instalment variation Deferred companylund 7 S . instalment 1A+4 +54 +7 BAS od 1B + SB 8B $ Payment or refund? then write the result of A minus 88 at 9. This amount is Yes, Is 8A more than 8B? Your payment or refund amount payable to the ATO. indicate with X) 9 Na then write the result of minus BA at 9. This amount is refundable to you for offset against any other tax debt you have Do not use symbols such as +, -7,5 Declaration Ideclare that the information given on this form is true and correct, and that Return this completed form to HRS MINS I am authorised to make this declaration. The tax invoice requirements have been met. Estimate the time taken to complete Signature Date this form. Include the time taken to collect any information Taxation laws authorise the ATO to collect information including personal information about individuals who may complete this form. For information about privacy and personal information go to ato.gov.au/privacy. Activity statement instructions are available from ato.gov.au or can be ordered by phoning 13 28 66 Australian Government Ava Using the following information, complete the Business Activity Statement, you may need to refer to the ATO website to help you complete. Company Name - Chilli Bin Pty Limited Address - 55 Addison Street, Gosford NSW 2450 Contact Name and Phone Number - make up Option 1 Chosen - GST o Total Sales (Including GST Free Sales) $1,565,888 O GST Free Sales $ 250,000 Capital Purchases $ 175,000 o Non- Capital Purchases $1,233,850 PAYG Tax Withheld o Total Wages o Amount withheld AA $ $ 82,500 22,375 Option 2 Chosen - PAYG Income Tax Instalment o PAYG Instalment Income $ 1,653,746 o Tax rate 3.3% Summary - to be completed and payment or refund to be calculated and inserted in the BAS. Download and complete the Business Activity Statement (BAS). It can be found separately on the course page. A Office use only 41890314 Business activity statement Document ID ABN Form due on When completing this form: print clearly using a black pen round down to whole dollars (do not show cents) if reporting a zero amount, print 'O' (do not use NIL) leave boxes blank if not applicable (do not use N/A, NIL) do not report negative figures or use symbols such as +, -,/, $. Goods and services tax (GST) Payment due on GST accounting method Contact phone number Authorised contact person who completed the form 1.00 Complete Option 1 OR 2 OR 3 (indicate one choice with an X) Option 1: Calculate GST and report quarterly Total sales OR (G1 requires 1A completed G1 $ 000000 1.00 Does the amount shown at G1 include GST? (indicate with X) Export sales G2 $ .00 Option 2: Calculate GST quarterly and report annually Total sales (1 requires 1A completed) G1 $ Does the amount shown at G1 include GST? Yes No (indicate with X) Report GST on sales at 1A and GST on purchases at 1B in the Summary section over the page Yes No Other GST-free sales G3 $ 1.BR OR Option 3: Pay GST instalment amount quarterly Capital purchases G10 $ .00 .00 Non-capital purchases G11 $ Report GST on sales at 1A and GST on purchases at 18 in the Summary section over the page G21 $ Write the G21 amount at 1A in the Summary section over the page (leave 1B blank) OR if varying this amount, complete G22, G23, G24 Estimated net G22 GST for the year Varied amount payable G23 $ for the quarter Write the G23 amount at 1A in the Summary section over the page (leave 1B blank) Reason code for variation G24 1.00 1.00 PAYG tax withheld PAYG income tax instalment Total salary, wages and wis other payments Complete Option 1 OR 2 indicate one choice with X Option 1: Pay a PAYG Instalment amount quarterly . Amount withheld from W2 $ payments shown at W1 Amount withheld where W4S no ABN is quoted T7 $ Write the T7 amount at 5A in the Summary section below OR If varying this amount, complete T8, T3, T4 Estimated tax for the year T8 $ DC Other amounts withheld (excluding any amount W3 $ shown at 12 or 4) 96 O Varied amount payable T9 $ for the quarter Write the T9 amount at 5A in the Summary section below Reason code for variation T4 OR Total amounts withheld (W2 W4+3) WS S Write the W5 amount at 4 In the Summary section below 98 option 2. Calculate PAYG Instalment using Income times rate PAYG instalment income T1 $ DC % Reason for varying (G24 & T4) Change in investments Current business structure not continuing Significant change in trading conditions Internal business restructure Change in legislation or product mix Financial market changes Use of income tax losses Code 21 22 23 24 25 26 27 Obligation PAYG only GST & PAYG GST & PAYG GST & PAYG GST & PAYG GST & PAYG PAYG only T2 OR New varied rate T3 % T1 x T2 qorxT3) T11 $ Write the T11 amount at 5A In the Summary section below Reason code for variation T4 Summary Amounts you owe the ATO GST on sales of GST instalment 1A $ Od Amounts the ATO owes you GST on purchase 1B $ Do not complete 1B if using GST instalment amount (Option 3) PAYG tax withheld 4 S L od $ PAYG income tax instalment 5A S Credit fram PAYG income tax 5B $ instalment variation Deferred companylund 7 S . instalment 1A+4 +54 +7 BAS od 1B + SB 8B $ Payment or refund? then write the result of A minus 88 at 9. This amount is Yes, Is 8A more than 8B? Your payment or refund amount payable to the ATO. indicate with X) 9 Na then write the result of minus BA at 9. This amount is refundable to you for offset against any other tax debt you have Do not use symbols such as +, -7,5 Declaration Ideclare that the information given on this form is true and correct, and that Return this completed form to HRS MINS I am authorised to make this declaration. The tax invoice requirements have been met. Estimate the time taken to complete Signature Date this form. Include the time taken to collect any information Taxation laws authorise the ATO to collect information including personal information about individuals who may complete this form. For information about privacy and personal information go to ato.gov.au/privacy. Activity statement instructions are available from ato.gov.au or can be ordered by phoning 13 28 66 Australian Government Ava