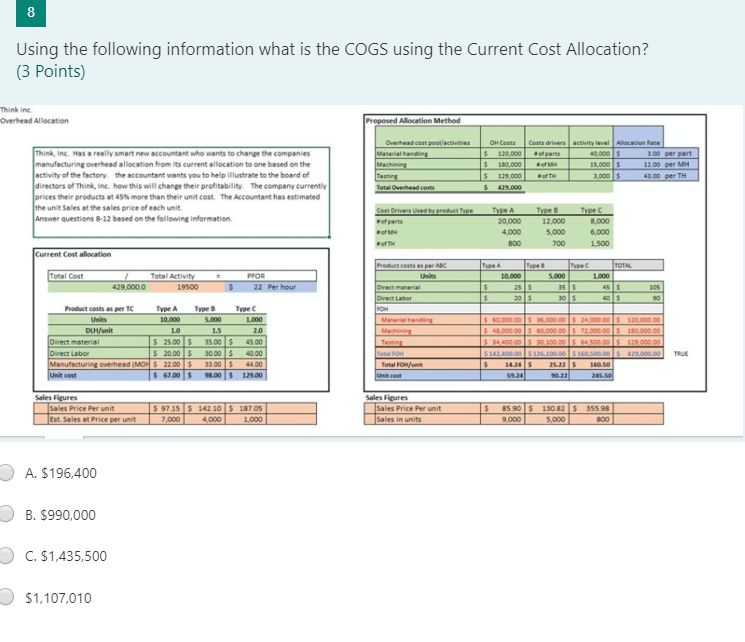

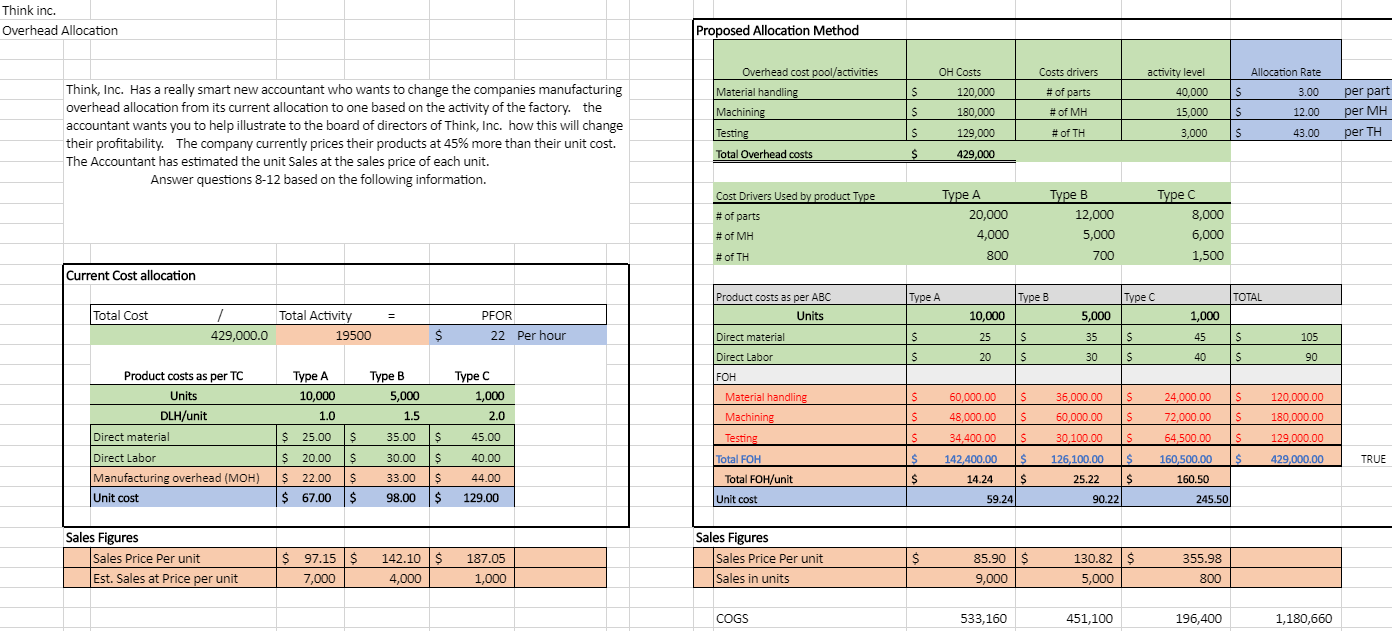

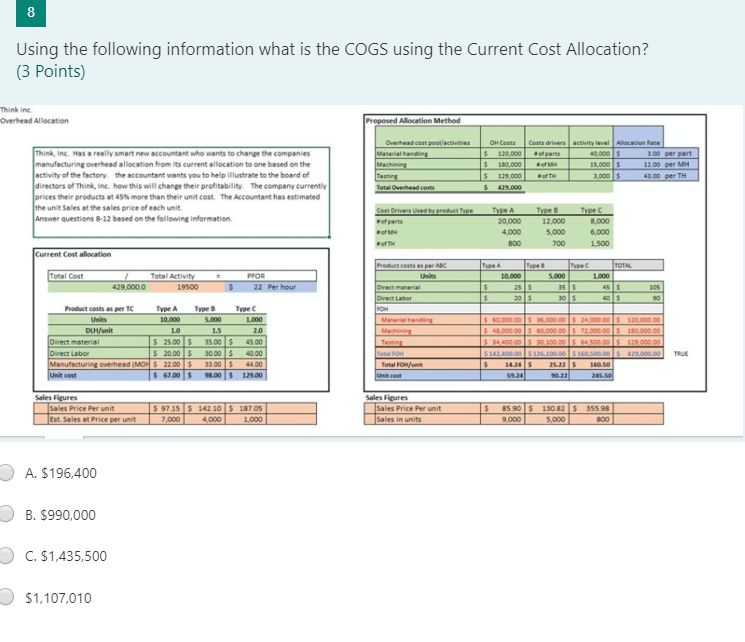

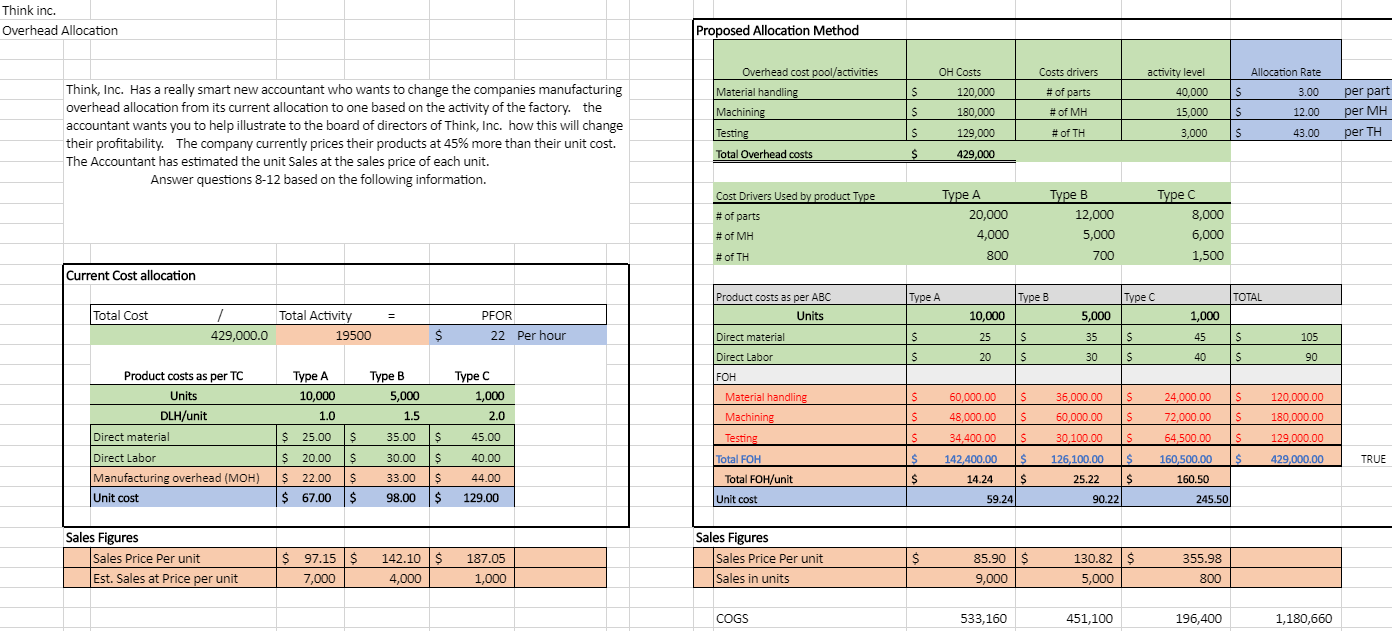

Using the following information what is the COGS using the Current Cost Allocation? (3 Points) Overhead Allocation Proposed Allocation Method Overhead cost poolectivities Material handling Costs drivers activity level Allocation Rate of parts 40.000 S 300 per part 15000S 12.00 per MM of 3,000 S 4300 per TH Think, Inc. Has a really smart new accountant who wants to change the companies manufacturing overhead allocation from its current allocation to one based on the activity of the factory, the accountant wants you to help illustrate to the board of directors of Thinking how this will change their profitability. The company currently prices their products at 45N more than their unit cost The Accountant has estimated the unit Sales at the sales price of each unit Answer questions 8-12 based on the following information OH Costs $ 120,000 $ 100,000 $ 129,000 $ 13,000 Cost Drivers Used Type Type A 20.000 4,000 800 Type B 12.000 5,000 700 Type C 8.000 6,000 1500 Current Cost allocation Type Total Cost - .000 Total Activity 19500 PFOR 22 Per hour The Type 10.000 255 5 20 15 TOTAL 1.000 455 0 5 429,000.0 $ S 105 10 10 5 Product costs as per TC