Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Using the formulas and charts provided to answer the following questions: Sam's Structures desires to buy a new crane and accessories to help move and

Using the formulas and charts provided to answer the following questions:

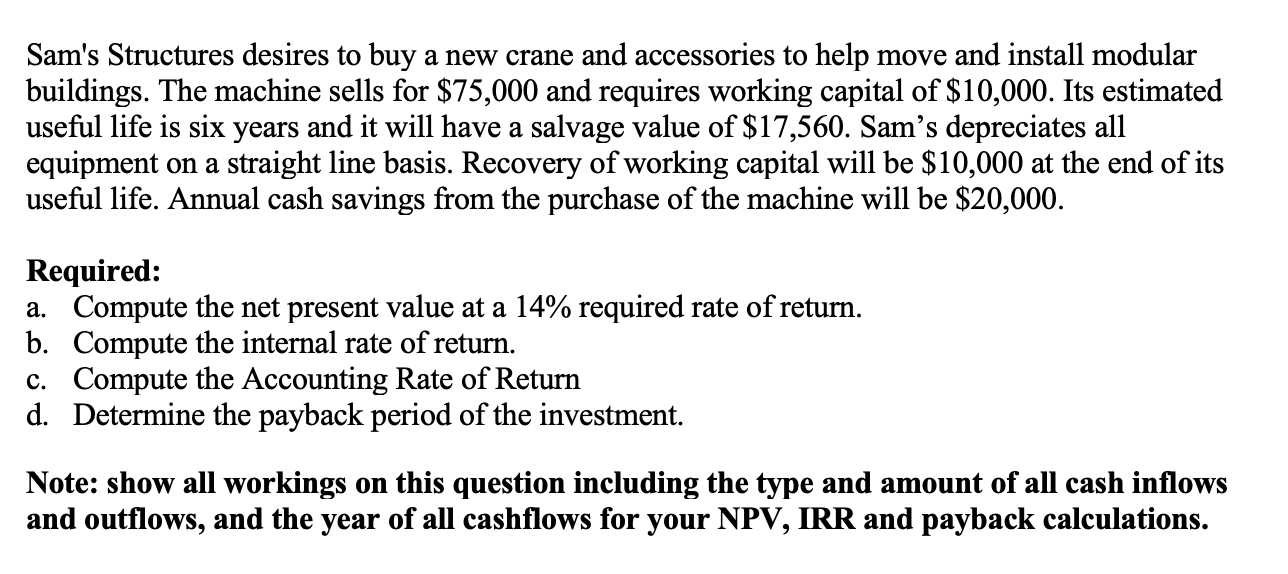

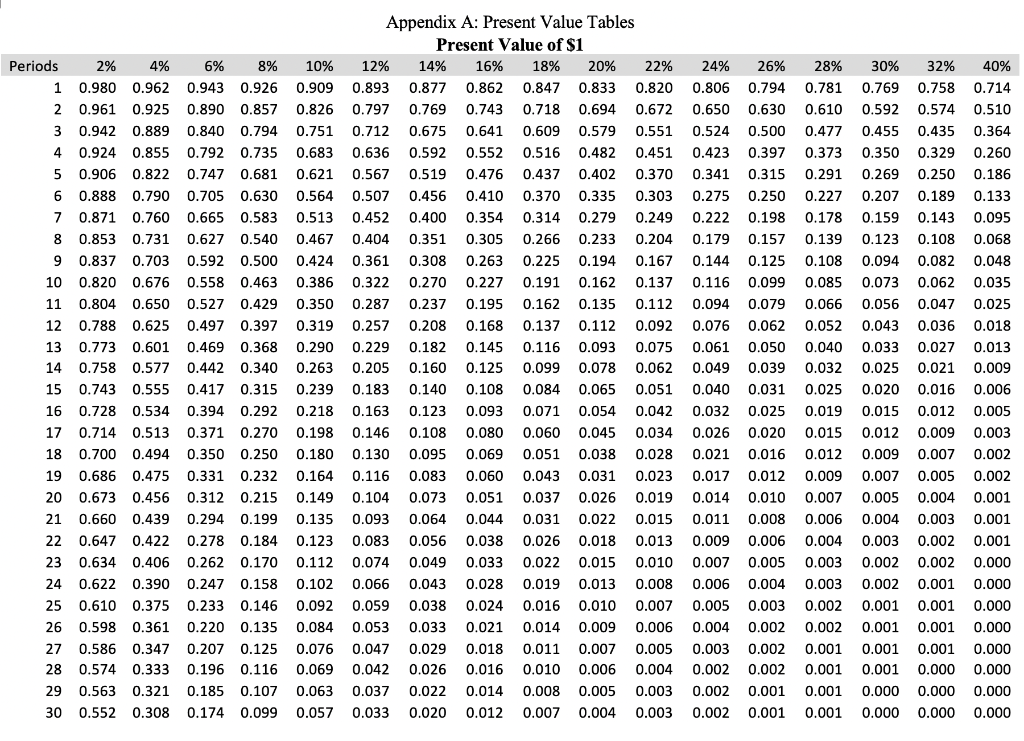

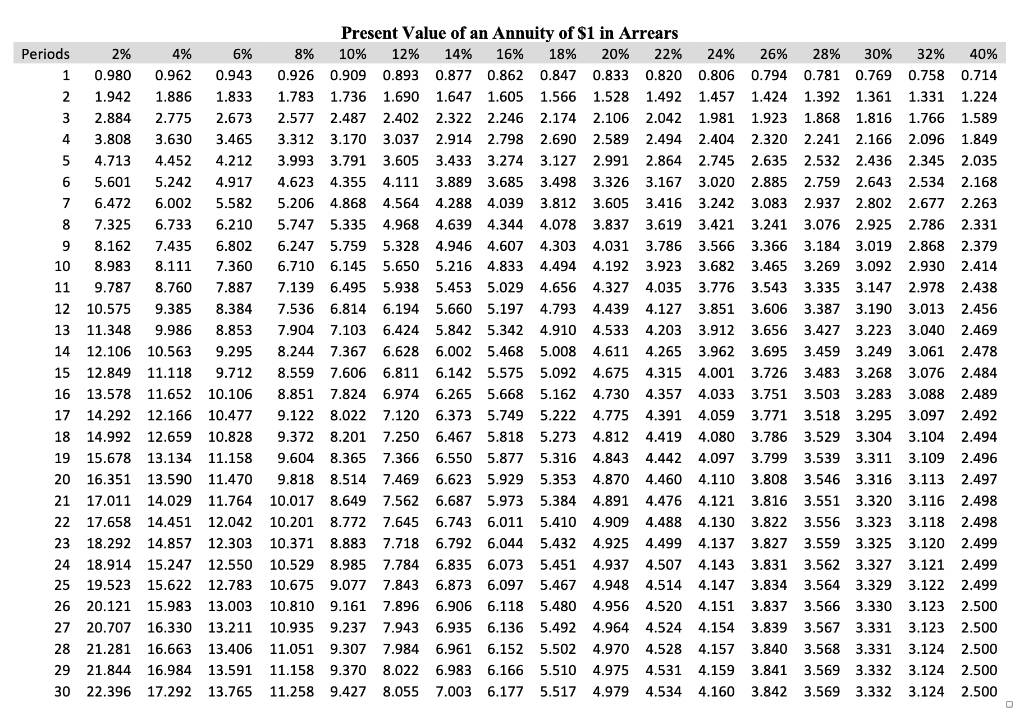

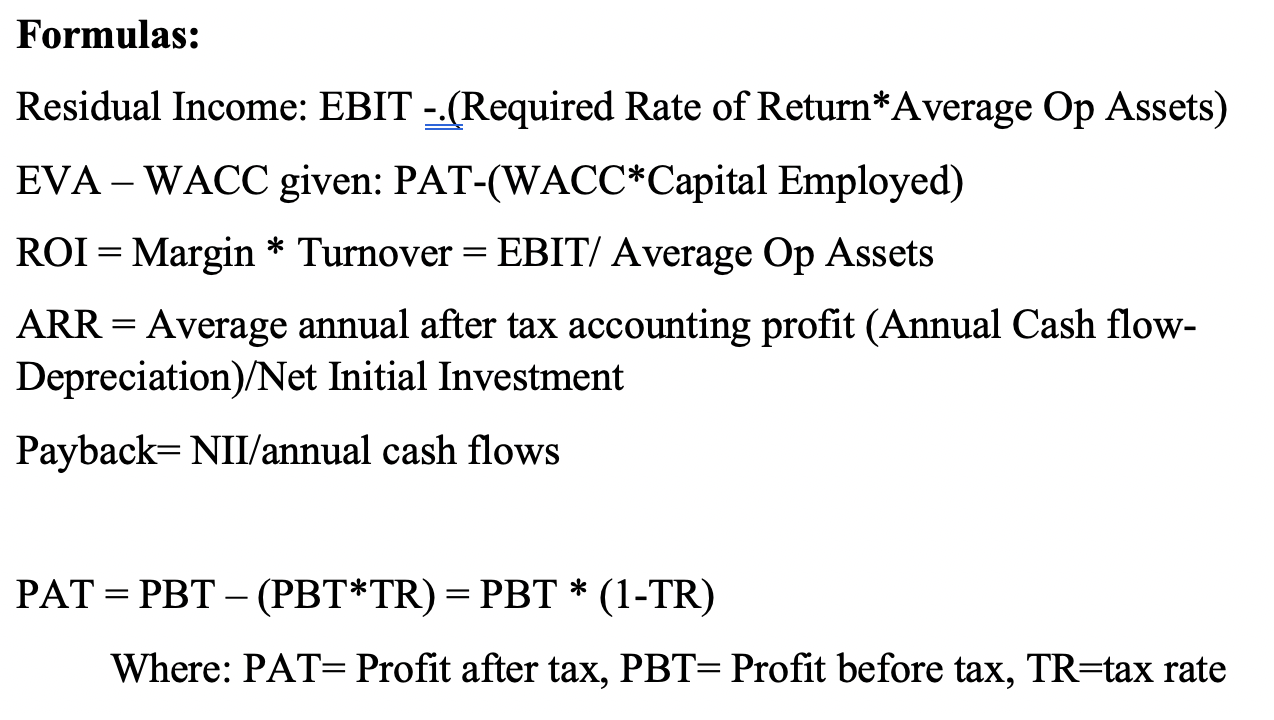

Sam's Structures desires to buy a new crane and accessories to help move and install modular buildings. The machine sells for $75,000 and requires working capital of $10,000. Its estimated useful life is six years and it will have a salvage value of $17,560. Sam's depreciates all equipment on a straight line basis. Recovery of working capital will be $10,000 at the end of its useful life. Annual cash savings from the purchase of the machine will be $20,000. Required: a. Compute the net present value at a 14% required rate of return. b. Compute the internal rate of return. c. Compute the Accounting Rate of Return d. Determine the payback period of the investment. Note: show all workings on this question including the type and amount of all cash inflows and outflows, and the year of all cashflows for your NPV, IRR and payback calculations. Appendix A: Present Value Tables Present Value of $1 Periods 2% 4% 6% 8% 10% 12% 14% 16% 18% 20% 22% 1 0.980 0.962 0.943 0.926 0.909 0.893 0.877 0.862 0.847 0.833 0.820 2 0.961 0.925 0.890 0.857 0.826 0.797 0.769 0.743 0.718 0.694 0.672 3 0.942 0.889 0.840 0.794 0.751 0.712 0.675 0.641 0.609 0.579 0.551 4 0.924 0.855 0.792 0.735 0.683 0.636 0.592 0.552 0.516 0.482 0.451 