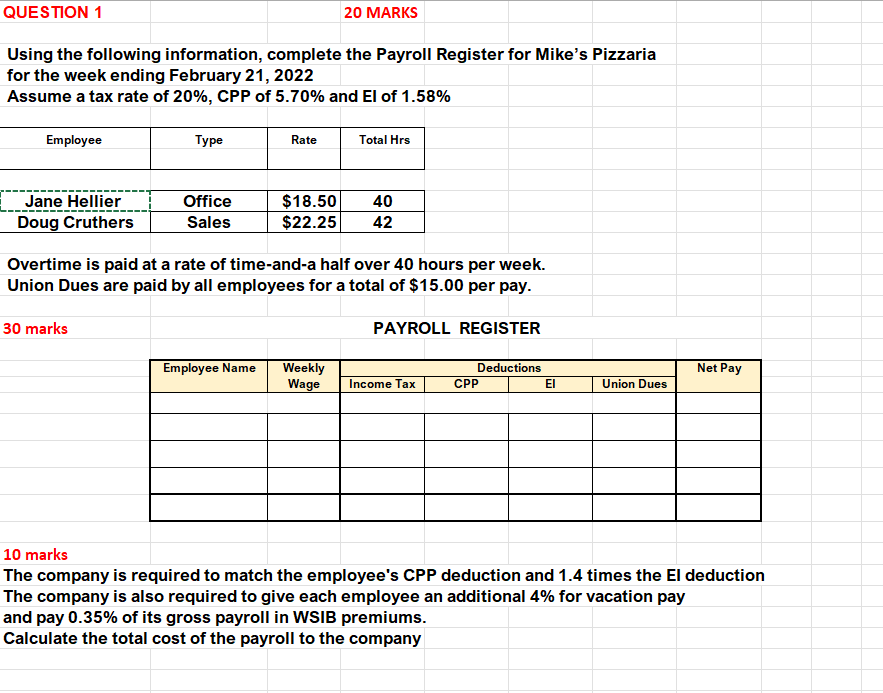

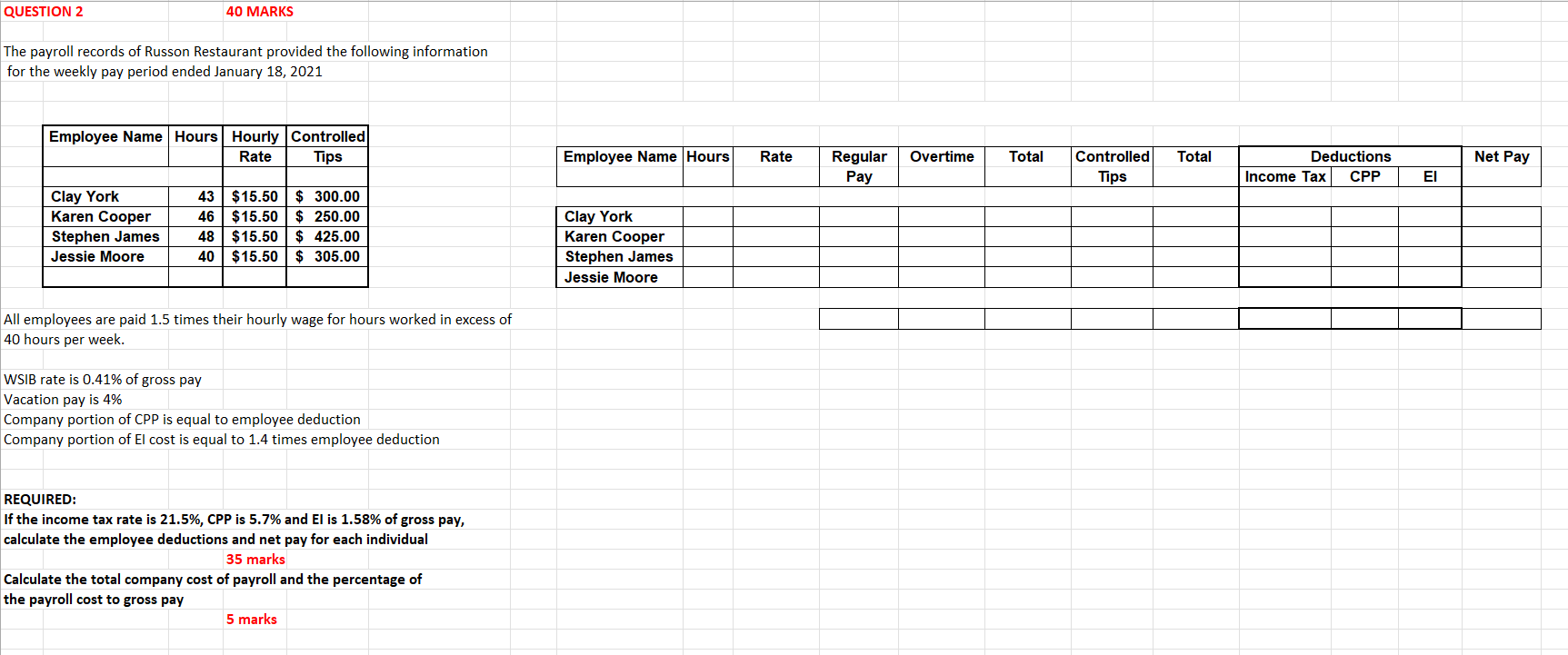

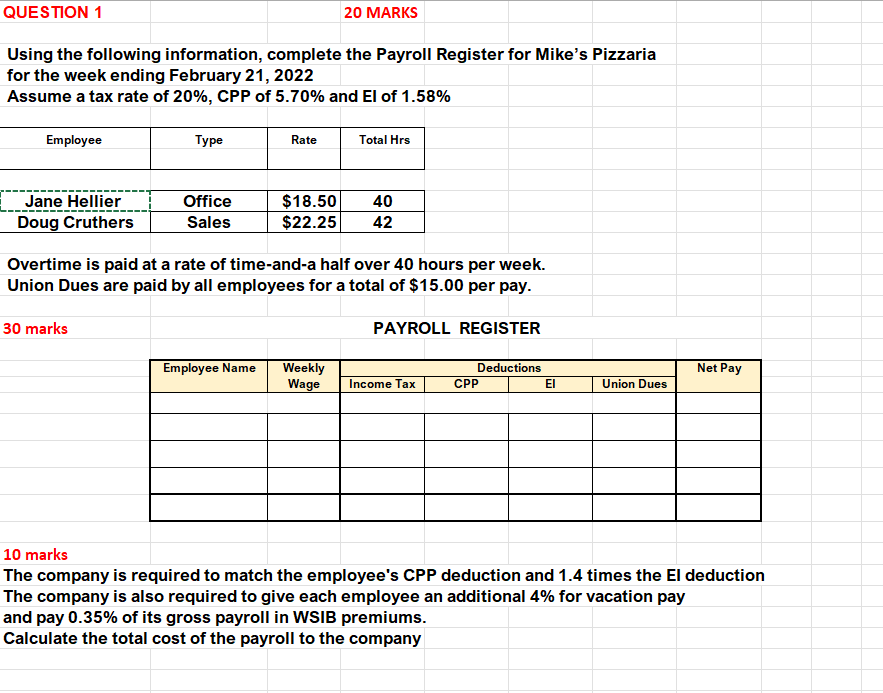

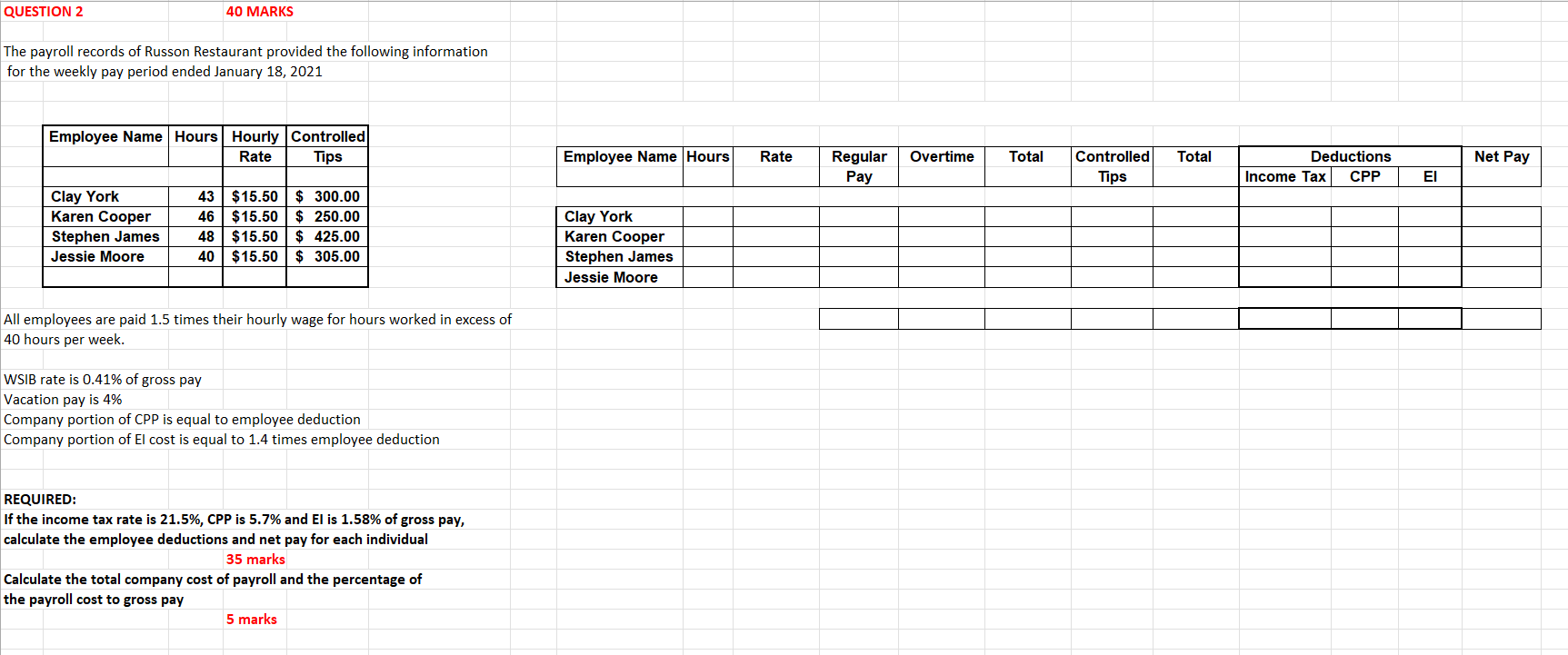

Using the following information, complete the Payroll Register for Mike's Pizzaria for the week ending February 21, 2022 Assume a tax rate of 20%, CPP of 5.70% and El of 1.58% Overtime is paid at a rate of time-and-a half over 40 hours per week. Union Dues are paid by all employees for a total of $15.00 per pay. 10 marks The company is required to match the employee's CPP deduction and 1.4 times the El deduction The company is also required to give each employee an additional 4% for vacation pay and pay 0.35% of its gross payroll in WSIB premiums. Calculate the total cost of the payroll to the company QUESTION 2 40 MARKS The payroll records of Russon Restaurant provided the following information for the weekly pay period ended January 18, 