Question

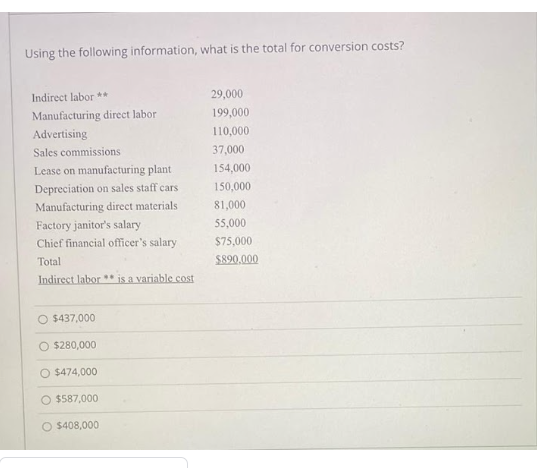

Using the following information, what is the total for conversion costs? Indirect labor ** 29,000 Manufacturing direct labor Advertising 199,000 110,000 Sales commissions 37,000

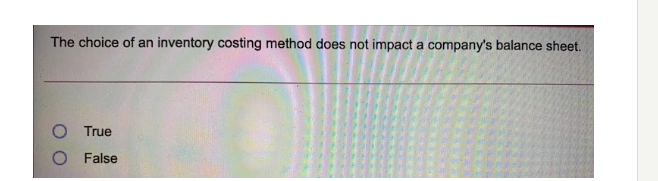

Using the following information, what is the total for conversion costs? Indirect labor ** 29,000 Manufacturing direct labor Advertising 199,000 110,000 Sales commissions 37,000 Lease on manufacturing plant 154,000 150,000 Depreciation on sales staff cars Manufacturing direct materials Factory janitor's salary 81,000 55,000 Chief financial officer's salary $75,000 Total $890,000 Indirect labor * is a variable cost O $437,000 O $280,000 O $474,000 O $587,000 O $408,000 The choice of an inventory costing method does not impact a company's balance sheet. True O False

Step by Step Solution

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Solution Answer 1 The correct answer is Conversion cost 437000 Explanation Conversion costs are cost...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Accounting concepts and applications

Authors: Albrecht Stice, Stice Swain

11th Edition

978-0538750196, 538745487, 538750197, 978-0538745482

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App