5 0.906 0.822 0.747 0.681 0.621 0.567 0.519 0.476 0.437 0.402 0.370 6 0.888 0.790 0.705 0.630 0.564 0.507 0.456 0.410 0.370 0.335 0.303 7 0.871 0.760 0.665 0.583 0.513 0.452 0.400 0.354 0.314 0.279 0.249 8 0.853 0.731 0.627 0.540 0.467 0.404 0.351 0.305 0.266 0.233 0.204 9 0.837 0.703 0.592 0.500 0.424 0.361 0.308 0.263 0.225 0.194 0.167 10 0.820 0.676 0.558 0.463 0.386 0.322 0.270 0.227 0.191 0.162 0.137 11 0.804 0.650 0.527 0.429 0.350 0.287 0.237 0.195 0.162 0.135 0.112 12 0.788 0.625 0.497 0.397 0.319 0.257 0.208 0.168 0.137 0.112 0.092 13 0.773 0.601 0.469 0.368 0.290 0.229 0.182 0.145 0.116 0.093 0.075 14 0.758 0.577 0.442 0.340 0.263 0.205 0.160 0.125 0.099 0.078 0.062 15 0.743 0.555 0.417 0.315 0.2390.183 0.140 0.108 0.084 0.065 0.051 16 0.728 0.534 0.394 0.292 0.218 0.163 0.123 0.093 0.071 0.054 0.042 17 0.714 0.513 0.371 0.270 0.1980.146 0.108 0.080 0.060 0.045 0.034 18 0.700 0.494 0.350 0.250 0.180 0.130 0.095 0.069 0.051 0.038 0.028 19 0.686 0.475 0.331 0.232 0.164 0.116 0.083 0.060 0.043 0.031 0.023 20 0.673 0.456 0.312 0.215 0.149 0.104 0.073 0.051 0.037 0.026 0.019 21 0.660 0.439 0.294 0.199 0.135 0.093 0.064 0.044 0.031 0.022 0.015 22 0.647 0.422 0.278 0.184 0.123 0.083 0.056 0.038 0.026 0.018 0.013 23 0.634 0.406 0.262 0.170 0.112 0.074 0.049 0.033 0.022 0.015 0.010 24 0.622 0.390 0.247 0.158 0.102 0.066 0.043 0.028 0.019 0.013 0.008 25 0.610 0.375 0.233 0.146 0.092 0.059 0.038 0.024 0.016 0.010 0.007 26 0.598 0.361 0.220 0.135 0.084 0.053 0.033 0.021 0.014 0.0090.006 27 0.586 0.347 0.207 0.125 0.076 0.047 0.029 0.018 0.011 0.007 0.005 28 0.574 0.333 0.196 0.116 0.069 0.042 0.026 0.016 0.010 0.006 0.004 29 0.563 0.321 0.185 