Using the following link: https://www.jdplc.com/reports-presentations download JD Sports Fashion Plc's annual reports for the past 3 (most recent) years to provide a critical analysis of the financial health of the company. The annual reports are in a consolidated format, and relevant financial statements can be found under the latest results (results archive) section. Do not forget to review the notes to the financial statements.

The FULL document is available at coursehero

(https://www.coursehero.com/file/104408128/JD-Sports-Fashion-Plcspdf).

The reports with the financial data to calculate the ratios are

at https://www.jdplc.com/reports-presentations.

Exact Reports location for last years. 2020:

https://files.jdplc.com/pdf/reports/annual-report-and-accounts-2020.pdf, 2019:

https://files.jdplc.com/pdf/reports/annual-report-2019.pdf and 2018:

https://files.jdplc.com/pdf/reports/2018-annual-report-v1.pdf

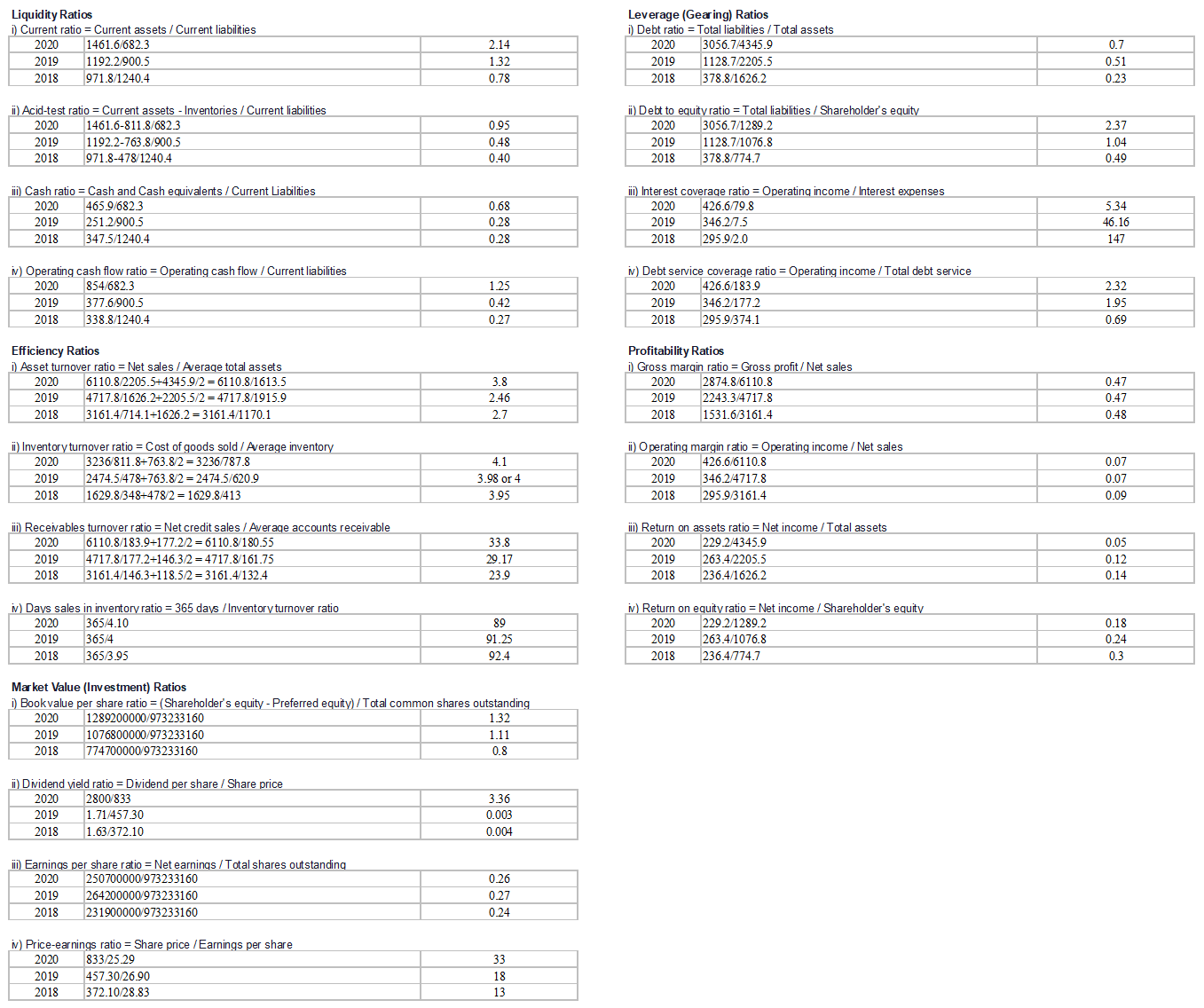

Important - Consider the calculate ratios for the last 3 years - 2020,2019 and 2018 in the attached picture