2021 All employees are paid 1.5 times their hourly wage for hours worked in excess of 40 hours per week. WSIB rate is 0.41% of gross pay Vacation pay is 4% Company portion of CPP is equal to employee deduction Company portion of El cost is equal to 1.4 times employee deduction REQUIRED: If the income tax rate is 21.5%,CPP is 5.7% and El is 1.58% of gross pay, calculate the employee deductions and net pay for each individual 35 marks Calculate the total company cost of payroll and the percentage of the payroll cost to gross pay 5 marks Using the following information, complete the Payroll Register for Mike's Pizzaria for the week ending February 21, 2022 Assume a tax rate of 20%, CPP of 5.70% and El of 1.58% Overtime is paid at a rate of time-and-a half over 40 hours per week. Union Dues are paid by all employees for a total of $15.00 per pay. 10 marks The company is required to match the employee's CPP deduction and 1.4 times the El deduction The company is also required to give each employee an additional 4% for vacation pay and pay 0.35% of its gross payroll in WSIB premiums. Calculate the total cost of the payroll to the company QUESTION 2 40 MARKS The payroll records of Russon Restaurant provided the following information for the weekly pay period ended January 18, 2021 All employees are paid 1.5 times their hourly wage for hours worked in excess of 40 hours per week. WSIB rate is 0.41% of gross pay Vacation pay is 4% Company portion of CPP is equal to employee deduction Company portion of El cost is equal to 1.4 times employee deduction REQUIRED: If the income tax rate is 21.5%,CPP is 5.7% and El is 1.58% of gross pay, calculate the employee deductions and net pay for each individual 35 marks Calculate the total company cost of payroll and the percentage of the payroll cost to gross pay 5 marks