0.107 0.063 0.037 0.022 0.014 0.008 0.005 0.003 30 0.552 0.308 0.174 0.099 0.057 0.033 0.020 0.012 0.007 0.004 0.003 24% 26% 0.806 0.794 0.650 0.630 0.524 0.500 0.423 0.397 0.341 0.315 0.275 0.250 0.222 0.198 0.179 0.157 0.144 0.125 0.116 0.099 0.094 0.079 0.076 0.062 0.061 0.050 0.049 0.039 0.040 0.031 0.032 0.025 0.026 0.020 0.021 0.016 0.017 0.012 0.014 0.010 0.011 0.008 0.009 0.006 0.007 0.005 0.006 0.004 0.005 0.003 0.004 0.002 0.003 0.002 0.002 0.002 0.002 0.001 0.002 0.001 28% 30% 32% 40% 0.781 0.769 0.758 0.714 0.610 0.592 0.574 0.510 0.477 0.455 0.435 0.364 0.373 0.350 0.329 0.260 0.291 0.269 0.250 0.186 0.227 0.207 0.189 0.133 0.178 0.159 0.143 0.095 0.139 0.123 0.108 0.068 0.108 0.094 0.082 0.048 0.085 0.073 0.062 0.035 0.066 0.056 0.047 0.025 0.052 0.043 0.036 0.018 0.040 0.033 0.027 0.013 0.032 0.025 0.021 0.009 0.025 0.0200.016 0.006 0.019 0.015 0.012 0.005 0.015 0.012 0.0090.003 0.012 0.0090.007 0.002 0.009 0.007 0.005 0.002 0.007 0.005 0.004 0.001 0.006 0.004 0.003 0.001 0.004 0.003 0.002 0.001 0.003 0.002 0.002 0.000 0.003 0.002 0.001 0.000 0.002 0.001 0.001 0.000 0.002 0.001 0.001 0.000 0.001 0.001 0.001 0.000 0.001 0.001 0.000 0.000 0.001 0.000 0.000 0.000 0.001 0.000 0.000 0.000 Present Value of an Annuity of $1 in Arrears Periods 2% 4% 6% 8% 10% 12% 14% 16% 18% 20% 22% 24% 26% 28% 30% 32% 40% 1 0.980 0.962 0.943 0.926 0.909 0.893 0.877 0.862 0.847 0.833 0.820 0.806 0.794 0.781 0.769 0.758 0.714 2 1.942 1.886 1.833 1.783 1.736 1.690 1.647 1.605 1.566 1.528 1.492 1.457 1.424 1.392 1.361 1.331 1.224 3 2.884 2.775 2.6732.577 2.487 2.402 2.322 2.246 2.174 2.106 2.042 1.981 1.923 1.868 1.816 1.766 1.589 4 3.808 3.630 3.465 