Answered step by step

Verified Expert Solution

Question

1 Approved Answer

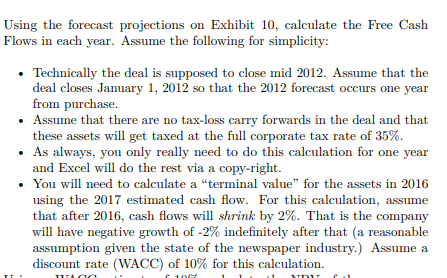

Using the forecast projections on Exhibit 10, calculate the Free Cash Flows in each year. Assume the following for simplicity: Technically the deal is

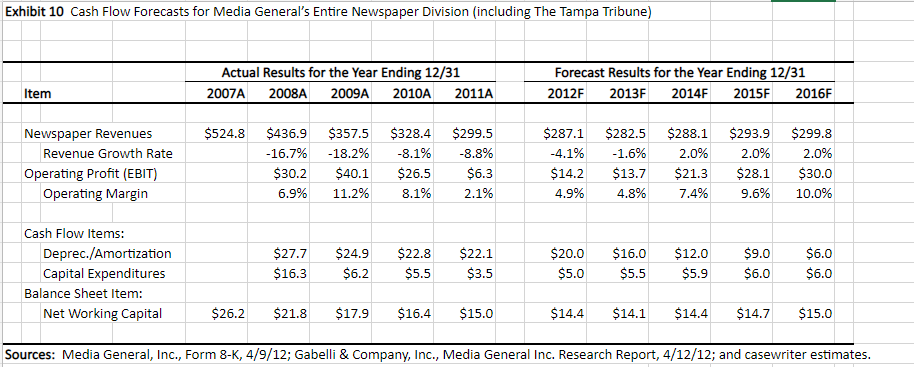

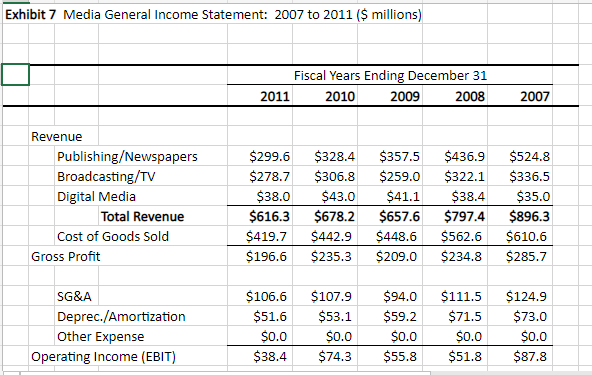

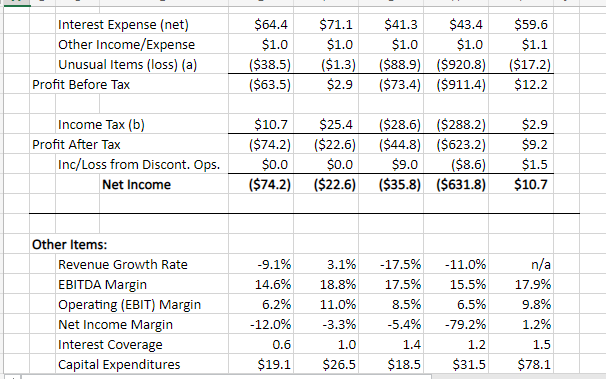

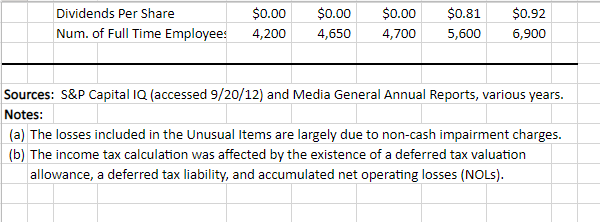

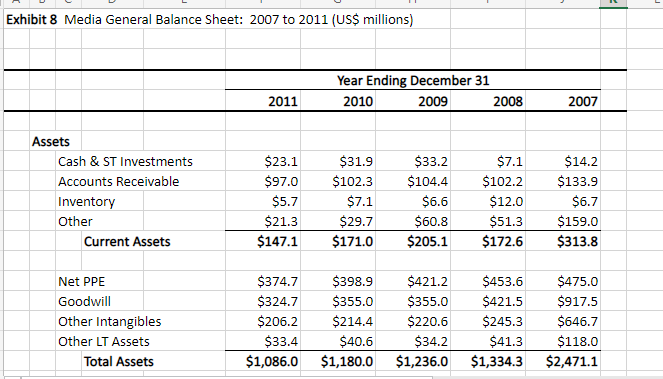

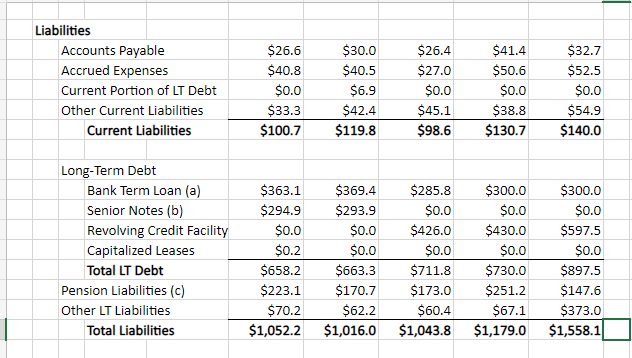

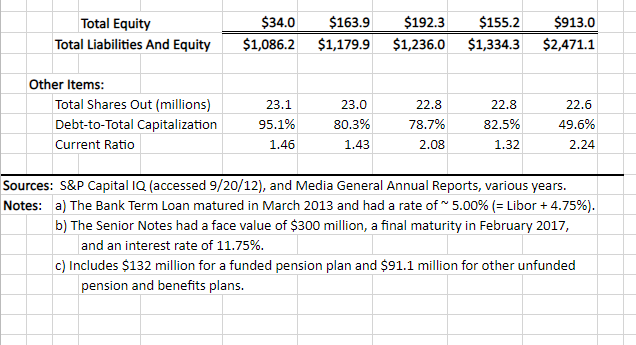

Using the forecast projections on Exhibit 10, calculate the Free Cash Flows in each year. Assume the following for simplicity: Technically the deal is supposed to close mid 2012. Assume that the deal closes January 1, 2012 so that the 2012 forecast occurs one year from purchase. Assume that there are no tax-loss carry forwards in the deal and that these assets will get taxed at the full corporate tax rate of 35%. As always, you only really need to do this calculation for one year and Excel will do the rest via a copy-right. You will need to calculate a "terminal value" for the assets in 2016 using the 2017 estimated cash flow. For this calculation, assume that after 2016, cash flows will shrink by 2%. That is the company will have negative growth of -2% indefinitely after that (a reasonable assumption given the state of the newspaper industry.) Assume a discount rate (WACC) of 10% for this calculation. Exhibit 10 Cash Flow Forecasts for Media General's Entire Newspaper Division (including The Tampa Tribune) Item Newspaper Revenues Revenue Growth Rate Operating Profit (EBIT) Operating Margin Cash Flow Items: Deprec./Amortization Capital Expenditures Balance Sheet Item: Actual Results for the Year Ending 12/31 2007A 2008A 2009A 2010A 2011A $524.8 $436.9 $357.5 $328.4 -16.7% -18.2% -8.1% $30.2 $40.1 $26.5 6.9% 11.2% 8.1% $27.7 $24.9 $16.3 $6.2 $299.5 -8.8% $6.3 2.1% $22.8 $22.1 $5.5 $3.5 Forecast Results for the Year Ending 12/31 2012F 2013F 2014F 2015F 2016F $287.1 $282.5 $288.1 -1.6% -4.1% 2.0% $14.2 $13.7 $21.3 4.9% 4.8% 7.4% $20.0 $5.0 $16.0 $12.0 $5.5 $5.9 $293.9 $299.8 2.0% 2.0% $28.1 9.6% $9.0 $6.0 $30.0 10.0% $6.0 $6.0 Net Working Capital $26.2 $21.8 $17.9 $16.4 $15.0 $14.4 $14.1 $14.4 $14.7 Sources: Media General, Inc., Form 8-K, 4/9/12; Gabelli & Company, Inc., Media General Inc. Research Report, 4/12/12; and casewriter estimates. $15.0 Exhibit 7 Media General Income Statement: 2007 to 2011 ($ millions) Revenue Publishing/Newspapers Broadcasting/TV Digital Media Total Revenue Cost of Goods Sold Gross Profit SG&A Deprec./Amortization Other Expense Operating Income (EBIT) 2011 Fiscal Years Ending December 31 2010 2009 2008 $299.6 $278.7 $328.4 $357.5 $436.9 $306.8 $259.0 $38.0 $43.0 $41.1 $616.3 $678.2 $657.6 $419.7 $442.9 $448.6 $196.6 $524.8 $322.1 $336.5 $38.4 $35.0 $797.4 $896.3 $562.6 $610.6 $235.3 $209.0 $234.8 $285.7 $106.6 $107.9 $51.6 $53.1 $59.2 $0.0 $0.0 $38.4 $74.3 $94.0 $111.5 $71.5 $0.0 $51.8 2007 $0.0 $55.8 $124.9 $73.0 $0.0 $87.8 Interest Expense (net) Other Income/Expense Unusual Items (loss) (a) Profit Before Tax Income Tax (b) Profit After Tax Inc/Loss from Discont. Ops. Net Income Other Items: Revenue Growth Rate EBITDA Margin Operating (EBIT) Margin Net Income Margin Interest Coverage Capital Expenditures $64.4 $1.0 ($38.5) ($63.5) -9.1% 14.6% 6.2% -12.0% $71.1 $1.0 0.6 $19.1 $10.7 $25.4 ($28.6) ($288.2) ($74.2) ($22.6) $0.0 $0.0 ($74.2) ($22.6) $41.3 $1.0 ($1.3) ($88.9) ($920.8) $2.9 ($73.4) ($911.4) 3.1% 18.8% 11.0% -3.3% 1.0 $26.5 $43.4 $1.0 ($44.8) ($623.2) $9.0 ($8.6) ($35.8) ($631.8) -17.5% 17.5% -11.0% 15.5% 8.5% 6.5% -5.4% -79.2% 1.4 $18.5 1.2 $31.5 $59.6 $1.1 ($17.2) $12.2 $2.9 $9.2 $1.5 $10.7 n/a 17.9% 9.8% 1.2% 1.5 $78.1 Dividends Per Share $0.00 Num. of Full Time Employees 4,200 $0.00 $0.00 $0.81 $0.92 4,650 4,700 5,600 6,900 Sources: S&P Capital IQ (accessed 9/20/12) and Media General Annual Reports, various years. Notes: (a) The losses included in the Unusual Items are largely due to non-cash impairment charges. (b) The income tax calculation was affected by the existence of a deferred tax valuation allowance, a deferred tax liability, and accumulated net operating losses (NOLs). Exhibit 8 Media General Balance Sheet: 2007 to 2011 (US$ millions) Assets Cash & ST Investments Accounts Receivable Inventory