using the formulas and numbers provided solve the equations

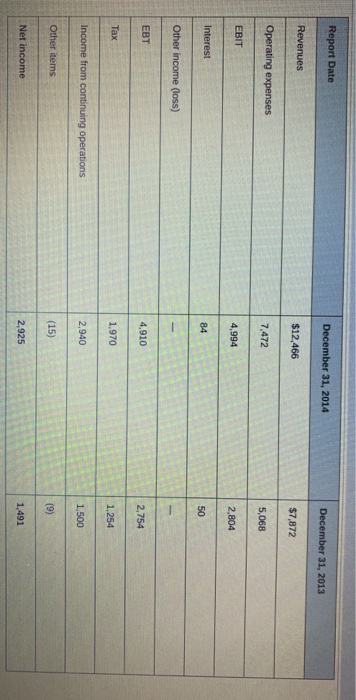

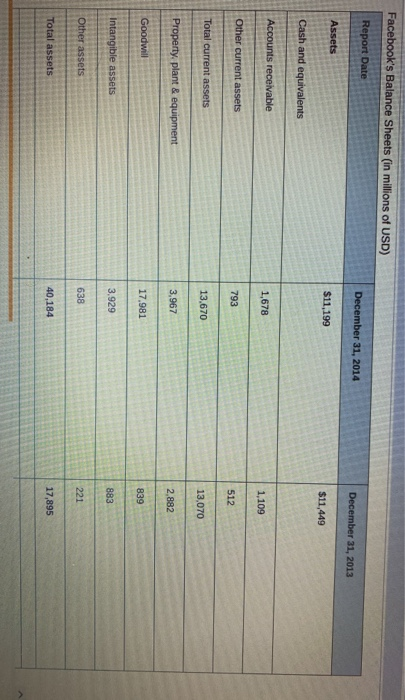

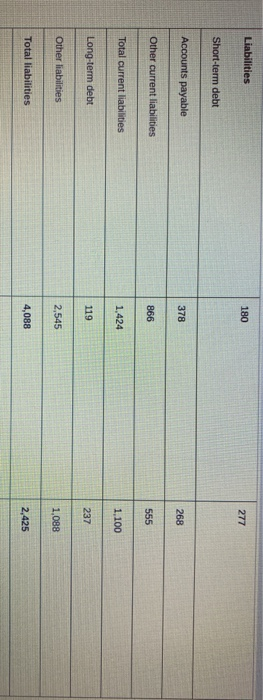

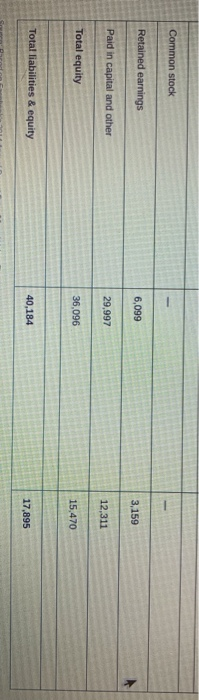

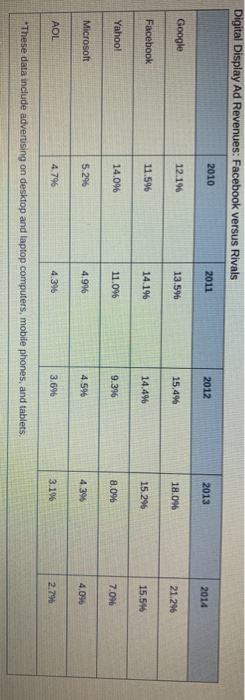

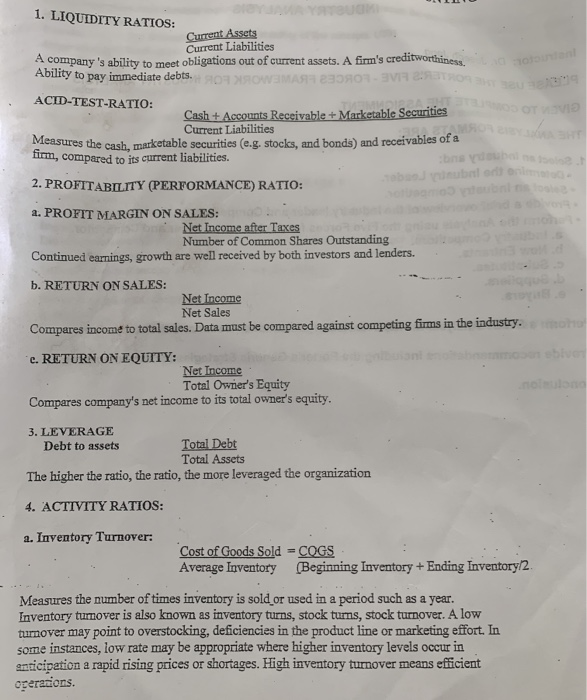

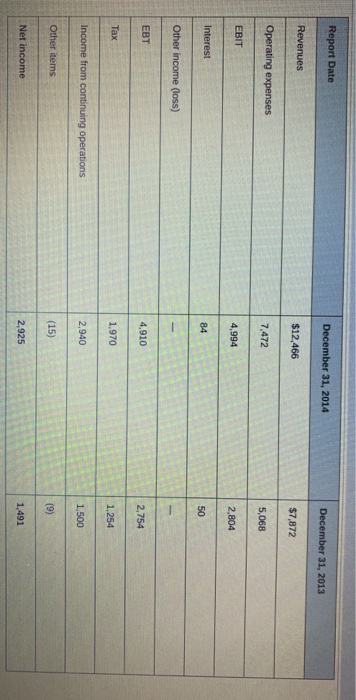

Report Date December 31, 2014 December 31, 2013 Revenues $12.466 $7,872 Operating expenses 7,472 5,068 EBIT 4,994 2,804 Interest 84 Other income (loss) EBT 4,910 2,754 Tax 1,970 1,254 Income from continuing operations 2,940 1,500 Other items (15) (9) Net income 2,925 1.491 Facebook's Balance Sheets (in millions of USD) Report Date December 31, 2014 December 31, 2013 Assets $11,199 $11,449 Cash and equivalents Accounts receivable 1,678 1,109 Other current assets 793 512 Total current assets 13,670 13,070 Property, plant & equipment 3,967 2,882 Goodwill 17.981 Intangible assets 3.929 Other assets 638 Total assets 17,895 40,184 Liabilities 180 277 Short-term debt Accounts payable 378 268 Other current liabilities 866 555 Total current liabilities 1,424 1.100 Long-term debt 119 237 Other liabilities 2,545 1,088 Total liabilities 4,088 2,425 Common stock Retained earnings 6,099 3,159 Paid in capital and other 29,997 12,311 Total equity 36,096 15,470 Total liabilities & equity 40,184 17,895 Digital Display Ad Revenues: Facebook versus Rivals 2010 2011 2012 2013 2014 Google 12.1% 13.596 15.4% 18.0% 21.29 Facebook 11.5% 14.196 14.4% 15.296 15,5% Yahoo! 14.0% 11.0% 9.396 8.096 7.0% Microsoft 5.296 4.9% 4.5% 4.396 AOL 4.796 4.396 3.696 3.1% 2.79 These data include advertising on desktop and laptop computers, mobile phones, and tablets. 