Type A Type B Type C DLH/unit 1.0 Direct material s 2500 S Direct labor $ 20.00 $ Manufacturing overhead MOH$ 2200 Unit cost S 67.00 S 1.5 2.0 3500S 4500 30.00 $ 40.00 330015400 9.00 $ 129.00 5000 100000 1300 120100000 S400000 $ 60,000.00 $ 72,000.00 $ 100 000 00 $ 34,400.00 $ 30.10000 $ 00 s129 000 00 S162.400.00 5 126.100.00 $160.500.00 429000.00 TRUE Sales Price Per unit Est. Sales at Price per unit S S 97.15 S 7,000 142 10 4.000 Sales Figures Sales Price Per unit Sales in units S 18705 1.000 85.90 $ 9.000 130.82 $35598 5.000 300 A. $196,400 B. 5990,000 C. $1,435,500 $1,107,010 Think inc. Overhead Allocation Proposed Allocation Method Overhead cost pool/activities Material handling Machining Testing Total Overhead costs Think, Inc. Has a really smart new accountant who wants to change the companies manufacturing overhead allocation from its current allocation to one based on the activity of the factory. the accountant wants you to help illustrate to the board of directors of Think, Inc. how this will change their profitability. The company currently prices their products at 45% more than their unit cost. The Accountant has estimated the unit Sales at the sales price of each unit. Answer questions 8-12 based on the following information. S $ Is OH Costs 120,000 180,000 129,000 429,000 Costs drivers # of