3.312 3.170 3.037 2.914 2.798 2.690 2.589 2.494 2.404 2.320 2.241 2.166 2.096 1.849 5 4.713 4.452 4.212 3.993 3.791 3.605 3.433 3.274 3.127 2.991 2.864 2.745 2.635 2.532 2.436 2.345 2.035 6 5.601 5.2424.917 4.623 4.355 4.111 3.889 3.685 3.498 3.326 3.167 3.020 2.885 2.759 2.643 2.534 2.168 7 6.472 6.002 5.582 5.206 4.868 4.564 4.288 4.039 3.812 3.605 3.416 3.242 3.083 2.937 2.802 2.677 2.263 8 7.325 6.733 6.210 5.747 5.335 4.968 4.639 4.344 4.078 3.837 3.619 3.421 3.241 3.076 2.925 2.786 2.331 9 8.162 7.435 6.802 6.247 5.759 5.328 4.946 4.607 4.303 4.031 3.786 3.566 3.366 3.184 3.019 2.868 2.379 10 8.983 8.111 7.360 6.710 6.145 5.650 5.216 4.833 4.494 4.192 3.923 3.682 3.465 3.269 3.092 2.930 2.414 11 9.787 8.760 7.887 7.139 6.495 5.938 5.453 5.029 4.656 4.327 4.035 3.776 3.543 3.335 3.147 2.978 2.438 12 10.575 9.3858.384 7.536 6.814 6.194 5.660 5.197 4.793 4.439 4.127 3.851 3.606 3.387 3.190 3.013 2.456 13 11.348 9.986 8.853 7.904 7.103 6.424 5.842 5.342 4.910 4.533 4.203 3.912 3.656 3.427 3.223 3.040 2.469 14 12.106 10.563 9.295 8.244 7.367 6.628 6.002 5.468 5.008 4.611 4.265 3.962 3.695 3.459 3.249 3.061 2.478 15 12.849 11.118 9.712 8.559 7.606 6.811 6.142 5.575 5.092 4.675 4.315 4.001 3.726 3.483 3.268 3.076 2.484 16 13.578 11.652 10.106 8.851 7.824 6.974 6.265 5.668 5.162 4.730 4.357 4.033 3.751 3.503 3.283 3.088 2.489 17 14.292 12.166 10.477 9.122 8.022 7.120 6.373 5.749 5.222 4.775 4.391 4.059 3.771 3.518 3.295 3.097 2.492 18 14.992 12.659 10.828 9.372 8.201 7.250 6.467 5.818 5.273 4.812 4.419 4.080 3.786 3.529 3.304 3.104 2.494 19 15.678 13.134 11.158 9.604 8.365 7.366 6.550 5.877 5.316 4.843 4.442 4.097 3.799 3.539 3.311 3.109 2.496 