Liquidity Ratios Leverage (Gearing) Ra 1) Current ratio = Current assets / Current liabilities 1) Debt ratio = Total liabilities / Total assets 2020 1461.6/682.3 2.14 2020 3056.7/4345.9 0.7 2019 1192.2/900. 1.32 2019 1128.7/2205.5 0.51 2018 971.8/1240.4 0.78 2018 378.8/1626.2 0.23 ii) Acid-test ratio = Current assets - Inventories / Current liabilities ii) Debt to equity ratio = Total liabilities / Shareholder's equity 2020 1461.6-811.8/682 0.95 2020 3056.7/1289.2 2.37 2019 1192.2-763.8/900.5 0.48 2019 1128.7/1076.8 1.04 2018 971.8-478/1240.4 0.40 2018 378.8/774.7 0.49 iii) Cash ratio = Cash and Cash equivalents / Current Liabilities "ili) Interest coverage ratio = Operating income / Interest expenses 2020 465.9/682.3 0.68 2020 426.6/79.8 5.34 2019 251.2/900.5 0.2 2019 346.2/7.5 16.16 2018 347.5/1240.4 0.28 2018 295.9/2.0 147 I) Operating cash flow ratio = Operating cash flow / Current liabilities I) Debt service coverage ratio = Operating income / Total debt service 2020 854/682.3 1.25 2020 426.6/183.9 2.32 2019 377.6/900.5 0.42 2019 346.2/177.2 1.95 2018 338.8/1240.4 0.27 2018 295.9/374.1 0.69 Efficiency Ratios Profitability Ratios i Asset turnover ratio = Net sales / Average total assets i) Gross margin ratio = Gross profit / Net sales 2020 6110.8/2205.5+4345.9/2 = 6110.8/1613. 3.8 2020 2874.8/6110.8 0.47 2019 4717.8/1626.2+2205.5/2 =4717.8/1915.9 2.46 2019 2243.3/4717.8 0.47 2018 3161.4/714.1+1626.2 =3161.4/1170.1 2.7 2018 1531.6/3161.4 0.48 ii) Inventory turnover ratio = Cost of goods sold / Average inventory ii) Operating margin ratio = Operating income / Net sales 2020 3236/811.8+763.8/2 =3236/787.8 4.1 2020 426.6/6110.8 0.07 2019 2474.5/478+763.8/2=2474.5/620.9 3.98 or 4 2019 346.2/4717.8 0.07 2018 1629.8/348+478/2 = 1629.8/413 3.95 2018 295.9/3161.4 0.09 iii) Receivables turnover ratio = Net credit sales / Average accounts receivable iii) Return on assets ratio = Net income / Total assets 2020 6110.8/183.9+177.2/2 = 61 10.8/180.55 33.8 2020 229.2/4345.9 0.05 2019 4717.8/177.2+146.3/2 =4717.8/161.75 29.17 2019 263.4/2205.5 0.12 2018 3161.4/146.3+118.5/2 =3161.4/132.4 23.9 2018 236.4/1626.2 0.14 i) Days sales in inventory ratio = 365 days / Inventory turnover ratio i) Return on equity ratio = Net income / Shareholder's equity 2020 365/4.10 89 2020 229.2/1289.2 0.18 2019 365/4 91.25 2019 263.4/1076.8 0.24 2018 365/3.95 92 4 2018 236.4/774.7 0.3 Market Value (Investment) Ratios i Book value per share ratio = (Shareholder's equity - Preferred equity) / Total common shares outstanding 2020 1289200000/973233160 1.32 2019 1076800000/973233160 1.11 2018 774700000/973233160 0.8 ii) Dividend vield ratio = Dividend per share / Share price 2020 2800/833 3.36 2019 1.71/457.30 0.003 2018 1.63/372.10 0.004 iii) Earnings per share ratio = Net earnings / Total shares outstanding 2020 250700000/973233160 0.26 2019 264200000/973233160 0.27 2018 231900000/973233160 0.24 i) Price-earnings ratio = Share price / Earnings per share 2020 833/25.29 33 2019 457.30/26.90 18 2018 372.10/28.83 13