parts # of MH # of TH 1 activity level 40,000 15,000 3 ,000 S $ S Allocation Rate 3.00 12.00 43.00 per part per MH per TH | $ Cost Drivers Used by product Type # of parts # of MH Type A 20,000 4,000 800 Type B 12,000 5,000 700 Type C 8,000 6,000 1,500 # of TH Current Cost allocation Type A | Type B Type C TOTAL Total Cost = 5 Total Activity 19500 PFOR 22 Per hour 429,000.0 $ 10,000 L 25 20 Is Is ,000 35 30 Is s 1 1,000 45 40 s s Is IS 105 90 Type A 10,000 Product costs as per TC Units DLH/unit Direct material Direct Labor Manufacturing overhead (MOH) Unit cost 1.0 Product costs as per ABC Units Direct material Direct Labor FOH Material handling Machining Testing Total FOH Total FOH/unit Unit cost Type B 5,000 1.5 35.00 30.00 33.00 98.00 Type C 1,000 2.0 45.00 40.00 44.00 129.00 $ 25.00 $ 20.00 $ 22.00 $ 67.00 $ $ $ $ $ $ S $ is 60,000.00 48,000.00 34,400.00 142,400.00 14.24 5 9.24 $ $ $ $ $ $ S $ S $ $ $ $ 36,000.00 $ 60,000.00 $ 30,100.00 S 126,100.00 $ 25.22 $ 90.220 120,000.00 180,000.00 129,000.00 429,000.00 24,000.00 72,000.00 64,500.00 160,500.00 160.50 245.50 TRUE 1 Sales Figures Sales Price Per unit Est. Sales at Price per unit $ $ $ $ 97.15 7,000 $ Sales Figures Sales Price Per unit Sales in units 142.10 4,000 187.05 1,000 85.90 9,000 130.82 5,000 355.98 800 COGS 533,160 451,100 196,400 1,180,660