1. LIQUIDITY RATIOS: Current Assets Current Liabilities A company's ability to meet obligations out of current assets. A firm's creditworthiness. Ability to pay immediate debts. OWENAS 235RO V E ACD-TEST-RATIO: Cash + Accounts Receivable + Marketable Securities Current Liabilities easures the cash, marketable securities (e.g. stocks, and bonds) and receivables of a firm, compared to its current liabilities. OTV O 2. PROFITABILITY (PERFORMANCE) RATIO: a. PROFIT MARGIN ON SALES: Net Income after Taxes Number of Common Shares Outstanding Continued earnings, growth are well received by both investors and lenders. b. RETURN ON SALES: Net Income Net Sales Compares income to total sales. Data must be compared against competing firms in the industry. c. RETURN ON EQUITY: Net Income Total Owner's Equity Compares company's net income to its total owner's equity. 3. LEVERAGE Debt to assets Total Debt Total Assets The higher the ratio, the ratio, the more leveraged the organization 4. ACTIVITY RATIOS: a. Inventory Turnover: Cost of Goods Sold = COGS Average Inventory (Beginning Inventory + Ending Inventory/2 Measures the number of times inventory is sold or used in a period such as a year. Inventory turnover is also known as inventory turns, stock turns, stock turnover. A low turnover may point to overstocking, deficiencies in the product line or marketing effort. In some instances, low rate may be appropriate where higher inventory levels occur in anticipation a rapid rising prices or shortages. High inventory turnover means efficient operations