Other Current Assets Net PPE Goodwill Other Intangibles Other LT Assets Total Assets 2011 $23.1 $97.0 $5.7 $21.3 $147.1 Year Ending December 31 2010 2009 $31.9 $102.3 $7.1 $29.7 $171.0 $33.2 $104.4 $6.6 $60.8 $205.1 $374.7 $398.9 $421.2 $324.7 $355.0 $355.0 $206.2 $214.4 $33.4 $40.6 $1,086.0 $1,180.0 2008 $7.1 $102.2 $12.0 $51.3 $172.6 $453.6 $421.5 $220.6 $245.3 $34.2 $41.3 $1,236.0 $1,334.3 2007 $14.2 $133.9 $6.7 $159.0 $313.8 $475.0 $917.5 $646.7 $118.0 $2,471.1 Liabilities Accounts Payable Accrued Expenses Current Portion of LT Debt Other Current Liabilities Current Liabilities Long-Term Debt Bank Term Loan (a) Senior Notes (b) Revolving Credit Facility Capitalized Leases Total LT Debt Pension Liabilities (c) Other LT Liabilities Total Liabilities $26.6 $40.8 $0.0 $33.3 $100.7 $363.1 $294.9 $0.0 $0.2 $658.2 $223.1 $70.2 $1,052.2 $30.0 $40.5 $6.9 $42.4 $119.8 $369.4 $293.9 $26.4 $27.0 $0.0 $0.0 $0.0 $45.1 $98.6 $285.8 $300.0 $0.0 $0.0 $426.0 $430.0 $0.0 $0.0 $663.3 $711.8 $730.0 $170.7 $173.0 $251.2 $62.2 $60.4 $67.1 $1,016.0 $1,043.8 $1,179.0 $41.4 $50.6 $0.0 $38.8 $130.7 $32.7 $52.5 $0.0 $54.9 $140.0 $300.0 $0.0 $597.5 $0.0 $897.5 $147.6 $373.0 $1,558.1 Total Equity Total Liabilities And Equity Other Items: Total Shares Out (millions) Debt-to-Total Capitalization Current Ratio $34.0 $163.9 $192.3 $155.2 $913.0 $1,086.2 $1,179.9 $1,236.0 $1,334.3 $2,471.1 23.1 95.1% 1.46 23.0 80.3% 1.43 22.8 78.7% 2.08 22.8 82.5% 1.32 22.6 49.6% 2.24 Sources: S&P Capital IQ (accessed 9/20/12), and Media General Annual Reports, various years. Notes: a) The Bank Term Loan matured in March 2013 and had a rate of ~ 5.00% (= Libor +4.75%). b) The Senior Notes had a face value of $300 million, a final maturity in February 2017, and an interest rate of 11.75%. c) Includes $132 million for a funded pension plan and $91.1 million for other unfunded pension and benefits plans.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the free cash flows for each year and the terminal value in 2016 based on the provided assumptions lets use the forecast projections from Exhibit 10 Heres the stepbystep calculation Step ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started