20 16.351 13.590 11.470 9.818 8.514 7.469 6.623 5.929 5.353 4.870 4.460 4.110 3.808 3.546 3.316 3.113 2.497 21 17.011 14.029 11.764 10.017 8.649 7.562 6.687 5.973 5.384 4.891 4.476 4.121 3.816 3.551 3.320 3.116 2.498 22 17.658 14.451 12.042 10.201 8.772 7.645 6.743 6.011 5.410 4.909 4.488 4.130 3.822 3.556 3.323 3.118 2.498 23 18.292 14.857 12.303 10.371 8.883 7.718 6.792 6.044 5.432 4.925 4.499 4.137 3.827 3.559 3.325 3.120 2.499 24 18.914 15.247 12.550 10.529 8.985 7.784 6.835 6.073 5.451 4.937 4.507 4.143 3.831 3.562 3.327 3.121 2.499 25 19.523 15.622 12.783 10.675 9.077 7.843 6.873 6.097 5.467 4.948 4.514 4.147 3.834 3.564 3.329 3.122 2.499 26 20.121 15.983 13.003 10.810 9.161 7.896 6.906 6.118 5.480 4.956 4.520 4.151 3.837 3.566 3.330 3.123 2.500 27 20.707 16.330 13.211 10.935 9.237 7.943 6.935 6.136 5.492 4.964 4.524 4.154 3.839 3.567 3.331 3.123 2.500 28 21.281 16.663 13.406 11.051 9.307 7.984 6.961 6.152 5.502 4.970 4.528 4.157 3.840 3.568 3.331 3.124 2.500 29 21.844 16.984 13.591 11.158 9.370 8.022 6.983 6.166 5.510 4.975 4.531 4.159 3.841 3.569 3.332 3.124 2.500 30 22.396 17.292 13.765 11.258 9.427 8.055 7.003 6.177 5.517 4.979 4.534 4.160 3.842 3.569 3.332 3.124 2.500 Formulas: Residual Income: EBIT - (Required Rate of Return*Average Op Assets) EVA - WACC given: PAT-(WACC*Capital Employed) ROI = Margin * Turnover = EBIT/ Average Op Assets ARR = Average annual after tax accounting profit (Annual Cash flow- Depreciation)/Net Initial Investment Payback=NII/annual cash flows | PAT= PBT - (PBT*TR)= PBT * (1-TR) Where: PAT= Profit after tax, PBT= Profit before tax, TR=tax rate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started